Regarding the legitimacy of tiomarkets forex brokers, it provides FCA and WikiBit, (also has a graphic survey regarding security).

Is tiomarkets safe?

Pros

Cons

Is tiomarkets markets regulated?

The regulatory license is the strongest proof.

FCA Forex Execution License (STP)

Financial Conduct Authority

Financial Conduct Authority

Current Status:

RegulatedLicense Type:

Forex Execution License (STP)

Licensed Entity:

TIO Markets UK Limited

Effective Date:

2009-08-26Email Address of Licensed Institution:

compliance@tiomarkets.ukSharing Status:

No SharingWebsite of Licensed Institution:

www.tiomarkets.ukExpiration Time:

--Address of Licensed Institution:

Tio Markets UK Limited 4th Floor - 116 8 Devonshire Square London EC2M 4YD UNITED KINGDOMPhone Number of Licensed Institution:

+4402038652275Licensed Institution Certified Documents:

Is TIO Markets A Scam?

Introduction

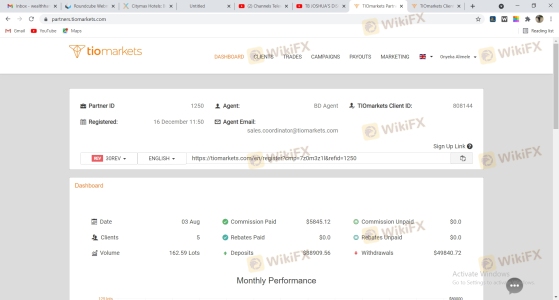

TIO Markets, a relatively new player in the forex trading arena, has quickly positioned itself as a multi-asset brokerage offering various financial instruments, including forex, CFDs, indices, and cryptocurrencies. Founded in 2019, the broker operates under two entities: TIO Markets UK Limited, regulated by the Financial Conduct Authority (FCA) in the UK, and TIO Markets Ltd, based in Saint Vincent and the Grenadines. As the trading landscape grows increasingly complex, traders must carefully evaluate the legitimacy and reliability of brokers like TIO Markets. This article aims to provide a comprehensive analysis of TIO Markets, using a structured approach that encompasses regulatory compliance, company background, trading conditions, customer experiences, and overall risk assessment.

Regulation and Legitimacy

The regulation of a brokerage is a critical factor that contributes to its credibility and trustworthiness. TIO Markets is regulated by the FCA, a highly regarded financial authority known for its stringent oversight of financial institutions. Regulatory oversight ensures that brokers adhere to strict standards that protect investors and promote transparency in trading practices. Below is a summary of TIO Markets' regulatory information:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| FCA | 488900 | United Kingdom | Verified |

| SVG FSA | 24986 | Saint Vincent | Verified |

The FCA's regulatory framework provides several layers of protection for traders, including the segregation of client funds, negative balance protection, and participation in the Financial Services Compensation Scheme (FSCS), which covers client deposits up to £85,000 in case of broker insolvency. However, it is important to note that while the UK entity is well-regulated, the offshore entity in Saint Vincent operates under a less stringent regulatory environment, which may expose clients to higher risks.

Company Background Investigation

TIO Markets was established in 2019 and has quickly gained traction in the online trading community. The company operates under two separate legal entities, with TIO Markets UK Limited being regulated by the FCA and TIO Markets Ltd registered in Saint Vincent and the Grenadines. The management team comprises experienced professionals from the financial services industry, bringing a wealth of expertise to the broker. Transparency is a crucial aspect of TIO Markets' operations, as they provide detailed information about their services, trading conditions, and regulatory compliance on their website.

The broker claims to prioritize client safety and satisfaction, which is reflected in their commitment to providing a secure trading environment. However, the dual structure of TIO Markets, with one entity being offshore and the other regulated, raises questions about the overall transparency and accountability of the broker. While the FCA-regulated entity offers robust investor protection, the offshore entity's operations may lack the same level of scrutiny.

Trading Conditions Analysis

TIO Markets offers a variety of trading accounts, each with different fee structures and conditions. The broker provides competitive spreads and commission structures, aiming to cater to both novice and experienced traders. However, potential clients should be aware of any unusual or problematic fee policies. Here's a comparative overview of the core trading costs associated with TIO Markets:

| Fee Type | TIO Markets | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 0.4 - 1.2 pips | 1.0 - 1.5 pips |

| Commission Model | $2 - $6 per lot | $5 - $10 per lot |

| Overnight Interest Range | Varies by instrument | Varies by instrument |

While TIO Markets' spreads are competitive, particularly for higher-tier accounts, the commission structure may not be as favorable for all traders. The presence of withdrawal fees for certain methods, such as $25 for bank wire transfers, could also deter potential clients. It is essential for traders to read the fine print regarding fees to avoid unexpected costs.

Client Fund Safety

The safety of client funds is paramount when choosing a forex broker. TIO Markets implements several measures to ensure the security of client deposits. Client funds are held in segregated accounts, separate from the broker's operating funds, ensuring that traders' money is protected even in the event of the broker's insolvency. Additionally, TIO Markets offers negative balance protection, which prevents traders from losing more than their deposited amount.

Despite these safeguards, the presence of an offshore entity poses potential risks. The regulatory environment in Saint Vincent lacks the stringent requirements found in the UK, which raises concerns about the level of protection afforded to clients trading through that entity. Historically, there have been no significant reports of fund safety issues with TIO Markets, but traders should remain vigilant and conduct thorough due diligence.

Customer Experience and Complaints

Customer feedback plays a crucial role in assessing a broker's reliability. TIO Markets has received a mix of reviews from clients, with many praising the responsive customer support and competitive trading conditions. However, some users have reported issues related to withdrawals and account management. Below is a summary of common complaint types and their severity assessments:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | Medium | Generally responsive |

| Account Management Issues | High | Slow resolution |

| Fee Transparency Concerns | Medium | Addressed upon inquiry |

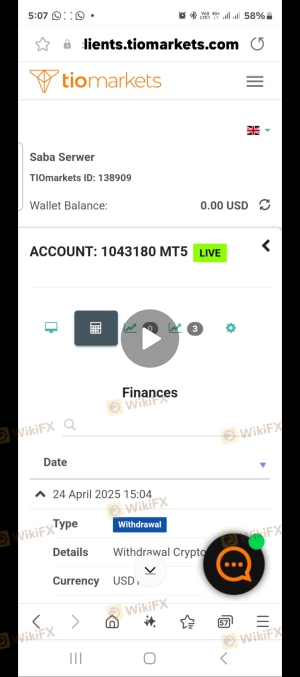

Typical cases include clients experiencing delays in withdrawals, particularly from the offshore entity, and concerns over unclear fee structures. While TIO Markets generally responds to complaints, the quality of resolution may vary, with some clients expressing dissatisfaction with the speed and effectiveness of the support team.

Platform and Trade Execution

TIO Markets offers access to the popular trading platforms MetaTrader 4 and MetaTrader 5, both known for their reliability and comprehensive trading tools. The broker emphasizes fast order execution and minimal slippage, which are essential for traders looking to capitalize on market movements. However, there have been occasional reports of execution issues during periods of high volatility.

The overall user experience on the trading platforms is largely positive, with many users appreciating the intuitive interface and advanced analytical tools. Nevertheless, the absence of proprietary trading platforms or additional features may limit the appeal for some traders seeking more innovative solutions.

Risk Assessment

Using TIO Markets involves several risks, primarily related to the dual regulatory structure and the potential for issues with the offshore entity. Below is a risk scorecard summarizing key risk areas:

| Risk Category | Risk Level | Brief Explanation |

|---|---|---|

| Regulatory Risk | Medium | Offshore entity may lack robust protections. |

| Execution Risk | Medium | Potential delays or issues during high volatility. |

| Fee Transparency Risk | Medium | Some fees may not be clearly disclosed. |

To mitigate these risks, traders are advised to use the FCA-regulated entity for trading and to thoroughly review all fee structures before committing funds. Additionally, maintaining a diversified trading strategy can help manage exposure.

Conclusion and Recommendations

In conclusion, TIO Markets is not a scam; it operates under FCA regulation, which provides a significant level of investor protection. However, traders should remain cautious, particularly regarding the offshore entity's operations and the potential risks associated with it. The trading conditions, including competitive spreads and commissions, make TIO Markets an attractive option for various traders, but issues related to withdrawal processes and fee transparency warrant attention.

For new traders, it is advisable to start with the FCA-regulated entity and consider using a demo account to familiarize themselves with the trading platform. Experienced traders looking for competitive conditions may find value in the VIP accounts. Overall, while TIO Markets presents a viable option, traders should conduct thorough research and consider alternatives such as IG or CMC Markets for a more comprehensive trading experience.

Is tiomarkets a scam, or is it legit?

The latest exposure and evaluation content of tiomarkets brokers.

tiomarkets Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

tiomarkets latest industry rating score is 5.82, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 5.82 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.