Is STL safe?

Business

License

Is STL Safe or a Scam?

Introduction

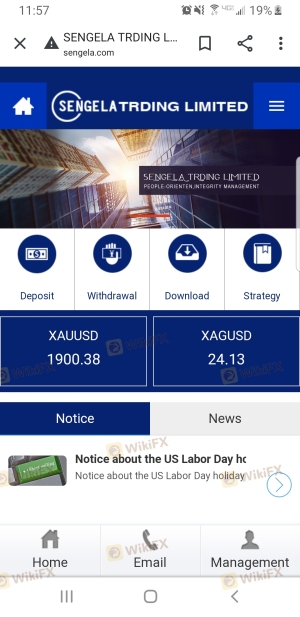

STL is a forex broker that has been gaining attention in the trading community. Positioned as a platform offering a wide array of trading instruments, STL claims to provide traders with the tools they need to succeed in the highly competitive forex market. However, as with any financial service, it is crucial for traders to conduct thorough due diligence before committing their funds. The forex market is rife with scams, and the potential for financial loss is significant if traders choose an unreliable broker. This article aims to investigate whether STL is safe or a scam by evaluating its regulatory status, company background, trading conditions, customer experiences, and overall risk profile. Our investigation is based on a comprehensive review of available online resources, including user testimonials, regulatory databases, and expert analyses.

Regulation and Legitimacy

A broker's regulatory status is one of the most critical factors in determining its legitimacy and safety. A well-regulated broker is typically subject to stringent oversight, providing a layer of protection for traders. Unfortunately, STL does not appear to be regulated by any recognized financial authority, which raises significant red flags regarding its operations.

| Regulatory Authority | License Number | Regulated Area | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Not Verified |

The absence of regulatory oversight means that STL operates without the accountability that comes with regulation. This lack of oversight can lead to potential risks for traders, including issues related to fund safety and the execution of trades. Furthermore, the absence of a regulatory history raises questions about STL's compliance with industry standards and ethical practices. Without a credible regulatory body overseeing its operations, STLs claims of safety and reliability remain unverified, making it imperative for traders to exercise caution when considering this broker.

Company Background Investigation

Understanding the company behind a broker can provide valuable insights into its trustworthiness. STL, operating under the name Sengela Trading Limited, has limited information available regarding its history and ownership structure. The company claims to offer a modern trading platform, yet its transparency is questionable. There is no clear indication of the management teams qualifications or experience in the financial industry, which is a significant concern for potential clients.

In addition, the lack of a verifiable physical address and contact information can further obscure the broker's legitimacy. Many fraudulent brokers often utilize vague or unverifiable details to avoid accountability. As a result, potential clients may find it challenging to obtain recourse should any issues arise. In this context, the question of "Is STL safe?" becomes increasingly relevant, as the absence of transparency raises doubts about the broker's intentions and operational integrity.

Trading Conditions Analysis

Examining trading conditions is essential for evaluating a broker's overall value proposition. STL offers a range of trading instruments, but the specifics of its fee structure and trading conditions are not well-documented. Traders should be wary of any broker that does not provide clear information regarding spreads, commissions, and other costs associated with trading.

| Fee Type | STL | Industry Average |

|---|---|---|

| Spread on Major Pairs | High (exact value not disclosed) | Low (typically 1-2 pips) |

| Commission Model | Not clearly defined | Generally transparent |

| Overnight Interest Range | Unspecified | Varies by broker |

The lack of transparency around trading costs can be a significant red flag. Traders may find themselves facing unexpected fees or unfavorable trading conditions that could erode their profits. Moreover, STL's failure to provide a clear fee structure raises concerns about its overall business practices. If traders are unable to understand the costs associated with trading on STL, it may indicate that the broker is not operating in good faith.

Customer Fund Safety

The safety of customer funds is paramount when evaluating a broker's trustworthiness. STL's lack of regulation raises serious concerns about how it manages client funds. Reputable brokers typically implement measures such as segregated accounts, investor protection schemes, and negative balance protection to safeguard their clients' investments. However, there is no evidence that STL offers such protections.

Traders should be particularly cautious if a broker does not provide clear information about its fund management practices. The absence of these safety measures can leave traders vulnerable to losing their entire investment without any recourse. Therefore, the question of "Is STL safe?" is crucial, as traders must assess whether their funds would be secure in the event of a financial dispute or broker insolvency.

Customer Experience and Complaints

Customer feedback is an essential component of evaluating a broker's reliability. Unfortunately, STL has received numerous complaints from users regarding withdrawal issues, lack of customer support, and aggressive sales tactics. These complaints suggest a pattern of behavior that is often associated with fraudulent brokers.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Lack of Support | Medium | Inadequate |

| Aggressive Sales Tactics | High | Unresponsive |

Typical complaints include difficulties in accessing funds, unresponsive customer service, and high-pressure sales tactics encouraging additional deposits. Such practices are often indicative of a broker operating outside of industry norms, further solidifying concerns about STL's legitimacy. The persistent nature of these complaints raises significant questions about whether STL is a safe trading environment for potential clients.

Platform and Execution

The trading platform's performance is crucial for a seamless trading experience. STL claims to offer a user-friendly platform; however, reports from users indicate issues with stability, execution speed, and slippage. Such problems can severely impact a trader's ability to execute trades effectively, leading to potential financial losses.

Moreover, indications of potential platform manipulation, such as frequent rejections of orders or unexplained slippage, can further erode trust in the broker. Traders must be vigilant and assess whether STL provides a reliable trading environment, as any signs of manipulation can signal deeper issues within the broker's operations.

Risk Assessment

In conclusion, the overall risk profile of STL is concerning. The following risk assessment summarizes key areas of concern:

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Compliance | High | No regulation or oversight |

| Fund Safety | High | Lack of investor protection |

| Customer Support | Medium | Poor responsiveness to complaints |

| Trading Conditions | High | Unclear fee structure and potential hidden costs |

Given the high-risk level across multiple categories, it is essential for traders to approach STL with extreme caution. Without proper regulatory oversight and transparency, the risks associated with trading through STL could lead to significant financial losses.

Conclusion and Recommendations

After a thorough investigation, it is evident that STL exhibits several concerning traits that raise the question: "Is STL safe?" The lack of regulation, transparency, and customer support, coupled with numerous complaints from users, suggests that STL may not be a trustworthy broker. Traders should exercise caution and consider alternative options that are regulated and have a proven track record of reliability.

For those seeking a safer trading environment, reputable alternatives include brokers that are regulated by top-tier authorities such as the FCA, ASIC, or SEC. These brokers typically offer enhanced investor protections, transparent fee structures, and reliable customer support. Ultimately, it is crucial for traders to prioritize safety and due diligence when selecting a forex broker to ensure a secure trading experience.

Is STL a scam, or is it legit?

The latest exposure and evaluation content of STL brokers.

STL Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

STL latest industry rating score is 1.54, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.54 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.