VP Markets 2025 Review: Everything You Need to Know

Executive Summary

VP Markets presents itself as a UK-registered forex broker. However, specific regulatory information remains undisclosed, creating a significant trust divide among users. This vp markets review reveals a broker that attracts traders with competitive features including leverage up to 1:500 and zero starting spreads. The company positions itself to serve traders across different experience levels seeking high-leverage opportunities and diversified asset classes.

The broker's key characteristics include its focus on providing access to forex, precious metals, indices, commodities, and cryptocurrencies through the MetaTrader 4 platform. With a minimum deposit requirement of just $100, VP Markets appears to target both novice and experienced traders looking for accessible entry points into leveraged trading. However, the lack of transparent regulatory oversight and mixed user feedback raises important questions about the broker's reliability and trustworthiness in the competitive forex market landscape. The primary user base consists of investors seeking high-leverage trading opportunities and access to multiple asset categories.

Potential clients should carefully consider the regulatory uncertainties before committing funds.

Important Notice

Different regional regulatory requirements may cast doubt on VP Markets' legitimacy in certain markets. This requires investors to exercise extreme caution when selecting this broker. The absence of clear regulatory information from recognized financial authorities represents a significant red flag that potential clients must carefully evaluate.

This review is based on collected user feedback and publicly available information. The review has not been subject to on-site verification or independent audit. Users should conduct their own due diligence and consider consulting with financial advisors before engaging with VP Markets, particularly given the conflicting nature of available user testimonials and the lack of transparent regulatory compliance information.

Rating Framework

Broker Overview

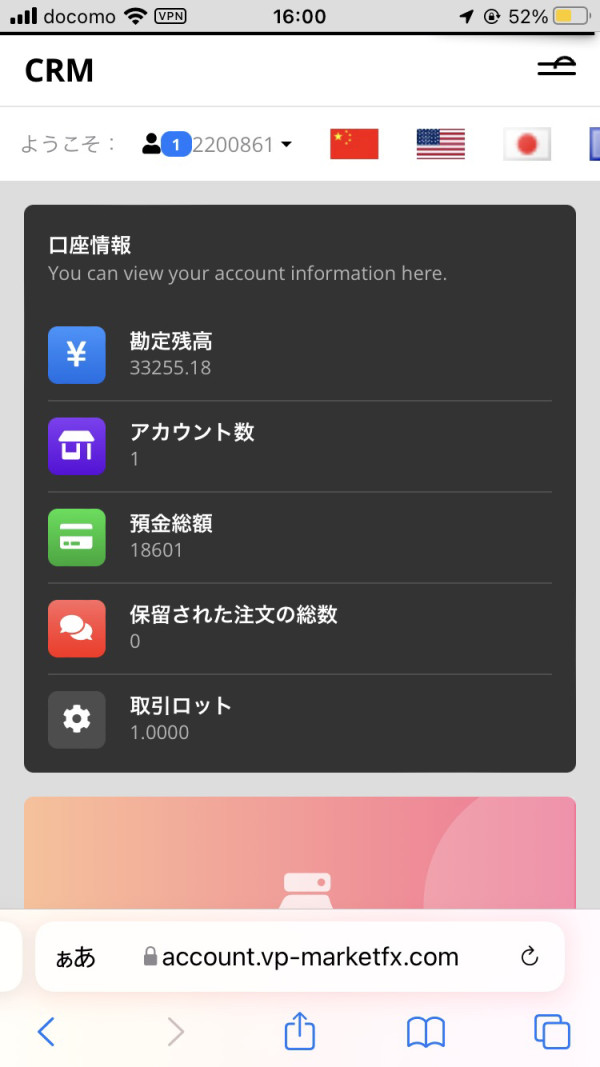

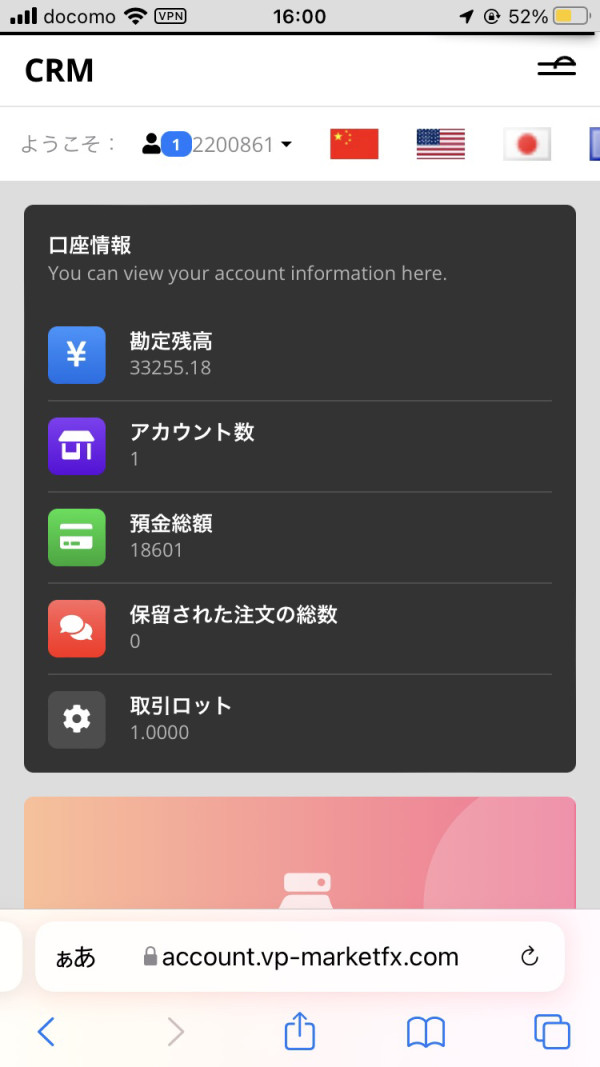

VP Markets operates as a financial services provider claiming UK registration. The company has not disclosed detailed background information about its establishment date or corporate history. The broker primarily focuses on delivering trading services across forex and other financial products, targeting traders who seek high-leverage opportunities and diversified investment options. Without comprehensive corporate transparency, clients face challenges in fully evaluating the company's operational foundation and business stability.

The broker's business model centers on providing access to global financial markets through its trading platform. It emphasizes competitive spreads and high leverage ratios to attract active traders. VP Markets positions itself as a service provider for both individual retail traders and potentially more sophisticated investors, though the lack of detailed company information makes it difficult to assess the full scope of their target market and service capabilities.

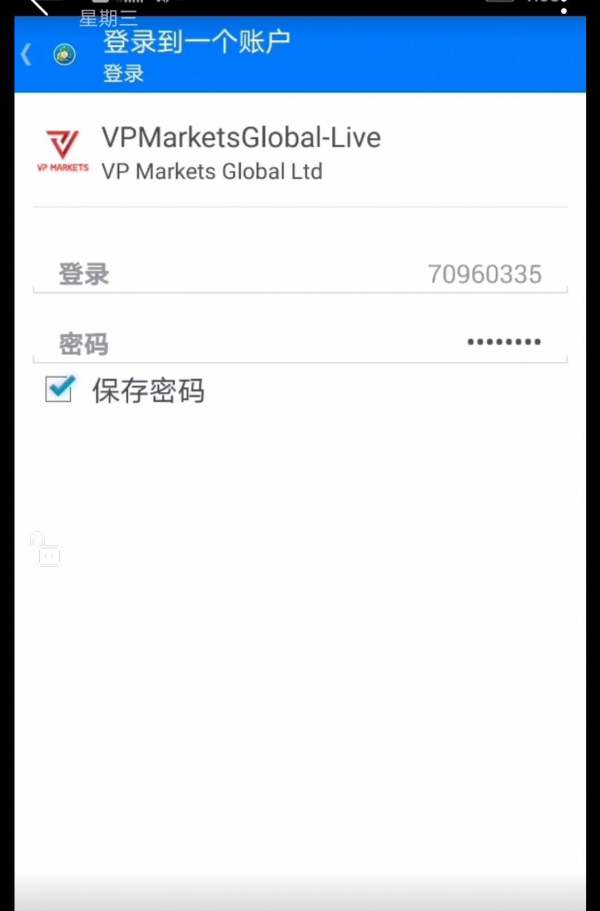

VP Markets utilizes the MetaTrader 4 platform as its primary trading interface. This provides access to forex, precious metals, indices, commodities, and cryptocurrencies. This vp markets review finds that while the asset selection appears comprehensive, the absence of specific regulatory authority information creates uncertainty about the broker's oversight and compliance standards. The platform selection, limited to MT4, may restrict traders who prefer alternative trading software or more advanced platform features.

Regulatory Jurisdiction: VP Markets claims UK registration but fails to provide specific regulatory body information or license numbers. This creates significant transparency concerns for potential clients.

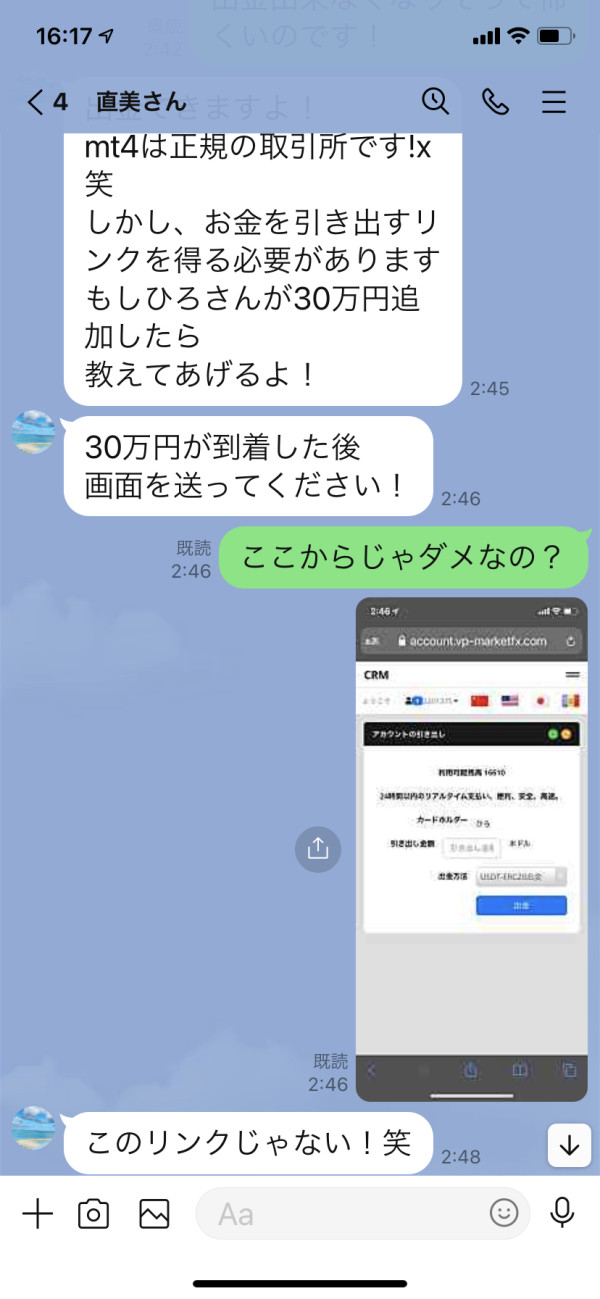

Deposit and Withdrawal Methods: Specific information about available deposit and withdrawal methods is not detailed in available sources, representing a notable information gap for prospective traders.

Minimum Deposit Requirements: The broker requires a minimum deposit of $100. This positions it competitively in the accessible trading segment of the market.

Bonus and Promotional Offers: No specific information about bonus structures or promotional campaigns is available in current sources. This suggests either absence of such programs or poor marketing transparency.

Tradeable Assets: The platform offers access to forex pairs, precious metals, stock indices, commodities, and cryptocurrency trading. This provides a reasonably diverse investment universe for traders.

Cost Structure: Spreads begin at zero, though specific commission structures and additional trading costs are not clearly detailed in available information.

Leverage Ratios: Maximum leverage reaches 1:500. This represents a high-risk, high-reward proposition attractive to experienced traders but potentially dangerous for novices.

Platform Options: Trading is conducted exclusively through MetaTrader 4, with no mention of additional platform alternatives or proprietary trading software.

Geographic Restrictions: Information regarding regional trading restrictions or prohibited jurisdictions is not specified in available sources.

Customer Service Languages: Available customer service language options are not detailed in current information sources.

This vp markets review highlights significant information gaps that potential clients should consider when evaluating the broker's suitability for their trading needs.

Detailed Rating Analysis

Account Conditions Analysis

VP Markets' account structure lacks the diversity typically expected from established brokers. Available sources do not detail specific account types or tier-based offerings. The $100 minimum deposit requirement positions the broker competitively within the accessible trading segment, making it potentially attractive to novice traders or those with limited initial capital. However, the absence of detailed information about account opening procedures, verification requirements, or special account features limits the ability to fully evaluate the broker's account conditions.

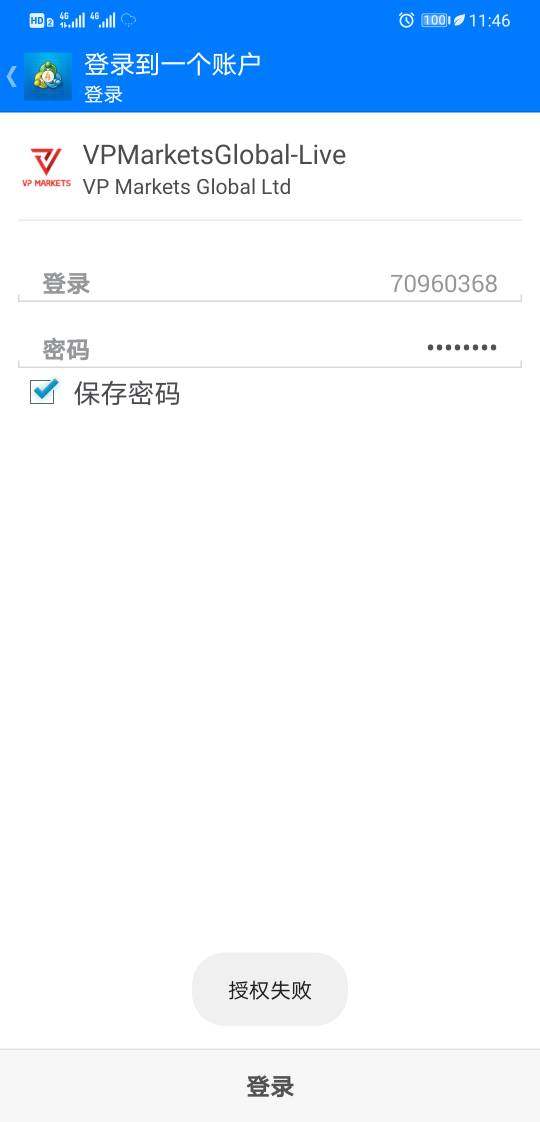

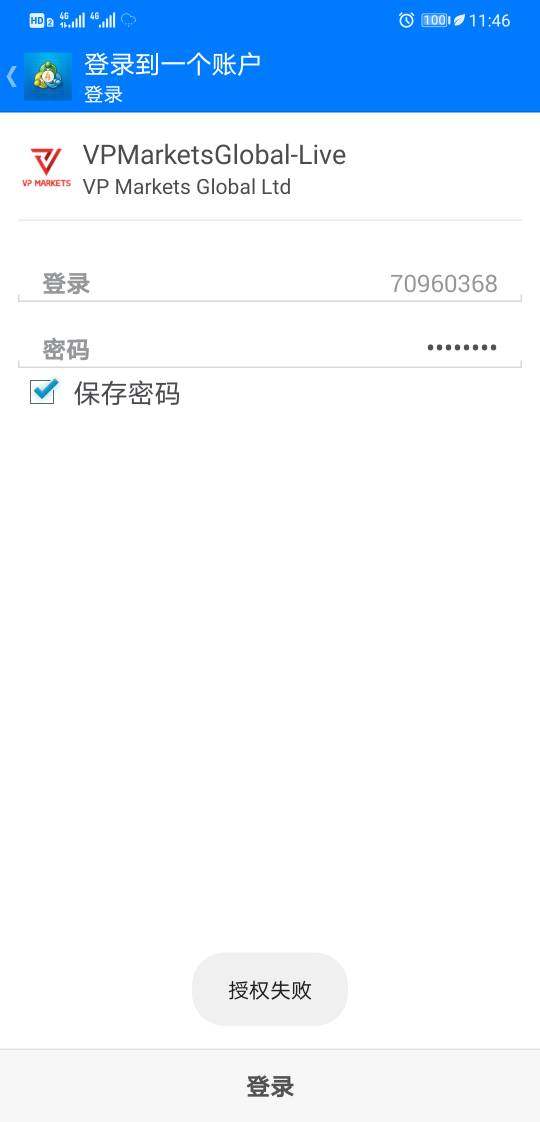

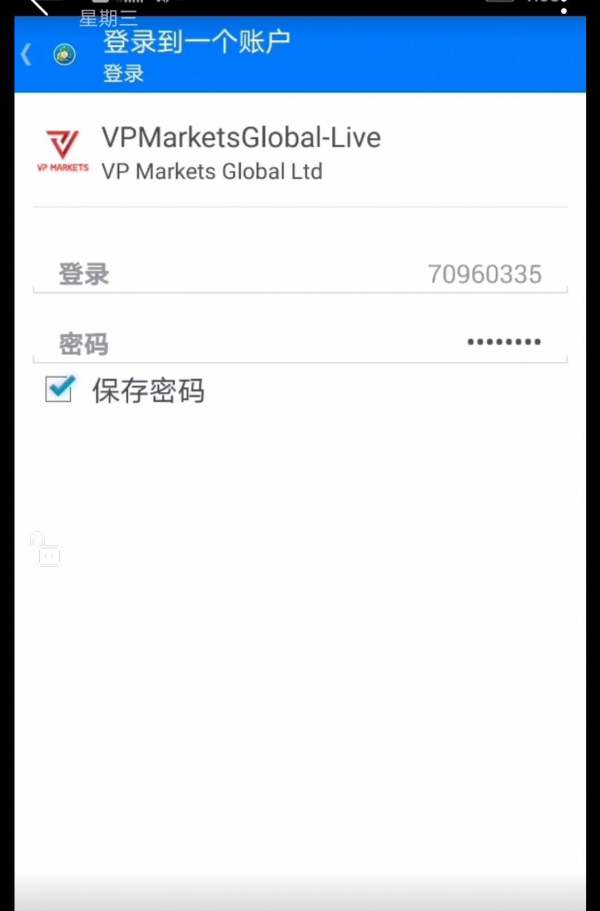

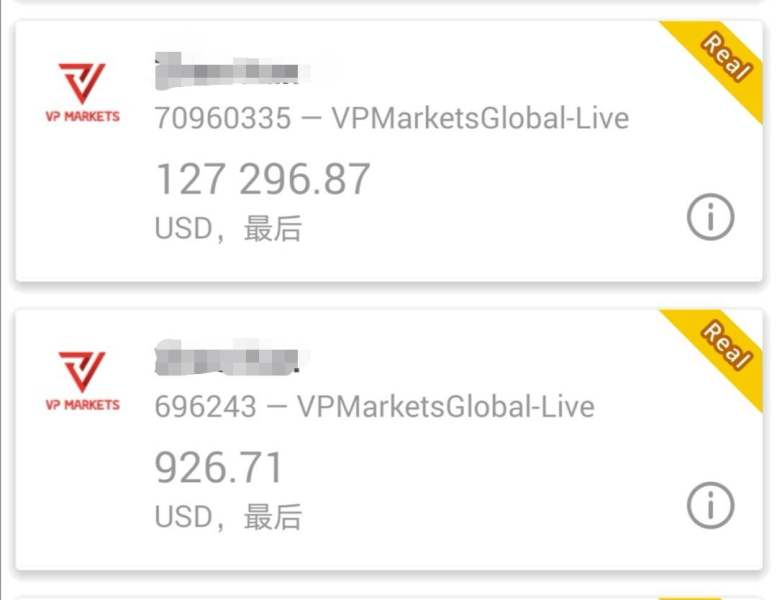

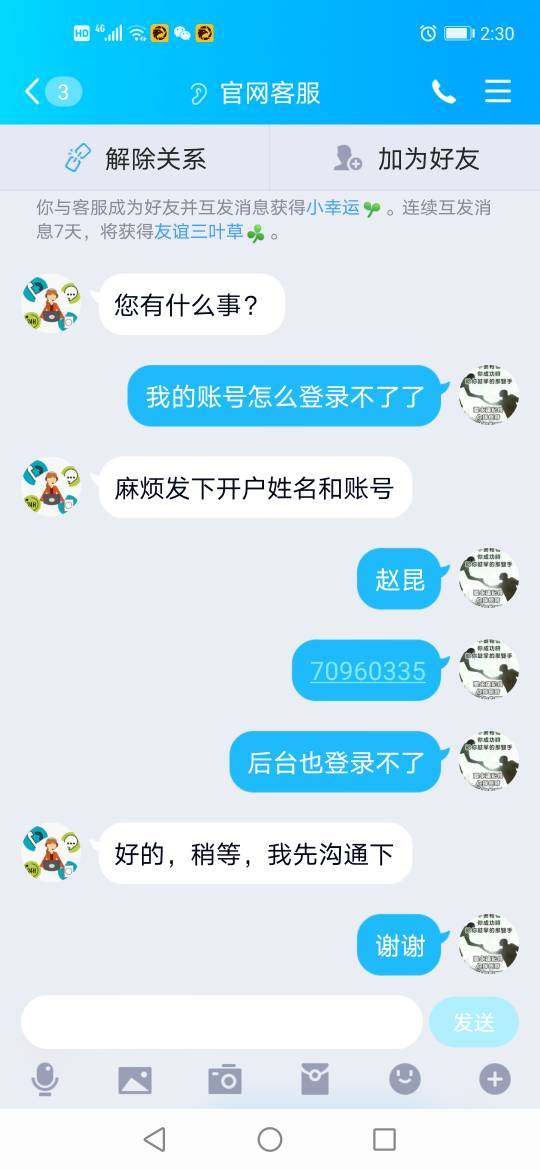

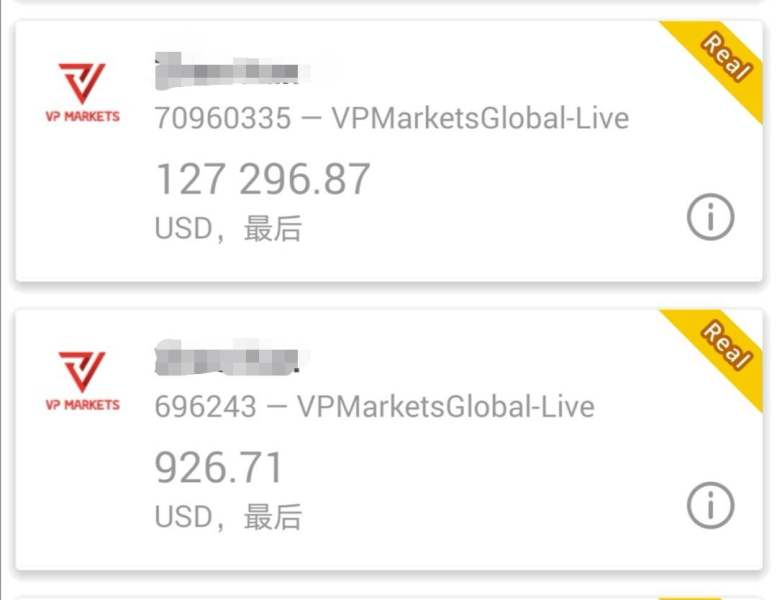

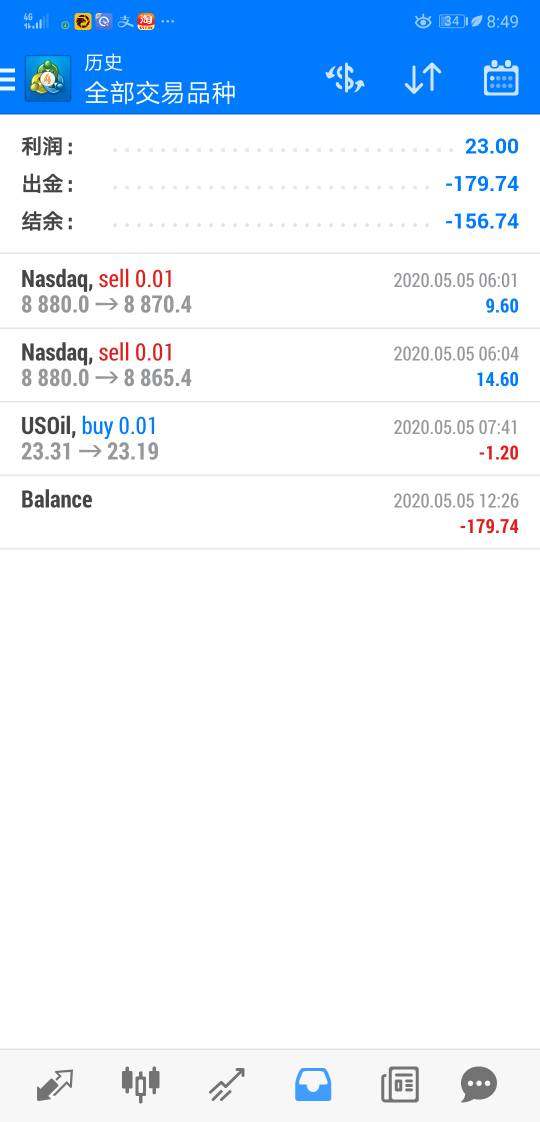

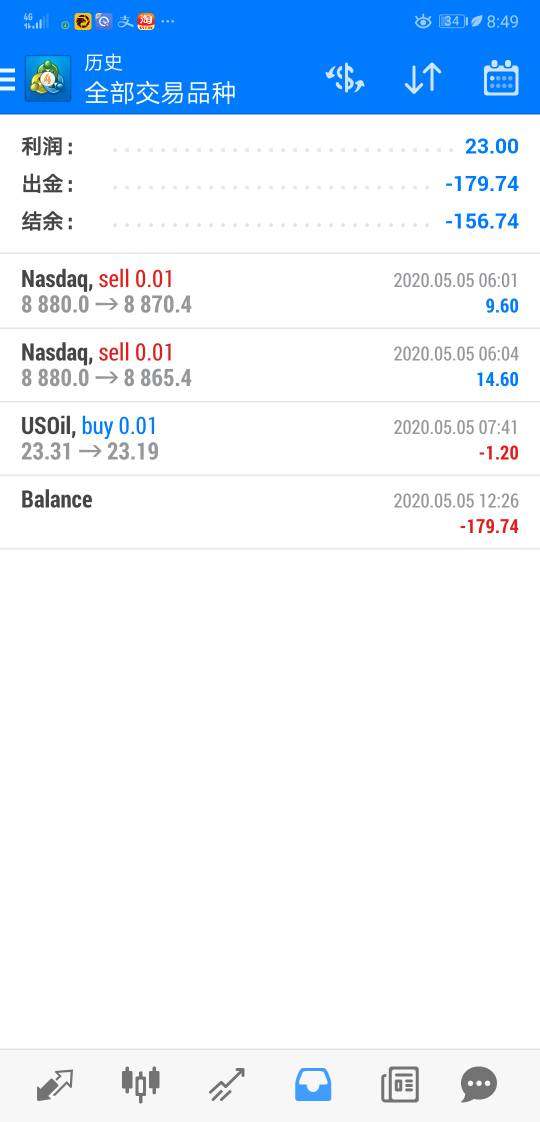

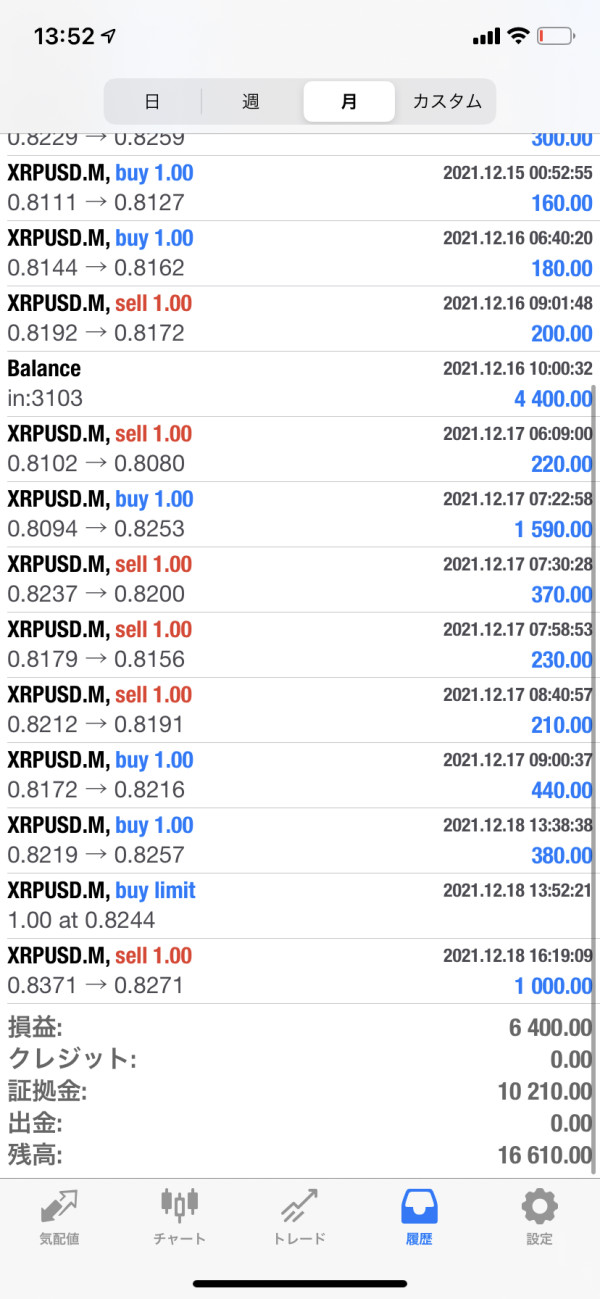

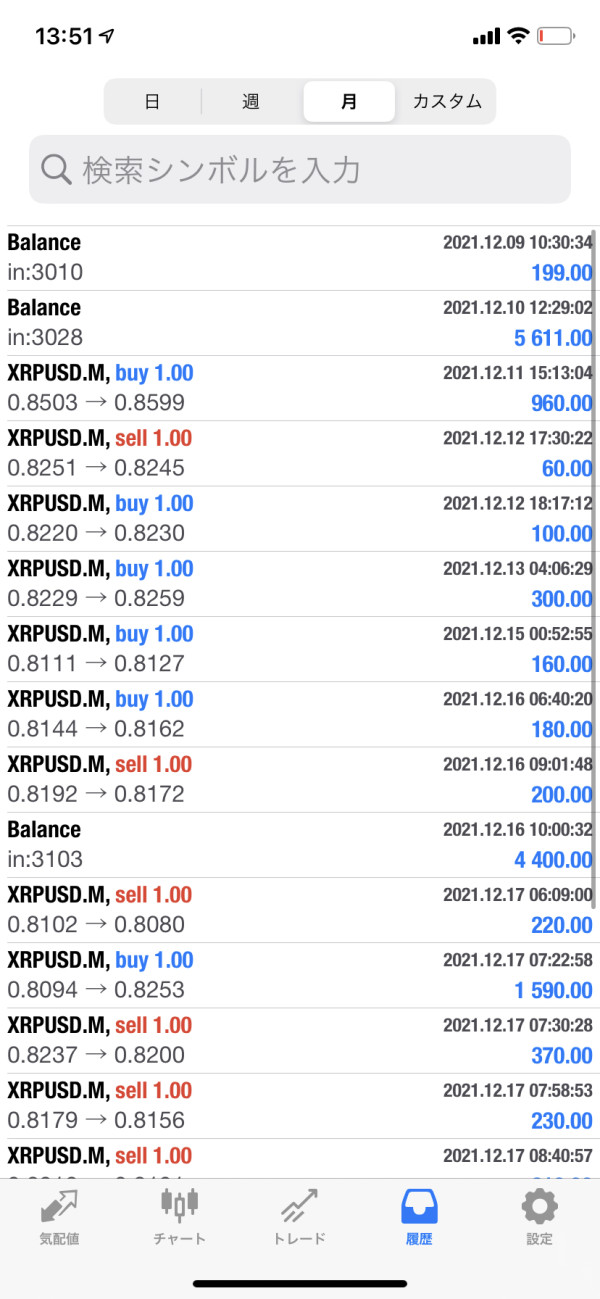

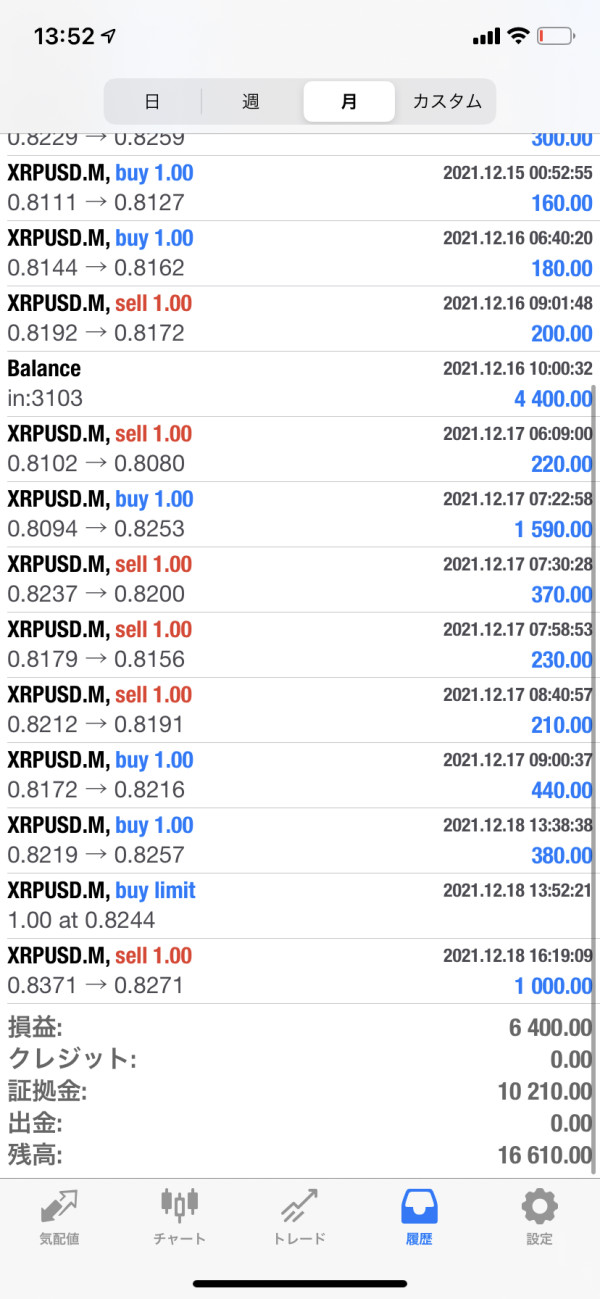

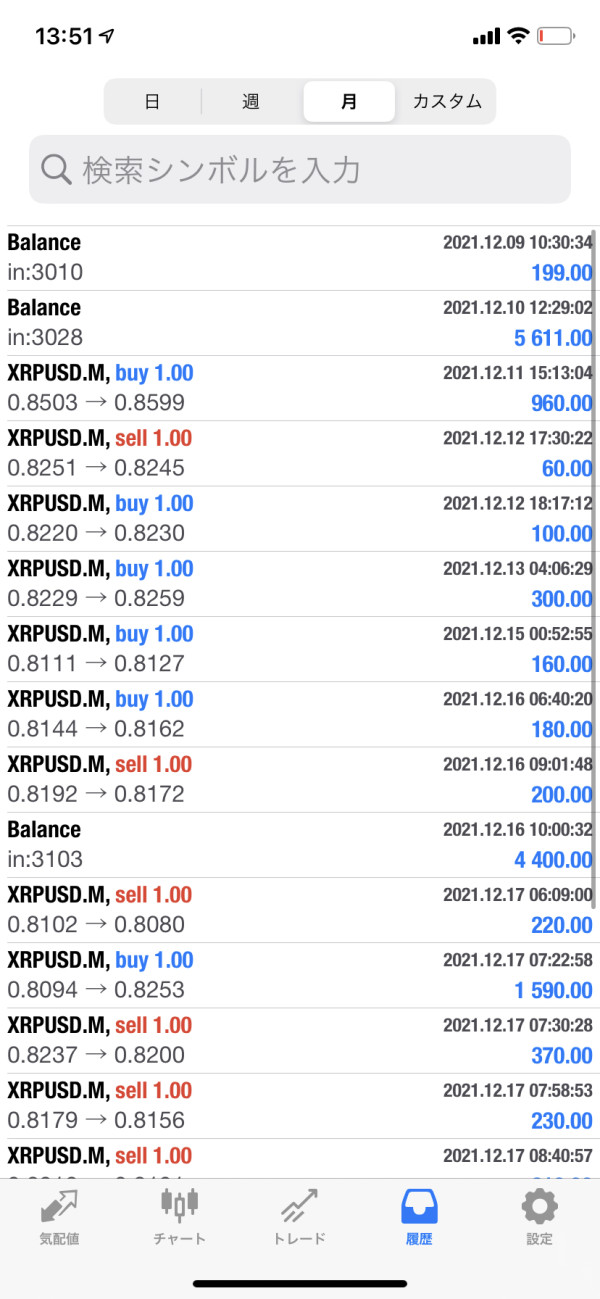

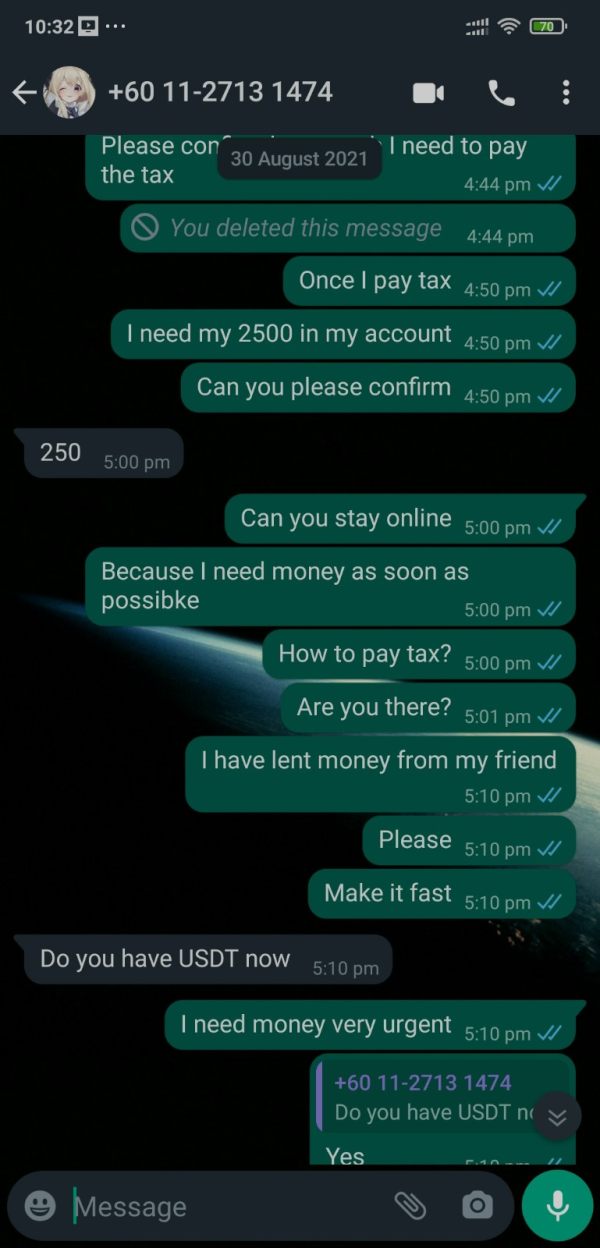

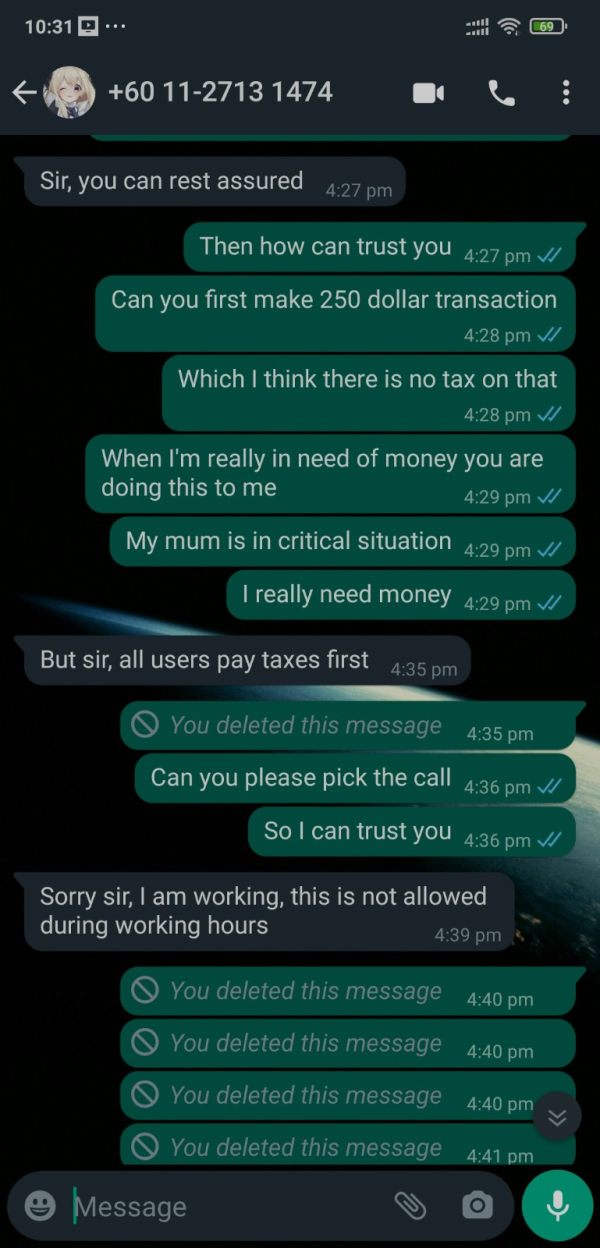

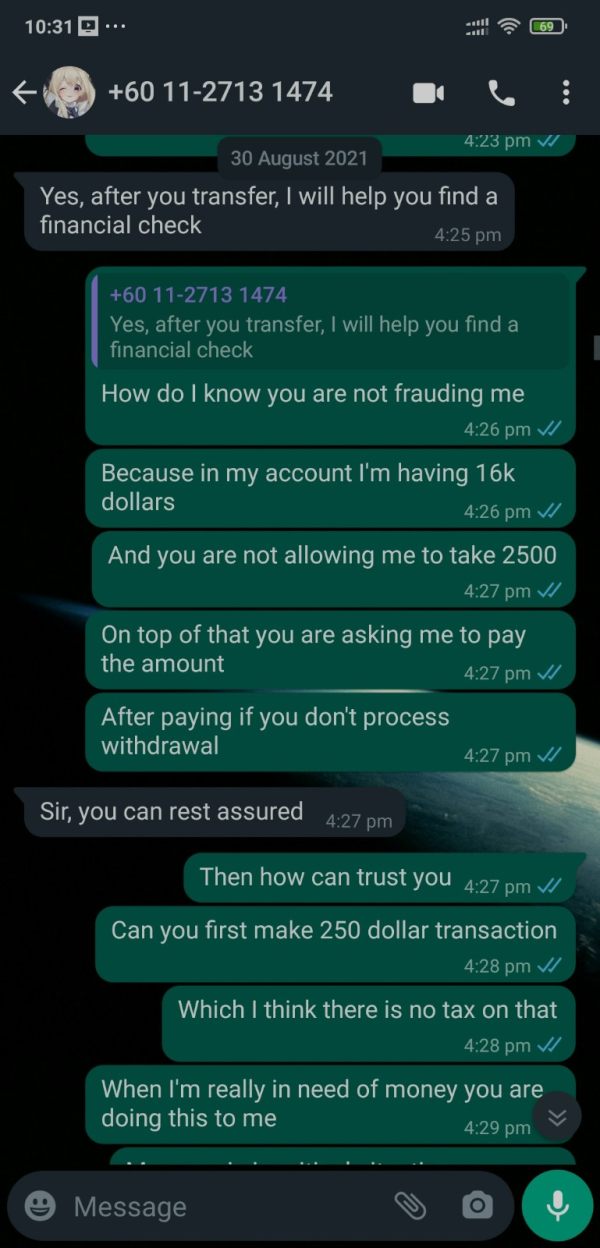

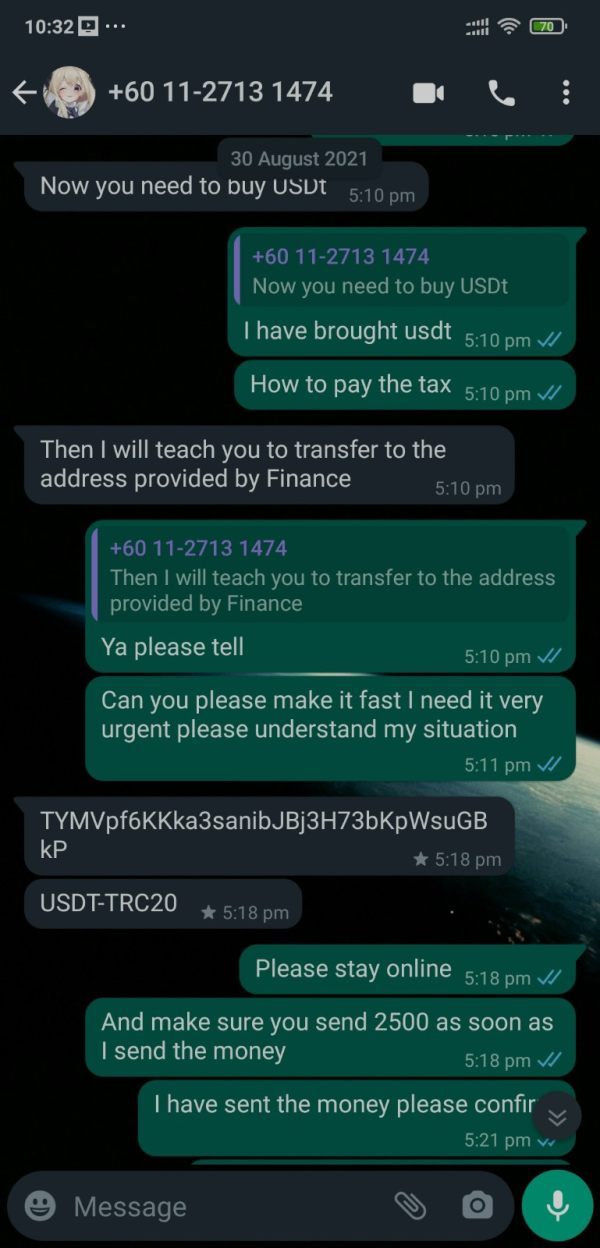

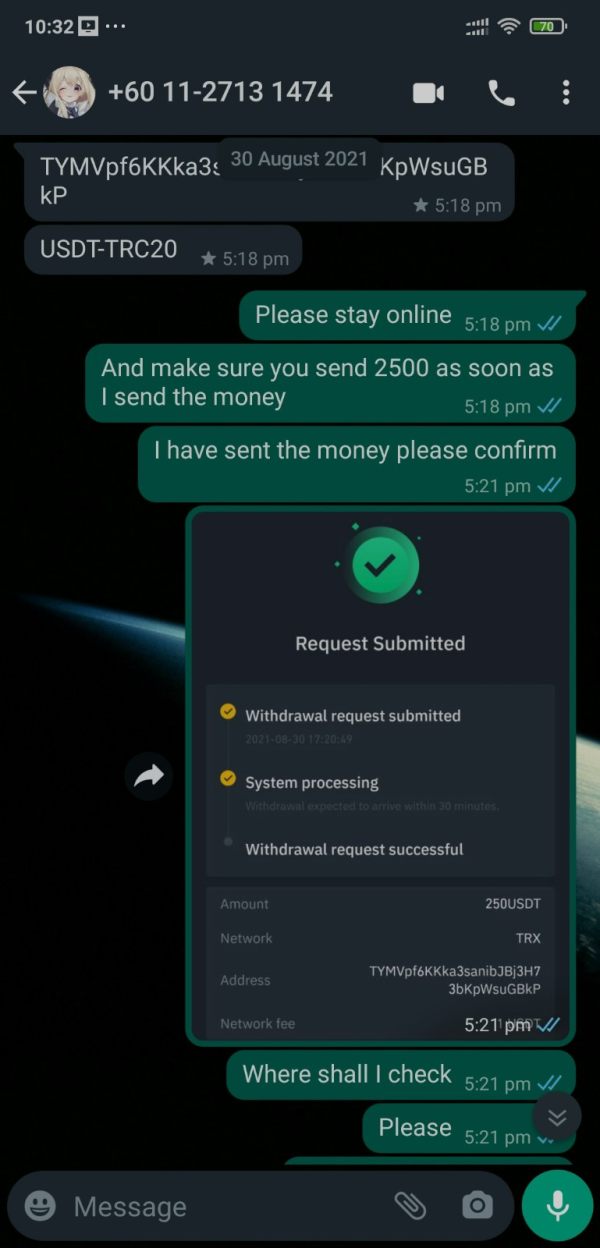

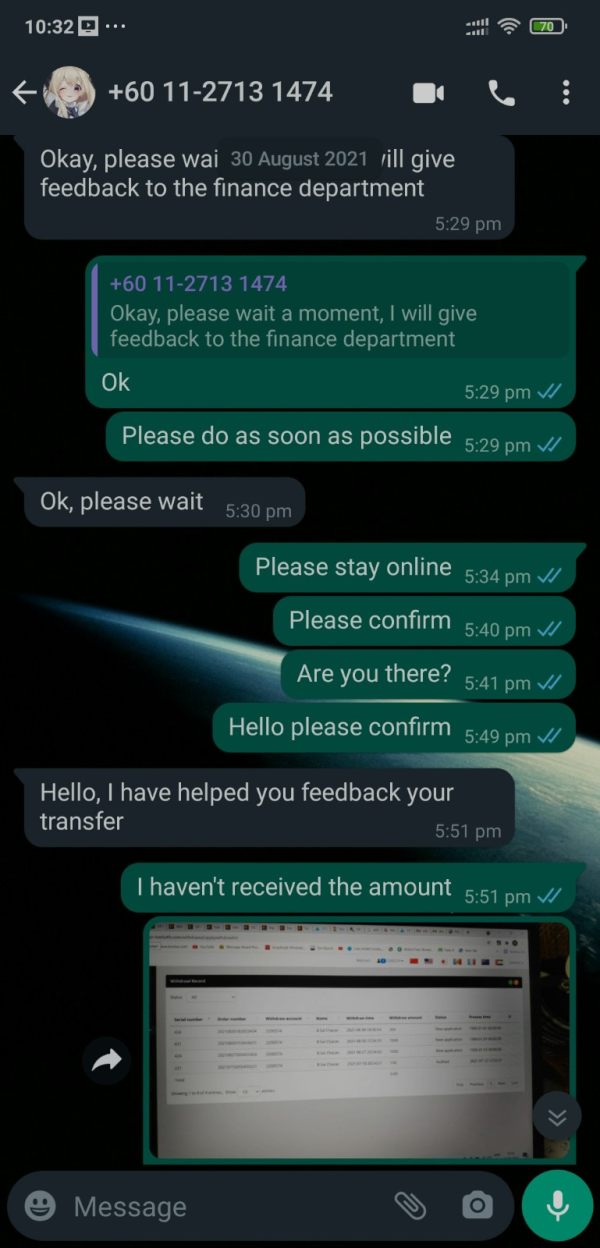

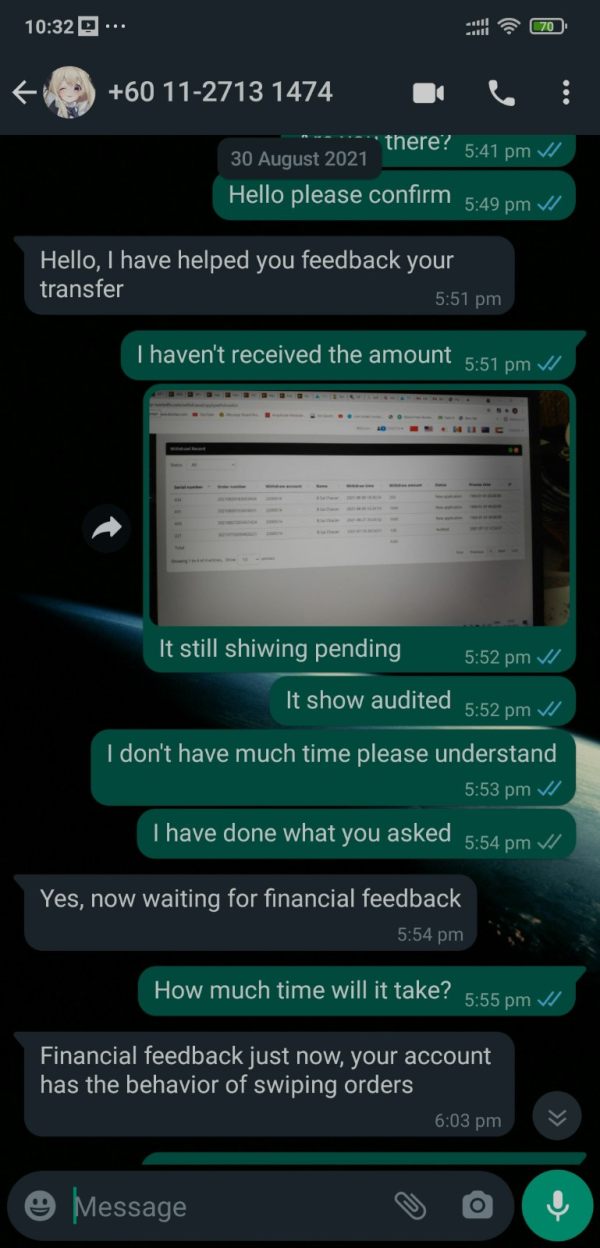

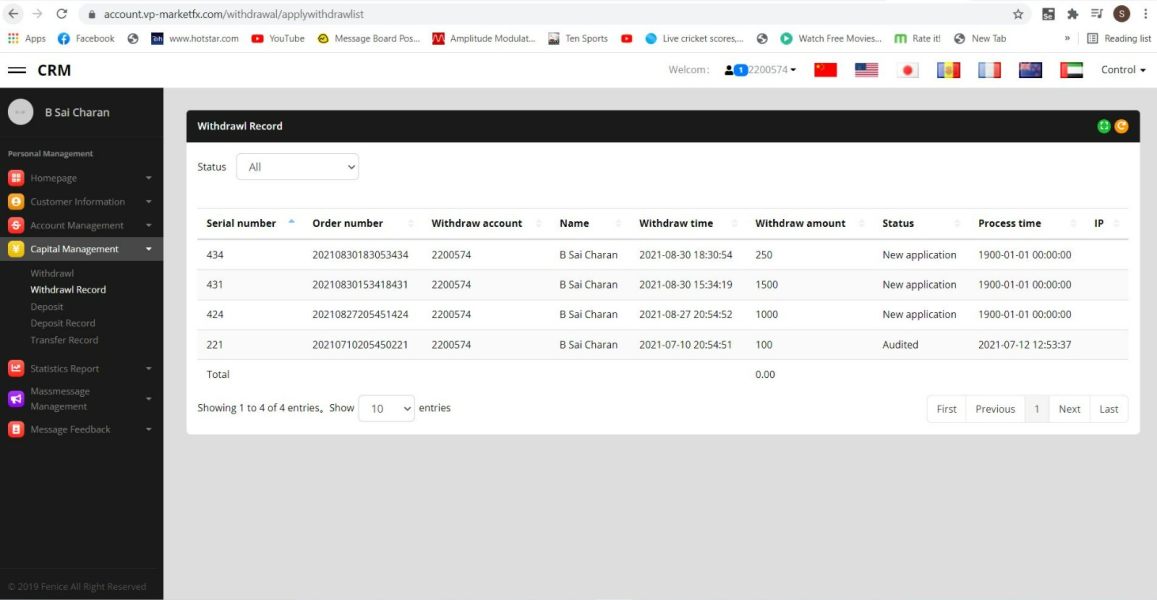

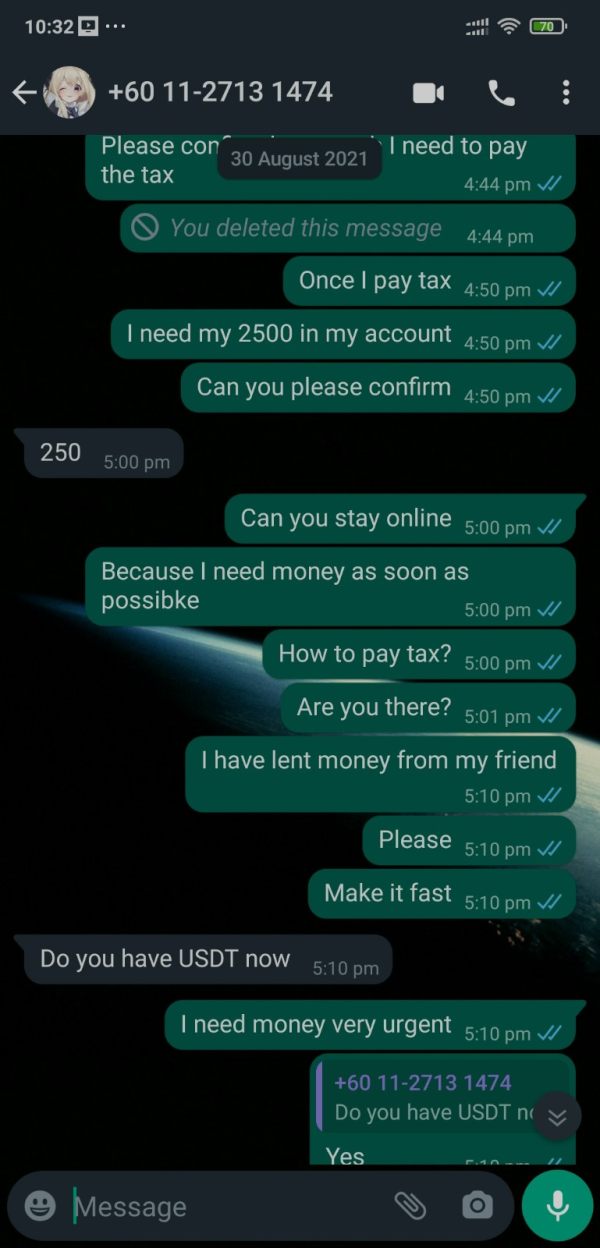

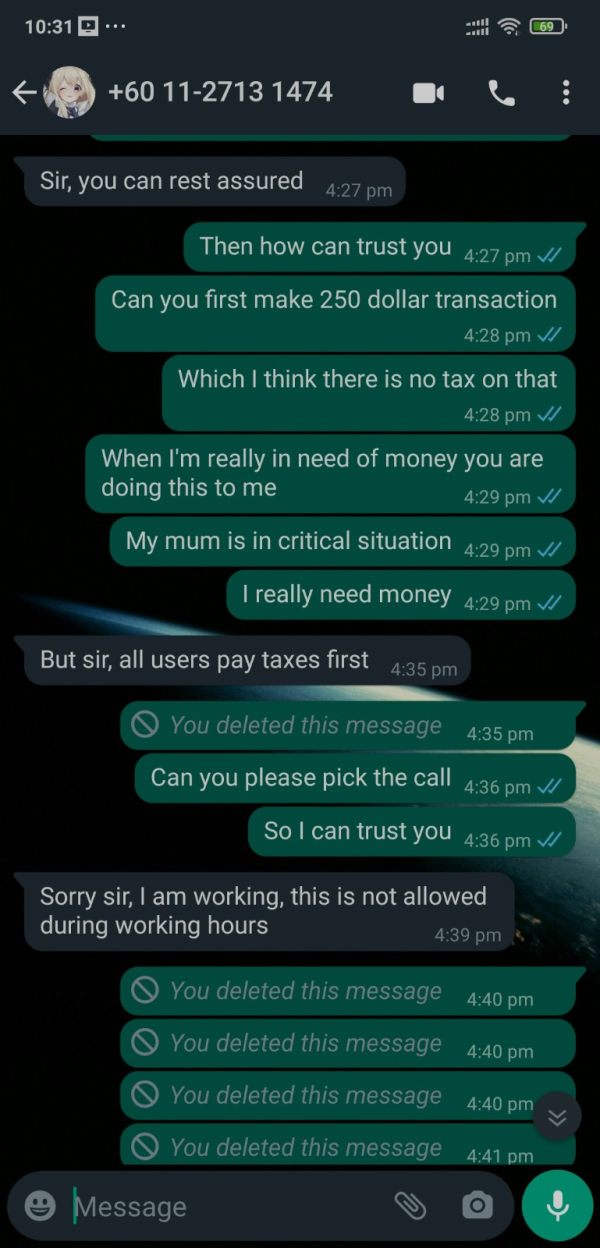

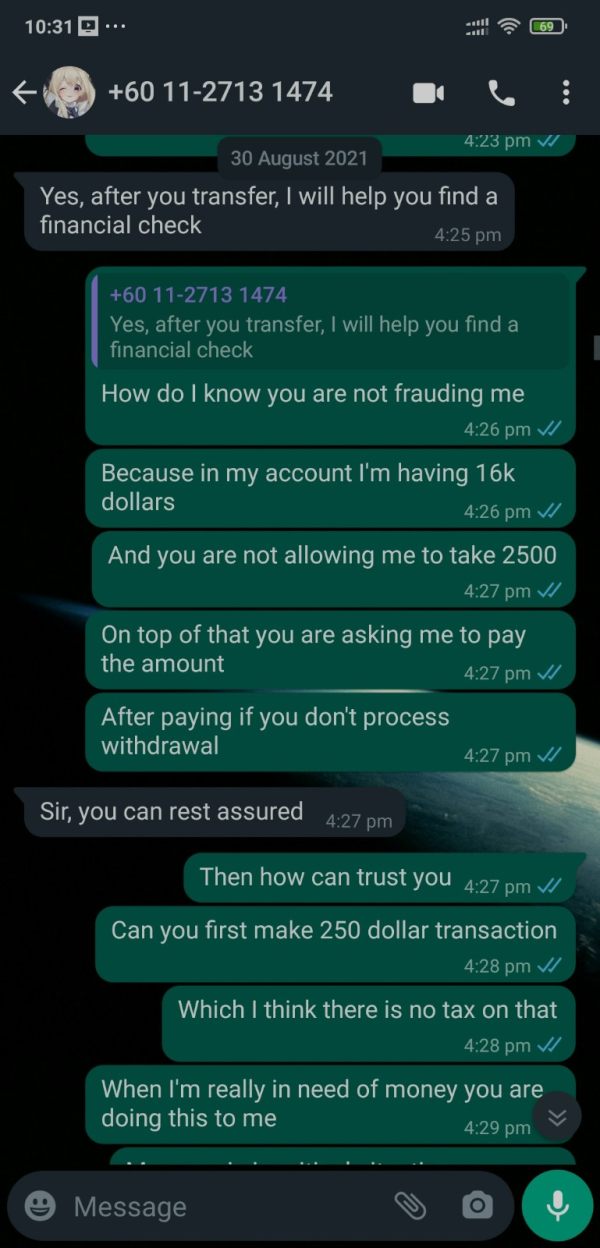

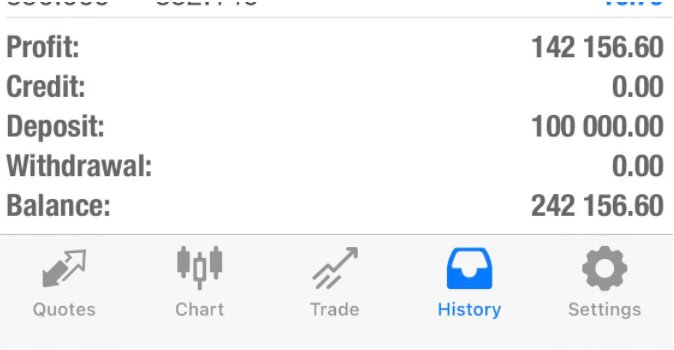

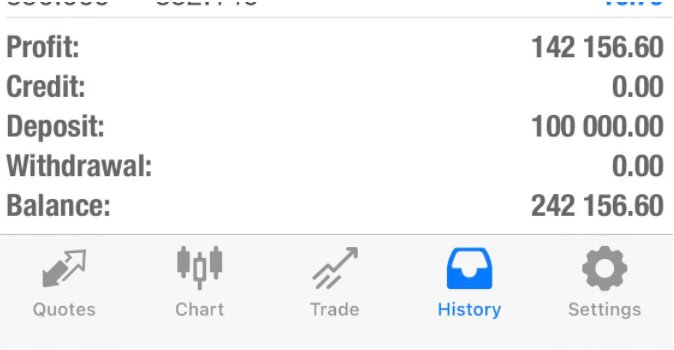

The lack of information regarding Islamic accounts, professional trader accounts, or other specialized account types suggests either limited product diversity or poor transparency in marketing materials. User feedback indicates concerning experiences, with one trader reporting that after depositing $127,000, approximately $20,000 was subsequently deducted without clear explanation. This raises serious questions about account safety and withdrawal procedures.

Without comprehensive account condition information, traders cannot adequately assess whether VP Markets offers suitable account structures for their specific needs, risk tolerance, or trading strategies. This vp markets review emphasizes that the limited account information represents a significant concern for serious traders seeking transparent and comprehensive account options.

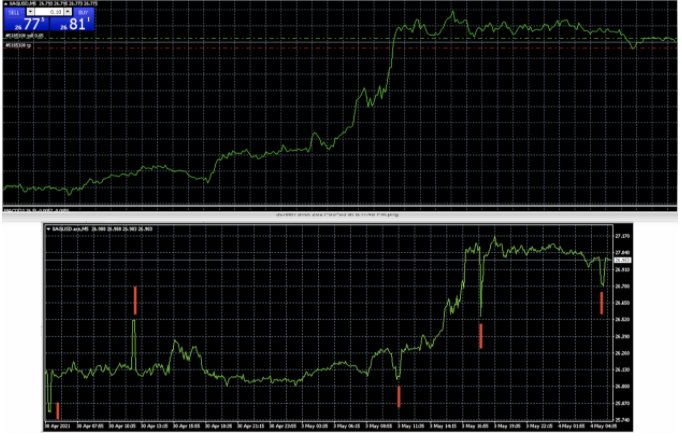

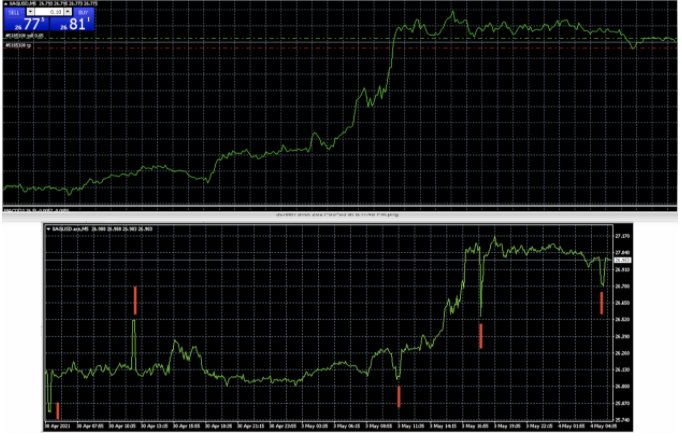

VP Markets provides the MetaTrader 4 platform as its primary trading tool. This offers standard charting capabilities, technical indicators, and automated trading support through Expert Advisors. However, the broker appears to lack comprehensive research and analysis resources that are typically expected from full-service trading providers. The absence of detailed educational materials, market analysis, or trading tutorials in available information suggests limited support for trader development and education.

The platform's tool selection appears restricted to standard MT4 functionality, without mention of additional proprietary tools, advanced charting packages, or enhanced analytical resources. This limitation may disadvantage traders who require sophisticated analysis tools or comprehensive market research to support their trading decisions. The lack of educational resources particularly impacts novice traders who might benefit from structured learning materials and market guidance.

Without detailed information about research capabilities, economic calendars, or market analysis tools, traders must rely primarily on third-party resources for comprehensive market insights. The absence of these supporting tools and resources contributes to a lower overall rating in this category, as modern traders typically expect integrated analytical and educational support from their chosen broker.

Customer Service and Support Analysis

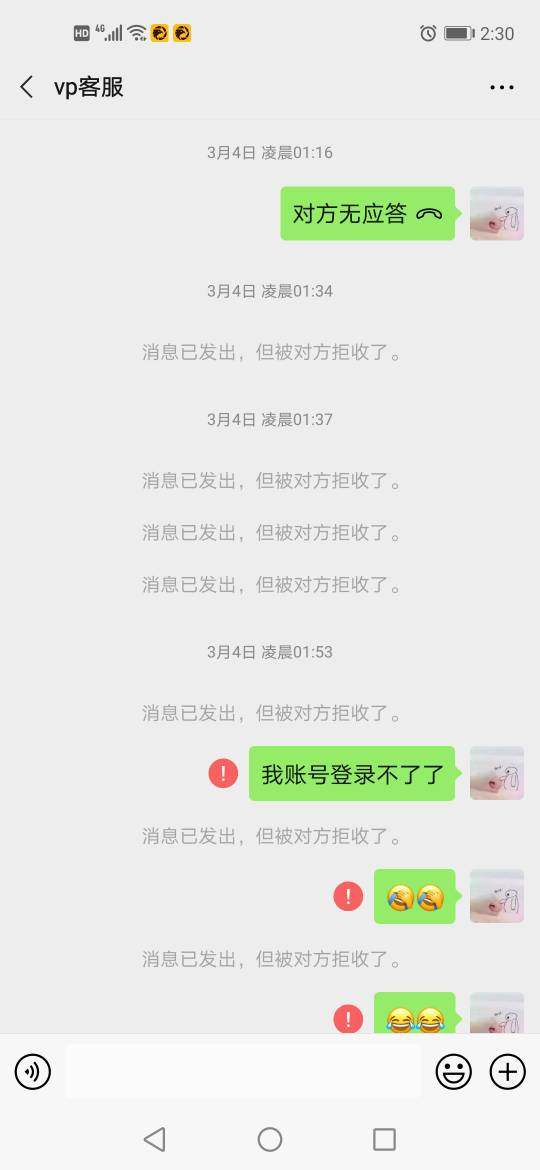

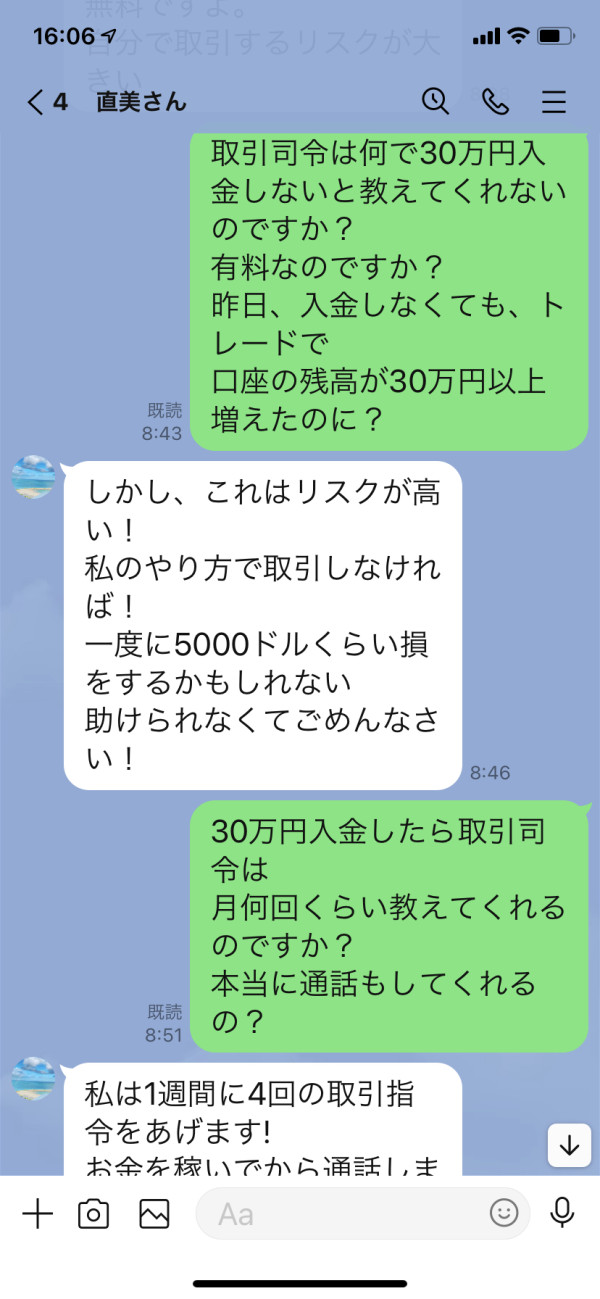

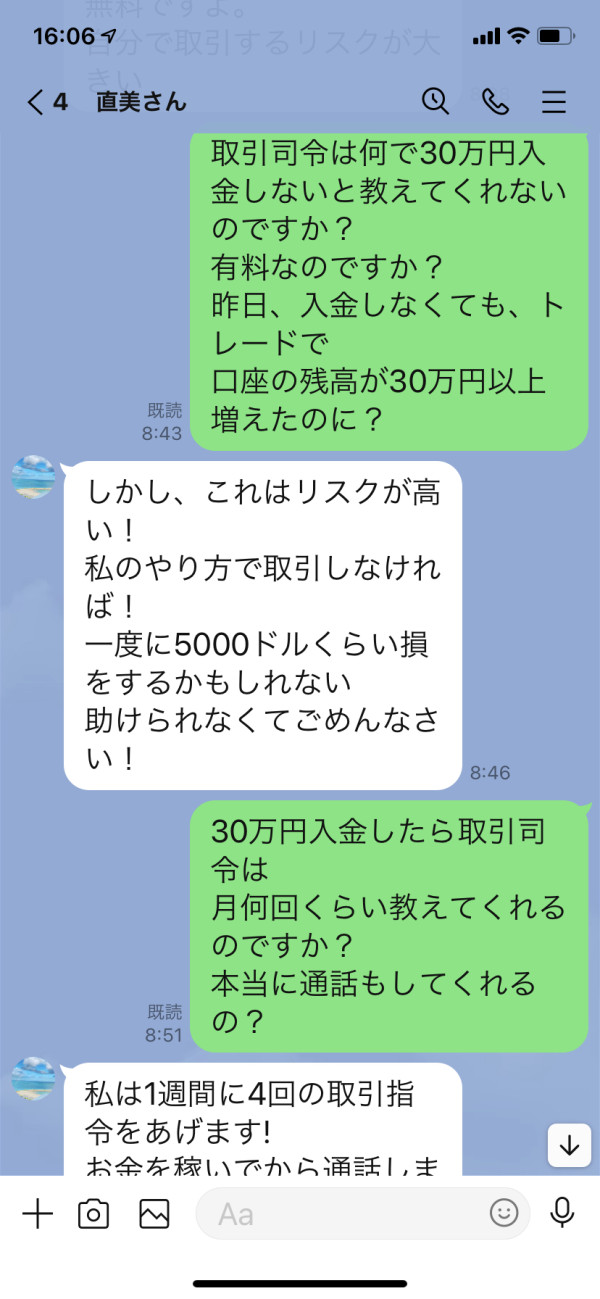

VP Markets' customer service infrastructure appears severely limited. Support is available only through email communication channels. The closure of online chat functionality represents a significant service limitation, particularly for traders who require immediate assistance during active trading sessions or urgent account issues. This restricted communication approach falls well below industry standards where multiple contact methods including phone, live chat, and email are typically expected.

User feedback regarding customer service quality is predominantly negative, with some clients warning others about potential fraudulent practices and poor service responsiveness. The lack of phone support or live chat options creates barriers for traders who need immediate assistance with time-sensitive trading or account issues. Response times for email inquiries are not specified, creating uncertainty about service efficiency and reliability.

The absence of detailed information about customer service hours, multilingual support, or specialized support teams for different trader categories further compounds service concerns. Without comprehensive customer support infrastructure, traders may find themselves unable to resolve critical issues promptly, potentially impacting their trading activities and account security.

Trading Experience Analysis

User feedback regarding trading experience with VP Markets presents mixed perspectives. Some traders praise the platform's stability and competitive spread conditions. Positive reviews highlight VP Markets as potentially being "one of the best trading platforms in the world," suggesting that some users have experienced satisfactory trading conditions and platform performance. The MT4 platform's stability appears to meet basic trading requirements for users who have successfully engaged with the broker.

However, the trading experience evaluation is complicated by the lack of detailed information about order execution quality, slippage rates, or platform performance during high-volatility periods. The absence of specific technical performance data makes it difficult to objectively assess the trading environment quality beyond user testimonials. Spread stability appears adequate based on available feedback, though comprehensive cost analysis remains limited.

The vp markets review indicates that while some traders report positive experiences, the overall trading environment assessment is hindered by limited technical specifications and mixed user feedback. Traders considering VP Markets should carefully evaluate their platform requirements against the available MT4 functionality and consider the risks associated with the broker's regulatory uncertainty.

Trust and Reliability Analysis

VP Markets faces significant trust and reliability challenges due to the absence of clear regulatory authority information and license numbers. The broker's claim of UK registration without providing specific Financial Conduct Authority or other regulatory details creates substantial transparency concerns. This regulatory ambiguity represents a critical red flag for traders seeking secure and compliant trading environments.

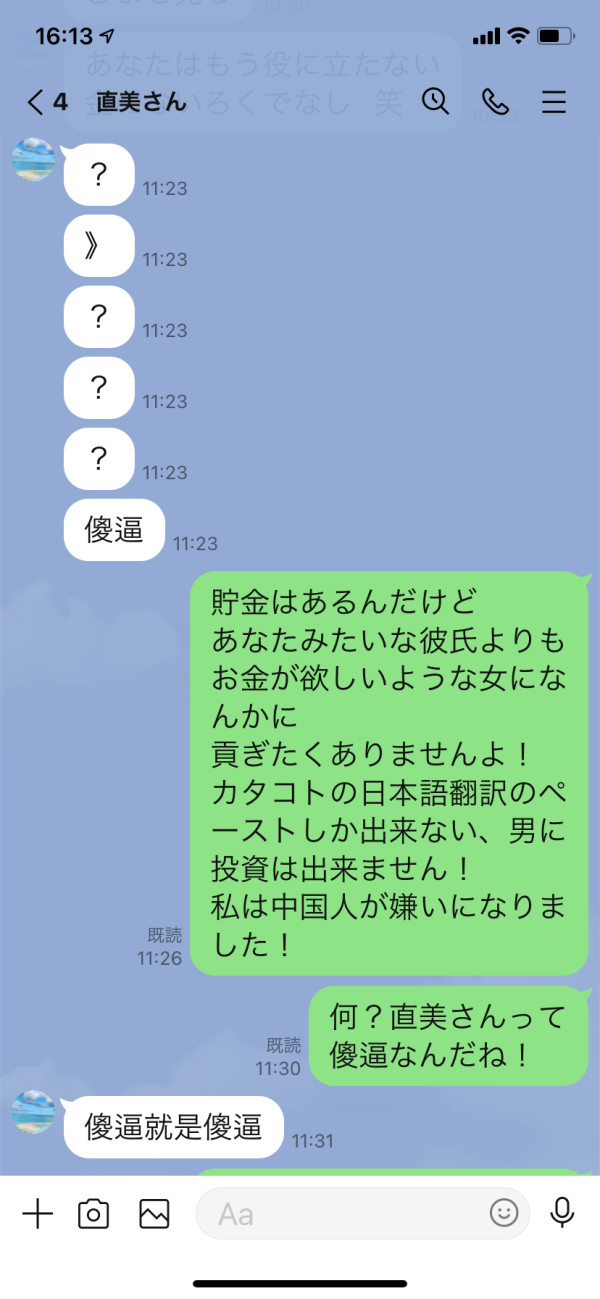

User reviews on platforms like Trustpilot reveal predominantly negative experiences, with some users explicitly warning others about potential fraudulent activities. These negative assessments contrast sharply with positive reviews found on other platforms, creating confusion about the broker's actual service quality and reliability. The extreme divergence in user opinions suggests either inconsistent service delivery or potentially manipulated review systems.

The reported incident of funds being deducted from user accounts without clear explanation further undermines trust in the broker's financial handling procedures. Without transparent regulatory oversight, clients have limited recourse for dispute resolution or fund protection. The absence of detailed information about client fund segregation, insurance coverage, or regulatory compliance measures compounds these trust concerns significantly.

User Experience Analysis

The overall user experience with VP Markets appears highly variable. Feedback ranges from extremely positive to strongly negative assessments. This polarization suggests inconsistent service delivery or potentially different user experiences based on account types, deposit levels, or geographic locations. The lack of detailed information about user interface design, registration procedures, or verification processes makes comprehensive user experience evaluation challenging.

Funding operations appear problematic based on user reports of unauthorized deductions and withdrawal difficulties. These financial transaction issues represent serious user experience concerns that could significantly impact trader satisfaction and account security. The absence of clear information about deposit and withdrawal procedures, processing times, or supported payment methods further complicates the user experience assessment.

Common user complaints focus on customer service quality, fund security, and transparency issues. However, some positive feedback suggests that certain users have found the platform suitable for their trading needs. The user base appears most suitable for traders seeking high-leverage opportunities and diversified asset access, though risk tolerance for regulatory uncertainty must be high.

Conclusion

VP Markets presents a complex evaluation scenario with competitive trading conditions including high leverage and competitive spreads. These features are offset by significant concerns regarding regulatory transparency and user trust. While the broker offers attractive features such as 1:500 leverage, zero starting spreads, and diverse asset classes through the MT4 platform, the absence of clear regulatory oversight and mixed user feedback creates substantial risk considerations for potential clients.

The broker appears most suitable for high-risk tolerance traders who prioritize leverage and asset diversity over regulatory certainty and comprehensive customer support. However, the lack of transparent regulatory information, limited customer service channels, and concerning user reports about fund security make VP Markets a questionable choice for traders seeking reliable, long-term trading relationships.

This vp markets review concludes that while VP Markets may offer certain trading advantages, the significant trust and transparency concerns outweigh the potential benefits for most traders. Prospective clients should carefully consider these risks and explore alternative brokers with clearer regulatory standing and more comprehensive service offerings.