invdom 2025 Review: Everything You Need to Know

Abstract

Based on publicly available data and user feedback, the overall evaluation of invdom is overwhelmingly negative. Many users and WikiFX assessments indicate significant concerns regarding its trustworthiness and legitimacy. According to WikiFX, invdom has been rated merely 1 out of 10, raising major red flags about potential scam risks. Despite employing the popular MT5 trading platform that facilitates trading in forex, stock indices, and cryptocurrencies with up to 1:100 leverage, the broker's operational transparency remains remarkably low. Its methods and account parameters are not clearly articulated. This further compounds investor worries about the platform's integrity. The service appears geared toward high-leverage traders and those looking to diversify across multiple asset types, but the opacity surrounding account conditions and regulatory oversight could spell trouble for the average investor. This invdom review highlights a broker that features appealing product offerings on the surface. Yet it is ultimately undermined by poor reliability, regulatory ambiguities, and a concerning reputation among market participants.

Attention Notice

It is important to note that invdom operates with significant differences across regional entities. The regulatory information is not clearly disclosed, suggesting potential legal uncertainties, which may vary from region to region. This review is based on publicly available information and user feedback. As a result, we have been unable to verify specific trading conditions and account details. Readers should exercise caution and perform additional due diligence before considering any engagement with invdom. The lack of comprehensive regulatory oversight raises concerns regarding the broker's ability to provide reliable financial services and may expose traders to heightened risks. Transparency issues and limited detailed disclosures are critical points of concern in this analysis.

Rating Framework

Broker Overview

Invdom was established in 2023 with its headquarters located in Australia. Founded with an ambition to offer a diverse portfolio of financial instruments, invdom has aimed to carve a niche in the crowded market of online trading. The company focuses primarily on providing trading services in forex, stock indices, and cryptocurrencies. However, persistent issues surrounding its regulatory oversight and minimal transparency over critical trading conditions have raised various concerns among investors. The broker's background and relatively recent establishment contribute to an inherent uncertainty. This places it in a precarious position when compared with more reputable and well-established competitors. Despite its attractive offering of a popular trading platform and high leverage options, the documented high-risk nature of its services casts a long shadow over its overall credibility.

In its operational framework, invdom relies solely on the MT5 trading platform. This platform is well-regarded in the industry for its advanced technical features and analytical tools. The broker offers trading in multiple asset classes, including forex, stock indices, and cryptocurrencies, which might appeal to traders looking for diversified investment opportunities. However, the absence of explicit regulatory oversight and clear disclosure of account features is problematic. This invdom review acknowledges that while the availability of a powerful trading platform and the potential to use leverage up to 1:100 are appealing, the lack of detailed information about the broker's operational practices and regulatory status significantly detracts from its overall reliability. Investors should therefore approach invdom with considerable caution. They should keep in mind the high-risk markers noted in industry evaluations.

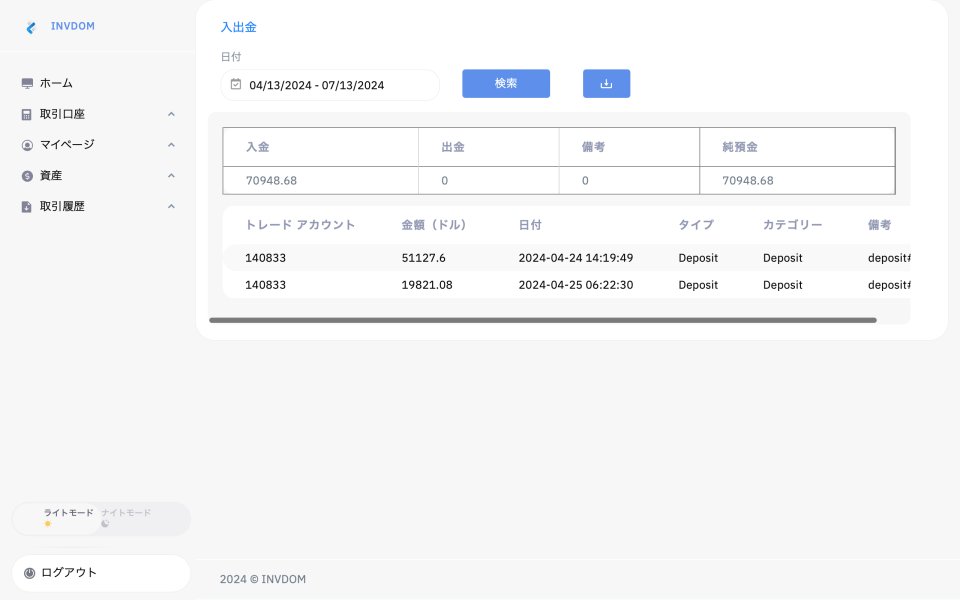

When analyzing invdom, it is important to note that regulatory details are sparse. There is no clear mention of any specific regulatory authority overseeing its operations, leaving potential legal and financial safety concerns unresolved. The deposit and withdrawal methods have not been specified in detail. This means that traders must carefully verify these procedures independently to avoid any unforeseen complications. Similarly, there is no disclosed minimum deposit requirement, making it unclear how accessible the platform is for different levels of investors. Additionally, invdom offers no promotional bonuses or incentives. This is either an indication of a cost-saving approach or a sign of a platform that refrains from aggressive marketing tactics.

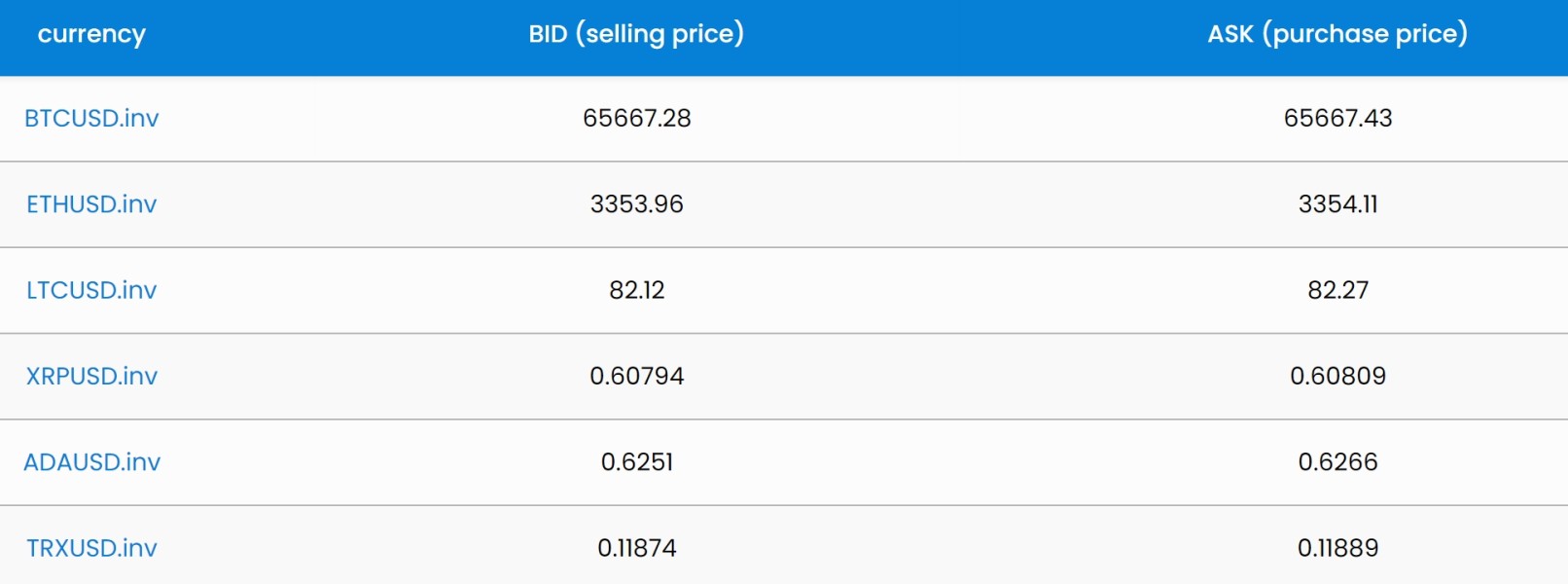

Regarding tradeable assets, the broker allows trading in forex, stock indices, and cryptocurrencies. This appeals to a varied group of traders. However, the cost structure is not detailed. There is no clear information on spreads, commissions, or any hidden fees, leaving potential traders in the dark regarding the true cost of trading. The leverage option of up to 1:100 is prominently advertised, which can be attractive to those with higher risk tolerances but should be approached with caution. The platform used for trading is the MT5 system. It offers a robust suite of trading functionalities but without additional choices for traders who might prefer alternative systems. Furthermore, there is no mention of any regional restrictions, and customer service is limited solely to English. Overall, this invdom review reiterates that while the asset diversity and high leverage might seem attractive, the significant gaps in critical operational details and cost transparency pose considerable risks to potential investors.

Detailed Rating Analysis

1. Account Conditions Analysis

Invdom presents very limited public information regarding its account conditions. There is no clarity on specific account types offered, leaving traders uncertain about whether tiered or specialized account options are available. The absence of a minimum deposit specification compounds these concerns. Traders are unable to determine the initial capital required to access the platform. Furthermore, crucial details such as spreads, commissions, and execution policies are entirely omitted from the public profile. This lack of transparency is particularly worrisome in an industry where well-defined account parameters are a significant part of investor trust. Additionally, the procedure for account opening and subsequent verification processes has not been detailed. Investors are left to speculate about the efficiency and security of these operations. Given the limited information available and negative user feedback circulating online, this invdom review must emphasize that the overall account conditions are subpar, with many key aspects either not disclosed or lacking verifiable support. This represents a serious drawback. It is especially concerning in contrast to other brokers who offer detailed account features and clear onboarding guidelines.

Invdom utilizes the MT5 trading platform. This platform is widely recognized for its comprehensive suite of analytical tools and trading features. However, beyond access to this well-known platform, invdom falls short in providing additional trading tools and resources that could enhance the overall trading experience. There is a noticeable absence of supplementary research and analytical materials, such as market analysis reports, educational resources, or automated trading signals that many competitors offer. Moreover, the platform does not provide a clear roadmap regarding the support for algorithmic trading or integration with third-party applications. This can be critical for traders relying on automated strategies or advanced customization. Although the MT5 platform is inherently robust, its benefits are somewhat diminished when not paired with a broader range of investor support services. The lack of dedicated educational programs or interactive training modules means that new traders might struggle to develop the necessary skills without external assistance. Overall, while the core trading tool—the MT5 platform—is reputable, invdom's failure to extend additional resources and tools ultimately creates a suboptimal environment for both novice and experienced traders alike.

3. Customer Service and Support Analysis

The customer service and support structure at invdom appears to be significantly limited. Only English language support is provided. This insufficient multilingual service can present a barrier for many international users who expect localized support. The contact channels for customer assistance are not thoroughly detailed, and there is little to no information regarding the availability or responsiveness of the support team. For example, there is no clear indication of operating hours or expected response times. This adds to the uncertainty about effective resolution of potential issues. In the competitive landscape of brokerage services, robust customer support is not just an add-on but a critical element of a reliable trading environment. The lack of evidence pointing to a multi-channel support system further undermines investor confidence. This analysis reinforces the notion that traders might face significant delays or difficulties in receiving assistance when needed. Consequently, the limited and somewhat opaque customer service entirely fails to offset the other negative aspects associated with invdom. This further compounds the overall dissatisfaction among its user base.

4. Trading Experience Analysis

The trading experience offered by invdom is primarily anchored in its use of the MT5 platform. This platform is known for its advanced functionalities and user-friendly interface. Despite the inherent strengths of the MT5 system, traders are left with limited information regarding the actual performance and reliability of the execution environment provided by invdom. Specific factors such as platform stability during high volatility, order execution speed, and the presence of issues like slippage or re-quotes are not documented. Furthermore, details pertaining to mobile trading and the usability of the platform on different devices are not provided. This suggests a one-size-fits-all approach that may not suit modern, on-the-go traders. Many users have expressed concerns about order execution and overall platform performance, though such feedback is not extensively documented in available sources. The overall trading conditions, while superficially supported by a reputable platform, are undermined by a lack of clear operational metrics. This invdom review highlights that despite having a platform with recognized technical merits, the absence of verifiable performance data and user testimonials creates significant uncertainty about the true trading experience one might encounter.

5. Trust Analysis

Trust in any trading platform is fundamentally built on transparency and robust regulatory oversight. These are areas where invdom is significantly deficient. There is no disclosed information regarding any credible regulatory body, leaving investors in the dark regarding the broker's licensing and oversight status. This gap is particularly alarming given the WikiFX rating of just 1/10, which serves as a strong negative indicator of overall trustworthiness. Furthermore, essential safeguards such as the segregation of client funds, detailed risk management protocols, or even clear statements on dispute resolution mechanisms are conspicuously absent. The overall transparency from invdom is minimal. This creates a pervasive sense of uncertainty among potential users. Negative reports and user feedback alleging fraudulent practices further amplify these concerns. The collective data—in particular, the absence of audited reports or third-party verifications—indicates that invdom may pose significant risks. For traders, whose decision-making often hinges on verified regulatory compliance and trust signals, this lack of clarity and control is a major red flag that should not be overlooked.

6. User Experience Analysis

User experience with invdom appears to be far from satisfactory. This is primarily due to the overarching concerns about regulatory transparency and potential scam risks. The platform's interface design and ease of navigation are not explicitly described in available literature, leaving a gap in understanding whether the user interface is intuitive or cluttered. Additionally, the absence of detailed feedback regarding the registration process and account verification procedures means that new users may face complications during onboarding. The lack of accessible customer support channels and language options further detracts from the overall user experience. This potentially leads to a frustrating and disjointed trading environment. Investors have expressed broad dissatisfaction that stems not only from operational opacity but also from the absence of user-centric features that many modern brokers prioritize. In summary, while the core capabilities of the MT5 platform might offer some technical advantages, the holistic user experience remains marred by uncertainty, limited support options, and significant concerns about the broker's integrity. This analysis suggests that the user experience with invdom suffers substantially as a result of these cumulative deficiencies.

Conclusion

In summary, invdom is a broker that poses significant risks for potential investors. This is due to its low level of operational transparency, a complete absence of detailed regulatory information, and a host of unanswered questions about its trading conditions. While it does offer access to the widely used MT5 platform and the possibility of trading across various asset classes with high leverage, the negative factors far outweigh any superficial advantages. Traders should be extremely cautious and are advised to consider brokers with clearer regulatory oversight and a more robust support system. This invdom review clearly demonstrates that the broker is more suitable only for those with an unusually high risk tolerance and the capacity to absorb potential losses, rather than for the average investor.