Is Vanavel safe?

Business

License

Is Vanavel Safe or a Scam?

Introduction

Vanavel is a trading platform that positions itself within the forex market, claiming to offer a diverse range of trading instruments, including forex pairs, CFDs, and cryptocurrencies. As the forex market continues to grow, traders are increasingly faced with a multitude of brokers, making it essential to assess their credibility and safety. With the potential for significant financial loss, it is crucial for traders to conduct thorough due diligence before engaging with any broker. This article aims to evaluate the trustworthiness of Vanavel by examining its regulatory status, company background, trading conditions, customer experience, and overall risk profile.

Regulation and Legitimacy

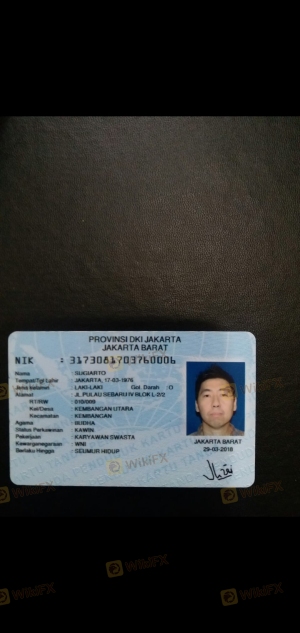

One of the fundamental aspects to consider when assessing the safety of a forex broker is its regulatory status. Regulation serves as a safeguard for traders, ensuring that brokers adhere to specific standards of conduct and transparency. Unfortunately, Vanavel operates without valid regulation from any recognized financial authority. The following table summarizes the core regulatory information:

| Regulatory Agency | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| NFA | 0545180 | United States (Unauthorized) | Not Verified |

The absence of regulation raises significant concerns about the safety and security of the trading environment provided by Vanavel. It implies a lack of oversight, which could lead to potential malpractice or fraudulent activities. Moreover, the fact that the official website of Vanavel is currently inaccessible further exacerbates these concerns, indicating a potential risk of the broker absconding with client funds. Therefore, it is essential for traders to approach Vanavel with caution when considering whether Vanavel is safe or a scam.

Company Background Investigation

Vanavel is registered in Saint Vincent and the Grenadines, a jurisdiction known for its lenient regulatory framework. This lack of stringent oversight can often attract less reputable brokers seeking to operate without rigorous compliance. The company claims to offer a user-friendly trading platform, primarily utilizing MetaTrader 4 (MT4), which is widely recognized in the trading community for its functionality. However, the lack of transparency regarding the ownership structure and management team raises further questions about the broker's credibility.

A thorough examination of the management team reveals limited information on their professional backgrounds and expertise in the financial markets. A well-established management team with relevant experience is often a good indicator of a broker's reliability. In contrast, the obscurity surrounding Vanavel's key personnel can be a red flag, suggesting a lack of accountability. This lack of transparency, combined with the absence of regulation, casts doubt on whether Vanavel is safe for traders.

Trading Conditions Analysis

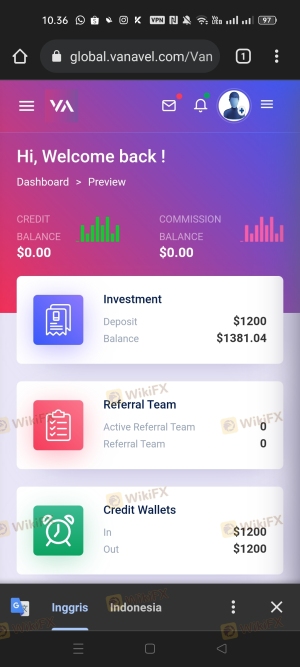

When evaluating a broker, understanding the trading conditions they offer is crucial. Vanavel presents a minimum deposit requirement of $1,000, which is relatively high compared to industry standards. Additionally, the broker claims to provide access to over 100 forex asset pairs, CFDs, and cryptocurrencies. However, the absence of a demo account limits potential clients' ability to test the platform before committing real funds.

The following table outlines the core trading costs associated with Vanavel:

| Fee Type | Vanavel | Industry Average |

|---|---|---|

| Major Currency Pair Spread | Variable | 1.0 pips |

| Commission Model | None | Varies |

| Overnight Interest Range | Not Disclosed | 0.5% - 2.0% |

While the spread on major currency pairs can be competitive, the lack of transparency regarding commissions and overnight interest rates raises concerns. The absence of clear information about trading fees can lead to unexpected costs for traders, further complicating the decision of whether Vanavel is safe to trade with.

Client Funds Security

The safety of client funds is paramount when evaluating a broker. Vanavel's operations raise significant concerns regarding the security of client deposits. The absence of regulation means there are no mandated protections in place to safeguard client funds. Furthermore, without clear information on whether client funds are held in segregated accounts, traders may be at risk of losing their investments in the event of the broker's insolvency.

In addition, the lack of investor protection schemes, such as those offered by regulated brokers, leaves clients vulnerable. The absence of negative balance protection further exacerbates the risks associated with trading with Vanavel. Traders must consider these factors carefully when assessing whether Vanavel is safe or a potential scam.

Customer Experience and Complaints

Customer feedback is a critical component of evaluating a broker's reliability. Reviews and testimonials from current and former clients can provide valuable insights into the overall customer experience. Unfortunately, there is a notable lack of user reviews for Vanavel, which raises further concerns about its credibility.

Common complaints associated with unregulated brokers include withdrawal issues, poor customer support, and lack of transparency. The following table summarizes prevalent complaint types and their severity:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Unresponsive |

| Poor Customer Support | Medium | Limited Availability |

| Transparency Issues | High | Not Addressed |

A lack of responsiveness to complaints can indicate deeper operational issues within the brokerage. In the absence of a solid track record and customer feedback, traders must approach Vanavel with caution when determining if Vanavel is safe for their trading activities.

Platform and Trade Execution

The trading platform is a critical aspect of any broker's offering. Vanavel utilizes the popular MetaTrader 4 (MT4) platform, known for its user-friendly interface and advanced charting capabilities. However, the stability and execution quality of the platform remain uncertain, especially considering the broker's unregulated status.

Concerns about order execution quality, slippage, and rejection rates are common among traders using platforms with questionable reputations. Without reliable data on these metrics, it is challenging to ascertain whether Vanavel provides a competitive trading environment. Therefore, potential clients must weigh these factors carefully when deciding if Vanavel is safe for trading.

Risk Assessment

Engaging with an unregulated broker presents inherent risks that traders must acknowledge. The following risk assessment summarizes key areas of concern:

| Risk Category | Risk Level | Brief Description |

|---|---|---|

| Regulatory Risk | High | No oversight or protection for clients |

| Financial Risk | High | Potential loss of funds without recourse |

| Operational Risk | Medium | Lack of transparency and accountability |

To mitigate these risks, traders are advised to conduct thorough research, consider alternative regulated brokers, and avoid investing significant capital until they can verify the broker's legitimacy. This is crucial in determining whether Vanavel is safe or potentially a scam.

Conclusion and Recommendations

In conclusion, the evaluation of Vanavel reveals several concerning factors that suggest it may not be a safe trading option. The absence of regulation, lack of transparency, and limited customer feedback raise serious questions about the broker's credibility. Traders must exercise caution and conduct thorough research before engaging with Vanavel.

For those seeking reliable alternatives, it is advisable to consider brokers with established regulatory oversight, transparent fee structures, and positive customer reviews. By prioritizing safety and due diligence, traders can make informed decisions and protect their investments in the forex market. Ultimately, it is essential to remain vigilant and ensure that any broker chosen for trading activities meets the necessary standards of safety and reliability.

Is Vanavel a scam, or is it legit?

The latest exposure and evaluation content of Vanavel brokers.

Vanavel Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Vanavel latest industry rating score is 1.47, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.47 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.