Wealthengine 2025 Review: Everything You Need to Know

Executive Summary

This detailed Wealthengine review looks at a platform that calls itself a wealth identification and prospect research solution provider instead of a regular forex broker. WealthEngine keeps profiles of more than 250 million people and works mainly with retail, real estate, and other businesses that need prospect development services.

The platform shows some good workplace culture signs. About 61% of workers on Glassdoor say they would recommend it as a place to work. But forex traders who want a complete trading environment will find WealthEngine has big problems because it lacks detailed information about trading conditions, regulatory oversight, and financial services that forex brokers usually provide.

Our study shows that WealthEngine works more like a data and analytics company than a financial services provider. This may upset traders who want traditional forex trading features. The company does well with its large database and prospect identification tools, but it lacks transparency about trading platforms, account conditions, and regulatory compliance that serious forex traders need.

Important Notice

Regional Entity Differences: WealthEngine has not given specific regulatory information across different areas, which may show varying compliance standards or operational differences in different regions. Users should check regulatory status in their specific location before using the platform.

Review Methodology: This evaluation uses publicly available information and user feedback from various sources. Because WealthEngine provides limited transparency about forex trading services, some parts of this review may have incomplete information. Traders should do independent verification of all claims and services before making any financial commitments.

Rating Framework

Broker Overview

WealthEngine calls itself a leading wealth identification and prospect research solution provider. It keeps a large database of more than 250 million unique individual profiles. The company's main business model focuses on giving wealth screening, segmentation, prospect development, and search services to various industries, especially retail and real estate sectors.

The platform's approach is very different from traditional forex brokers because it emphasizes data analytics and customer relationship management rather than direct financial trading services. According to available information, WealthEngine's main strength is its ability to help businesses identify potential high-value customers through sophisticated data analysis and wealth indicators.

However, this Wealthengine review must note that specific information about trading platform types, asset classes, and primary regulatory oversight remains unavailable in accessible materials. The lack of clear regulatory disclosure and trading-focused features raises questions about the platform's suitability for serious forex traders seeking comprehensive trading environments with proper oversight and protection.

Regulatory Jurisdictions: Specific regulatory information is not provided in available materials. This represents a significant concern for potential forex traders seeking properly regulated trading environments.

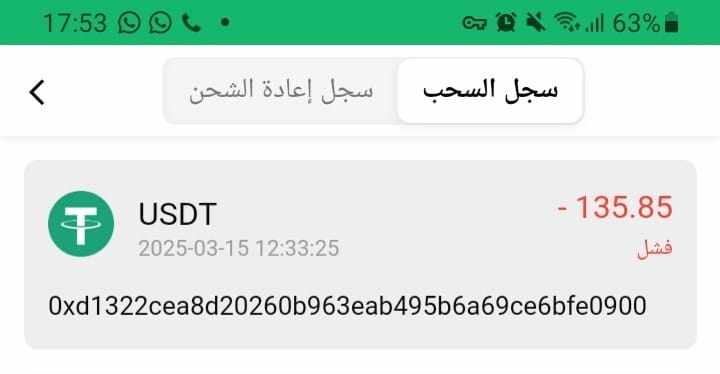

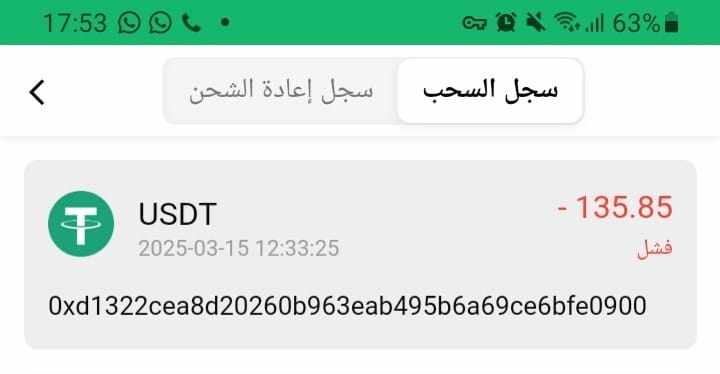

Deposit and Withdrawal Methods: Information about funding methods and withdrawal processes is not detailed in accessible sources. This makes it difficult to assess the convenience and security of financial transactions.

Minimum Deposit Requirements: Specific minimum deposit amounts are not disclosed in available materials. This prevents accurate assessment of accessibility for different trader categories.

Bonus and Promotions: Details about promotional offers or bonus structures are not mentioned in source materials. This suggests either absence of such programs or lack of transparency in marketing.

Tradeable Assets: The range of available trading instruments is not specified in accessible information. This is unusual for legitimate forex brokers who typically highlight their asset offerings prominently.

Cost Structure: Comprehensive information about spreads, commissions, and other trading costs is not available in source materials. This makes cost comparison with other brokers impossible.

Leverage Ratios: Specific leverage offerings are not detailed in available information. This is concerning given the importance of leverage disclosure in forex trading.

Platform Options: Trading platform specifications and options are not described in accessible materials. This prevents evaluation of technological capabilities.

Geographic Restrictions: Information about regional limitations or restrictions is not provided in available sources.

Customer Service Languages: Specific language support options are not detailed in accessible materials.

This Wealthengine review finds the lack of detailed trading information particularly concerning for potential forex traders.

Detailed Rating Analysis

Account Conditions Analysis

The evaluation of WealthEngine's account conditions faces significant limitations due to the absence of detailed information in available materials. Traditional forex brokers typically provide clear specifications about account types, minimum deposit requirements, and special features, but WealthEngine's available documentation does not include such details.

Account type variety and characteristics remain unspecified. This makes it impossible to determine whether the platform offers different account tiers for various trader experience levels or capital amounts. The lack of minimum deposit requirement disclosure prevents assessment of accessibility for retail traders, while account opening procedures are not detailed in accessible sources.

Special account features, such as Islamic accounts for Muslim traders or professional account options, are not mentioned in available materials. This absence of information raises concerns about the platform's commitment to serving diverse trading communities and regulatory compliance with various jurisdictions' requirements.

User feedback regarding account conditions is not available in source materials. This prevents the inclusion of real trader experiences in this Wealthengine review. Without comparative information about account conditions relative to other brokers, potential users cannot make informed decisions about the platform's competitiveness in the forex market.

The assessment of WealthEngine's trading tools and resources reveals significant information gaps that prevent comprehensive evaluation. While the platform emphasizes its wealth identification capabilities with over 250 million profiles, specific trading tools quality and variety are not detailed in available materials.

Research and analysis resources, which are crucial for successful forex trading, are not specifically described in accessible sources. Educational resources, including webinars, tutorials, or market analysis, are not mentioned in available documentation, suggesting either absence of such materials or inadequate marketing of these features.

Automated trading support, including Expert Advisor compatibility or algorithmic trading capabilities, is not addressed in source materials. This omission is particularly notable given the importance of automated trading in modern forex markets and the expectation that legitimate brokers provide such functionality.

User feedback about tool effectiveness and resource quality is not available in accessible materials. This prevents the inclusion of practical trader experiences. Expert opinions on tool quality are similarly absent from source documentation, limiting the depth of analysis possible in this evaluation.

Customer Service and Support Analysis

Customer service evaluation for WealthEngine faces substantial limitations due to insufficient information in available materials. Traditional forex brokers typically provide detailed information about support channels, availability, and service quality metrics, but WealthEngine's accessible documentation lacks such specifics.

Support channel availability and accessibility are not detailed in source materials. This makes it impossible to assess whether traders can reach assistance through phone, email, live chat, or other preferred methods. Response time metrics, which are crucial for time-sensitive trading situations, are not provided in available information.

Service quality indicators, including customer satisfaction scores or resolution rates, are not mentioned in accessible sources. Multi-language support capabilities, essential for international traders, are not specified in available documentation, raising questions about the platform's global service commitment.

Customer service hour availability is not detailed in source materials. This prevents assessment of support accessibility during different trading sessions. User feedback about service experiences is not available in accessible information, limiting the practical insights that could inform potential traders about real support quality.

Trading Experience Analysis

The evaluation of WealthEngine's trading experience encounters significant obstacles due to the absence of detailed platform information in available materials. Platform stability and execution speed, fundamental aspects of forex trading, are not addressed in accessible sources, preventing assessment of technical performance.

Order execution quality metrics, including slippage rates and fill speeds, are not provided in available documentation. Platform functionality completeness, such as charting capabilities, technical indicators, and order types, remains unspecified in source materials, making it impossible to evaluate trading environment sophistication.

Mobile trading experience details are not available in accessible information. This is particularly concerning given the importance of mobile trading in modern forex markets. Trading environment characteristics, including market depth display and real-time pricing accuracy, are not described in source materials.

User feedback about trading experiences is not available in accessible documentation. This prevents inclusion of practical trader perspectives in this Wealthengine review. Technical performance data from independent testing is similarly absent, limiting the objective assessment of platform capabilities and reliability.

Trust Factor Analysis

Trust factor assessment for WealthEngine reveals concerning information gaps that impact confidence evaluation. Regulatory qualification details are not provided in available materials, which represents a fundamental concern for forex traders seeking properly regulated trading environments with investor protection.

Fund security measures, including segregated account policies and insurance coverage, are not detailed in accessible sources. Company transparency levels, typically demonstrated through regular financial reporting and clear operational disclosure, are not evident in available documentation.

Industry reputation indicators, such as awards, recognition, or professional affiliations, are not mentioned in source materials. Negative event handling procedures and historical incident management are not addressed in available information, preventing assessment of crisis management capabilities.

Regulatory authority verification is not possible due to the absence of specific regulatory disclosure in accessible materials. Third-party evaluations and industry reports are not available in source documentation, limiting independent verification of trustworthiness claims.

User Experience Analysis

User experience evaluation for WealthEngine faces limitations due to insufficient feedback and interface information in available materials. Overall user satisfaction metrics are not provided in accessible sources, preventing comprehensive assessment of trader contentment with platform services.

Interface design and usability characteristics are not detailed in available documentation. This makes it impossible to evaluate platform accessibility and user-friendliness. Registration and verification process descriptions are not provided in source materials, preventing assessment of onboarding experience quality.

Fund operation experience details, including deposit and withdrawal procedures, are not specified in accessible information. Common user complaints and satisfaction drivers are not documented in available sources, limiting understanding of typical user concerns and preferences.

User demographic analysis is not available in source materials. This prevents identification of trader types best suited for the platform. Balanced presentation of positive and negative feedback is not possible due to insufficient user review availability in accessible documentation.

Conclusion

This Wealthengine review concludes that while WealthEngine demonstrates capabilities in wealth identification and prospect development with its extensive database of 250 million profiles, it lacks the comprehensive information and transparency expected from legitimate forex brokers. The absence of detailed trading conditions, regulatory disclosure, and platform specifications raises significant concerns for serious forex traders.

The platform appears more suitable for businesses requiring customer development and wealth analysis services rather than individual forex traders seeking robust trading environments. The lack of specific trading information, regulatory oversight details, and user experience feedback suggests that potential traders should exercise considerable caution and seek alternative, more transparent forex brokers.

Primary advantages include extensive customer profile databases and apparent positive workplace culture. Significant disadvantages encompass the absence of trading-specific information, regulatory transparency, and comprehensive service details that experienced forex traders require for informed decision-making.