AFEX 2025 Review: Everything You Need to Know

Executive Summary

AFEX is a well-established financial services provider that has been operating since 1979. This makes it one of the more experienced players in the global payments and foreign exchange market. Originally known as AFEX, the company has since rebranded to Corpay and continues to focus on providing comprehensive global payment and risk management solutions to both individual and corporate clients.

This afex review reveals that while the company has built a solid reputation over its decades of operation, there are some notable gaps in publicly available regulatory information that potential users should be aware of. Despite these concerns, user feedback suggests high satisfaction levels with the company's customer service. Trustpilot reviews show an impressive 90% five-star rating from users.

AFEX/Corpay primarily serves clients seeking reliable foreign exchange trading services and global payment solutions. The company has evolved from a traditional forex broker to a more comprehensive financial services provider, catering to businesses and individuals who require cross-border payment capabilities and currency risk management tools. However, prospective users should carefully consider the limited regulatory transparency when evaluating this service provider.

Important Notice

Due to the limited availability of specific regulatory information in public sources, users should exercise caution when considering AFEX's services across different jurisdictions. The regulatory landscape for financial services varies significantly between regions. The absence of clear regulatory details may present legal and financial risks depending on your location.

This evaluation is based on multiple information sources including user feedback, industry analysis, and platform accessibility data. However, readers should conduct their own due diligence and verify current regulatory status before making any financial commitments. The information presented reflects the available data at the time of writing and may not represent the complete picture of the company's current operations.

Scoring Framework

Broker Overview

AFEX was established in 1979 as a foreign exchange and global payments specialist. This positioned it as one of the more experienced providers in the international financial services sector. The company has undergone significant evolution over its four-decade history, transitioning from a traditional forex broker to a comprehensive global payments and risk management solutions provider. This transformation culminated in the company's rebranding to Corpay, reflecting its expanded service portfolio and corporate focus.

The company's business model centers on providing foreign exchange services and global payment solutions to a diverse client base. AFEX/Corpay has built its reputation on delivering reliable cross-border payment services and currency risk management tools, primarily targeting businesses and individuals with international financial needs. The company's longevity in the market suggests a stable operational foundation, though specific details about its current service offerings remain limited in publicly available sources.

While the company maintains a presence in the foreign exchange market, specific information about trading platforms, asset classes beyond forex and payment services, and regulatory oversight is not readily available in current sources. This afex review notes that the company's focus appears to have shifted toward corporate payment solutions rather than traditional retail forex trading. This may explain the limited availability of typical broker-related information.

Regulatory Jurisdiction: Specific regulatory information is not detailed in available sources. This represents a significant information gap for potential users seeking regulatory assurance.

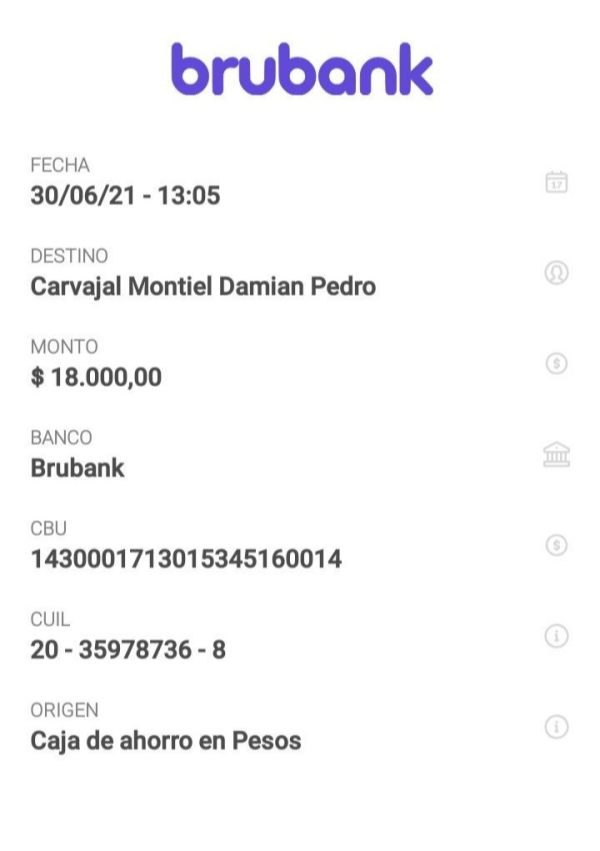

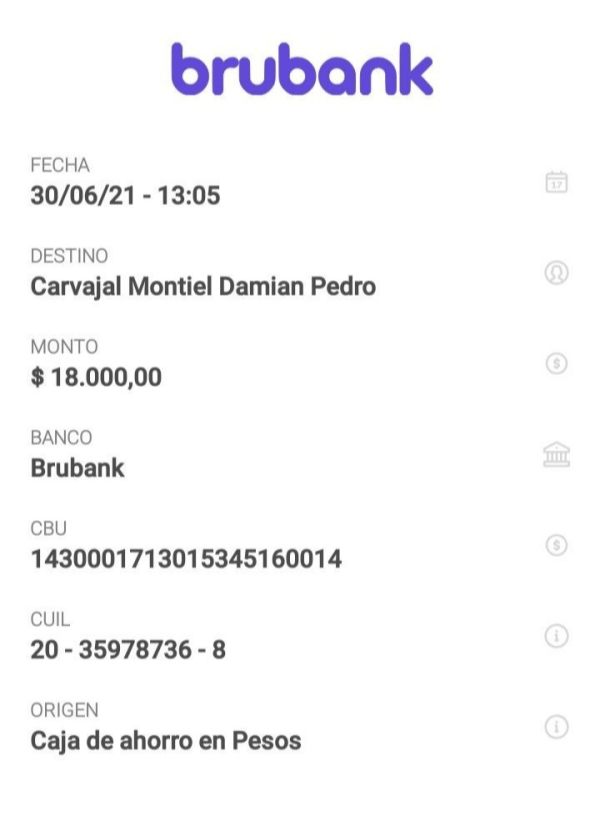

Deposit and Withdrawal Methods: Current deposit and withdrawal options are not specified in the reviewed materials. This makes it difficult to assess the convenience and accessibility of fund management.

Minimum Deposit Requirements: Specific minimum deposit amounts are not mentioned in available sources. This prevents accurate assessment of account accessibility for different user types.

Bonus and Promotions: No information about promotional offers or bonus programs is available in the current source materials.

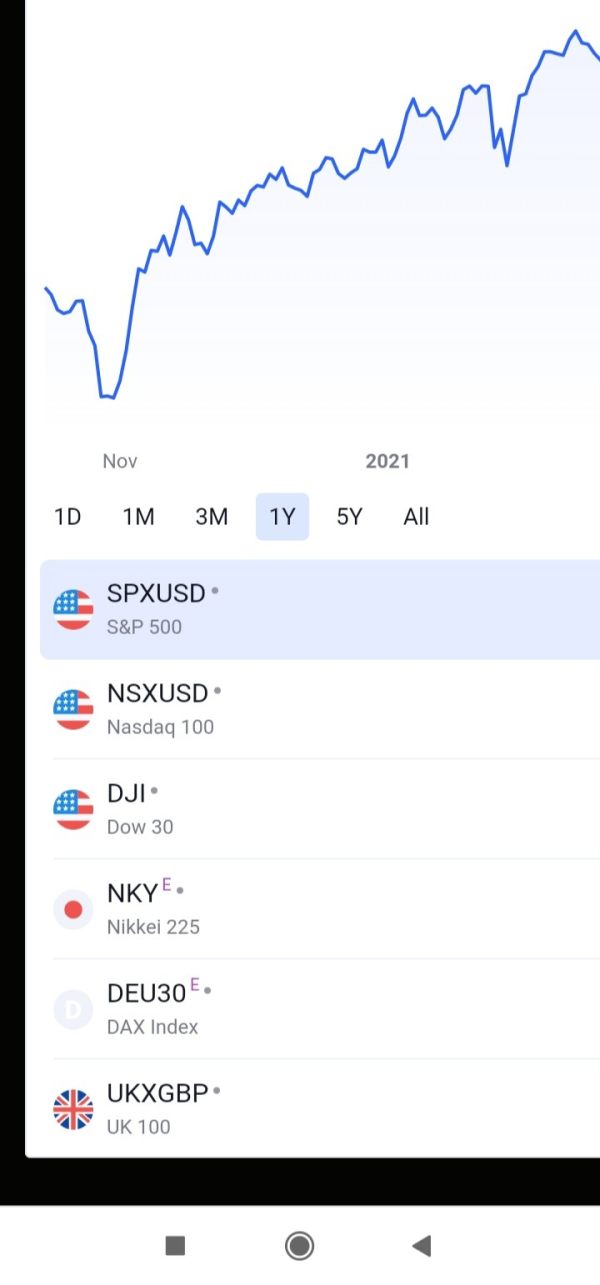

Tradeable Assets: The company primarily focuses on foreign exchange services and global payment solutions. However, the full range of tradeable instruments is not comprehensively detailed in available sources.

Cost Structure: Specific information about spreads, commissions, and other trading costs is not available in the reviewed materials. This makes it impossible to assess the competitiveness of the pricing structure.

Leverage Ratios: Current leverage offerings are not specified in available sources. This is crucial information for traders assessing risk management options.

Platform Options: Details about trading platforms and technological infrastructure are not provided in the source materials. This limits the ability to evaluate the technical aspects of the service.

Geographic Restrictions: Specific information about regional limitations or availability is not detailed in current sources.

This afex review highlights that while the company has a strong historical presence, the lack of detailed operational information in public sources may require direct contact with the provider for comprehensive service details.

Detailed Scoring Analysis

Account Conditions Analysis (5/10)

The evaluation of AFEX's account conditions is significantly hampered by the limited availability of specific information in public sources. Traditional broker account features such as account types, minimum deposit requirements, and account opening procedures are not clearly detailed in the reviewed materials. This lack of transparency makes it challenging for potential users to understand what account options are available and how they might align with different trading or payment needs.

Without specific information about account tiers, minimum balance requirements, or special account features, users cannot make informed decisions about whether AFEX's account structure meets their financial requirements. The absence of details about Islamic accounts, professional trading accounts, or other specialized account types further limits the assessment of the company's accommodation of diverse user needs.

The account opening process and verification requirements are not described in available sources. This makes it impossible to evaluate the user experience during onboarding. This information gap is particularly concerning for users who prioritize transparency and want to understand the full scope of requirements before committing to a service provider.

Given the transformation from AFEX to Corpay and the apparent shift toward corporate payment solutions, it's possible that traditional retail trading accounts may no longer be the primary focus. However, without clear communication about current account offerings, this afex review cannot provide a comprehensive assessment of account conditions.

The assessment of AFEX's trading tools and educational resources is limited by the lack of detailed information in available sources. Traditional broker offerings such as technical analysis tools, charting software, market research, and educational materials are not specifically described in the reviewed materials. This absence of information makes it difficult to evaluate the quality and comprehensiveness of the company's trading infrastructure.

Educational resources, which are crucial for both novice and experienced traders, are not detailed in current sources. The availability of webinars, tutorials, market analysis, or trading guides cannot be confirmed, limiting the ability to assess the company's commitment to user education and development. This is particularly important given the complexity of foreign exchange markets and the need for ongoing education.

Research and analysis tools, including economic calendars, market news, and expert analysis, are not mentioned in the available information. These resources are typically essential for informed trading decisions and risk management, making their absence from public information a significant concern for potential users.

The lack of information about automated trading support, API access, or advanced trading tools suggests either that these features are not prominently offered or that the company's focus has shifted away from traditional retail trading services toward corporate payment solutions.

Customer Service and Support Analysis (8/10)

Customer service represents one of AFEX's strongest areas based on available user feedback. The company has achieved an impressive 90% five-star rating on Trustpilot, indicating high levels of customer satisfaction with their support services. This strong performance in customer service suggests that users generally receive responsive and helpful assistance when needed.

The high satisfaction ratings indicate that AFEX has maintained quality customer support standards throughout its operational history. Users appear to value the level of service they receive, though specific details about support channels, response times, and availability hours are not detailed in the reviewed sources.

While the overall satisfaction metrics are encouraging, the lack of specific information about customer service channels, multilingual support options, and technical support capabilities limits a comprehensive assessment. The absence of details about whether support is available via phone, email, live chat, or other communication methods makes it difficult for potential users to understand how they can access assistance when needed.

The strong user satisfaction scores suggest that AFEX has invested in maintaining quality customer relationships. This is particularly important in financial services where trust and reliability are paramount. However, more detailed information about service level agreements and support scope would strengthen this assessment.

Trading Experience Analysis (5/10)

The evaluation of AFEX's trading experience is significantly constrained by the limited availability of specific information about platform performance, execution quality, and trading environment. Traditional metrics such as order execution speed, platform stability, and trading interface quality are not detailed in the reviewed sources.

Platform stability and reliability, which are crucial for successful trading operations, cannot be assessed due to insufficient information about the technical infrastructure. User feedback specifically related to trading experience, including comments about platform performance during market volatility or high-volume periods, is not available in current sources.

The absence of information about mobile trading capabilities, platform customization options, and advanced trading features makes it impossible to evaluate how well AFEX serves active traders. Modern traders typically require sophisticated platforms with real-time data, advanced charting capabilities, and seamless mobile access, but these features are not described in available materials.

Given the company's evolution toward Corpay and its focus on corporate payment solutions, it's possible that traditional retail trading may no longer be a primary service offering. However, without clear information about current trading capabilities, this afex review cannot provide a comprehensive assessment of the trading experience for users seeking traditional forex trading services.

Trust and Reliability Analysis (6/10)

AFEX's trust and reliability assessment presents a mixed picture based on available information. The company's establishment in 1979 provides a foundation of operational longevity that suggests stability and experience in the financial services sector. This extended operational history indicates that the company has successfully navigated various market conditions and regulatory environments over several decades.

However, the lack of specific regulatory information in public sources represents a significant concern for users prioritizing regulatory oversight and protection. Clear regulatory status and oversight are typically crucial factors in evaluating the trustworthiness of financial services providers, particularly for those handling client funds and providing trading services.

The company's rebranding to Corpay and apparent shift toward corporate payment solutions suggests ongoing business evolution. This could be viewed positively as adaptation to market needs or negatively as uncertainty about service continuity. Without detailed information about the reasons for this transition and its implications for existing users, it's difficult to assess the impact on service reliability.

User feedback, while generally positive regarding customer service, does not provide specific insights into trust-related issues such as fund security, withdrawal processing, or dispute resolution. The absence of detailed information about client fund segregation, insurance coverage, or regulatory protections limits the ability to fully assess the safety of user funds.

User Experience Analysis (5/10)

The assessment of overall user experience is limited by the lack of detailed information about interface design, registration processes, and day-to-day usability. While user satisfaction ratings suggest generally positive experiences, specific details about the user journey from account opening through ongoing service use are not available in reviewed sources.

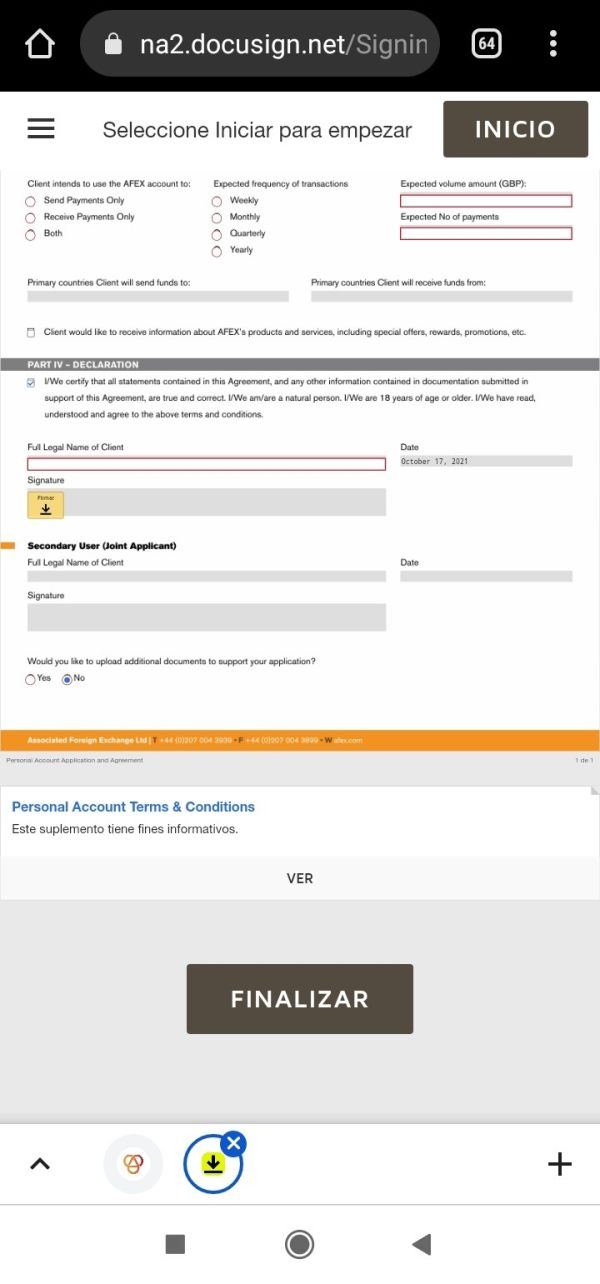

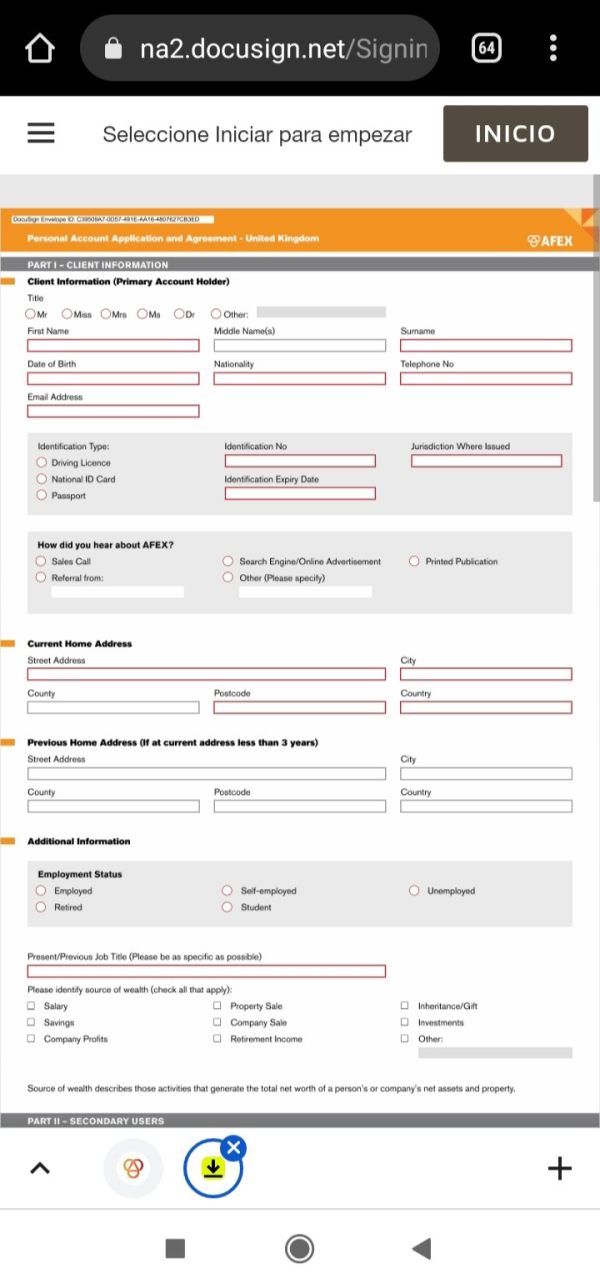

The registration and verification process, which forms users' first impression of the service, is not described in available materials. This includes information about required documentation, verification timeframes, and the overall complexity of getting started with AFEX's services. These factors significantly impact user experience and satisfaction levels.

Interface design and usability, crucial elements for both web and mobile platforms, are not detailed in current sources. Modern users expect intuitive interfaces, responsive design, and seamless navigation, but the evaluation of these aspects is not possible based on available information.

The company's apparent focus on corporate payment solutions suggests that the user experience may be tailored more toward business clients rather than individual retail users. However, without specific information about how different user types are accommodated, it's challenging to assess whether the platform meets diverse user needs effectively.

Conclusion

This afex review reveals a company with a strong historical foundation and positive user feedback, particularly regarding customer service quality. AFEX's transformation to Corpay represents an evolution toward comprehensive global payment and risk management solutions, though this shift has resulted in limited publicly available information about traditional trading services.

The company appears best suited for users seeking reliable global payment solutions and corporate financial services rather than traditional retail forex trading. The high customer satisfaction ratings suggest that existing users value the service quality, though the lack of detailed regulatory information requires careful consideration by potential users.

The main strengths include decades of operational experience and strong customer service ratings. However, the primary concerns center on limited regulatory transparency and insufficient publicly available information about current service offerings. Prospective users should conduct thorough due diligence and direct communication with the provider to understand current capabilities and regulatory status before making financial commitments.