Is Wealthengine safe?

Business

License

Is Wealthengine Safe or Scam?

Introduction

Wealthengine is a relatively new player in the forex market, offering a range of trading services aimed at both retail and institutional clients. As the forex market continues to grow in complexity and accessibility, it becomes increasingly crucial for traders to carefully evaluate the brokers they choose to work with. This evaluation is essential not only to ensure compliance with regulations but also to safeguard their investments against potential scams. In this article, we will investigate the legitimacy and safety of Wealthengine using a comprehensive framework that encompasses regulatory compliance, company background, trading conditions, customer experience, and risk assessment.

Regulation and Legitimacy

One of the most critical aspects of evaluating whether Wealthengine is safe lies in its regulatory status. Regulation serves as a form of oversight, ensuring that brokers adhere to industry standards and protect client funds. Wealthengine has been noted as lacking valid regulatory information, which raises significant concerns. Below is a summary of the core regulatory information:

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Not Verified |

The absence of a regulatory license is alarming. Regulatory bodies are tasked with protecting traders from fraud and malpractice, and brokers operating without oversight may have more freedom to engage in unethical practices. Wealthengine's low score and lack of a credible regulatory license suggest that traders should exercise caution. Historically, brokers without regulation have been involved in numerous compliance issues, which can jeopardize the safety of client funds. Therefore, the question remains: Is Wealthengine safe? The evidence suggests that it might not be.

Company Background Investigation

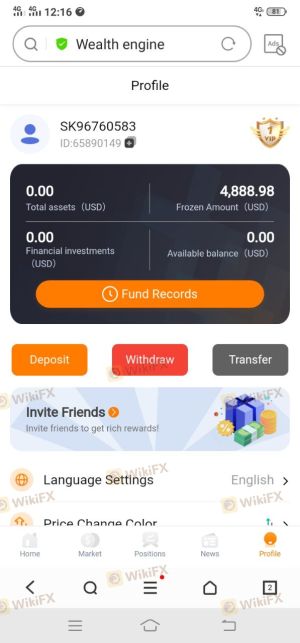

Wealthengine's history and ownership structure also play a significant role in determining its credibility. Founded in the United Kingdom, Wealthengine has been operational for less than a year, which raises questions regarding its experience and track record in the industry. The management teams background is also critical; however, there is limited publicly available information about the individuals behind Wealthengine, which diminishes transparency.

Transparency in a company's operations and ownership is essential for establishing trust. Companies that are open about their leadership and operational practices tend to instill more confidence among traders. The lack of comprehensive information about Wealthengine's management and operational history adds to the skepticism surrounding its legitimacy. This leads us to consider whether Wealthengine is safe for potential clients, especially given its short operational history and opaque management structure.

Analysis of Trading Conditions

When assessing a broker, understanding the trading conditions they offer is vital. Wealthengines fee structure appears to be somewhat unclear, with indications of potentially hidden fees that could catch traders off guard. Below is a comparison of core trading costs:

| Fee Type | Wealthengine | Industry Average |

|---|---|---|

| Spread for Major Pairs | N/A | Varies (1-3 pips) |

| Commission Model | N/A | Varies |

| Overnight Interest Rate | N/A | Varies |

The lack of detailed information on spreads and commissions raises red flags. Traders typically expect transparency regarding trading costs, as these can significantly impact profitability. The absence of standard fee disclosures can be a warning sign that Wealthengine is not safe for traders looking for a reliable and transparent trading environment.

Client Fund Safety

The security of client funds is paramount when evaluating a broker. Wealthengines measures for fund safety, such as fund segregation, investor protection, and negative balance protection, are unclear. Without a credible regulatory body overseeing these aspects, traders may find themselves at risk of losing their investments without recourse.

The absence of a strong framework for protecting client funds raises concerns about the broker's commitment to safeguarding investor interests. Historical issues related to fund safety can also influence perceptions of a broker's reliability. Given these factors, potential clients must consider whether Wealthengine is safe enough to entrust with their capital.

Customer Experience and Complaints

Client feedback and user experiences are invaluable in assessing a broker's reputation. Wealthengine has received mixed reviews, with complaints often revolving around poor customer service and difficulty withdrawing funds. Below is a summary of common complaint types:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow Response |

| Customer Service | Medium | Inadequate Support |

| Fee Transparency | High | Lack of Clarity |

The severity of complaints, particularly regarding withdrawal issues, is alarming. A broker that struggles with processing withdrawals can be indicative of deeper financial or operational problems. Therefore, the question arises: Is Wealthengine safe for traders who may need to access their funds quickly? The evidence suggests that potential clients should be cautious.

Platform and Trade Execution

The performance of a trading platform is critical for ensuring a smooth trading experience. Wealthengines platform has been noted for its lack of stability and performance issues, including slippage and order rejections. Traders expect a seamless experience when executing trades, and any signs of manipulation or technical glitches can lead to significant losses.

Given the importance of reliable trade execution, the question of whether Wealthengine is safe becomes even more pressing. A broker that cannot provide a stable trading environment may not be trustworthy, especially for those who rely heavily on timely execution for their trading strategies.

Risk Assessment

Using Wealthengine presents a range of risks that potential clients must consider. Below is a summary of key risk areas:

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | No valid regulation |

| Financial Risk | Medium | Limited transparency |

| Operational Risk | High | Poor platform performance |

The overall risk profile of using Wealthengine suggests that traders should proceed with caution. The high regulatory risk, coupled with operational concerns, indicates that Wealthengine is not safe for traders looking for a secure and reliable trading environment.

Conclusion and Recommendations

In conclusion, the evidence gathered raises significant concerns about the legitimacy and safety of Wealthengine. The lack of regulatory oversight, unclear trading conditions, poor customer feedback, and operational issues suggest that traders should be wary of engaging with this broker.

For those seeking reliable trading options, it may be prudent to consider established brokers with robust regulatory frameworks and positive customer reviews. Alternatives such as brokers with strong compliance records and transparent fee structures are recommended for traders looking to minimize risk. Ultimately, the question remains: Is Wealthengine safe? The consensus points towards a cautious approach, urging potential clients to thoroughly evaluate their options before proceeding.

Is Wealthengine a scam, or is it legit?

The latest exposure and evaluation content of Wealthengine brokers.

Wealthengine Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Wealthengine latest industry rating score is 1.23, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.23 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.