Regarding the legitimacy of TMGM forex brokers, it provides ASIC, VFSC and WikiBit, (also has a graphic survey regarding security).

Is TMGM safe?

Pros

Cons

Is TMGM markets regulated?

The regulatory license is the strongest proof.

ASIC Market Making License (MM)

Australia Securities & Investment Commission

Australia Securities & Investment Commission

Current Status:

RegulatedLicense Type:

Market Making License (MM)

Licensed Entity:

Trademax Australia Limited

Effective Date: Change Record

2013-05-21Email Address of Licensed Institution:

compliance@tmgm.com.auSharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

'L28 ONE INTERNATIONAL TOWERS TOWER 1' 100 BARANGAROO AVE BARANGAROO NSW 2000Phone Number of Licensed Institution:

0280368388Licensed Institution Certified Documents:

VFSC Forex Trading License (EP)

Vanuatu Financial Services Commission

Vanuatu Financial Services Commission

Current Status:

Offshore RegulatedLicense Type:

Forex Trading License (EP)

Licensed Entity:

Trademax Global Limited

Effective Date:

2022-12-22Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

--Phone Number of Licensed Institution:

--Licensed Institution Certified Documents:

Is TMGM A Scam?

Introduction

TMGM, or TradeMax Global Markets, is an online brokerage firm established in 2013, primarily known for offering a wide range of trading instruments, including forex, CFDs, and cryptocurrencies. Headquartered in Sydney, Australia, TMGM has positioned itself as a competitive player in the forex market, catering to both novice and experienced traders. In an industry rife with scams and unreliable brokers, it is crucial for traders to conduct thorough evaluations before committing their funds. This article aims to provide an objective analysis of TMGM's credibility, focusing on its regulatory status, company background, trading conditions, customer funds security, user experiences, and potential risks. The findings are based on a comprehensive review of various sources, including regulatory filings, user testimonials, and expert evaluations.

Regulation and Legitimacy

The regulatory environment in which a broker operates is a critical factor in assessing its legitimacy. TMGM is regulated by several authorities, including the Australian Securities and Investments Commission (ASIC) and the Financial Markets Authority (FMA) in New Zealand. Such oversight ensures that TMGM adheres to strict financial standards, providing a level of security and trust for its clients. Below is a summary of TMGM's regulatory information:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| ASIC | 436416 | Australia | Verified |

| FMA | 569807 | New Zealand | Verified |

| VFSC | 40356 | Vanuatu | Verified |

| FSC | GB22201012 | Mauritius | Verified |

The presence of ASIC, a tier-1 regulator known for its stringent compliance requirements, significantly enhances TMGM's credibility. Additionally, the broker's adherence to the regulations from the FMA and VFSC further solidifies its standing in the financial community. Historically, TMGM has maintained a clean regulatory record, with no major compliance issues reported. This regulatory framework not only protects client funds but also ensures that the broker operates transparently and ethically.

Company Background Investigation

TMGM's history traces back to its founding by a group of experienced traders who aimed to improve the trading environment for retail investors. Over the years, the company has expanded its operations globally, establishing offices in various regions, including New Zealand and Vanuatu. The ownership structure of TMGM is designed to provide a robust operational framework, ensuring that the firm can cater to a diverse client base.

The management team at TMGM boasts extensive experience in the financial markets, enhancing the firm's ability to deliver quality services. The transparency of the company is evident in its willingness to disclose information about its operations, regulatory compliance, and financial practices. TMGM's commitment to providing clear and accessible information to its clients further supports its reputation as a trustworthy broker.

Trading Conditions Analysis

TMGM offers a competitive trading environment characterized by low fees and a variety of account options. The broker provides two main account types: the Classic account, which features spreads starting from 1 pip and no commission, and the Edge account, which offers spreads as low as 0.0 pips with a commission of $7 per round turn. Below is a comparison of key trading costs:

| Cost Type | TMGM | Industry Average |

|---|---|---|

| Major Currency Pair Spread | From 0.0 pips | 1.0 pips |

| Commission Structure | $7 per round turn | $8 per round turn |

| Overnight Interest Range | Variable | Variable |

While TMGM's fee structure is generally competitive, traders should be aware of the inactivity fee of $30, which applies after six months of inactivity. This policy may discourage long-term investors who do not engage in frequent trading. Overall, TMGM's trading conditions are favorable, particularly for active traders seeking low spreads and efficient execution.

Customer Funds Security

The security of customer funds is paramount in the trading industry. TMGM employs several measures to ensure the safety of client funds. Client deposits are held in segregated accounts with the National Australia Bank (NAB), a tier-1 bank, which provides an additional layer of security. Furthermore, TMGM offers negative balance protection, ensuring that traders cannot lose more money than they have deposited in their accounts.

Additionally, the broker has professional indemnity insurance with coverage up to AUD 10 million, providing further assurance to clients in the event of unforeseen circumstances. Historically, TMGM has maintained a strong reputation regarding fund security, with no significant incidents of fund mismanagement or loss reported.

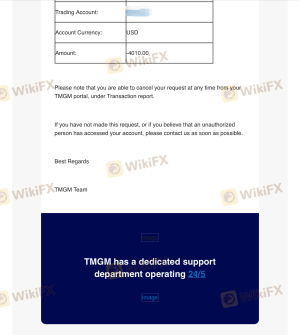

Customer Experience and Complaints

Customer feedback is an essential aspect of evaluating a broker's reliability. Overall, TMGM has received a mix of positive and negative reviews from users. Many clients praise the broker for its responsive customer support, efficient order execution, and competitive trading conditions. However, some common complaints include issues with account verification delays and difficulties in withdrawing funds.

The following table summarizes the primary complaint types and their severity:

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Delays | Moderate | Generally responsive |

| Account Verification Issues | High | Slow response |

| Platform Glitches | Moderate | Addressed promptly |

For example, one user reported a significant delay in withdrawing funds, which took longer than expected despite being processed within the promised timeframe. However, the broker's customer support team was noted for their willingness to assist and resolve issues.

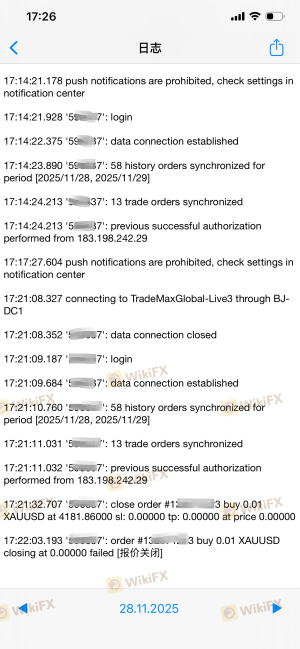

Platform and Trade Execution

TMGM provides access to popular trading platforms, including MetaTrader 4 (MT4) and MetaTrader 5 (MT5), which are known for their reliability and advanced trading features. Users have reported a generally positive experience with the platform's performance, noting its stability and fast execution speeds. The average execution time reported is under 30 milliseconds, which is competitive in the industry.

However, there have been occasional reports of slippage and re-quotes, particularly during high volatility periods. While these issues are not uncommon in the forex market, they can impact trading performance. Overall, TMGM's trading platform offers a solid user experience, but traders should remain vigilant during volatile market conditions.

Risk Assessment

When trading with TMGM, traders should be aware of several risks associated with the broker. The following risk assessment summarizes key areas of concern:

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | Low | Strong oversight by ASIC and FMA |

| Operational Risk | Medium | Occasional platform glitches reported |

| Withdrawal Risk | Medium | Some users report delays in fund access |

| Market Risk | High | High leverage can amplify potential losses |

To mitigate these risks, traders should implement sound risk management practices, such as using stop-loss orders and avoiding excessive leverage. Additionally, conducting thorough research and maintaining a diversified trading portfolio can help manage overall exposure.

Conclusion and Recommendations

In conclusion, TMGM appears to be a legitimate broker with a solid regulatory framework and a commitment to client security. The absence of significant fraud allegations or regulatory sanctions further supports its credibility. However, potential clients should remain cautious, particularly regarding withdrawal processes and account verification.

For novice traders, TMGM offers a user-friendly platform and educational resources, making it a suitable choice for those starting their trading journey. Experienced traders may appreciate the competitive spreads and advanced trading features available on the MT4 and MT5 platforms.

If you are considering trading with TMGM, it is advisable to start with a demo account to familiarize yourself with the platform and its features. Additionally, traders seeking alternatives may consider other reputable brokers such as IG, Saxo Bank, or OANDA, which also offer robust trading conditions and regulatory oversight.

Is TMGM a scam, or is it legit?

The latest exposure and evaluation content of TMGM brokers.

TMGM Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

TMGM latest industry rating score is 8.55, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 8.55 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.