Regarding the legitimacy of VALUTRADES forex brokers, it provides FCA, FSA and WikiBit, (also has a graphic survey regarding security).

Is VALUTRADES safe?

Software Index

Risk Control

Is VALUTRADES markets regulated?

The regulatory license is the strongest proof.

FCA Market Making License (MM)

Financial Conduct Authority

Financial Conduct Authority

Current Status:

RegulatedLicense Type:

Market Making License (MM)

Licensed Entity:

Valutrades Limited

Effective Date:

2013-04-03Email Address of Licensed Institution:

compliance@valutrades.com, graeme.watkins@valutrades.comSharing Status:

No SharingWebsite of Licensed Institution:

www.valutrades.comExpiration Time:

--Address of Licensed Institution:

51 Eastcheap London EC3M 1JP UNITED KINGDOMPhone Number of Licensed Institution:

+4402031410880Licensed Institution Certified Documents:

FSA Derivatives Trading License (EP)

The Seychelles Financial Services Authority

The Seychelles Financial Services Authority

Current Status:

Offshore RegulatedLicense Type:

Derivatives Trading License (EP)

Licensed Entity:

VALUTRADES (SEYCHELLES) LIMITED

Effective Date:

--Email Address of Licensed Institution:

support@valutrades.scSharing Status:

No SharingWebsite of Licensed Institution:

https://www.valutrades.comExpiration Time:

--Address of Licensed Institution:

Unit B, F28, Eden Plaza, Eden Island, Mahe, SeychellesPhone Number of Licensed Institution:

(+248) 4346849Licensed Institution Certified Documents:

Is Valutrades A Scam?

Introduction

Valutrades is a forex and CFD broker that has been operating since 2012, offering trading services primarily focused on forex and commodities. Based in London, UK, Valutrades positions itself as a reliable platform for both novice and experienced traders, providing access to various financial instruments through advanced trading platforms. However, with the increasing number of scams in the forex market, it is crucial for traders to carefully evaluate the credibility of any broker before committing their funds. This article aims to provide an objective analysis of Valutrades by examining its regulatory status, company background, trading conditions, customer fund safety, user experiences, platform performance, and associated risks.

Regulation and Legitimacy

Valutrades is regulated by the Financial Conduct Authority (FCA) in the UK and the Financial Services Authority (FSA) in Seychelles. Regulatory oversight is essential as it ensures that brokers adhere to specific standards that protect traders. The following table summarizes Valutrades' regulatory information:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| FCA | 586541 | United Kingdom | Verified |

| FSA | SD 028 | Seychelles | Verified |

The FCA is known for its stringent regulatory framework, which includes requirements for client fund segregation, capital adequacy, and operational transparency. Valutrades' compliance with these regulations is a positive indicator of its legitimacy. Furthermore, the broker is a member of the Financial Services Compensation Scheme (FSCS), which protects clients' funds up to £85,000 in the event of insolvency. While the FSA in Seychelles does not provide the same level of investor protection, Valutrades still adheres to its regulations, ensuring that client funds are held in segregated accounts with reputable banks.

Company Background Investigation

Valutrades was founded in 2012 and has undergone significant growth since its inception. Originally known as Monex Capital Markets, the company rebranded to Valutrades in 2014 after obtaining FCA regulation. The broker has expanded its reach globally, now serving clients in over 182 countries. The management team consists of industry professionals with extensive experience in finance and trading, which contributes to the broker's credibility. Valutrades emphasizes transparency, providing detailed information about its services and operations on its website. This level of disclosure is important for building trust with clients, as it allows potential traders to make informed decisions based on available information.

Trading Conditions Analysis

Valutrades offers competitive trading conditions, but it is essential to analyze the overall fee structure and any potential hidden costs. The following table compares Valutrades' core trading costs with industry averages:

| Fee Type | Valutrades | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 0.0 - 0.3 pips | 0.3 - 1.0 pips |

| Commission Model | $3 per lot | $5 - $10 per lot |

| Overnight Interest Range | Variable | Variable |

Valutrades operates on an ECN model, which allows for tighter spreads and lower commissions compared to traditional market-making brokers. However, some users have reported issues with slippage and withdrawal delays, which may indicate potential areas of concern regarding the broker's execution quality. The absence of a minimum deposit requirement is a positive aspect, making it accessible for new traders to start trading without a significant financial commitment.

Customer Fund Safety

Customer fund safety is a paramount concern for traders. Valutrades employs various measures to ensure the security of client funds. The broker maintains client funds in segregated accounts at top-tier banks, ensuring that these funds are not used for the broker's operational expenses. Additionally, Valutrades provides negative balance protection, meaning that clients cannot lose more than the amount they have deposited. This is a crucial feature for risk management, especially in the highly volatile forex market. Despite these protections, it is worth noting that there have been historical complaints regarding fund withdrawals, which could raise concerns about the broker's reliability in processing these requests.

Customer Experience and Complaints

Customer feedback is a vital aspect of evaluating a broker's reputation. Valutrades has received mixed reviews from users, with some praising its trading conditions and customer support, while others have highlighted issues related to withdrawals and slippage. The following table summarizes common complaint types and their severity:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

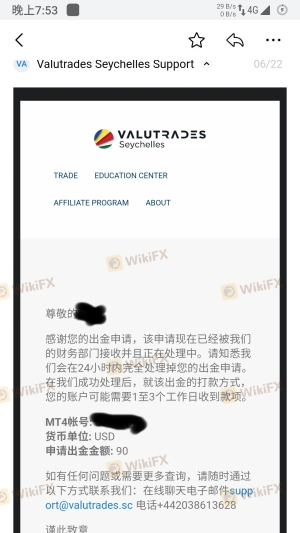

| Withdrawal Delays | High | Slow response |

| Slippage Issues | Medium | Average response |

| Customer Support Quality | Low | Quick response |

For instance, several users have reported delays in processing withdrawal requests, leading to frustration and concerns about the broker's reliability. However, the company has generally responded to inquiries in a timely manner, which is a positive aspect of its customer service.

Platform and Execution

Valutrades provides access to popular trading platforms, including MetaTrader 4 (MT4) and MetaTrader 5 (MT5). These platforms are known for their user-friendly interfaces and extensive analytical tools, making them suitable for both novice and experienced traders. However, reports of slippage and execution delays have surfaced, raising questions about the broker's order execution quality. Traders should be aware of these potential issues, as they can significantly impact trading performance.

Risk Assessment

When considering Valutrades as a trading partner, it is essential to evaluate the associated risks. The following risk assessment summarizes key risk areas:

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Compliance | Low | FCA regulated with investor protection |

| Fund Security | Medium | Segregated accounts, but withdrawal issues reported |

| Execution Quality | High | Reports of slippage and delays |

To mitigate risks, traders should ensure they fully understand the broker's policies and be cautious when withdrawing funds. It is advisable to start with a demo account to familiarize oneself with the trading environment before committing significant capital.

Conclusion and Recommendations

In conclusion, Valutrades is a regulated broker that offers a range of trading services with competitive conditions. However, potential traders should be cautious of some reported issues, particularly regarding withdrawals and execution quality. While there are no clear indications of fraudulent activity, the mixed reviews suggest that traders should conduct thorough research before investing. For those looking for reliable alternatives, brokers like IG, Pepperstone, or Forex.com might offer more robust trading conditions and customer support. Ultimately, traders should assess their individual needs and risk tolerance when choosing a broker.

Is VALUTRADES a scam, or is it legit?

The latest exposure and evaluation content of VALUTRADES brokers.

VALUTRADES Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

VALUTRADES latest industry rating score is 7.30, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 7.30 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.