Is TCC safe?

Business

License

Is TCC A Scam?

Introduction

TCC, also known as Top Capital Corporation, is a Hong Kong-based forex broker that has emerged on the trading scene since its establishment in 2020. With the rapid growth of online trading, TCC positions itself as a platform that offers various trading instruments, primarily focusing on forex trading. However, the influx of online trading platforms has led to an increase in fraudulent activities, making it imperative for traders to conduct thorough evaluations of brokers before investing their hard-earned money. This article aims to investigate the legitimacy of TCC by exploring its regulatory status, company background, trading conditions, customer fund safety, and user experiences. The analysis is based on information gathered from multiple reputable sources and aims to provide a balanced view of whether TCC is a safe trading option or a potential scam.

Regulation and Legality

Regulatory oversight is a crucial factor in determining the credibility of a forex broker. It ensures that the broker adheres to specific financial standards and provides a layer of protection for traders. In the case of TCC, the regulatory landscape appears concerning. While TCC claims to be regulated by the UK's Financial Conduct Authority (FCA) under license number 796510, investigations reveal that this registration was canceled in December 2019. Consequently, TCC currently operates without any regulatory oversight.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| FCA | 796510 | United Kingdom | Canceled |

The absence of valid regulation raises significant red flags regarding TCC's operations. Regulatory bodies like the FCA enforce strict compliance measures to protect investors, including fund segregation and investor compensation schemes. Without such oversight, traders are exposed to higher risks, including potential fraud and mismanagement of funds. Furthermore, the lack of regulatory history and the revocation of TCC's license amplify concerns about the broker's legitimacy. Therefore, it is essential for prospective traders to approach TCC with caution, as the absence of regulation significantly impacts the safety of their investments.

Company Background Investigation

TCC was founded in 2020, and its operational history is relatively short compared to many established brokers in the forex market. The company claims to offer a fully digital account opening process and various trading instruments, including 33 forex currency pairs. However, the lack of transparency surrounding its ownership structure and management team raises questions about its credibility.

The management team's background is crucial in assessing the broker's reliability. Unfortunately, detailed information about the key personnel at TCC is scarce, and there are concerns regarding the qualifications and experience of the individuals behind the platform. Furthermore, the companys website is often inaccessible, making it difficult for potential clients to verify the information presented. Transparency in operations and clear communication from the management are vital for building trust with clients. Given these factors, TCC's lack of a well-documented history and management transparency further complicates its standing in the forex market.

Trading Conditions Analysis

Understanding the trading conditions offered by a broker is vital for traders seeking to optimize their trading experience. TCC provides a selection of trading accounts with varying minimum deposit requirements and leverage options. However, the overall fee structure and potential hidden costs associated with trading on TCC's platform have raised concerns among users.

| Fee Type | TCC | Industry Average |

|---|---|---|

| Spread for Major Pairs | 0.03 pips | 1.0 – 1.5 pips |

| Commission Model | Not stated | Varies widely |

| Overnight Interest Range | Not disclosed | 2% - 5% |

While TCC advertises competitive spreads, the lack of transparency regarding commissions and overnight interest rates may indicate potential pitfalls for traders. Users have reported unexpected fees, making it crucial for traders to read the fine print before engaging with TCC. Additionally, the absence of a demo account limits traders' ability to test the platform without financial risk. Overall, the trading conditions at TCC warrant caution, as they may not align with industry standards.

Customer Fund Safety

The safety of customer funds is of utmost importance when selecting a forex broker. TCC's lack of regulatory oversight raises significant concerns about its fund security measures. Typically, regulated brokers are required to maintain client funds in segregated accounts, ensuring that traders' money is protected in the event of the broker's insolvency. However, without regulation, TCC may not be obligated to implement such protective measures.

Moreover, there is little information available regarding TCC's policies on negative balance protection and investor compensation schemes. The absence of these safeguards could expose traders to substantial financial losses. Historical accounts of clients facing withdrawal issues and losing their funds further exacerbate concerns about TCC's commitment to fund safety. Therefore, traders must carefully consider these factors before deciding to invest their money with TCC.

Customer Experience and Complaints

Customer feedback plays a critical role in assessing a broker's reliability. Reviews and testimonials regarding TCC have been mixed, with several users reporting negative experiences. Common complaints include withdrawal difficulties, lack of responsive customer support, and issues with account management.

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Support | Medium | Slow |

| Account Management | High | Unresolved |

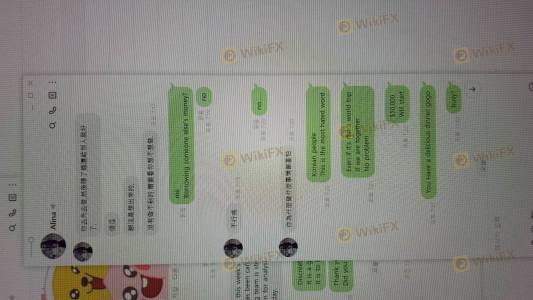

Many users have recounted their struggles to withdraw funds, with some claiming that their accounts were frozen after making initial deposits. These complaints align with the broader concerns about TCC's legitimacy, as users have described feeling trapped and unable to access their own money. Additionally, the company's response to such complaints has been criticized for being slow and inadequate.

For example, one user reported being introduced to TCC through a WhatsApp group, only to find themselves unable to withdraw their funds after several weeks of trading. This type of experience raises alarms about the broker's operational integrity and suggests a lack of accountability.

Platform and Execution

Evaluating the trading platform's performance is essential for traders seeking a seamless trading experience. TCC claims to offer a user-friendly interface with access to various trading tools. However, user reviews indicate that the platform may suffer from stability issues, including slow loading times and occasional downtime.

Furthermore, concerns regarding order execution quality have been raised, with reports of slippage and order rejections. Such issues can significantly impact a trader's ability to capitalize on market opportunities and may suggest potential manipulation. Traders must be cautious when using TCC's platform, as any signs of platform instability could lead to financial losses.

Risk Assessment

Using TCC as a forex broker presents several risks that traders should be aware of. The absence of regulatory oversight, combined with reports of withdrawal difficulties and customer complaints, indicates a high-risk environment for traders.

| Risk Category | Risk Level | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | No valid regulatory oversight |

| Fund Safety Risk | High | Lack of fund segregation and protection |

| Customer Service Risk | Medium | Poor response to customer complaints |

To mitigate these risks, traders should consider the following recommendations:

- Conduct Thorough Research: Always verify a broker's regulatory status and read customer reviews before investing.

- Start Small: If you choose to trade with TCC, consider starting with a small amount of capital to limit potential losses.

- Explore Alternatives: Look for regulated brokers with a proven track record and positive customer feedback.

Conclusion and Recommendations

After a comprehensive analysis of TCC, it is evident that significant concerns regarding its legitimacy and reliability exist. The lack of regulatory oversight, coupled with numerous customer complaints and issues related to fund safety, suggests that TCC may not be a safe option for traders.

For traders seeking a trustworthy forex broker, it is advisable to explore alternatives that are regulated and have a positive reputation in the industry. Brokers such as OANDA, IG, and Forex.com have established themselves as reliable options, offering strong regulatory protections and positive customer experiences. In conclusion, prospective traders should exercise caution and consider all available information before deciding to engage with TCC, as the risks associated with this broker may outweigh any potential benefits.

Is TCC a scam, or is it legit?

The latest exposure and evaluation content of TCC brokers.

TCC Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

TCC latest industry rating score is 1.53, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.53 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.