Is VP Markets safe?

Business

License

Is VP Markets Safe or a Scam?

Introduction

VP Markets is an online forex and CFD broker that claims to provide a platform for trading various financial instruments, including currencies, commodities, and indices. Established with the intent to cater to both novice and experienced traders, it positions itself as a go-to option in the competitive forex market. However, the importance of conducting thorough due diligence before selecting a broker cannot be overstated. Traders must assess the credibility, regulatory compliance, and overall reputation of a broker to ensure the safety of their investments. This article aims to evaluate whether VP Markets is a safe trading option or a potential scam by analyzing its regulatory status, company background, trading conditions, customer experiences, and risk factors.

Regulation and Legitimacy

When assessing the safety of any broker, regulatory oversight is a critical factor. A regulated broker is subject to strict guidelines and standards set by financial authorities, which helps protect investors. Unfortunately, VP Markets operates as an unregulated broker, which raises significant concerns regarding the safety of client funds and the overall integrity of its operations. The following table summarizes the core regulatory information available for VP Markets:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| NFA | 0523791 | United States | Unauthorized |

| FINTRAC | M20111743 | Canada | Not Applicable |

Despite claiming regulation by the National Futures Association (NFA) and being registered as a Money Services Business under FINTRAC in Canada, investigations reveal that VP Markets is not a member of the NFA, and thus does not operate under its oversight. This lack of regulatory compliance means that traders have little to no recourse in case of disputes or issues with fund withdrawals. The absence of a regulatory framework significantly increases the risks associated with trading with VP Markets, making it essential for potential clients to consider whether VP Markets is safe for their trading activities.

Company Background Investigation

VP Markets' history and ownership structure are essential components to consider when evaluating its legitimacy. The company claims to have a global presence, but detailed information about its founding, ownership, and operational history remains vague. The lack of transparency surrounding the management team and their qualifications raises further questions about the broker's credibility.

Many reports indicate that the company's website has experienced periods of downtime, and there are numerous complaints regarding the inability to withdraw funds. This suggests potential operational instability, which is a red flag for traders. Furthermore, the absence of clear information about the company's physical location and contact details adds to the uncertainty surrounding its legitimacy. Without a reputable management team and clear operational guidelines, it is challenging to ascertain whether VP Markets is safe for trading.

Trading Conditions Analysis

Understanding the trading conditions offered by a broker is crucial for evaluating its overall attractiveness. VP Markets advertises competitive trading fees, but scrutiny reveals a lack of clarity regarding its fee structure. Below is a comparison of core trading costs:

| Fee Type | VP Markets | Industry Average |

|---|---|---|

| Spread on Major Currency Pairs | 1.3 pips | 1.0 pips |

| Commission Model | Variable | Fixed/Variable |

| Overnight Interest Range | High | Moderate |

The spread on major currency pairs is higher than the industry average, which could diminish potential profits for traders. Additionally, reports of unexpected fees and withdrawal issues have surfaced, suggesting that the broker may impose additional costs that are not transparently communicated to clients. This lack of clarity raises concerns about whether VP Markets is safe for traders seeking a reliable and cost-effective trading environment.

Client Fund Security

The security of client funds is paramount when evaluating a broker. VP Markets claims to implement measures to protect client funds, but the lack of regulation means that these claims cannot be independently verified. Unregulated brokers are not required to segregate client funds from their operational funds, which poses a significant risk in the event of financial difficulties or insolvency.

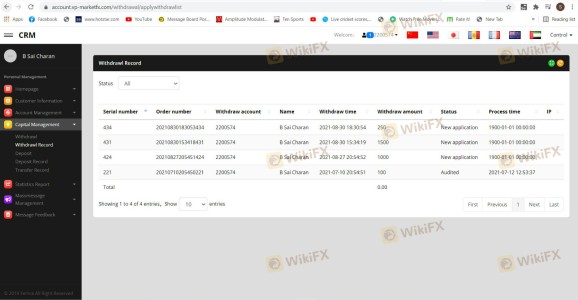

Moreover, there have been allegations of clients facing challenges in withdrawing their funds, which raises questions about the broker's financial practices. Historical complaints indicate that clients encounter hurdles when attempting to access their money, further highlighting potential issues with fund security. Given these factors, it is prudent for traders to exercise caution and consider whether VP Markets is safe for their investments.

Customer Experience and Complaints

Analyzing customer feedback is vital in understanding a broker's reputation. Numerous complaints against VP Markets have emerged, primarily focusing on withdrawal issues and poor customer support. Below is a summary of common complaint types and their severity:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow/No Response |

| Poor Customer Support | Medium | Inconsistent |

| Misleading Promotions | High | No Clarification |

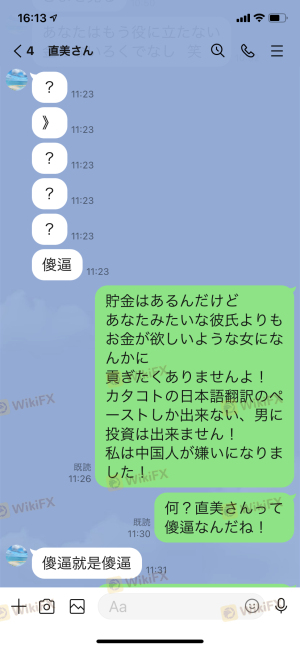

Many users report that once they deposit funds, communication with customer support becomes increasingly difficult, leading to frustration and dissatisfaction. For instance, one user reported being unable to withdraw their funds despite multiple attempts, while another highlighted a lack of response from the support team. These patterns of complaints cast doubt on the broker's reliability and raise concerns about whether VP Markets is safe for potential traders.

Platform and Execution

The trading platform's performance is another crucial aspect to consider. VP Markets offers access to popular trading platforms like MetaTrader 4, which is known for its user-friendly interface and powerful features. However, the overall stability and execution quality of the platform have come under scrutiny. Users have reported instances of slippage and order rejections, which can significantly impact trading outcomes.

Additionally, there are concerns regarding the potential for platform manipulation, especially given the broker's unregulated status. Without oversight from a reputable regulatory body, traders may be at risk of unfair practices that could compromise their trading experience. Therefore, it is essential to question whether VP Markets is safe when it comes to platform reliability and execution quality.

Risk Assessment

Engaging with an unregulated broker like VP Markets comes with inherent risks. Below is a risk assessment summary:

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | Lack of oversight leads to potential fraud. |

| Fund Security Risk | High | Unclear fund protection measures. |

| Customer Support Risk | Medium | Inconsistent responses to inquiries. |

| Execution Risk | Medium | Reports of slippage and order issues. |

To mitigate these risks, potential traders should consider using regulated brokers with established reputations. Conducting thorough research and reading customer reviews can also help in making informed decisions.

Conclusion and Recommendations

In conclusion, the evidence suggests that VP Markets is not a safe trading option. The lack of regulatory oversight, coupled with numerous complaints regarding fund withdrawals and customer support, raises significant red flags. Traders should be wary of engaging with an unregulated broker that lacks transparency and has a questionable reputation.

For those seeking reliable alternatives, it is advisable to consider brokers that are regulated by top-tier authorities such as the FCA or ASIC. These brokers provide a safer trading environment and better protection for client funds. In summary, potential traders should exercise extreme caution and consider whether VP Markets is safe before committing their funds.

Is VP Markets a scam, or is it legit?

The latest exposure and evaluation content of VP Markets brokers.

VP Markets Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

VP Markets latest industry rating score is 1.56, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.56 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.