Regarding the legitimacy of AUSFOREX forex brokers, it provides SFC, CYSEC and WikiBit, (also has a graphic survey regarding security).

Is AUSFOREX safe?

Pros

Cons

Is AUSFOREX markets regulated?

The regulatory license is the strongest proof.

SFC Market Making License (MM)

Securities and Futures Commission of Hong Kong

Securities and Futures Commission of Hong Kong

Current Status:

UnverifiedLicense Type:

Market Making License (MM)

Licensed Entity:

AUS Financial Group (Hong Kong) Limited

Effective Date:

2018-06-06Email Address of Licensed Institution:

info@ausfinancial.hkSharing Status:

No SharingWebsite of Licensed Institution:

www.ausfinancial.hkExpiration Time:

--Address of Licensed Institution:

5/F Kam Sang Building, 257 Des Voeux Road Central, Sheung Wan, Hong KongPhone Number of Licensed Institution:

--Licensed Institution Certified Documents:

CYSEC Market Making License (MM)

Cyprus Securities and Exchange Commission

Cyprus Securities and Exchange Commission

Current Status:

UnverifiedLicense Type:

Market Making License (MM)

Licensed Entity:

AC Markets (Europe) Ltd

Effective Date:

2017-12-11Email Address of Licensed Institution:

compliance@lt-markets.comSharing Status:

No SharingWebsite of Licensed Institution:

www.lt-markets.com, www.ausforex.eu, www.acprime.eu, www.ausprime.euExpiration Time:

--Address of Licensed Institution:

Spyrou Kyprianou Avenue, Room 102, Block B, Steratzias Court, No.41, 4003, Mesa Geitonia, LimassolPhone Number of Licensed Institution:

+357 25 752 420Licensed Institution Certified Documents:

Is Ausforex Safe or Scam?

Introduction

Ausforex, a forex broker that emerged in the early 2000s, has positioned itself as a player in the online trading market, particularly focusing on foreign exchange and contracts for difference (CFDs). With claims of regulatory compliance and an array of trading instruments, it attracts both novice and experienced traders. However, the volatility of the forex market and the prevalence of fraudulent schemes necessitate that traders exercise caution when selecting a broker. Evaluating the safety and credibility of a trading platform like Ausforex is paramount to safeguarding one's investments.

This article aims to provide an objective analysis of Ausforex by examining its regulatory status, company background, trading conditions, client fund safety, customer experiences, and overall risk assessment. The information is derived from a comprehensive review of various sources, including regulatory bodies, user testimonials, and industry analysis, to ascertain whether Ausforex is safe or potentially a scam.

Regulation and Legitimacy

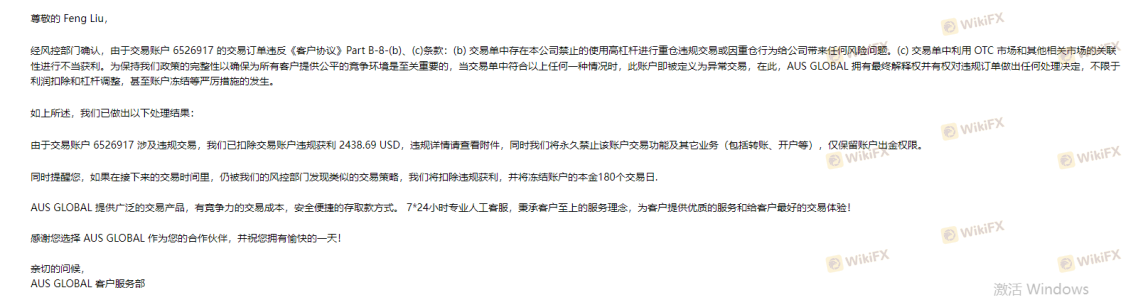

The regulatory framework within which a broker operates is crucial for ensuring the safety of client funds and the integrity of trading practices. Ausforex claims to be regulated by multiple authorities, including the Financial Conduct Authority (FCA) in the UK, the Cyprus Securities and Exchange Commission (CySEC), and the Securities and Futures Commission (SFC) in Hong Kong. However, scrutiny reveals inconsistencies regarding its regulatory status.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| FCA | 803268 | United Kingdom | No longer authorized |

| CySEC | 350/17 | Cyprus | Suspicious license |

| SFC | BLU 727 | Hong Kong | Suspicious license |

The FCA has confirmed that Ausforex is no longer authorized to conduct regulated activities in the UK, raising serious questions about its legitimacy. Furthermore, complaints from clients indicate a pattern of fraudulent activities, including delayed withdrawals and unresponsive customer service. The lack of a valid regulatory framework significantly undermines the broker's credibility, leading to the conclusion that Ausforex may not be safe for traders.

Company Background Investigation

Founded in Melbourne, Australia, in 2003, Ausforex initially gained regulatory approval from the Australian Securities and Investments Commission (ASIC). However, its subsequent relocation to the UK in 2015 has raised concerns about its operational transparency and regulatory compliance. The company's ownership structure is murky, with limited information available about its management team and their qualifications.

A robust management team is essential for a brokerage's success, as it influences operational integrity and client trust. Unfortunately, Ausforex does not provide sufficient details about its executives, which is a red flag for potential investors. Transparency in operations and management is critical for establishing trust, and the lack thereof in Ausforex's case suggests that it may not be a safe option for traders.

Trading Conditions Analysis

Understanding a broker's trading conditions is vital for evaluating its overall value proposition. Ausforex offers two primary account types: STP (Straight Through Processing) and ECN (Electronic Communication Network). However, the minimum deposit requirement of $1,000 is considered high compared to industry standards, which can deter new traders.

The fee structure of Ausforex is another area of concern. While it advertises competitive spreads, user reports indicate that the actual trading costs may be higher than advertised, particularly due to hidden fees and commissions.

| Fee Type | Ausforex | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 2.0 pips (STP) | 1.5 pips |

| Commission Model | $10 per lot (ECN) | $7 per lot |

| Overnight Interest Range | Varies | Varies |

The higher-than-average spreads and commission fees can significantly impact a trader's profitability, indicating that Ausforex might not offer the best trading conditions in the market.

Client Fund Safety

The safety of client funds is a paramount concern for any trader. Ausforex claims to hold client funds in segregated accounts, which is a standard practice among reputable brokers. However, the lack of regulatory oversight raises questions about the effectiveness of these measures.

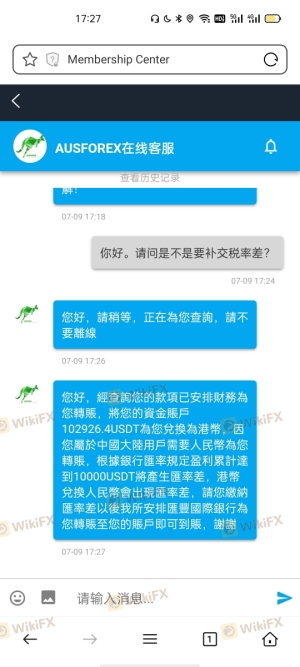

Additionally, there have been numerous complaints regarding the withdrawal process, with clients experiencing delays and, in some cases, total refusal of withdrawal requests. This raises alarms about the actual safety of client funds. Without robust regulatory protection and a transparent operational framework, traders may find themselves at risk of losing their investments, further reinforcing the notion that Ausforex is not a safe option.

Customer Experience and Complaints

Customer feedback serves as a crucial indicator of a broker's reliability and service quality. Reviews of Ausforex reveal a troubling pattern of complaints, primarily centered around withdrawal issues and unresponsive customer service. Many users report that their accounts were blocked after withdrawal requests, and attempts to contact support yielded no responses.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Unresponsive |

| Account Blocking | High | Unresponsive |

| Misleading Information | Medium | Minimal Communication |

Case studies from users highlight severe issues, such as one trader who reported being unable to withdraw their funds after a profitable trading period, only to find their account blocked without explanation. This lack of accountability and support points to a significant risk for clients, suggesting that Ausforex may not be a reliable broker.

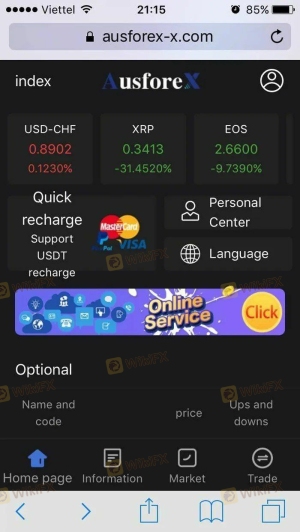

Platform and Execution

The trading platform is another critical aspect of a broker's service. Ausforex offers the popular MetaTrader 4 and 5 platforms, which are known for their user-friendly interface and advanced trading features. However, user experiences vary, with some reporting issues related to execution speed and slippage.

Traders have expressed concerns about the quality of order execution, citing instances of slippage and rejected orders during volatile market conditions. These issues can severely impact trading outcomes, leading to the conclusion that the trading environment at Ausforex may not be optimal.

Risk Assessment

Using Ausforex presents several risks that potential traders should consider. The lack of regulatory oversight, questionable fund safety measures, and poor customer service collectively contribute to a high-risk profile for this broker.

| Risk Category | Risk Level | Brief Description |

|---|---|---|

| Regulatory Compliance | High | No valid regulatory licenses currently held |

| Fund Safety | High | Reports of withdrawal issues and account blocking |

| Customer Support | Medium | Unresponsive service leading to unresolved complaints |

To mitigate these risks, potential clients should conduct thorough research, consider starting with a demo account, and only invest funds they can afford to lose.

Conclusion and Recommendation

In conclusion, the evidence suggests that Ausforex is not a safe broker. The lack of valid regulatory oversight, coupled with numerous client complaints regarding fund safety and withdrawal issues, raises significant red flags. While the platform offers popular trading tools and a variety of instruments, the associated risks appear to outweigh the potential benefits.

For traders seeking reliable alternatives, it is advisable to consider brokers that are fully regulated by reputable authorities, offer transparent fee structures, and maintain a strong track record of customer service. Some recommended alternatives include brokers like IG, OANDA, and Forex.com, which have established reputations for safety and reliability in the forex trading landscape.

Is AUSFOREX a scam, or is it legit?

The latest exposure and evaluation content of AUSFOREX brokers.

AUSFOREX Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

AUSFOREX latest industry rating score is 1.52, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.52 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.