Wealthengine foreign exchange brokers specializing in providing foreign exchange trading services, the company's official website https://h5.wealthengine.me/#/pages/register/index, about the company's legal and temporary regulatory information, the company's address .

Wealthengine Forex Broker

Basic Information

Australia

Australia

Wealthengine Broker - Complete Information Guide

1. Broker Overview

WealthEngine, Inc. is a prominent provider of predictive marketing analytics, audience development, and wealth intelligence services. Established in 1991, the company is headquartered in Bethesda, Maryland, with additional operations in the United Kingdom. WealthEngine operates as a private company and serves a diverse clientele, primarily focusing on nonprofit organizations, financial services, and luxury brands.

WealthEngine has grown significantly since its inception, currently boasting approximately 4,000 clients utilizing its products and solutions for comprehensive consumer insights. The company has achieved several milestones, including the expansion of its data sources and the enhancement of its predictive analytics capabilities. WealthEngine is a part of Altrata, a division of Euromoney PLC, which underscores its standing within the financial services landscape.

The business model of WealthEngine revolves around providing sophisticated tools for retail forex and institutional services, enabling organizations to identify and engage with high-potential prospects through data-driven insights. By leveraging its extensive database, WealthEngine empowers clients to optimize their fundraising and marketing strategies effectively.

2. Regulatory and Compliance Information

WealthEngine is subject to various regulatory frameworks, ensuring compliance with industry standards. The primary regulatory bodies include:

- Federal Trade Commission (FTC)

- Data Protection Authorities in the UK and EU

While specific regulatory numbers are not disclosed in the available data, WealthEngine adheres to strict compliance measures, including Know Your Customer (KYC) and Anti-Money Laundering (AML) protocols. These measures are essential for maintaining the integrity of its operations and protecting client data.

The company implements a robust customer funds segregation policy, ensuring that client funds are kept separate from corporate funds. This practice is crucial for safeguarding clients' investments and enhancing trust in the WealthEngine broker.

WealthEngine also participates in investor compensation schemes, providing an additional layer of security for its clients. The firm is committed to transparency and ethical practices, which are vital in the data-driven financial services industry.

3. Trading Products and Services

WealthEngine offers a diverse range of trading products and services tailored to meet the needs of its clients. The platform supports an extensive array of forex currency pairs, providing access to major, minor, and exotic pairs. In addition to forex, WealthEngine offers Contracts for Difference (CFDs) across various asset classes, including:

- Indices

- Commodities

- Stocks

- Cryptocurrencies

The company is dedicated to continuously updating its product offerings, regularly introducing new trading instruments to meet market demands. WealthEngine's retail trading services are complemented by its institutional customer services, which cater to larger organizations seeking tailored solutions.

Moreover, WealthEngine provides white-label solutions for businesses looking to leverage its technology and data insights under their brand. This flexibility allows clients to enhance their service offerings while maintaining their unique identity in the market.

4. Trading Platforms and Technology

WealthEngine supports the widely-used MetaTrader 4/5 trading platforms, which are known for their user-friendly interfaces and advanced trading functionalities. Additionally, the company has developed its own proprietary trading platform, designed to meet the specific needs of its clients.

The platform is accessible through a web-based interface, ensuring that users can trade from any location without the need for software installation. Furthermore, WealthEngine provides mobile applications for both iOS and Android, allowing traders to manage their accounts and execute trades on the go.

WealthEngine operates with an ECN (Electronic Communication Network) execution model, ensuring fast and efficient trade execution. The company maintains its servers in secure locations, enhancing the reliability and performance of its trading services.

For clients interested in automated trading, WealthEngine offers API access, enabling seamless integration with third-party trading systems and facilitating algorithmic trading strategies.

5. Account Types and Trading Conditions

WealthEngine provides a variety of account types to accommodate different trading preferences and strategies. The standard account conditions include:

- Minimum Deposit: Specific amounts vary by account type.

- Spreads: Competitive spreads are offered, with variations depending on market conditions.

- Commission: Commission structures are transparent, with details available upon account setup.

For more advanced traders, WealthEngine offers premium account types, such as VIP and professional accounts, which come with enhanced features and benefits. The firm also provides Islamic accounts to cater to clients who require Sharia-compliant trading options.

WealthEngine facilitates a demo account policy, allowing prospective clients to test the platform's features and functionalities without financial risk. The leverage offered varies across different products, providing clients with the flexibility to choose their preferred risk exposure.

6. Fund Management

WealthEngine supports a range of deposit methods, including:

- Bank Transfers

- Credit Cards

- E-wallets

The minimum deposit requirements differ based on the type of account selected. WealthEngine ensures prompt processing of deposits, typically within one to three business days, depending on the payment method chosen.

While there may be some fees associated with deposits, these are clearly outlined in the account terms. For withdrawals, WealthEngine offers multiple options, including bank transfers and electronic payment methods, with processing times generally ranging from one to five business days.

The company maintains a transparent fee structure for withdrawals, ensuring clients are informed of any applicable charges before initiating transactions.

7. Customer Support and Educational Resources

WealthEngine provides comprehensive customer support through various channels, including:

- Phone Support

- Email Support

- Live Chat

- Social Media

The support team is available during standard business hours, ensuring timely assistance for clients across different time zones. WealthEngine also offers multilingual support, accommodating a diverse client base.

To enhance client knowledge and trading skills, WealthEngine provides a variety of educational resources, including:

- Webinars

- Tutorials

- E-books

Additionally, the firm offers market analysis services, delivering daily insights, news updates, and research reports to keep clients informed about market trends. WealthEngine also equips traders with essential tools, such as calculators, calendars, and signal services, to aid in their trading decisions.

8. Regional Coverage and Restrictions

WealthEngine primarily serves clients in the United States and the United Kingdom, with a focus on expanding its reach to other international markets. The company has established regional offices to enhance its service delivery and support.

However, WealthEngine does not accept clients from certain jurisdictions, including:

- North Korea

- Iran

- Syria

- Certain regions under international sanctions

These restrictions are in place to comply with legal regulations and ensure that WealthEngine operates within the bounds of international law.

In conclusion, WealthEngine is a comprehensive broker that offers a wide range of services and products tailored to meet the needs of its diverse clientele. With a strong commitment to regulatory compliance, innovative technology, and exceptional customer support, WealthEngine continues to position itself as a leader in the wealth intelligence and fundraising sectors. As clients seek to maximize their potential in the financial markets, the WealthEngine broker provides the necessary tools and insights to achieve their goals effectively.

Wealthengine Similar Brokers

Latest Reviews

FX1097238837

Algeria

The fraudulent platform closed the withdrawal and then closed it again. Where is the compensation?

Exposure

2025-04-24

Mando8414

Algeria

Robo, Fraud. They alleged hacking and asked for a deposit of $100 to authenticate accounts. After depositing and following instructions, they shut down the platform, and I have no way to recover my money, over $1,400.

Exposure

2025-04-21

FX2168426609

Saudi Arabia

The account was frozen, the platform shut down, and we were not compensated. Moreover, there was no response from the platform.

Exposure

2025-04-14

FX2729820354

Algeria

We've been defrauded and robbed of our money by this trading platform, which shut down without prior notice. Before that, they'd frozen all our balances. How do we claim compensation, and is there any update regarding the platform?

Exposure

2025-04-11

FX3850539310

Spain

Hello, this app scammed many of us. It started in June of 2024 and by February 1st it crashed with many people suffering losses. They put two signals for trading and on March 17, 2025, they claimed to be victim of a hacking attack that stole 12M USDT, resulting in our funds being frozen. They said we had to deposit 100USDT to start trading and unfreeze the funds by March 25th. Once this date arrived, they demanded a deposit of 10% of our funds to ensure we were real people and to release our money. Finally, the app stopped working completely, everything became blank. They ripped off many people and stole thousands of dollars. If you don't believe me, look up the app name on Facebook, there're groups about it.

Exposure

2025-04-07

Wealthengine

News

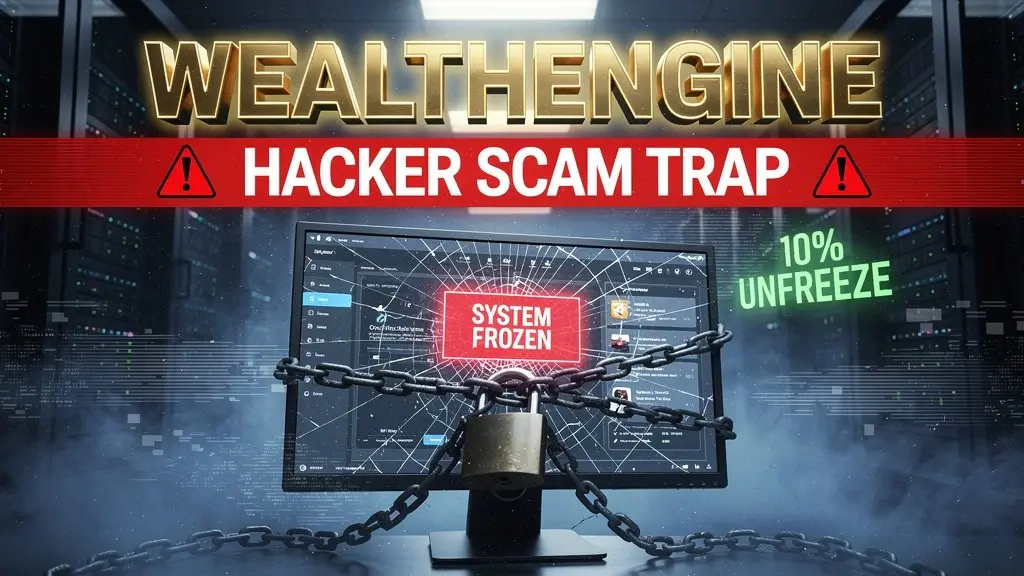

Exposure Wealthengine Review: The "Hacker" Excuse and the 10% Unfreezing Trap

Our investigation into the Wealthengine broker reveals a critical peril: the platform has frozen client funds globally seeking a "verification fee" to restore access. Victims report paying an initial $100 demand only to be targeted with a secondary request for 10% of their total balance, while withdrawals remain completely blocked.

FX2018732018

Bangladesh

This wealth engine is a fraud platform. I have invested from sep 2024. But 2nd Feb 2025 all my wealth lossed. They compensate and i believed them so i have worked. Totally all of my money have been lost. After 13th march 2025 they request to deposit 100USD and then they went offline. Please help. Are there any way to back in online again.

Exposure

2025-05-18