Is Succedo Markets safe?

Pros

Cons

Is Succedo Markets A Scam?

Introduction

Succedo Markets is a relatively new player in the forex trading arena, claiming to provide a modern trading platform with a wide array of financial instruments. As with any broker, it is essential for traders to exercise caution and conduct thorough due diligence before committing their funds. The forex market is rife with opportunities, but it also attracts its fair share of unscrupulous entities. This article aims to provide a comprehensive analysis of Succedo Markets, evaluating its legitimacy and safety for potential investors. The investigation will be based on a review of its regulatory status, company background, trading conditions, client experiences, and overall risk assessment.

Regulatory and Legitimacy

One of the primary indicators of a broker's reliability is its regulatory status. A regulated broker is subject to oversight by financial authorities, which helps protect investors from fraud and malpractice. Unfortunately, Succedo Markets operates without any valid regulatory licenses from recognized financial authorities such as the Financial Conduct Authority (FCA) or the Australian Securities and Investments Commission (ASIC). This lack of regulation raises significant concerns about the broker's legitimacy and accountability.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Unregulated |

The absence of oversight means that Succedo Markets is not required to adhere to any industry standards, leaving clients vulnerable to unethical practices. Furthermore, the physical address provided by the broker appears to be unverifiable, which is a common tactic employed by fraudulent brokers to avoid accountability. Without regulatory compliance, potential investors should approach Succedo Markets with extreme caution.

Company Background Investigation

Succedo Markets was established in 2023 and claims to be registered in Saint Lucia. However, there is minimal information available regarding its ownership structure or the history of its operations. The management team behind the broker is not well-documented, raising questions about their qualifications and experience in the financial sector. A transparent company should provide detailed information about its leadership and operational history, which is notably lacking in this case.

The overall transparency of Succedo Markets is questionable, as many details about the company's operations and practices are either vague or missing. This lack of information can be a red flag for potential investors, as it indicates that the broker may not be forthcoming about its practices and policies. In a market where trust is paramount, the absence of clear information about the company's background makes it difficult to assess whether Succedo Markets is safe for trading.

Trading Conditions Analysis

When evaluating a broker, it is crucial to understand its fee structure and trading conditions. Succedo Markets offers various account types, including standard and ECN accounts, with leverage up to 1:500. However, the broker does not clearly disclose the minimum deposit requirements for its accounts, which can lead to confusion among potential clients.

The overall cost structure of Succedo Markets appears competitive, but the lack of transparency regarding fees can be concerning. Many traders have reported hidden fees and unexpected charges, which can significantly impact profitability.

| Fee Type | Succedo Markets | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 1.5 pips (Standard) | 1.2 pips |

| Commission Model | $7 per lot (ECN) | $5 per lot |

| Overnight Interest Range | Varies | Varies |

The discrepancies in fee structures compared to industry averages suggest that traders may not be getting the best deal possible. Furthermore, the potential for hidden fees raises the risk of unexpected costs, making it essential for traders to fully understand the fee structure before committing to this broker.

Client Funds Security

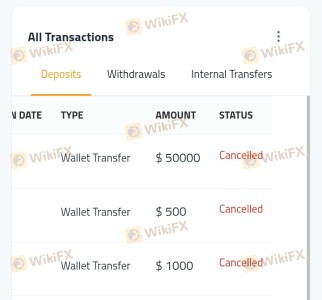

Client fund security is a crucial aspect of any trading platform. Succedo Markets claims to implement various measures to protect client funds, but the lack of regulation raises significant concerns about the effectiveness of these measures. The absence of segregated accounts means that client funds may not be protected in the event of the broker's insolvency.

Moreover, there is no information available regarding any investor protection schemes or negative balance protection policies. This lack of safeguards can expose traders to significant risks, as they could potentially lose more than their initial investment. Historical data indicates that unregulated brokers often face issues related to fund mismanagement or fraud, which further emphasizes the need for caution when considering whether Succedo Markets is safe.

Customer Experience and Complaints

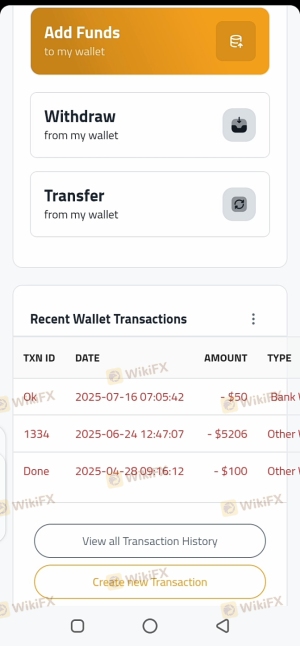

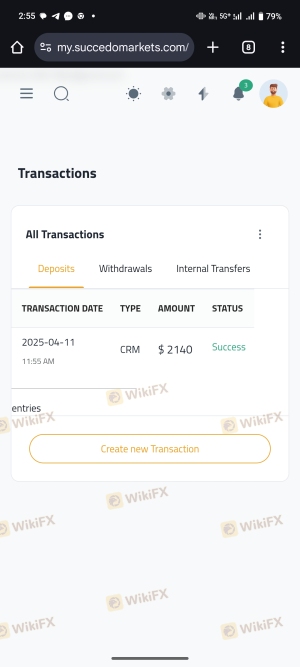

Customer feedback is an essential component of assessing a broker's reliability. Reviews of Succedo Markets reveal a pattern of negative experiences, with many clients reporting difficulties in withdrawing funds and inadequate customer support. Common complaints include:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Lack of Transparency | Medium | Minimal |

| Customer Support Delays | High | Slow |

One particularly concerning case involved a trader who deposited funds but faced significant challenges when attempting to withdraw them. After multiple attempts to contact customer support, the trader reported being blocked from accessing their account altogether. Such experiences highlight the potential risks associated with trading through Succedo Markets.

Platform and Trade Execution

The trading platform offered by Succedo Markets is based on the widely used MetaTrader 5 (MT5) framework, which is known for its robust features and user-friendly interface. However, the platform's performance and execution quality have been called into question. Users have reported instances of slippage and order rejections, indicating potential issues with trade execution.

Moreover, there are concerns about possible platform manipulation, as some traders have noted that their trades often seem to experience unfavorable conditions. Such issues can severely impact trading outcomes, making it essential for traders to thoroughly assess the platform's reliability before investing significant capital.

Risk Assessment

Using Succedo Markets comes with a range of risks that potential investors should carefully consider. The following risk assessment summarizes the key areas of concern:

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | No valid regulation or oversight |

| Fund Security Risk | High | Lack of segregated accounts |

| Customer Service Risk | Medium | Poor response to complaints |

| Execution Risk | Medium | Reports of slippage and order rejections |

To mitigate these risks, traders should consider starting with a small investment and conducting thorough research. Additionally, seeking regulated alternatives may provide a safer trading environment.

Conclusion and Recommendations

In conclusion, the evidence suggests that Succedo Markets raises several red flags that indicate it may not be a safe trading platform. The lack of regulation, transparency issues, and negative customer experiences all point to potential risks for investors. While the broker offers a range of trading instruments and competitive conditions, the overall safety and legitimacy of the platform remain questionable.

For traders seeking a reliable and secure trading experience, it is advisable to consider regulated alternatives such as brokers overseen by top-tier financial authorities. These brokers typically offer better protections for client funds and a more transparent trading environment. Always prioritize safety and due diligence when engaging in forex trading to avoid potential scams and financial losses.

Is Succedo Markets a scam, or is it legit?

The latest exposure and evaluation content of Succedo Markets brokers.

Succedo Markets Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Succedo Markets latest industry rating score is 1.32, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.32 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.