Is ForexLive safe?

Pros

Cons

Is ForexLive Safe or a Scam?

Introduction

ForexLive is a brokerage that claims to provide traders with access to various financial markets, including forex and CFDs. Established in 2023, the broker positions itself as a modern trading platform aimed at attracting both novice and experienced traders. However, the increasing number of fraudulent schemes in the forex market necessitates that traders exercise caution when evaluating brokers. This article aims to investigate the safety and legitimacy of ForexLive, assessing its regulatory status, company background, trading conditions, customer experiences, and overall risk. The evaluation is based on a thorough review of various online sources, including user reviews and regulatory databases.

Regulation and Legitimacy

The regulatory status of a brokerage is crucial for determining its legitimacy and safety. A well-regulated broker is more likely to adhere to industry standards and protect its clients' funds. ForexLive claims to be registered in Saint Vincent and the Grenadines, but it lacks any valid licenses from recognized financial authorities. Below is a summary of the regulatory information:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| N/A | N/A | N/A | Not Registered |

The absence of regulation raises significant concerns regarding ForexLive's credibility. It is important to note that brokers operating in offshore jurisdictions often face less stringent oversight, which can lead to higher risks for traders. ForexLive's claims of having multiple licenses from European regulators have not been substantiated, further casting doubt on its legitimacy. Without proper regulation, traders may find it challenging to seek recourse in case of disputes or fund mismanagement.

Company Background Investigation

ForexLive's company history is relatively short, having been established in 2023. The broker's ownership structure is unclear, as it does not disclose information about its founders or management team. Transparency is vital in the financial industry, and the lack of information regarding the company's leadership raises red flags. A reputable broker typically provides details about its management team, including their qualifications and experience in the financial sector.

Furthermore, the broker's website lacks comprehensive information about its services, which is indicative of a potentially untrustworthy operation. The absence of a clear corporate history and ownership structure suggests that ForexLive may not be committed to maintaining transparency with its clients. This lack of clarity can lead to skepticism among potential traders considering whether ForexLive is safe.

Trading Conditions Analysis

Understanding a broker's trading conditions is essential for evaluating its overall offering. ForexLive presents itself as a competitive trading platform; however, its fee structure is not clearly outlined. Traders should be aware of all associated costs before committing their funds. Below is a comparison of core trading costs:

| Fee Type | ForexLive | Industry Average |

|---|---|---|

| Spread on Major Currency Pairs | N/A | 1.0 - 3.0 pips |

| Commission Model | N/A | Varies |

| Overnight Interest Range | N/A | 0.5% - 3% |

The absence of specific details regarding spreads and commissions is concerning. A reputable broker typically provides transparent information about its fee structure, allowing traders to make informed decisions. If ForexLive's trading conditions are not competitive or transparent, it may lead to unexpected costs that could erode traders' profits.

Customer Funds Security

The security of customer funds is a paramount concern for any trader. ForexLive claims to implement measures to safeguard clients' investments, but the effectiveness of these measures is questionable given its lack of regulation. Traders should look for features such as segregated accounts, investor protection schemes, and negative balance protection.

ForexLive does not provide detailed information on its fund security policies, which raises concerns about how it manages and protects client funds. Without regulatory oversight, the risk of fund mismanagement increases, making it essential for traders to approach ForexLive with caution. Historical complaints or issues regarding fund security could further exacerbate these concerns.

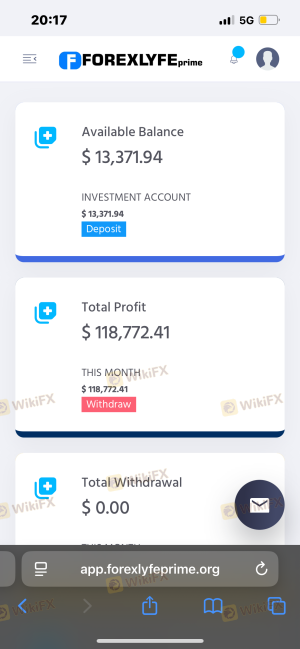

Customer Experience and Complaints

Customer feedback is a valuable resource for assessing a broker's reliability and service quality. ForexLive has received mixed reviews from users, with several complaints highlighting issues related to withdrawal delays and poor customer service. Below is a summary of common complaint types and their severity:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Inconsistent |

| Poor Customer Support | Medium | Slow Response |

| Misleading Information | High | No Clarification |

Typical cases involve traders experiencing difficulties in withdrawing their funds or receiving inadequate responses from customer support. Such patterns of complaints can significantly impact a trader's experience and trust in the broker. If ForexLive fails to address these issues effectively, it raises further questions about whether ForexLive is safe for potential clients.

Platform and Trade Execution

The performance of a trading platform is critical for a seamless trading experience. ForexLive claims to offer a user-friendly trading platform, but there is limited information available regarding its stability and execution quality. Traders should be wary of platforms that exhibit frequent downtime or slippage, which can adversely affect trading outcomes.

Additionally, any signs of potential platform manipulation, such as price discrepancies or unusual trading conditions, should be closely monitored. A reliable broker typically provides a transparent and efficient trading environment, ensuring that traders can execute their trades without unnecessary complications.

Risk Assessment

When evaluating whether ForexLive is safe, it is essential to consider the overall risk involved in using the broker. Below is a risk assessment summary:

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | No valid regulation |

| Financial Security Risk | High | Lack of transparency in fund management |

| Customer Support Risk | Medium | Inconsistent response to complaints |

Given the high-risk levels associated with ForexLive, traders should exercise caution. It is advisable to conduct thorough research and consider alternative brokers with better regulatory oversight and customer service records.

Conclusion and Recommendations

In conclusion, the evidence suggests that ForexLive presents several red flags that warrant concern. The lack of regulation, unclear company background, and numerous complaints regarding customer experiences indicate that traders should approach ForexLive with caution. While the broker may offer trading opportunities, the potential risks involved raise questions about its overall safety.

For traders seeking a more secure trading environment, it is advisable to consider established brokers with strong regulatory oversight and positive customer feedback. Some reliable alternatives include brokers regulated by top-tier authorities such as the FCA, ASIC, or CySEC. By choosing a well-regulated broker, traders can mitigate risks and ensure a safer trading experience.

Is ForexLive a scam, or is it legit?

The latest exposure and evaluation content of ForexLive brokers.

ForexLive Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

ForexLive latest industry rating score is 1.40, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.40 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.