World Traders 2025 Review: Everything You Need to Know

Executive Summary

This world traders review presents a comprehensive analysis of World Traders Broker. The company is a Latin American financial services provider that positions itself to serve both retail and institutional clients. Based on available information, World Traders offers a diverse range of tradable assets including stocks, cryptocurrencies, commodities, forex, and indices. They use the well-established MetaTrader 5 platform.

However, our evaluation reveals significant information gaps regarding crucial aspects such as regulatory oversight, specific account conditions, and user feedback. While the broker demonstrates strength in asset diversity and platform selection, the lack of transparent regulatory information and detailed trading conditions raises questions. The company appears to focus on the Latin American market. Specific regional restrictions and service limitations remain unclear. This review maintains a neutral stance given the limited concrete data available about the broker's operational standards and client satisfaction levels.

Important Notice

When evaluating World Traders, readers should be aware that Latin American financial markets often operate under different regulatory frameworks. User needs and expectations in this market may vary significantly from those in Europe or North America.

This evaluation is based on publicly available information collected from various sources. Due to the limited availability of comprehensive user feedback and specific regulatory data, some aspects of this review rely on incomplete information. Potential clients should conduct their own due diligence and verify current terms and conditions directly with the broker before making any investment decisions.

Rating Framework

Broker Overview

World Traders Broker operates as a financial services provider with a focus on the Latin American market. The company positions itself as a provider of high-quality financial services. Specific details about its founding date and corporate history are not detailed in available materials. The broker's business model centers on serving both retail and institutional clients, suggesting a comprehensive approach to different market segments.

The platform's primary strength lies in its asset diversity and choice of trading technology. World Traders utilizes MetaTrader 5, one of the industry's most recognized and feature-rich trading platforms. This world traders review finds that the broker offers access to multiple asset classes including stocks, cryptocurrencies, commodities, foreign exchange, and various market indices. However, specific information regarding regulatory oversight remains unavailable in the source materials reviewed.

Regulatory Status: Available materials do not specify the regulatory authorities overseeing World Traders' operations. This represents a significant information gap for potential clients seeking regulatory assurance.

Deposit and Withdrawal Methods: Specific information about funding options and withdrawal processes is not detailed in the available source materials.

Minimum Deposit Requirements: The broker's minimum deposit thresholds are not specified in the reviewed information.

Promotional Offers: Details about welcome bonuses, trading incentives, or promotional campaigns are not available in current source materials.

Tradable Assets: World Traders provides access to stocks, cryptocurrencies, commodities, forex pairs, and market indices. This offers clients diversification opportunities across multiple asset classes.

Cost Structure: Specific information regarding spreads, commissions, overnight fees, and other trading costs is not detailed in available materials. This makes cost comparison challenging.

Leverage Options: Maximum leverage ratios and margin requirements are not specified in the reviewed source materials.

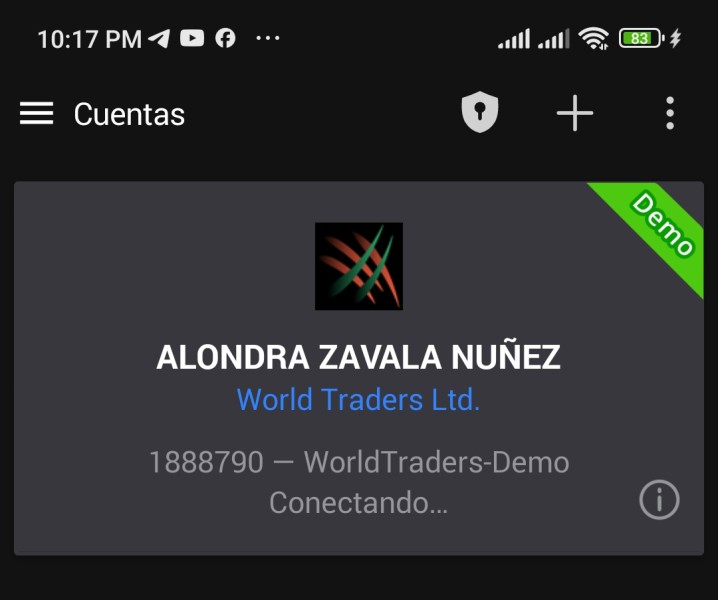

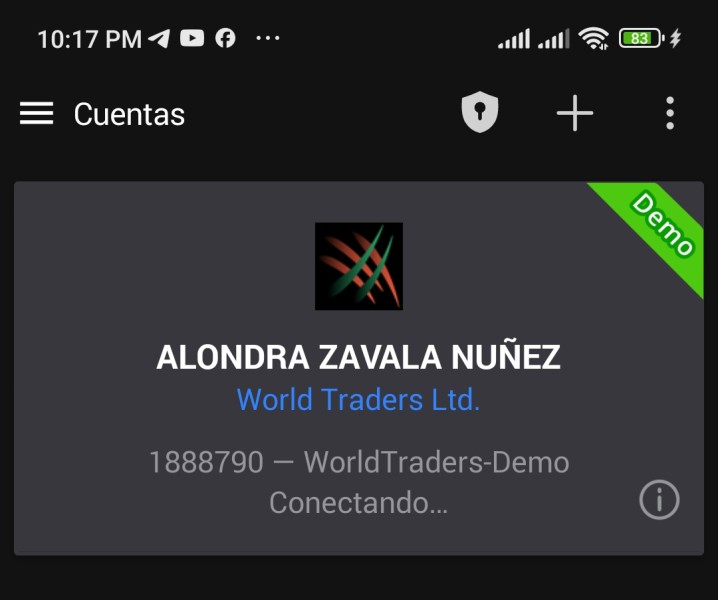

Platform Options: The broker offers MetaTrader 5 as its primary trading platform. This provides clients with advanced charting tools and automated trading capabilities.

Geographic Restrictions: Specific information about service availability by region is not detailed in current materials.

Customer Support Languages: Available support languages are not specified in the reviewed information materials.

This world traders review notes that the lack of detailed information in many key areas may concern potential clients. They seek comprehensive broker evaluation data.

Detailed Rating Analysis

Account Conditions Analysis

The evaluation of World Traders' account conditions faces significant limitations due to insufficient available information. Source materials do not provide details about account types, their specific features, or the differentiation between various account tiers. These might be available to different client segments.

Minimum deposit requirements are not specified in available documentation. These typically serve as a key factor in broker accessibility. This absence of information makes it challenging for potential clients to assess whether the broker aligns with their capital availability and investment approach.

Account opening procedures, verification requirements, and the overall onboarding process remain undocumented in reviewed materials. Additionally, information about special account features, Islamic accounts, professional trader accounts, or institutional account offerings is not available.

The lack of transparent account condition information represents a significant gap in this world traders review. These details typically form the foundation of client decision-making processes when selecting a forex and CFD broker.

World Traders demonstrates strength in its platform offering by providing MetaTrader 5. This stands as one of the industry's most comprehensive trading platforms. MT5 offers advanced charting capabilities, multiple timeframes, extensive technical indicators, and support for automated trading through Expert Advisors.

The platform's multi-asset capabilities align well with World Traders' diverse asset offerings. This allows clients to trade stocks, cryptocurrencies, commodities, forex, and indices from a single interface. This integration potentially provides operational efficiency for traders managing diversified portfolios.

However, information about additional research and analysis resources remains limited in available materials. Details about market analysis, economic calendars, trading signals, or educational resources that might complement the MT5 platform are not specified in reviewed sources.

The absence of information about automated trading support, copy trading features, or advanced order types beyond standard MT5 functionality limits the complete assessment. While the MT5 platform foundation is solid, the lack of detail about supplementary tools and resources prevents a comprehensive evaluation of the broker's complete technological ecosystem.

Customer Service and Support Analysis

Customer service evaluation for World Traders faces substantial limitations due to the absence of detailed information in available source materials. Critical aspects such as available support channels, response times, and service quality metrics are not documented in reviewed materials.

The availability of customer support through various communication methods remains unspecified. This includes live chat, email, telephone support, or social media channels. This information gap makes it impossible to assess the broker's commitment to client accessibility and support availability.

Response time expectations, support availability hours, and weekend or holiday support coverage are not detailed in available documentation. For international clients, particularly those in different time zones from the broker's operational base, this information would be crucial for service planning.

Multi-language support capabilities are not specified in reviewed materials. These are particularly relevant given the broker's Latin American focus. The quality of support in different languages and the availability of native-speaking support staff remain unclear.

Without user feedback or documented support quality metrics, this evaluation cannot provide meaningful insights. This includes the actual client service experience or problem resolution effectiveness.

Trading Experience Analysis

The assessment of trading experience with World Traders centers primarily on the MetaTrader 5 platform. Specific performance metrics and execution quality data are not available in reviewed materials. MT5 generally provides a robust trading environment with advanced charting and analysis capabilities.

Platform stability and execution speed lack specific documentation in available source materials. These are crucial factors in trading experience. Information about server uptime, connection reliability, and order execution statistics would typically inform this analysis but are not present in reviewed data.

Order execution quality remains undocumented. This includes fill rates, slippage statistics, and rejection rates. These metrics typically provide insight into the broker's operational efficiency and trading environment quality but are not available for evaluation.

Mobile trading experience through MT5 mobile applications would typically be part of the overall trading experience assessment. Specific information about mobile platform optimization or additional mobile features is not detailed in available materials.

This world traders review cannot provide comprehensive trading experience insights without access to performance data. User feedback or specific technical specifications about the broker's trading infrastructure and execution capabilities are also unavailable.

Trust and Safety Analysis

Trust and safety evaluation represents one of the most significant challenges in this World Traders assessment. This is due to the absence of regulatory information in available source materials. Regulatory oversight typically serves as the primary foundation for broker trust evaluation, yet specific regulatory authorities and license numbers are not documented.

Fund security measures are not detailed in reviewed materials. This includes client fund segregation, deposit insurance coverage, and negative balance protection policies. These protections typically form the cornerstone of client fund safety but cannot be evaluated without specific information.

Company transparency regarding ownership structure, financial statements, and operational disclosure remains unclear from available documentation. Public disclosure of company information typically contributes to trust assessment but is not available for review.

Industry reputation indicators are not mentioned in available source materials. This includes awards, recognitions, or industry association memberships. These factors often provide insight into peer recognition and industry standing but cannot be assessed here.

The absence of information about complaint handling procedures, regulatory compliance history, or any negative regulatory actions limits the comprehensive trust evaluation. Potential clients would typically expect this from a thorough broker review.

User Experience Analysis

User experience evaluation faces significant limitations due to the absence of client feedback and satisfaction data in available source materials. Overall user satisfaction metrics are not documented in reviewed information. These typically inform this analysis.

Interface design and platform usability assessment relies primarily on general MetaTrader 5 characteristics. Broker-specific customizations or interface modifications are not detailed in available materials. While MT5 generally provides good usability, specific enhancements or modifications by World Traders remain unknown.

Registration and account verification processes are not described in available documentation. These significantly impact initial user experience. The efficiency and user-friendliness of onboarding procedures cannot be assessed without this information.

Funding and withdrawal experience lacks documentation in reviewed materials. This includes processing times, fee structures, and available payment methods. These operational aspects significantly impact ongoing user satisfaction but cannot be evaluated here.

Common user complaints, satisfaction surveys, or testimonials are not available in source materials. These would typically inform user experience analysis, preventing meaningful assessment of actual client experience with World Traders' services.

Conclusion

This world traders review reveals a broker with some notable strengths but significant information transparency challenges. World Traders demonstrates competency in asset diversity and platform selection through its MetaTrader 5 offering and multi-asset approach. They cover stocks, cryptocurrencies, commodities, forex, and indices.

The broker appears suitable for retail and institutional clients seeking diversified trading opportunities across multiple asset classes. However, the substantial lack of information regarding regulatory oversight, specific account conditions, trading costs, and user feedback creates uncertainty about the broker's overall reliability and service quality.

Potential clients should exercise caution and conduct thorough independent research before engaging with World Traders. This is particularly important regarding regulatory status verification and detailed terms and conditions clarification. The absence of transparent operational information represents a significant limitation in making informed broker selection decisions.