Is AFEX safe?

Pros

Cons

Is AFEX Safe or Scam?

Introduction

AFEX, also known as Associated Foreign Exchange, has been a player in the foreign exchange market for several decades. Established in California in 1979, AFEX has positioned itself as a provider of international payment solutions and foreign exchange services for both businesses and individuals. However, the question remains: Is AFEX safe? In an industry where trust and reliability are paramount, traders need to exercise caution when evaluating forex brokers. The potential for scams is high, and the consequences of choosing an unreliable broker can be severe, including the loss of funds and personal data exposure.

This article aims to provide a comprehensive evaluation of AFEX by examining its regulatory status, company background, trading conditions, customer fund safety, user experiences, platform performance, and associated risks. Our investigation draws on various online reviews, regulatory databases, and user feedback to present an objective perspective on whether AFEX is a trustworthy broker.

Regulation and Legitimacy

The regulatory environment is a critical aspect of any forex broker's legitimacy. A regulated broker is subject to oversight by financial authorities, which helps ensure that they adhere to specific operational standards and provide a level of protection to their clients. In the case of AFEX, the broker claims to have been regulated by several authorities, including the UK's Financial Conduct Authority (FCA). However, a closer look reveals that AFEX's regulatory status is questionable.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| FCA | N/A | United Kingdom | Revoked |

| ASIC | N/A | Australia | N/A |

| VQF | N/A | Switzerland | N/A |

The FCA has revoked AFEX's license, which raises significant concerns about its operational legitimacy. This revocation indicates that AFEX no longer meets the regulatory requirements set by the authority, which is a red flag for potential clients. Furthermore, the absence of a valid license from other reputable regulatory bodies further complicates the question of Is AFEX safe? Without proper regulation, traders are left vulnerable to potential fraud and mismanagement of funds.

Company Background Investigation

AFEX has a long history in the currency exchange industry, having been founded over 40 years ago. It has evolved from a small operation into a multinational corporation with offices in various countries, including the United States, the United Kingdom, and Australia. However, the transparency of its ownership structure and management team has been a concern.

The company is owned by Fleetcor Technologies, a global provider of commercial payment solutions. While Fleetcor is a well-established entity, the lack of detailed information regarding AFEX's management team raises questions about the broker's accountability and operational integrity.

Moreover, AFEX's website lacks comprehensive information about its leadership and their qualifications, which is essential for assessing the broker's credibility. The absence of clear communication and transparency contributes to the skepticism surrounding Is AFEX safe? Investors should be wary of engaging with a broker that does not provide sufficient information about its management and operational practices.

Trading Conditions Analysis

Understanding the trading conditions offered by AFEX is vital for evaluating its attractiveness to potential clients. AFEX provides a range of services, including foreign exchange and international payments. However, there are concerns regarding the overall fee structure and potential hidden costs.

| Fee Type | AFEX | Industry Average |

|---|---|---|

| Major Currency Pair Spread | Varies (not disclosed) | 1.0 - 2.0 pips |

| Commission Model | N/A | Varies |

| Overnight Interest Range | Varies | 0.5% - 2.0% |

AFEX's lack of transparency regarding its fee structure is troubling. While it claims to offer competitive rates, the absence of clear information about spreads and commissions makes it difficult for traders to assess the true cost of trading. Moreover, the potential for hidden fees could lead to unexpected expenses, further complicating the question of Is AFEX safe? Traders should be cautious and seek clarity on any costs before committing to a broker.

Customer Fund Safety

The safety of customer funds is one of the most critical factors when evaluating a forex broker. AFEX claims to implement various measures to protect client funds, including segregated accounts and compliance with regulatory requirements. However, the revocation of its FCA license raises significant concerns about the effectiveness of these measures.

AFEX's lack of a robust investor protection scheme leaves clients vulnerable to potential losses. For instance, there is no indication that AFEX participates in a compensation scheme that would refund clients in the event of insolvency. This lack of protection is a major drawback and highlights the risks associated with trading with an unregulated broker.

Additionally, historical complaints regarding fund withdrawal issues further exacerbate concerns about the safety of customer funds. Reports of delayed withdrawals and unresponsive customer service suggest that traders may face challenges when attempting to access their funds. Thus, the question remains: Is AFEX safe? The answer leans toward caution given the broker's questionable practices.

Customer Experience and Complaints

Customer feedback is invaluable when assessing a broker's reliability. AFEX has received mixed reviews from users, with some praising its services while others express significant dissatisfaction. Common complaints include difficulties with fund withdrawals, lack of transparency regarding fees, and unresponsive customer support.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow response |

| Fee Transparency | Medium | Generic replies |

| Customer Support | High | Unresponsive |

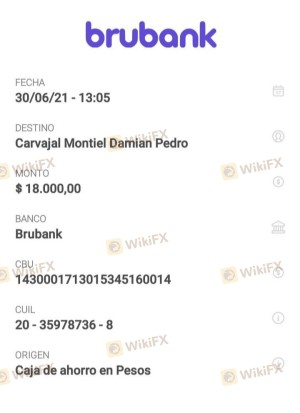

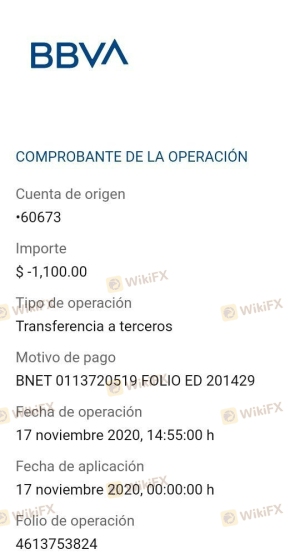

Two typical cases highlight the concerns surrounding AFEX. In one instance, a user reported waiting weeks for a withdrawal request to be processed, only to receive vague responses from customer service. In another case, a trader expressed frustration over unexpected fees that were not disclosed during the account setup process. These experiences raise serious questions about Is AFEX safe? and whether it can be trusted to handle clients' funds responsibly.

Platform and Trade Execution

The performance of a trading platform is crucial for a seamless trading experience. AFEX offers a proprietary platform, but user reviews indicate mixed results regarding its stability and execution quality. Issues such as slippage and order rejections have been reported, which can significantly impact trading outcomes.

Moreover, the absence of well-known trading platforms like MetaTrader 4 or 5 raises concerns about the broker's commitment to providing a reliable trading environment. Users have reported difficulties in executing trades, leading to frustration and potential financial losses. Given these factors, it is reasonable to question Is AFEX safe? when it comes to platform reliability and trade execution.

Risk Assessment

Engaging with AFEX involves several risks that potential clients should consider. The lack of regulation, transparency issues, and customer complaints collectively contribute to a high-risk profile for this broker.

| Risk Category | Risk Level | Brief Explanation |

|---|---|---|

| Regulatory Compliance | High | No valid regulatory oversight |

| Fund Safety | High | Potential for loss of funds |

| Customer Support Reliability | Medium | Slow or unresponsive service |

To mitigate these risks, potential traders should conduct thorough due diligence before engaging with AFEX. Seeking alternative, regulated brokers with positive user reviews may provide a more secure trading environment.

Conclusion and Recommendations

In conclusion, the investigation into AFEX reveals multiple red flags that suggest the broker may not be a safe choice for traders. The revocation of its FCA license, lack of transparency regarding fees, and numerous customer complaints raise significant concerns about its legitimacy. Therefore, it is prudent for traders to exercise caution and consider alternative options.

For those looking for reliable forex brokers, it is advisable to seek out well-regulated firms that offer transparent fee structures, robust customer support, and positive user experiences. Brokers such as OANDA, IG, and Forex.com are examples of reputable alternatives that provide a safer trading environment.

Ultimately, the question Is AFEX safe? leans toward a negative answer, and traders should prioritize their financial safety by choosing regulated and trustworthy brokers.

Is AFEX a scam, or is it legit?

The latest exposure and evaluation content of AFEX brokers.

AFEX Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

AFEX latest industry rating score is 1.59, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.59 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.