AMarkets 2025 Review: Everything You Need to Know

Executive Summary

AMarkets is an unregulated forex and CFD broker established in 2007. The company is registered in Saint Vincent and the Grenadines. This Amarkets review reveals a trading platform that attracts traders seeking high-leverage opportunities across diverse asset classes. The broker operates primarily through the MT4 platform. It offers access to forex pairs, CFDs, and stocks with competitive leverage conditions.

According to available information, AMarkets has garnered over 3,039 customer reviews on Trustpilot. The company reportedly received more than 30 awards in 2025, indicating some level of market recognition. The platform particularly appeals to traders who prioritize high-leverage trading conditions. These traders are comfortable with the risks associated with unregulated brokers.

The broker's main selling points include its extensive asset selection and established market presence since 2007. It also offers enhanced trading fee rebates designed to maximize user returns. However, potential clients should carefully consider the regulatory implications before opening an account.

Important Disclaimers

Regional Entity Differences: AMarkets operates from Saint Vincent and the Grenadines. This means regulatory policies and client protections may vary significantly across different countries. Traders should verify their local regulatory requirements before engaging with this broker.

Review Methodology: This assessment is based on publicly available information and user feedback. While we strive for accuracy, we have not independently verified all data points presented by the broker. Specific terms may change without notice.

Rating Framework

Broker Overview

Company Background and Establishment

AMarkets entered the forex and CFD trading market in 2007. The company established itself as a financial services provider registered in Saint Vincent and the Grenadines. Over its 18-year operational history, the company has positioned itself as a broker specializing in high-leverage trading opportunities. The broker's longevity in the market suggests some level of operational stability. However, this should be weighed against its unregulated status.

The company operates under a business model focused on providing access to global financial markets through contract for difference trading and foreign exchange services. According to company information, AMarkets has built a client base that values aggressive trading conditions and diverse investment opportunities.

Trading Infrastructure and Asset Coverage

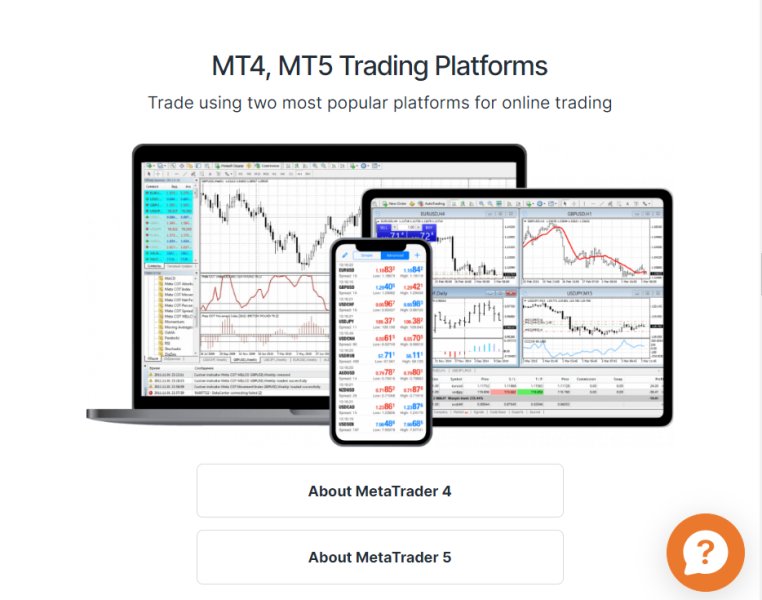

AMarkets operates exclusively through the MetaTrader 4 platform. This is one of the industry's most recognized trading interfaces. This Amarkets review finds that the broker offers access to multiple asset classes including foreign exchange pairs, contracts for difference on various underlying assets, and stock trading opportunities. The platform choice suggests a focus on traditional retail forex trading rather than proprietary technology development.

The broker's asset selection spans major, minor, and exotic currency pairs. It also includes CFD instruments covering commodities, indices, and individual equity positions. This diversification allows traders to implement various strategies across different market sectors. However, specific instrument counts and availability details require further verification through direct broker contact.

Regulatory Jurisdiction: AMarkets operates from Saint Vincent and the Grenadines without formal financial services regulation. This significantly impacts client protection standards and dispute resolution mechanisms.

Deposit and Withdrawal Methods: Specific payment processing options are not detailed in available materials. They require direct inquiry with the broker for comprehensive information.

Minimum Deposit Requirements: The broker has not publicly specified minimum account opening amounts. This suggests potential flexibility or tier-based account structures that need clarification.

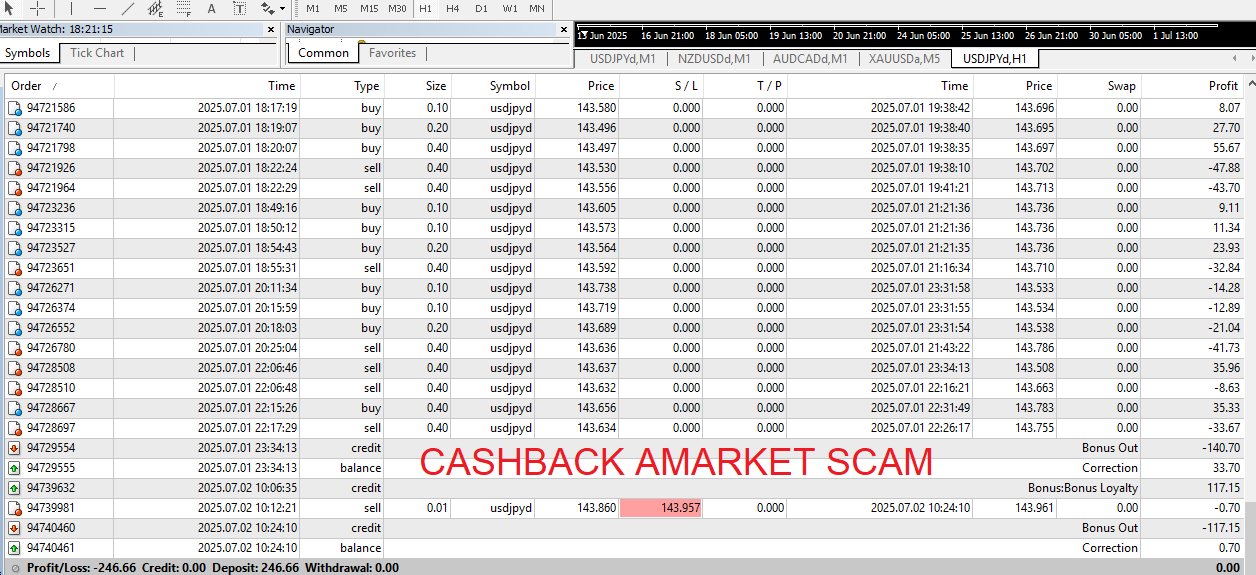

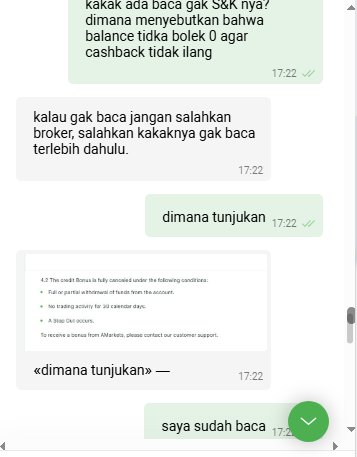

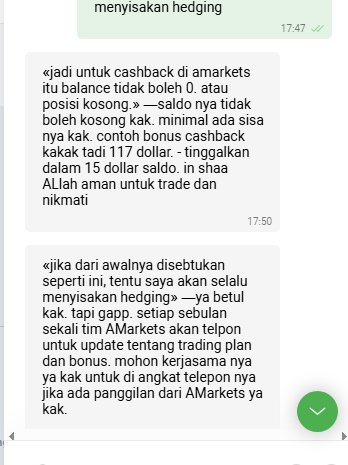

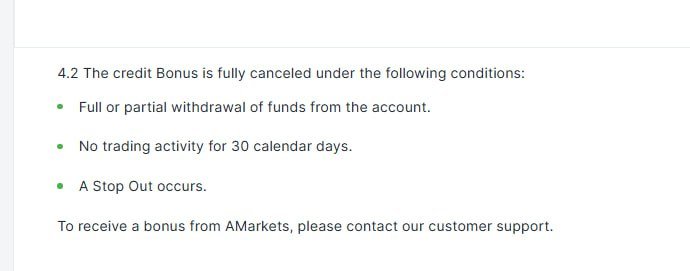

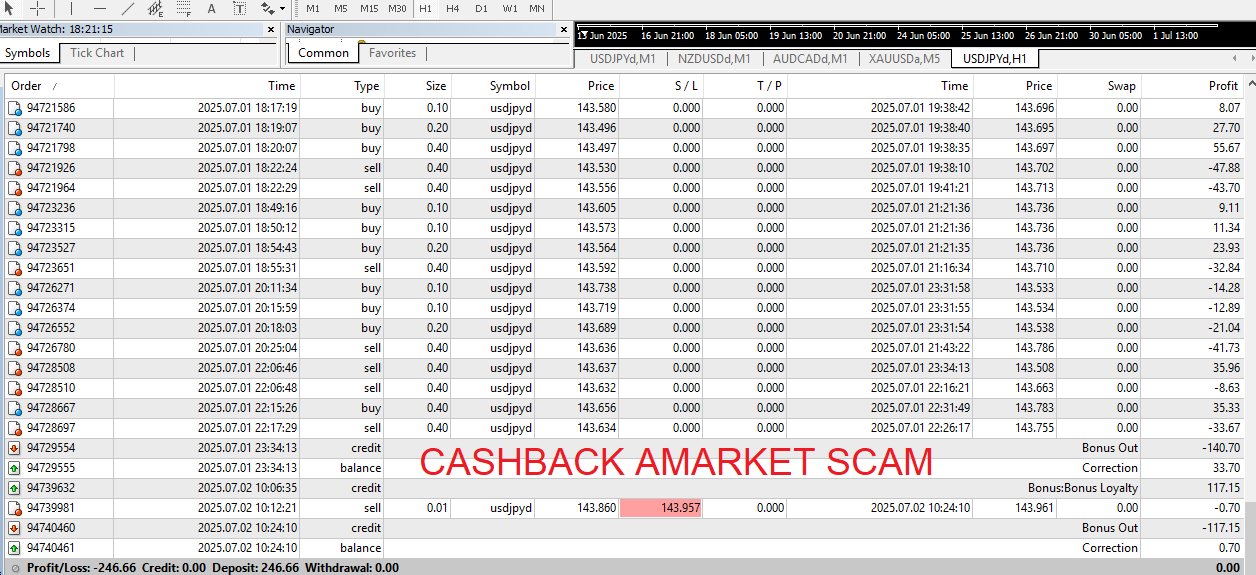

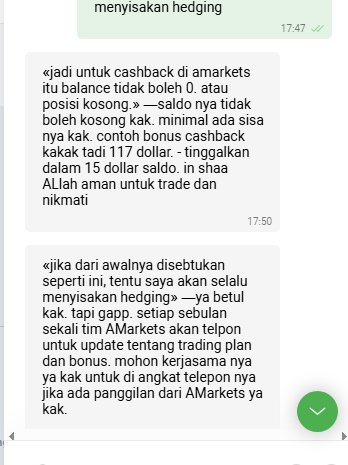

Promotional Offerings: AMarkets advertises enhanced trading fee rebates designed to maximize client returns. However, specific terms, conditions, and eligibility criteria are not publicly detailed in this Amarkets review.

Available Trading Assets: The platform supports forex currency pairs and CFD instruments across multiple asset classes. It also provides direct stock trading, giving traders comprehensive market exposure opportunities.

Cost Structure: Detailed information about spreads, commission rates, overnight financing charges, and other trading costs requires direct verification with the broker. Public materials lack specific pricing transparency.

Leverage Capabilities: The broker offers high-leverage trading conditions. However, maximum leverage ratios, margin requirements, and risk management policies need individual confirmation based on account type and jurisdiction.

Platform Technology: Trading is conducted exclusively through MetaTrader 4. This provides access to standard charting tools, technical indicators, automated trading capabilities, and third-party expert advisor support.

Detailed Rating Analysis

Account Conditions Analysis

The account conditions evaluation for AMarkets reveals significant information gaps that impact trader decision-making. Available materials do not specify distinct account types, their respective features, or minimum deposit requirements. This makes it difficult to assess the broker's accessibility to different trader segments. The lack of transparency in account structuring raises questions about the broker's commitment to clear client communication.

Without detailed information about spread structures, commission schedules, or account tier benefits, potential clients cannot accurately compare AMarkets' offerings against regulated competitors. The absence of publicly available account opening procedures, verification requirements, or special account features like Islamic trading accounts further complicates evaluation.

User feedback specifically addressing account conditions, fees, or opening experiences is not readily available in current materials. This Amarkets review cannot provide comparative analysis against industry standards without access to concrete pricing and account structure data. The broker's failure to provide transparent account information significantly impacts its competitiveness in the current market environment.

AMarkets' technology infrastructure centers around the MetaTrader 4 platform. This provides traders with access to industry-standard charting capabilities, technical analysis tools, and automated trading support. The MT4 platform offers comprehensive functionality including multiple timeframe analysis, custom indicator integration, and expert advisor compatibility. It meets most retail trading requirements.

However, this evaluation reveals notable gaps in educational resources, market research capabilities, and proprietary analysis tools. The broker does not appear to offer extensive educational materials, webinar programs, or market commentary that many traders value for skill development and market insight. Advanced research tools, economic calendars, or fundamental analysis resources are not prominently featured in available materials.

The platform's automated trading support allows for algorithmic strategy implementation. However, the quality of execution, server stability, and latency performance require independent verification. User experiences with tool reliability, platform uptime, and technical support quality are not sufficiently documented to provide comprehensive assessment in this review.

Customer Service and Support Analysis

Customer service evaluation for AMarkets is significantly hampered by the lack of detailed information about support channels, availability hours, and service quality metrics. The broker has not clearly outlined whether support is available through phone, email, live chat, or other communication methods. This makes it impossible to assess accessibility for urgent trading issues.

Response time commitments, service level agreements, and escalation procedures are not documented in available materials. The absence of information about multilingual support capabilities raises questions about the broker's ability to serve its international client base effectively. This is particularly concerning given its global marketing approach.

With over 3,039 reviews on Trustpilot, there appears to be substantial user interaction. However, specific feedback about customer service experiences, problem resolution effectiveness, and support quality is not detailed in current materials. The lack of documented customer service standards or quality assurance measures suggests potential inconsistency in support delivery across different client situations and time zones.

Trading Experience Analysis

The trading experience evaluation focuses primarily on the MetaTrader 4 platform implementation. This provides a familiar interface for most forex and CFD traders. Platform stability, execution speed, and order processing quality are critical factors that require real-time testing to assess accurately. However, such performance data is not available in current review materials.

Order execution quality, including slippage rates, requote frequency, and fill rates during volatile market conditions, remains unspecified. The broker's execution model, whether market making, STP, or ECN, is not clearly documented. This makes it difficult to predict trading cost structures and execution characteristics.

Mobile trading capabilities through MT4 mobile applications should provide standard functionality. However, user experiences with mobile platform performance, synchronization, and feature completeness are not detailed in available materials. This Amarkets review cannot provide specific assessment of trading environment quality without access to detailed performance metrics and user experience data.

Trust and Safety Analysis

The trust and safety evaluation reveals significant concerns due to AMarkets' unregulated status. Operating without oversight from established financial regulators like the FCA, CySEC, or ASIC means clients lack standard investor protections. These include compensation schemes, segregated fund requirements, and regulatory dispute resolution mechanisms.

The absence of regulatory supervision raises questions about fund security measures, client money handling procedures, and operational transparency standards. Without regulatory requirements for regular auditing, capital adequacy reporting, or compliance monitoring, clients must rely entirely on the broker's voluntary commitments to safe business practices.

Despite receiving reportedly over 30 awards in 2025, the lack of regulatory oversight significantly impacts the broker's trustworthiness assessment. Industry recognition and awards cannot substitute for regulatory compliance and client protection measures that regulated brokers must maintain. The broker's long market presence since 2007 provides some operational history. However, this does not mitigate regulatory protection gaps.

User Experience Analysis

User experience assessment is based on the substantial review presence on platforms like Trustpilot. AMarkets has accumulated 3,039 customer reviews there. However, specific satisfaction ratings, common user complaints, and detailed feedback analysis are not available in current materials. This limits comprehensive user experience evaluation.

The MT4 platform interface provides familiar navigation and functionality for experienced traders. However, ease of use for beginners, onboarding processes, and account management interfaces require individual assessment. Registration procedures, identity verification requirements, and account activation timelines are not documented in available materials.

Fund management experiences, including deposit processing times, withdrawal procedures, and transaction fee structures, lack detailed user feedback in current review materials. The broker appears to attract traders seeking high-leverage opportunities. This suggests a user base comfortable with elevated risk levels. However, specific user demographics and satisfaction metrics need further investigation.

Conclusion

This Amarkets review reveals a broker with an established market presence since 2007. It offers high-leverage trading opportunities across multiple asset classes through the reliable MT4 platform. The broker's appeal primarily targets traders seeking aggressive trading conditions and diverse investment options. These traders are particularly comfortable operating with unregulated financial service providers.

However, the unregulated status presents significant concerns for trader safety and fund security. The lack of transparency in account conditions, pricing structures, and service standards creates uncertainty for potential clients. The broker may suit experienced traders who prioritize leverage and asset diversity over regulatory protection. However, conservative traders should carefully consider the associated risks before engagement.

The substantial user review presence suggests active client engagement. However, detailed satisfaction metrics and service quality assessments require further investigation beyond this review's scope.