Is WHITEFOREX safe?

Pros

Cons

Is White Forex Safe or Scam?

Introduction

White Forex, an online trading platform, positions itself as a gateway for traders seeking to engage in the foreign exchange market. With promises of competitive spreads and a user-friendly interface, it aims to attract both novice and experienced traders. However, the legitimacy of such platforms is often shrouded in uncertainty, making it imperative for traders to conduct thorough due diligence before committing their funds. This article aims to investigate the safety and legitimacy of White Forex by analyzing its regulatory status, company background, trading conditions, customer feedback, and overall risk profile.

To achieve a comprehensive assessment, we will employ a structured evaluation framework that encompasses key areas of concern for potential investors. Our investigation will draw on data from various credible sources, including user reviews, regulatory databases, and industry reports, to present a balanced view of whether White Forex is safe or potentially a scam.

Regulation and Legitimacy

The regulatory status of a trading platform is crucial in determining its legitimacy. Regulated brokers are held to stringent standards, which provide a layer of protection for investors. In the case of White Forex, it operates without any notable regulatory oversight from recognized financial authorities, which raises significant red flags.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Unregulated |

The absence of a valid license from reputable institutions such as the Financial Conduct Authority (FCA) or the Australian Securities and Investments Commission (ASIC) suggests that White Forex does not meet the necessary compliance standards. This lack of regulation exposes traders to potential risks, including financial mismanagement and fraudulent practices. Furthermore, the platform's claims of high returns with minimal risk should be approached with skepticism, as these are common tactics used by unregulated brokers to lure unsuspecting investors.

Company Background Investigation

White Forex Limited, the entity behind the trading platform, is registered in Saint Lucia. However, details regarding its ownership structure and operational history remain vague. The company's website offers limited information about its management team or their qualifications, which is concerning for potential investors seeking transparency.

The lack of clear information about the company's history and ownership raises questions about its credibility. Established brokers typically provide detailed insights into their leadership and operational frameworks, which helps build trust among clients. In contrast, White Forex's opaque corporate structure may indicate a lack of accountability, further exacerbating concerns about its legitimacy.

Trading Conditions Analysis

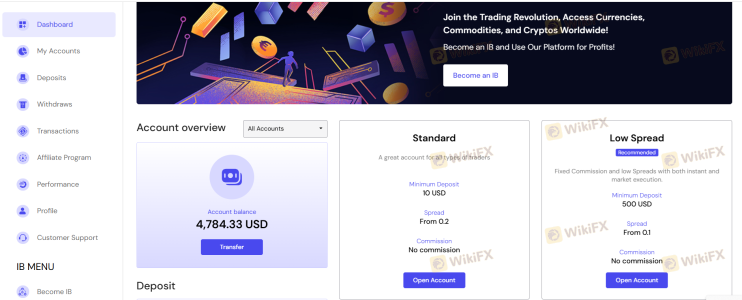

When evaluating whether White Forex is safe, it is essential to scrutinize its trading conditions and fee structures. White Forex advertises low spreads and no commission on trades, which may initially appear attractive. However, the overall fee structure is often where unregulated brokers conceal additional costs that can significantly impact profitability.

| Fee Type | White Forex | Industry Average |

|---|---|---|

| Major Currency Pairs Spread | 1.5 pips | 1.0 pips |

| Commission Model | None | $5 per lot |

| Overnight Interest Range | 0.5% | 0.3% |

While the advertised spreads may seem competitive, traders must be cautious of hidden fees or unfavorable terms that could arise during the trading process. Reports from users indicate that withdrawal issues and unexpected charges are common complaints, which could suggest that the platform does not operate transparently.

Client Funds Safety

The safety of client funds is paramount when assessing a trading platform's reliability. White Forex claims to implement various security measures, including segregated accounts and negative balance protection. However, without regulatory oversight, these claims become difficult to verify.

Traders should be particularly wary of platforms that do not provide clear information about how client funds are managed. The lack of independent audits or third-party verification further compounds this issue, making it challenging to ascertain whether White Forex genuinely prioritizes client fund security. Historical complaints of blocked accounts and withheld profits add to the apprehension surrounding the safety of funds deposited with this broker.

Customer Experience and Complaints

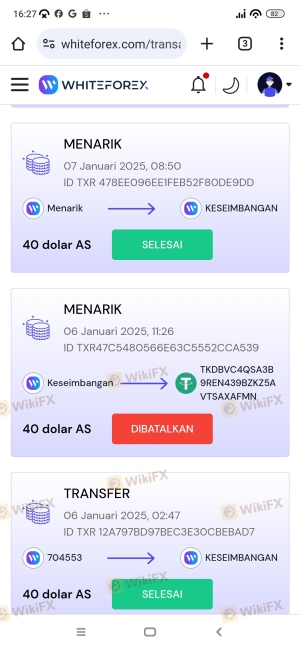

Customer feedback is a valuable resource for evaluating the reliability of any trading platform. In the case of White Forex, numerous users report negative experiences, particularly concerning withdrawal difficulties and unresponsive customer service.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Account Blocking | High | Poor |

| Customer Support Response | Medium | Poor |

Many traders have expressed frustration over their inability to access funds after making deposits, with some reporting that their accounts were blocked without explanation. Such patterns of behavior are indicative of potential fraud, raising serious questions about whether White Forex is safe for trading.

Platform and Execution Quality

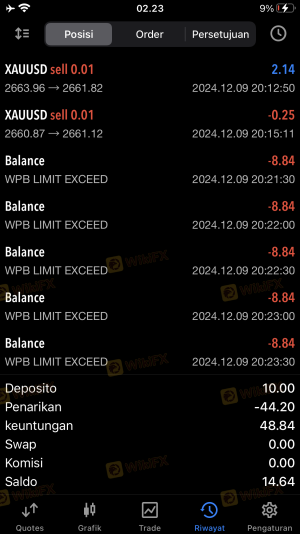

The performance of a trading platform directly affects the trading experience. White Forex claims to offer a stable and efficient trading environment; however, user reviews suggest otherwise. Issues with order execution quality, including slippage and rejected orders, have been reported.

Traders have noted that the platform's performance does not align with its advertised capabilities, leading to frustration and financial losses. If a broker cannot guarantee reliable order execution, it poses a significant risk to traders, further emphasizing the need for caution.

Risk Assessment

Using White Forex involves several inherent risks, primarily stemming from its unregulated status and negative user feedback.

| Risk Category | Risk Level | Brief Description |

|---|---|---|

| Regulatory Risk | High | No oversight from recognized regulatory bodies |

| Financial Risk | High | Reports of difficulty withdrawing funds |

| Operational Risk | Medium | Poor platform performance and execution issues |

To mitigate these risks, traders should consider using regulated brokers with a proven track record. Conducting thorough research and seeking out platforms with positive user feedback can help safeguard investments.

Conclusion and Recommendations

In conclusion, the evidence suggests that White Forex exhibits several characteristics commonly associated with scam brokers. The lack of regulation, poor customer experiences, and questionable trading practices raise significant concerns about its legitimacy.

For traders considering engaging with White Forex, it is advisable to exercise extreme caution. Those who value the safety of their funds and seek a reliable trading experience should opt for regulated brokers with transparent practices and positive reputations. Alternatives such as brokers regulated by the FCA or ASIC should be prioritized to ensure a secure trading environment. Ultimately, the risks associated with White Forex far outweigh any potential benefits, making it a platform to avoid.

Is WHITEFOREX a scam, or is it legit?

The latest exposure and evaluation content of WHITEFOREX brokers.

WHITEFOREX Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

WHITEFOREX latest industry rating score is 1.27, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.27 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.