Regarding the legitimacy of MIFX forex brokers, it provides BAPPEBTI, JFX, ICDX and WikiBit, (also has a graphic survey regarding security).

Is MIFX safe?

Pros

Cons

Is MIFX markets regulated?

The regulatory license is the strongest proof.

BAPPEBTI Forex Trading License (EP)

Badan Pengawas Perdagangan Berjangka Komoditi Kementerian Perdagangan

Badan Pengawas Perdagangan Berjangka Komoditi Kementerian Perdagangan

Current Status:

RegulatedLicense Type:

Forex Trading License (EP)

Licensed Entity:

PT. Monex Investindo Futures

Effective Date:

--Email Address of Licensed Institution:

backoffice@id.mifx.comSharing Status:

No SharingWebsite of Licensed Institution:

www.mifx.comExpiration Time:

--Address of Licensed Institution:

Sahid Sudirman Center Lt. 17 Unit D & H, Jl. Jend. Sudirman Kav. 86 KARET TENGSIN TANAH ABANG JAKARTA PUSAT DKI JAKARTA 10220Phone Number of Licensed Institution:

021 - 27889333Licensed Institution Certified Documents:

JFX Derivatives Trading License (AGN)

Jakarta Futures Exchange

Jakarta Futures Exchange

Current Status:

RegulatedLicense Type:

Derivatives Trading License (AGN)

Licensed Entity:

Monex Investindo Futures

Effective Date: Change Record

--Email Address of Licensed Institution:

legal.audit@mifx.com, backoffice@id.mifx.comSharing Status:

No SharingWebsite of Licensed Institution:

mifx.comExpiration Time:

--Address of Licensed Institution:

Gd. Sahid Sudirman Center Lt. 17 Unit C Jl. Jend. Sudirman Kav. 86, Jakarta 10220Phone Number of Licensed Institution:

021-27889333Licensed Institution Certified Documents:

ICDX Derivatives Trading License (EP)

Indonesia Commodity and Derivatives Exchange

Indonesia Commodity and Derivatives Exchange

Current Status:

RegulatedLicense Type:

Derivatives Trading License (EP)

Licensed Entity:

Monex Investindo Futures, PT

Effective Date:

--Email Address of Licensed Institution:

support@mifx.comSharing Status:

No SharingWebsite of Licensed Institution:

http://www.mifx.com/Expiration Time:

--Address of Licensed Institution:

Gedung Sahid Sudirman Center Lt. 17, Jl. Jend. Sudirman Kav. 86, Jakarta 10220Phone Number of Licensed Institution:

(021) 2788 9333Licensed Institution Certified Documents:

Is MIFX Safe or Scam?

Introduction

MIFX, also known as Monex Investindo Futures, is a prominent forex broker based in Indonesia, established in 2000. It positions itself as a leader in the Indonesian forex market, boasting a significant market share and offering a range of trading services, including forex, commodities, and indices. However, the forex market is fraught with risks, and traders must exercise caution when selecting a broker. The potential for scams and unethical practices necessitates a thorough evaluation of brokers to ensure the safety of investments. This article aims to provide an objective analysis of MIFX, examining its regulatory standing, company background, trading conditions, customer experiences, and overall safety.

Regulation and Legitimacy

MIFX operates under the regulatory oversight of several Indonesian financial authorities, which is crucial for ensuring compliance and protecting traders. The following table summarizes the core regulatory information:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| Bappebti | 178/Bappebti/Si/I/2003 | Indonesia | Verified |

| Jakarta Futures Exchange (JFX) | Spa B-044/BBJ/03/02 | Indonesia | Verified |

| Indonesia Commodity and Derivatives Exchange (ICDX) | 010/SP KB/ICDX/DIR/III/2010 | Indonesia | Verified |

Regulatory Quality: The Indonesian regulatory framework, particularly Bappebti, is designed to oversee the trading of futures, options, and derivatives. While it is a recognized regulatory body, it is essential to note that the strictness and enforcement of regulations can vary significantly compared to regulators in more established markets like the UK or US. MIFX has maintained its licenses without major regulatory infractions noted in recent years, which adds a layer of credibility to its operations.

Company Background Investigation

MIFX is owned by PT Monex Investindo Futures, a company that has been operational since 2000. The firm has grown to become one of the largest brokers in Indonesia, with over 30% market share in the forex sector. The management team comprises experienced professionals with backgrounds in finance and trading, which is essential for maintaining operational integrity and providing quality service.

Transparency: MIFX has a relatively high level of transparency regarding its operations and services. The company provides detailed information on its website, including trading conditions, account types, and educational resources for traders. However, like many brokers, it could improve on disclosing more about its ownership structure and internal governance.

Trading Conditions Analysis

MIFX offers various trading accounts with different features and fee structures. The overall cost structure is critical for traders as it directly impacts profitability. Below is a comparison of MIFX's core trading costs with industry averages:

| Cost Type | MIFX | Industry Average |

|---|---|---|

| Major Currency Pair Spread | From 0.2 pips | 1.0 - 1.5 pips |

| Commission Structure | $1 - $10 per lot | $5 - $15 per lot |

| Overnight Interest Range | Varies | Varies |

MIFXs spreads for major currency pairs are competitive, starting as low as 0.2 pips. However, the commission structure can be higher than the industry average, particularly for certain account types. Traders should be aware of any unusual fees, such as inactivity fees, which can apply if an account is dormant for an extended period.

Customer Funds Security

The security of customer funds is paramount in the forex trading industry. MIFX claims to implement several measures to protect client funds, including segregated accounts, which ensure that client funds are kept separate from the company's operating funds. This practice is essential for safeguarding against insolvency and ensuring that clients can access their funds even if the broker faces financial difficulties.

MIFX also participates in investor protection schemes, which provide additional security for client deposits. However, it is important for traders to remain vigilant and aware of any historical issues related to fund security or disputes that may have arisen in the past.

Customer Experience and Complaints

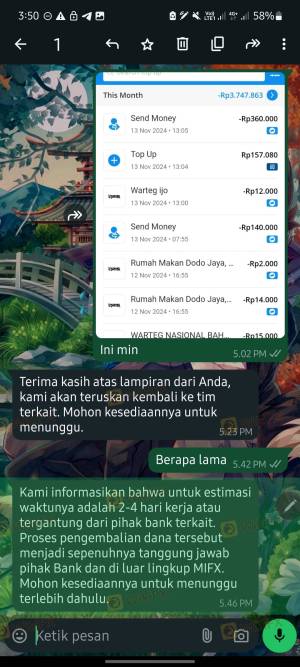

Customer feedback is a vital indicator of a broker's reliability and service quality. MIFX has received mixed reviews from users, with several complaints regarding withdrawal issues and customer service responsiveness. Below is a summary of common complaint types and their severity:

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Delays | High | Slow response |

| Poor Customer Support | Medium | Average response |

| Account Management Issues | High | Inconsistent response |

Case Analysis: One user reported difficulties in withdrawing funds, claiming that their requests were ignored for weeks. Another trader expressed frustration over the lack of timely support when facing technical issues on the trading platform. These complaints highlight potential areas of concern regarding MIFX's customer service and operational efficiency.

Platform and Execution

MIFX offers the widely used MetaTrader 4 and MetaTrader 5 platforms, which are known for their robust features and user-friendly interfaces. However, the execution quality and reliability of these platforms are critical for traders. Users have reported varying experiences regarding order execution speed, slippage, and instances of order rejections.

Manipulation Signs: While there is no concrete evidence of platform manipulation, the complaints regarding execution delays raise questions about the broker's operational integrity. Traders should be cautious and monitor their trading experiences closely.

Risk Assessment

Engaging with MIFX carries inherent risks that traders should be aware of. The following risk assessment summarizes key risk categories:

| Risk Category | Risk Level | Brief Description |

|---|---|---|

| Regulatory Risk | Medium | Operates under Indonesian regulations, which may be less stringent than others. |

| Fund Security Risk | Medium | Segregated accounts in place, but historical issues may raise concerns. |

| Customer Service Risk | High | Complaints about withdrawal delays and poor support. |

Mitigation Suggestions: Traders are advised to conduct thorough research and consider using smaller amounts when starting with MIFX. It is also recommended to maintain clear records of all transactions and communications with the broker to protect against potential disputes.

Conclusion and Recommendations

In conclusion, MIFX presents itself as a regulated broker with a significant presence in the Indonesian forex market. While it offers competitive trading conditions and a well-known trading platform, several concerns regarding customer service, withdrawal issues, and the overall transparency of operations warrant caution.

For potential traders, it is essential to weigh the benefits against the risks. If you are considering trading with MIFX, start with a small investment and ensure that you are comfortable with the broker's terms and conditions. For those seeking alternative options, consider brokers with stronger regulatory oversight and a proven track record of reliable customer service.

Is MIFX a scam, or is it legit?

The latest exposure and evaluation content of MIFX brokers.

MIFX Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

MIFX latest industry rating score is 6.52, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 6.52 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.