Is W7 Broker&Trading safe?

Business

License

Is W7 Broker & Trading A Scam?

Introduction

W7 Broker & Trading, established in 2019, positions itself as an Electronic Communication Network (ECN) broker, offering a variety of trading services across multiple asset classes, including forex, commodities, indices, and cryptocurrencies. As the forex market continues to attract traders globally, evaluating the credibility and reliability of brokers like W7 is crucial. With numerous reports of scams and fraudulent activities in the trading industry, traders must exercise caution and conduct thorough research before committing their funds. This article aims to provide an objective assessment of W7 Broker & Trading by investigating its regulatory status, company background, trading conditions, customer experiences, and overall safety measures. The analysis is based on a review of various credible sources, including user feedback, regulatory information, and industry comparisons.

Regulation and Legitimacy

The regulatory status of a broker is a critical factor in determining its reliability and safety. Regulation serves as a safeguard for traders, ensuring that brokers adhere to specific standards and practices. Unfortunately, W7 Broker & Trading operates without any significant regulatory oversight. This lack of regulation raises serious concerns regarding the protection of client funds and the broker's operational integrity.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| N/A | N/A | N/A | Unregulated |

The absence of a regulatory body overseeing W7 Broker & Trading means that there are no guarantees regarding the safety of client funds. In contrast, regulated brokers are required to maintain segregated accounts, ensuring that client funds are kept separate from the broker's operational capital. Furthermore, regulated brokers are often subject to regular audits and must adhere to strict capital requirements, providing an additional layer of security for traders. Given W7's unregulated status, potential clients may be exposed to a higher risk of fraud and malpractice, making it imperative for traders to consider this factor seriously.

Company Background Investigation

W7 Broker & Trading is registered in Saint Vincent and the Grenadines, a jurisdiction known for its lax regulatory environment. The company's history is relatively short, having been founded in 2019 by Willy Heine Neto and Paulo Roberto, along with several other trading clients. While the founders claim to have extensive trading experience, the lack of transparency regarding their backgrounds raises questions about the broker's credibility.

The management team's details are not prominently disclosed, which can be a red flag for potential clients. Transparency in a broker's ownership and management structure is essential, as it provides insight into the company's accountability and ethical practices. The absence of clear information about the management team may lead traders to question the broker's reliability.

Trading Conditions Analysis

W7 Broker & Trading advertises competitive trading conditions, including various account types and leverage options. However, the overall fee structure and trading conditions should be scrutinized to assess their fairness and competitiveness. Traders often face hidden fees or unfavorable conditions that can significantly impact their trading experience.

| Fee Type | W7 Broker & Trading | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 1.5 pips | 1.0 pips |

| Commission Model | $7.50 per lot | $5.00 per lot |

| Overnight Interest Range | Varies | Varies |

The spreads offered by W7 Broker start from 1.5 pips, which is higher than the industry average, indicating that traders may incur higher costs when trading. Additionally, the commission structure is less favorable compared to many competitors, which could deter potential clients. Analyzing the fee structure is vital for traders to ensure they are not overpaying for their trades.

Customer Funds Safety

Safety of funds is a paramount concern for any trader. W7 Broker claims to implement measures such as negative balance protection, which ensures that clients cannot lose more than their account balance. However, the lack of regulatory oversight raises concerns about the effectiveness of these measures.

Traders should also consider whether their funds are held in segregated accounts. W7 Broker's operations in an offshore jurisdiction mean that there is no guarantee of fund segregation, which could expose traders to risks in case of the broker's financial instability. Historically, offshore brokers have faced scrutiny for mishandling client funds, leading to significant losses for traders.

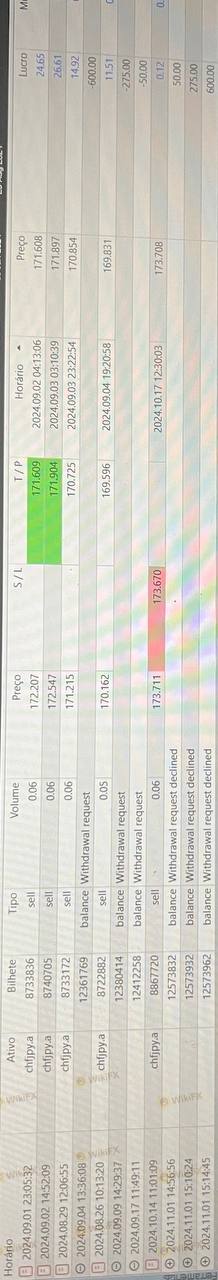

Customer Experience and Complaints

Customer feedback is an essential aspect of evaluating a broker's reliability. Reviews of W7 Broker & Trading reveal a mixed bag of experiences. While some users praise the trading platform and execution speed, others report significant issues, particularly concerning withdrawals and customer service responsiveness.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Slow Response |

| Account Freezes | High | Limited Support |

| Poor Customer Service | Medium | Inconsistent |

Several users have expressed frustration over delayed withdrawals, with some reporting that their accounts were frozen without adequate explanation. Such complaints are serious and highlight potential operational issues within the broker. The quality of customer service is also a recurring theme, with many traders indicating that responses to inquiries can be slow or unhelpful.

Platform and Trade Execution

W7 Broker & Trading utilizes the MetaTrader 5 platform, which is known for its robust features and user-friendly interface. However, the quality of trade execution is a critical factor that can affect a trader's experience. Reports of slippage and order rejections have surfaced, raising concerns about the broker's execution quality.

Traders should be wary of any signs of platform manipulation, which can severely impact trading performance. A broker's ability to execute trades efficiently is a fundamental aspect of its reliability, and any discrepancies in this area could indicate underlying issues.

Risk Assessment

Using W7 Broker & Trading presents several risks that potential clients should consider. The absence of regulation, combined with the broker's operational history and customer feedback, leads to a high-risk assessment.

| Risk Category | Risk Level | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | No regulatory oversight increases fraud risk. |

| Fund Safety Risk | High | Lack of fund segregation and protection. |

| Customer Service Risk | Medium | Complaints about slow responses and withdrawals. |

To mitigate these risks, traders should conduct thorough research before engaging with W7 Broker & Trading. It may also be prudent to diversify trading accounts across multiple brokers to minimize exposure to any single entity's risks.

Conclusion and Recommendations

In conclusion, W7 Broker & Trading raises several red flags that potential clients should carefully consider. The absence of regulation, coupled with mixed customer feedback and concerns about fund safety, suggests that traders should approach this broker with caution. While some users report satisfactory experiences, the overall risk profile indicates that W7 Broker may not be a trustworthy option for many traders.

For those seeking reliable trading options, it may be advisable to consider brokers with established regulatory oversight and positive customer reviews. Alternatives such as well-regulated brokers in the EU or the UK may provide greater security and peace of mind for traders.

Is W7 Broker&Trading a scam, or is it legit?

The latest exposure and evaluation content of W7 Broker&Trading brokers.

W7 Broker&Trading Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

W7 Broker&Trading latest industry rating score is 1.54, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.54 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.