GTOptions 2025 In-Depth Review: Opportunity or Trap?

Executive Summary

GTOptions has undergone a significant transformation since its inception in 2011, evolving from a once-promising binary options broker into a platform rife with difficulties. Initially lauded for its innovative trading options, the broker's reputation has suffered immensely due to its lack of regulatory oversight, poor customer service, and persistent withdrawal issues. As potential traders assess their options in 2025, it becomes crucial to weigh the allure of potential high rewards against the stark realities of significant risk and instability that GTOptions presents.

Targeted primarily at novice traders seeking a straightforward trading experience, GTOptions attracts those willing to engage in high-risk opportunities. However, the platform is best avoided by experienced traders who value regulatory security and those concerned about fund safety. With competing brokers offering more secure options, it is essential for traders to conduct comprehensive research before engaging with GTOptions.

⚠️ Important Risk Advisory & Verification Steps

Given the risks associated with trading on unregulated platforms like GTOptions, potential users must heed the following advisory:

- Lack of Regulation: GTOptions operates without the oversight of any major financial authority, placing your funds at risk.

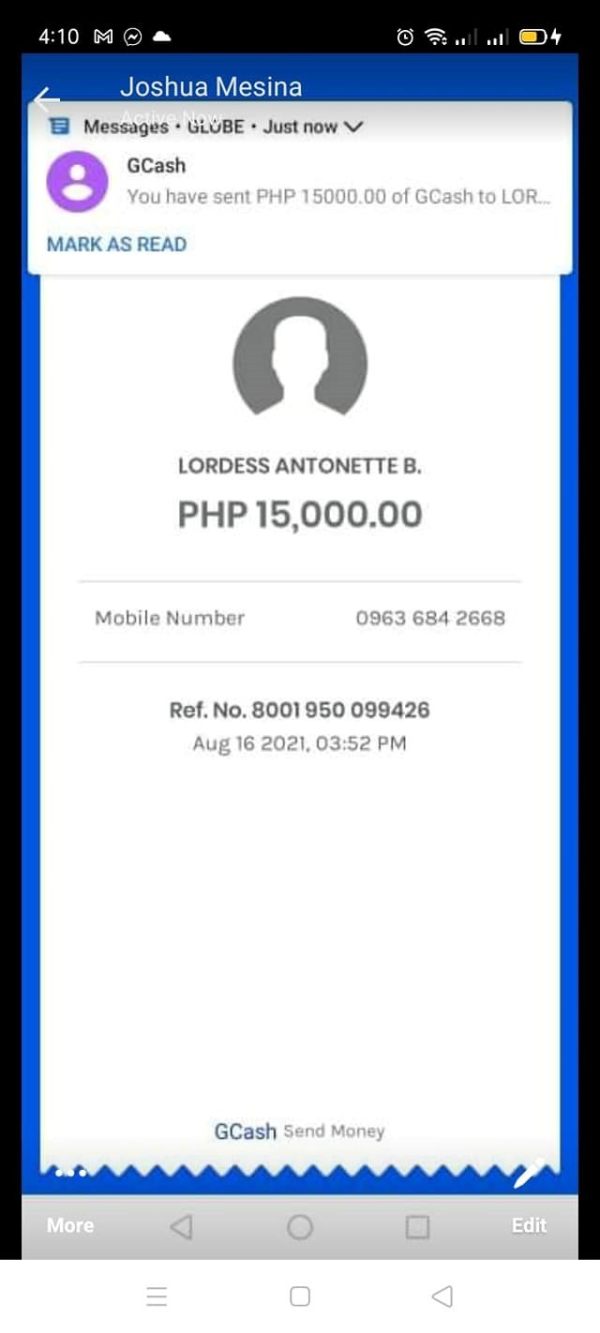

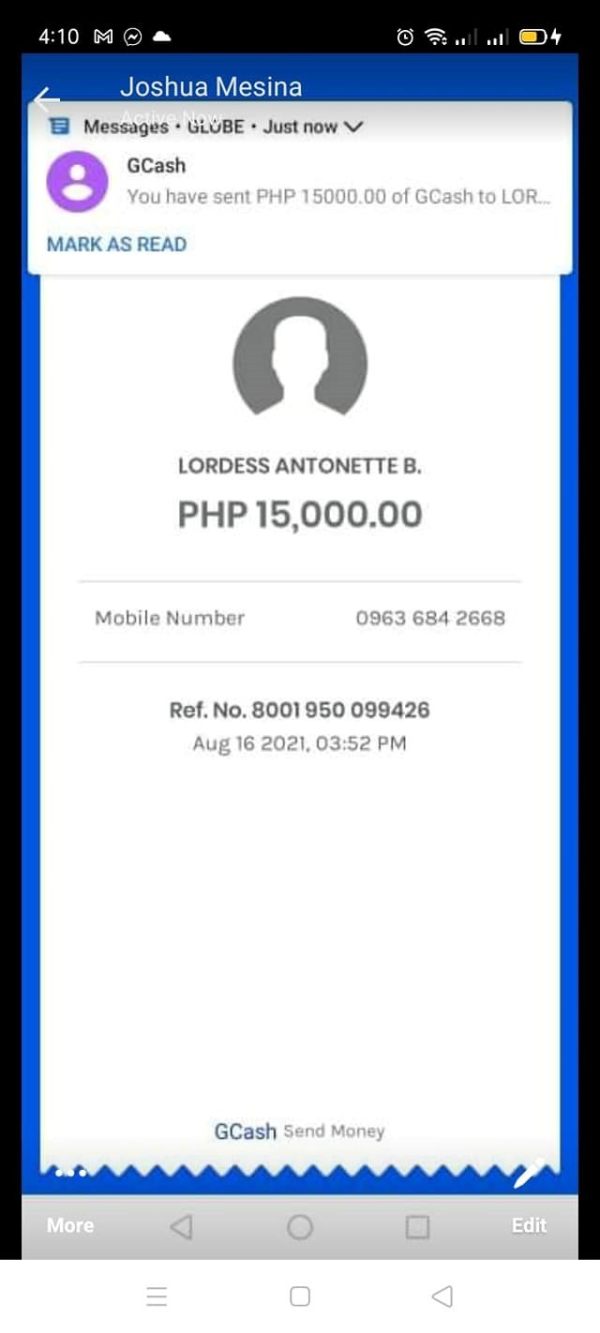

- Withdrawal Issues: Numerous complaints have surfaced regarding delayed or denied withdrawals, which can lead to frustrated and disenfranchised traders.

- Self-Verification Steps:

- Check Regulatory Bodies: Visit official financial authority websites to confirm the regulatory status of any broker.

- User Reviews: Look for independent user feedback on platforms that aggregate user experiences and complaints regarding GTOptions.

- Consult Online Resources: Use reputable financial review sites to gather comprehensive information about the brokers trustworthiness.

These steps are crucial to ensuring the safety of your investments.

Rating Framework

Company Background and Positioning

GTOptions, founded in 2011, has its operations shrouded in controversy and skepticism. Initially established by a group of financial professionals, including veterans from the investment banking sector, it aimed to cater to a global audience eager to engage in binary options trading. The initial growth trajectory positioned GTOptions as a significant player in the binary options market. However, as regulatory scrutiny increased and trader experiences became a focal point of discussion, GTOptions struggled to maintain its reputation.

Originally headquartered in Cyprus, the broker has transitioned into a murkier operational status, lacking any credible oversight. The repercussions of this have been dire, leading to the firms gradual decline and alienation from its user base.

Core Business Overview

GTOptions operates as a binary options trading platform, providing access to a variety of assets, including forex pairs, commodities, stocks, and indices. While the interface has been built on the widely used SpotOption platform, reports indicate that the trading experience is now hindered by outdated functionality and lack of innovation, leaving traders with basic options like high/low and one-touch trades.

The broker claims various regulatory affiliations; however, multiple warnings have been issued due to its unregulated status across numerous jurisdictions. Reports of operational instability have affected confidence in GTOptions and undermined its initial value propositions.

Quick-Look Details Table

In-depth Analysis of Each Dimension

Trustworthiness Analysis

Regulatory Information Conflicts:

GTOptions has deteriorated from a potentially viable broker to one surrounded by allegations of scams and untrustworthiness. The absence of a regulatory framework means that traders have no legal recourse if things go awry (GBCSC Warning 2025).

User Self-Verification Guide:

- Visit Official Regulatory Sites: Search for information about GTOptions on financial authority websites.

- Check for Complaints or Alerts: Review insights on trader experiences from independent resources.

- Evaluate Historical Performance: Analyze GTOptions past and present status using historical review platforms.

Industry Reputation and Summary:

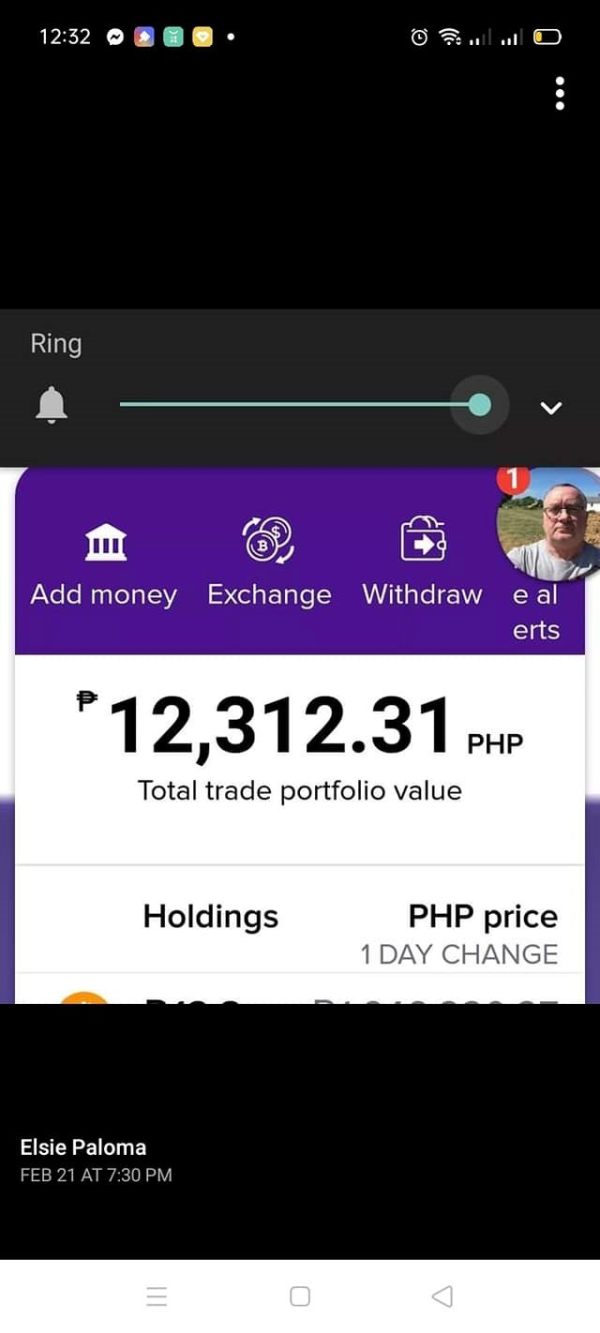

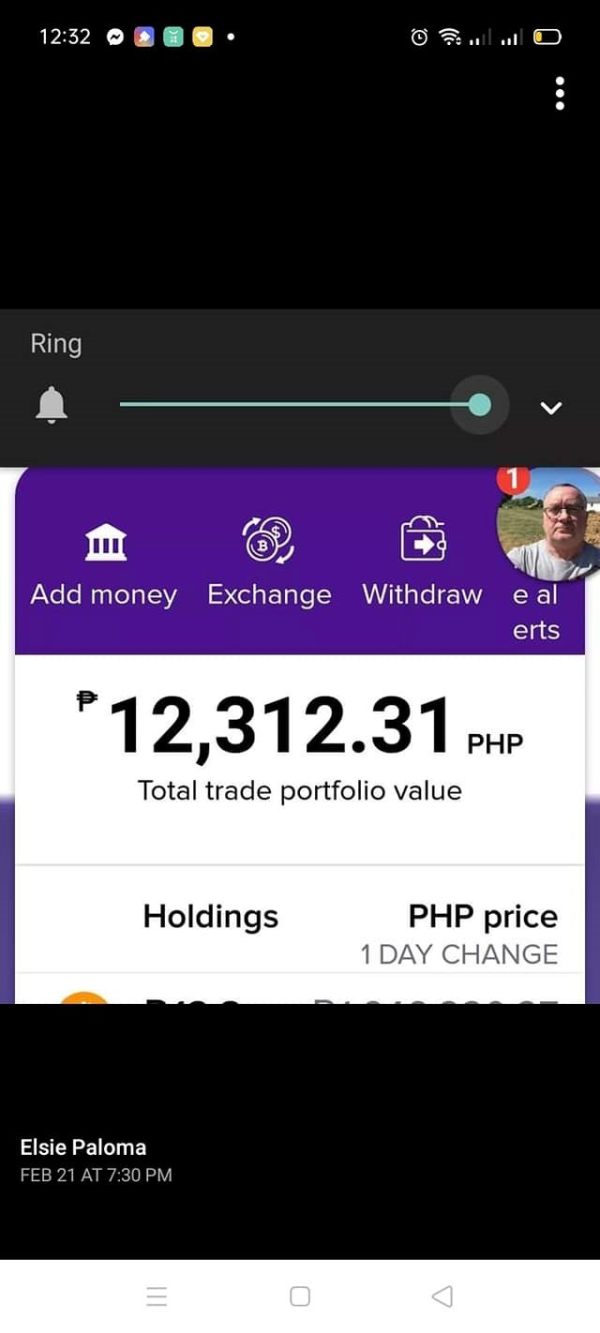

User experiences are dismal, particularly regarding fund safety and service quality. Many have reported withdrawal complications, leaving them questioning the broker's legitimacy.

"The broker doesn't reply to support requests. I'm still waiting for my money." – Anonymous trader.

Trading Costs Analysis

Advantages in Commissions:

GTOptions has maintained competitive commission structures. However, potential traders should remain vigilant about other associated costs that may not be immediately apparent.

Non-Trading Fees:

High withdrawal fees, notably a $25 fee for wire transfers, have become a significant pain point for users, often equating to financial loss. Complaints have surfaced detailing complicated fee structures, leading to frustration.

"With a $25 withdrawal fee, it's like they don't want you to take your money out." – User complaint.

Cost Structure Summary:

While some fees may be seen as manageable by novice traders, the hidden costs associated with withdrawals can quickly negate any apparent advantages of trading costs.

Platform Diversity:

Using the SpotOption platform, GTOptions previously offered traders a variety of tools; however, it now fails to deliver on innovations essential for modern trading.

Quality of Tools and Resources:

Current offerings are insufficient; for instance, users noted a lack of advanced indicators and customization, which are commonly found on competitor platforms.

Platform Experience Summary:

User feedback reflects dissatisfaction with the interface and functionality, labeling it as outdated compared to industry benchmarks.

"The trading experience feels like stepping back five years – everything is slow and unresponsive." – User review.

User Experience

Expanding on user feedback, the general sentiment reflects uncertainty and dissatisfaction with GTOptions' current trading experience. Users have voiced concerns regarding frequent errors on the platform and long load times, further tarnishing the broker's reputation. Inconsistent service quality has created a mistrustful atmosphere, making the trading environment less inviting.

Customer Support Analysis

The highlights of customer support at GTOptions are grim. Traders have described their attempts to reach support as arduous, with reports surfacing of multiple days without replies.

"I tried to get an answer for a week, and no one bothered to respond to my emails." – Frustrated user.

Furthermore, the absence of live chat functionality has compounded issues, pushing traders to wait indefinitely for answers to pressing questions.

Account Conditions

The accounts available on GTOptions include a mini account for beginners and standard accounts designed for experienced traders. However, users have found the terms attached to these accounts, particularly regarding withdrawals, to be less favorable than anticipated. With a minimum deposit requirement of $250, users are incentivized to deposit quickly without understanding the full implications of account conditions.

Conclusion

In summary, GTOptions emerged in 2011 as a broker that captured initial interest but has spiraled into a platform characterized by significant risks. Lacking proper regulatory oversight and mired in complaints related to withdrawal issues and customer support, it stands as a high-risk choice for traders. Evaluating the trade-offs between potential rewards and considerable risks, informed decision-making remains paramount for anyone considering engagement with GTOptions. As the trading landscape continues to shift, prospective traders are urged to prioritize security and reliability over fleeting potential rewards. For those seeking safer alternatives, exploring more reputable brokers is prudent in safeguarding one's investments.