Is TRADE CAPITAL HOLDING safe?

Business

License

Is Trade Capital Holding A Scam?

Introduction

Trade Capital Holding has emerged as a player in the forex trading market, positioning itself as a provider of investment services and fintech technology. With claims of extensive market experience and a diverse range of trading products, it attracts the interest of both novice and experienced traders alike. However, the forex market is notorious for its potential risks, and it is crucial for traders to conduct thorough evaluations of brokers before committing their funds. This article aims to investigate the legitimacy of Trade Capital Holding by analyzing its regulatory status, company background, trading conditions, customer safety, and user experiences. Our investigation draws on various online resources, reviews, and regulatory databases to provide a comprehensive overview of whether Trade Capital Holding is a safe broker or merely a facade for fraudulent activities.

Regulation and Legitimacy

Regulatory oversight is a cornerstone of trustworthiness in the financial services sector. Brokers regulated by reputable authorities are subject to stringent compliance standards designed to protect investors. In the case of Trade Capital Holding, the absence of regulation raises significant concerns. Below is a summary of the regulatory status:

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| FCA | N/A | UK | Not Registered |

| ASIC | N/A | Australia | Not Registered |

| FINMA | N/A | Switzerland | Not Registered |

The table indicates that Trade Capital Holding is not registered with any major financial regulatory body, such as the Financial Conduct Authority (FCA) in the UK or the Australian Securities and Investments Commission (ASIC). This lack of regulation is alarming, as it means there are no legal protections in place for clients' funds. Furthermore, the Swiss Financial Market Supervisory Authority (FINMA) has issued warnings against Trade Capital Holding, indicating that it may be providing financial services without proper authorization. The absence of a regulatory framework not only increases the risk of fraud but also suggests that the broker may engage in unscrupulous practices without fear of repercussions. Therefore, the question "Is Trade Capital Holding safe?" becomes increasingly pertinent.

Company Background Investigation

Trade Capital Holding claims to have been established in 2014, with a presence in multiple financial hubs worldwide. However, a closer examination reveals inconsistencies in its history and ownership structure. The company's website lacks transparency regarding its ownership and management team, which is a red flag for potential investors. Reliable brokers typically provide detailed information about their executives and their qualifications.

Moreover, the company seems to be linked to various other trading brands, creating confusion about its actual operations. The lack of a clear and verifiable corporate structure makes it difficult to ascertain the legitimacy of Trade Capital Holding. Transparency is vital in the financial sector, and the absence of such information raises doubts about the company's operational integrity. Therefore, when asking "Is Trade Capital Holding safe?" one must consider the opaque nature of its corporate governance.

Trading Conditions Analysis

The trading conditions offered by a broker can significantly impact a trader's experience. Trade Capital Holding claims to provide competitive trading costs; however, the absence of a transparent fee structure raises concerns. Heres a comparison of the core trading costs:

| Cost Type | Trade Capital Holding | Industry Average |

|---|---|---|

| Major Currency Pair Spread | N/A | 1.0 - 1.5 pips |

| Commission Model | N/A | Varies |

| Overnight Interest Range | N/A | 0.5% - 2% |

The lack of specific details regarding spreads, commissions, and overnight interest rates is troubling. Typically, reputable brokers provide clear and accessible information about their fees. The absence of such data can indicate hidden charges or unfavorable trading conditions, suggesting that traders might face unexpected costs that could erode their profits. In light of these findings, traders should exercise caution and consider whether "Is Trade Capital Holding safe?" before engaging in trading activities.

Client Funds Security

The safety of client funds is paramount in the trading industry. A reliable broker implements measures such as segregated accounts, investor compensation schemes, and negative balance protection to safeguard client assets. Unfortunately, Trade Capital Holding fails to provide any substantial information regarding its client fund protection policies. Without clear indications of how client funds are managed, potential investors are left vulnerable to risks associated with unregulated brokers.

Furthermore, past incidents involving unregulated brokers often highlight issues such as difficulty in withdrawing funds, delayed payments, and even total loss of deposits. Given that Trade Capital Holding lacks regulatory oversight, the question of whether "Is Trade Capital Holding safe?" becomes more pressing, as traders may find themselves exposed to the risks of losing their investments without recourse to legal protections.

Customer Experience and Complaints

Customer feedback is an essential aspect of evaluating a broker's reliability. Reviews of Trade Capital Holding reveal a troubling pattern of complaints, with many users reporting issues related to withdrawal delays, lack of communication, and account freezes. The following table summarizes the primary types of complaints:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Account Blocking | High | Poor |

| Lack of Customer Support | Medium | Poor |

Typical cases include clients who have reported being unable to withdraw their funds after repeated attempts, with some claiming that their accounts were blocked upon raising concerns. The overall negative sentiment surrounding customer experiences raises significant doubts about the broker's operational integrity. Thus, the question "Is Trade Capital Holding safe?" is increasingly validated by the alarming reports from users.

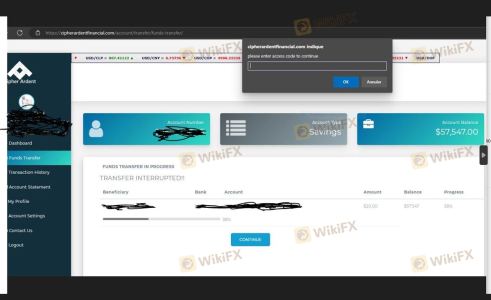

Platform and Execution

The trading platform is a crucial component of the trading experience. Trade Capital Holding primarily offers a web-based platform, which may lack the features and stability found in more established trading software like MetaTrader 4 or 5. Evaluating the platform's performance, execution quality, and any signs of manipulation is essential. Users have reported instances of slippage and order rejections, which can severely impact trading results.

In summary, the absence of a well-regulated platform and potential execution issues further complicate the question of whether "Is Trade Capital Holding safe?" Traders must be wary of the risks associated with unreliable trading platforms.

Risk Assessment

The overall risk associated with using Trade Capital Holding is high due to multiple factors, including regulatory non-compliance, poor customer feedback, and opaque trading conditions. The following risk assessment summarizes the key risk areas:

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | No regulatory oversight |

| Financial Risk | High | Lack of fund protection measures |

| Operational Risk | Medium | Poor customer service and platform stability |

To mitigate these risks, potential traders should consider diversifying their investments and seeking brokers with established regulatory credentials.

Conclusion and Recommendations

In conclusion, the evidence overwhelmingly suggests that Trade Capital Holding operates in a high-risk environment that lacks the necessary regulatory oversight and transparency. The numerous complaints from clients, coupled with the absence of a credible regulatory framework, raise serious concerns about the safety of trading with this broker. Therefore, the answer to "Is Trade Capital Holding safe?" is a resounding no.

Traders are advised to exercise extreme caution and consider alternative brokers that are well-regulated and have a proven track record of customer satisfaction. Reputable options include brokers regulated by the FCA, ASIC, or CySEC, which offer the necessary protections and transparent trading conditions. Ultimately, protecting your investments should be the foremost priority, and choosing a trustworthy broker is a critical step in achieving that goal.

Is TRADE CAPITAL HOLDING a scam, or is it legit?

The latest exposure and evaluation content of TRADE CAPITAL HOLDING brokers.

TRADE CAPITAL HOLDING Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

TRADE CAPITAL HOLDING latest industry rating score is 1.53, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.53 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.