Valutrades 2025 Review: Everything You Need to Know

Executive Summary

This comprehensive valutrades review looks at a regulated forex and CFD broker that has become a notable player in the competitive trading world. Valutrades is an ECN (Electronic Communication Network) broker based in London. It operates under the regulatory oversight of the Financial Conduct Authority (FCA) in the United Kingdom. According to [TradingBeasts], the broker features currency pairs, commodities, and CFDs on indices on its trading platform. This gives traders many different investment opportunities.

Two key features make Valutrades stand out in the market. First, the broker offers ECN trading conditions with spreads starting from zero. This makes it very attractive for cost-conscious traders. Second, as reported by [The Forex Geek], Valutrades provides leverage options for qualified professional clients. This enhances trading flexibility for experienced market participants. The platform supports both MetaTrader 4 and MetaTrader 5. This ensures traders have access to industry-standard trading tools and analytical capabilities.

The broker mainly targets both new and experienced traders seeking a regulated trading environment with competitive conditions. With an overall rating of 4 stars according to available user feedback, Valutrades positions itself as a reliable option. Traders who prioritize regulatory compliance and transparent trading conditions in their broker selection process will find this appealing.

Important Notice

Valutrades operates as a subsidiary of Monex Investindo Futures, an Indonesian forex broker. This may result in different regulatory and operational conditions across various regions. While this review focuses on the UK-regulated entity under FCA supervision, potential clients should verify the specific regulatory framework applicable to their jurisdiction before opening an account.

This evaluation is based on publicly available information from multiple industry sources and user feedback collected as of 2025. The analysis aims to provide an objective assessment of Valutrades' services, features, and overall performance. Readers should conduct their own research and consider their individual trading needs and risk tolerance before making any investment decisions.

Rating Framework

Broker Overview

Valutrades was established in 2012 and maintains its headquarters in London, United Kingdom. Originally operating under the name Monex Capital, the company functions as a subsidiary of Monex Investindo Futures. This is an established Indonesian forex broker. According to [TradingFinder], this relationship provides Valutrades with substantial backing while allowing it to maintain its focus on serving both beginning and experienced traders in the European market.

The broker operates as an ECN forex and CFD provider. It uses an Electronic Communication Network model that connects traders directly to liquidity providers. This business model enables Valutrades to offer competitive spreads and transparent pricing, as reported by multiple industry sources. The company's positioning in the London financial district reflects its commitment to maintaining high professional standards and regulatory compliance.

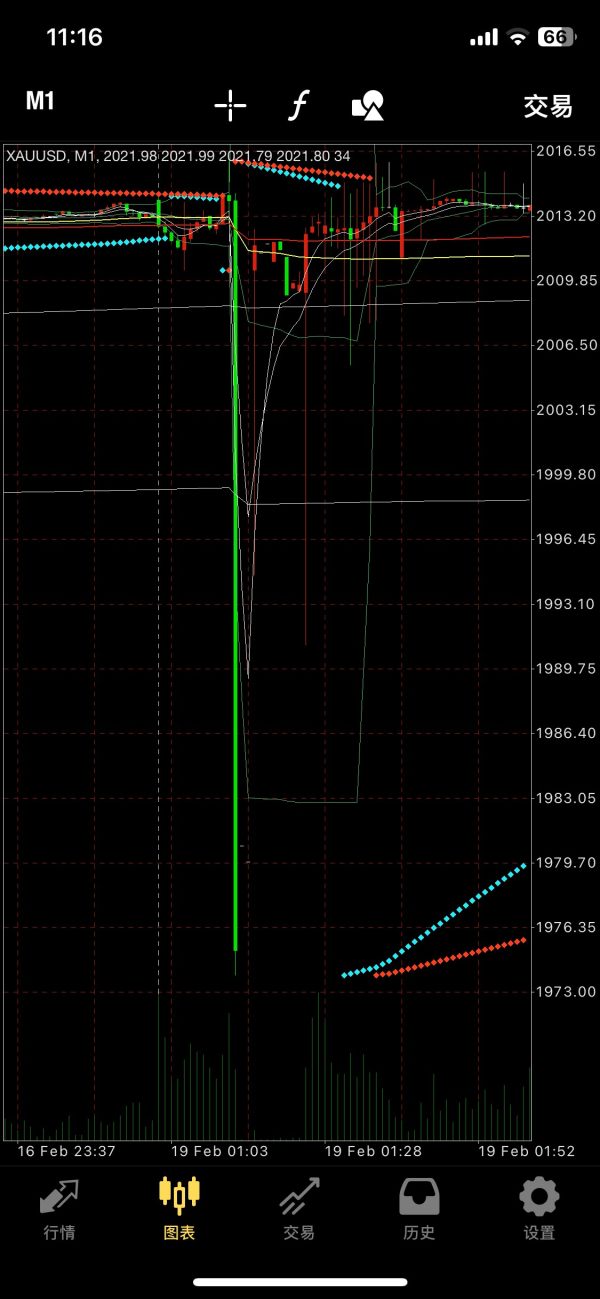

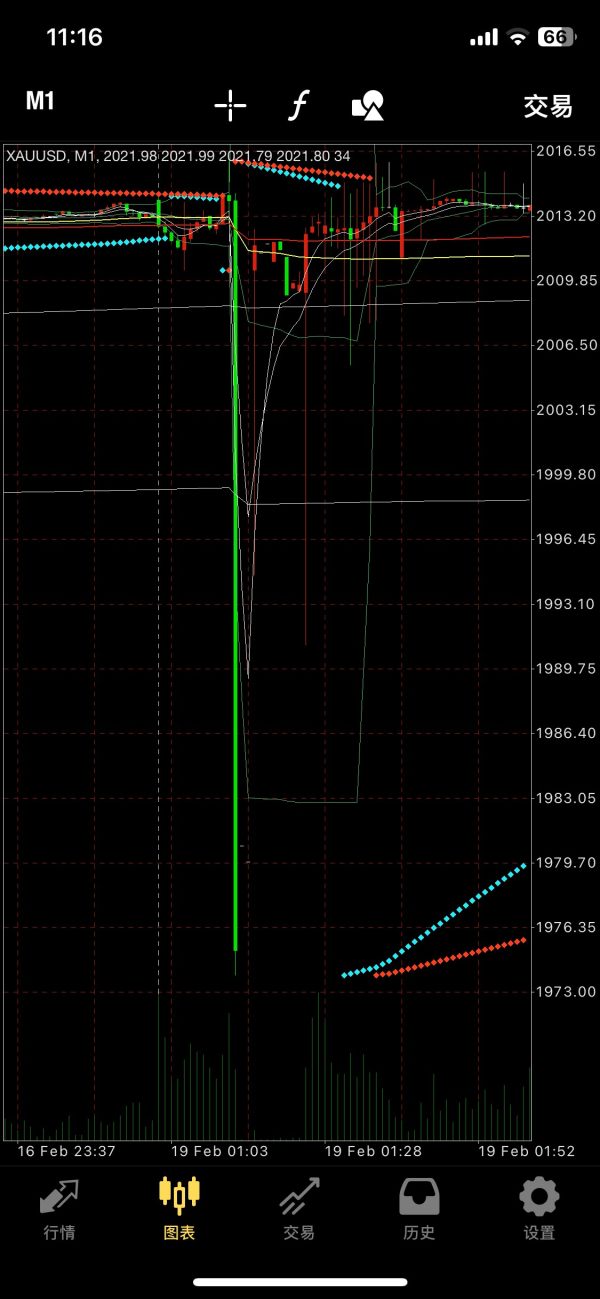

Valutrades review sources consistently highlight the broker's platform diversity and asset range. The company supports both MetaTrader 4 and MetaTrader 5 platforms. This provides traders with access to advanced charting tools, automated trading capabilities, and comprehensive market analysis features. Available trading instruments include major and minor forex pairs, commodities such as gold and oil, stock indices CFDs, and cryptocurrency options including Bitcoin. This offers traders exposure to diverse market sectors through a single trading account.

The broker operates under the regulatory supervision of the Financial Conduct Authority (FCA). This is one of the most respected financial regulators globally. This regulatory framework ensures client fund protection, fair trading practices, and adherence to strict operational standards that enhance trader confidence and security.

Regulatory Jurisdiction: Valutrades Limited operates under FCA regulation in the United Kingdom. This provides clients with access to the Financial Services Compensation Scheme (FSCS) and ensures compliance with stringent European financial standards. This regulatory framework offers significant protection for client funds and trading activities.

Deposit and Withdrawal Methods: While specific payment methods are not detailed in available sources, the broker's FCA regulation suggests support for standard banking methods. These include bank transfers and electronic payment systems. Traders should contact Valutrades directly for comprehensive payment option information.

Minimum Deposit Requirements: Current minimum deposit thresholds are not specified in available documentation. Prospective clients should verify current account opening requirements directly with the broker. This ensures accurate and up-to-date information.

Bonus and Promotional Offers: Available sources do not provide specific information regarding current promotional campaigns or bonus structures. Potential clients should inquire directly about any available incentives or promotional terms.

Tradeable Assets: According to [TradingBeasts], Valutrades offers a comprehensive range of financial instruments. These include forex currency pairs, commodity CFDs, stock indices, and cryptocurrency trading options. This diversity allows traders to implement varied strategies across multiple market sectors.

Cost Structure: The broker provides ECN spreads starting from zero. This indicates competitive pricing for active traders. However, specific commission structures and additional fees require direct verification with the broker for complete cost transparency.

Leverage Ratios: As noted by [The Forex Geek], Valutrades offers leverage options for clients who qualify as professional traders under FCA guidelines. Specific leverage ratios depend on client classification and instrument type.

Platform Options: Valutrades supports both MetaTrader 4 and MetaTrader 5 platforms. This provides traders with industry-standard tools for technical analysis, automated trading, and order management. This valutrades review confirms platform reliability and functionality.

Geographic Restrictions: Specific geographic limitations are not detailed in available sources. FCA regulation typically restricts services to eligible jurisdictions though.

Customer Support Languages: Available documentation does not specify the range of languages supported by customer service teams.

Detailed Rating Analysis

Account Conditions Analysis (8/10)

Valutrades demonstrates strong performance in account conditions through its ECN model implementation. The broker's zero-spread starting point represents a significant advantage for traders focused on transaction costs. This particularly benefits scalpers and high-frequency traders who rely on tight spreads for profitability. This pricing structure positions Valutrades competitively against other ECN providers in the market.

The account opening process receives positive user feedback. Specific details about verification requirements and timeframes are not extensively documented though. The broker's FCA regulation ensures standardized account protection measures, including segregated client funds and participation in the Financial Services Compensation Scheme. This provides additional security for account holders.

However, the lack of detailed information about minimum deposit requirements and account tier structures represents a limitation in this valutrades review. Prospective clients must contact the broker directly to understand specific account conditions. This may create friction in the decision-making process. Additionally, the absence of clearly defined Islamic account options may limit accessibility for certain trader demographics.

When compared to other ECN brokers, Valutrades' spread conditions appear competitive. Comprehensive cost analysis requires consideration of commission structures and other potential fees though. The broker's London-based operation and FCA oversight provide additional credibility to its account offerings. This supports the strong rating in this category.

Valutrades provides solid trading infrastructure through its dual MetaTrader platform support. Both MT4 and MT5 offer comprehensive charting capabilities, technical indicators, and automated trading support through Expert Advisors. This platform diversity accommodates different trader preferences and experience levels. It serves beginners requiring straightforward interfaces to advanced traders needing sophisticated analytical tools.

The broker's asset diversity strengthens its tools offering. Forex, commodities, indices, and cryptocurrency options provide multiple trading opportunities. This range allows traders to diversify portfolios and implement cross-market strategies within a single account structure. However, available sources do not detail specific research and analysis resources, such as daily market commentary, economic calendars, or proprietary research reports.

Educational resources represent a potential gap in Valutrades' offering. Current documentation does not highlight webinars, tutorials, or educational content for developing traders. This limitation may impact the broker's appeal to novice traders who require additional learning support. Similarly, information about automated trading tools beyond standard MetaTrader capabilities is not extensively covered.

User feedback suggests satisfaction with platform functionality and reliability. This indicates that core trading tools meet client expectations. However, the absence of detailed information about advanced features, mobile trading capabilities, and additional analytical resources prevents a higher rating in this category.

Customer Service and Support Analysis (7/10)

User feedback indicates general satisfaction with Valutrades' customer service, particularly regarding deposit and withdrawal processes. This positive response suggests effective handling of routine account management tasks and transaction processing. However, comprehensive details about service channels, response times, and support quality are not extensively documented in available sources.

The broker's FCA regulation implies adherence to customer service standards required by UK financial authorities. These typically include complaint handling procedures and client communication protocols. This regulatory framework provides a foundation for service quality expectations. Specific performance metrics are not available for detailed analysis though.

The lack of detailed information about available support channels represents a limitation in this evaluation. Standard industry practice includes live chat, email, and telephone support. Confirmation of these options and their availability hours requires direct verification though. Similarly, multi-language support capabilities are not specified. This may impact international client service quality.

Problem resolution capabilities and escalation procedures are not detailed in available documentation. This prevents a comprehensive assessment of service effectiveness during challenging situations. While user satisfaction appears positive based on available feedback, the absence of specific service quality metrics and detailed support information limits the rating potential in this category.

Trading Experience Analysis (8/10)

User feedback consistently highlights satisfaction with Valutrades' trading environment, particularly regarding spread stability and overall execution quality. The ECN model typically provides transparent pricing and direct market access. This contributes to a positive trading experience for clients seeking institutional-grade conditions.

Platform stability appears strong based on user reports. MetaTrader 4 and 5 provide reliable trading infrastructure. These platforms offer comprehensive order management capabilities, including various order types, risk management tools, and real-time market data access. The dual platform approach accommodates different trader preferences and technical requirements.

However, specific information about order execution statistics, slippage rates, and requote frequency is not available in current sources. These technical performance metrics are crucial for evaluating trading experience quality. This is particularly true for active traders and scalpers who depend on precise execution. The absence of detailed performance data represents a gap in this valutrades review.

Mobile trading experience and platform accessibility across devices are not extensively covered in available documentation. Modern traders increasingly require seamless mobile access. The lack of specific mobile platform information may impact the overall trading experience assessment. Despite these information gaps, positive user feedback supports a strong rating for trading experience quality.

Trust Factor Analysis (9/10)

Valutrades achieves excellent performance in trust factors primarily through its FCA regulatory status. The Financial Conduct Authority represents one of the most stringent regulatory frameworks globally. It requires comprehensive client protection measures, operational transparency, and adherence to strict financial standards. This regulatory oversight provides substantial credibility and security for client funds and trading activities.

The broker's London headquarters location within a major financial center adds to its credibility profile. Operating from the UK's established financial district suggests commitment to professional standards and regulatory compliance. Additionally, the connection to Monex Investindo Futures provides corporate backing while maintaining independent regulatory status.

However, available sources do not provide detailed information about specific client protection measures beyond basic FCA requirements. Details about segregated account structures, insurance coverage levels, and financial reporting transparency are not extensively documented. Similarly, information about company awards, industry recognition, or third-party certifications that could enhance trust factors is not available.

The absence of documented negative events or regulatory issues supports the positive trust assessment. Comprehensive due diligence would require access to complete regulatory records and financial statements though. Despite these information limitations, the strong regulatory foundation justifies a high rating in trust factors.

User Experience Analysis (7/10)

Available user feedback indicates a 4-star overall satisfaction rating. This suggests generally positive experiences with Valutrades' services. This rating reflects satisfaction across multiple service areas, including trading conditions, platform functionality, and account management processes. Users particularly highlight positive experiences with deposit and withdrawal procedures. This indicates efficient back-office operations.

Platform usability appears strong based on MetaTrader implementation. Both MT4 and MT5 offer familiar interfaces for traders experienced with these industry-standard platforms. The learning curve for new users is typically manageable with MetaTrader platforms. This supports accessibility for beginning traders while providing advanced features for experienced users.

However, specific details about account opening procedures, verification processes, and onboarding experiences are not extensively documented. These initial user interactions significantly impact overall experience quality. The lack of detailed information prevents comprehensive assessment. Similarly, information about common user complaints or areas for improvement is not available in current sources.

The valutrades review sources suggest broad user satisfaction but lack specific feedback about interface design, navigation efficiency, and user-friendly features beyond standard platform capabilities. Mobile experience quality and cross-device synchronization capabilities are not detailed. This represents potential gaps in modern user experience expectations.

Conclusion

This comprehensive valutrades review reveals a regulated ECN broker that provides competitive trading conditions within a secure regulatory framework. Valutrades' FCA oversight, combined with ECN spreads starting from zero and support for both MetaTrader platforms, creates a solid foundation for various trading strategies and experience levels.

The broker particularly suits traders prioritizing regulatory security and transparent pricing structures. Beginning traders benefit from the regulated environment and standard platform interfaces. Experienced traders can leverage ECN conditions and professional client leverage options. The diverse asset range accommodates multiple trading approaches and portfolio diversification strategies.

Key strengths include strong regulatory credentials, competitive spread conditions, and positive user satisfaction ratings. However, areas for improvement include more comprehensive information transparency about account conditions, enhanced educational resources, and detailed service specifications. Despite these limitations, Valutrades represents a credible option for traders seeking a regulated, London-based broker with institutional-grade trading conditions.