Is SHINE safe?

Business

License

Is Shine Safe or Scam?

Introduction

In the ever-evolving landscape of the forex market, traders must navigate a myriad of platforms, each promising lucrative returns and seamless trading experiences. Among these, Shine has emerged as a notable player, offering various trading options and features. However, as the market is rife with both legitimate and fraudulent brokers, it is crucial for traders to exercise caution and conduct thorough evaluations before committing their funds. This article aims to assess whether Shine is a safe trading platform or a potential scam.

To achieve this, we will employ a multi-faceted evaluation framework that encompasses regulatory compliance, company background, trading conditions, client fund safety, customer experiences, and overall risk assessment. Our investigation draws from various credible sources, including user reviews, regulatory bodies, and financial analysis platforms, to provide a comprehensive overview of Shine's legitimacy.

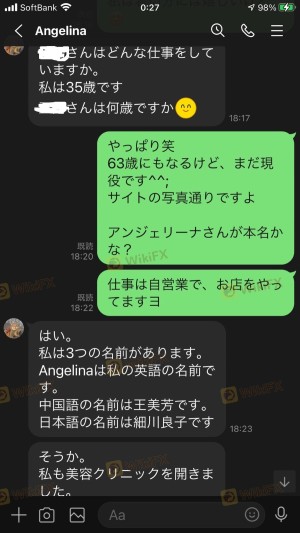

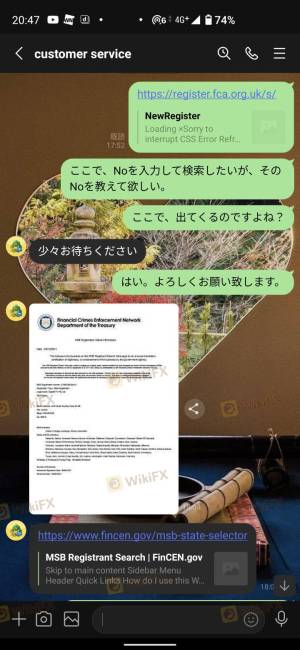

Regulatory and Legitimacy

The regulatory status of a forex broker is paramount in determining its legitimacy and the safety of client funds. Shine claims to operate from the United Kingdom, yet it lacks authorization from the Financial Conduct Authority (FCA) or any other recognized regulatory body. This absence of regulation raises significant red flags regarding its operational practices and the protection of traders' investments.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| FCA | N/A | UK | Not Regulated |

The importance of regulation cannot be overstated; it serves as a safeguard for traders, ensuring that brokers adhere to strict operational standards. Regulated brokers are required to maintain segregated accounts for client funds, provide transparent reporting, and adhere to ethical trading practices. Shine's lack of regulatory oversight suggests a higher risk profile for potential investors, as they may not have recourse in the event of disputes or financial mishaps.

Company Background Investigation

Shine was established in 2016 and has positioned itself as a forex and CFD broker. However, the lack of transparency regarding its ownership and management structure raises concerns. The company operates under the name Shine Markets Limited, but detailed information about its founders and management team is scarce. This opacity can be indicative of a lack of accountability and raises questions about the broker's long-term viability.

The absence of a robust corporate history and a well-defined management team further complicates the assessment of Shine's credibility. A reputable broker typically provides comprehensive information about its leadership and operational practices, which helps build trust among potential clients. Shine's failure to disclose such information may lead traders to question its legitimacy and operational integrity.

Trading Conditions Analysis

When evaluating a forex broker, the trading conditions it offers are critical to understanding its competitiveness and fairness. Shine provides a low minimum deposit requirement of $10, which may attract novice traders. However, the trading costs associated with its services are concerning. Shine offers high leverage ratios of up to 1:500, which, while appealing to some traders, can lead to significant risks of loss.

| Cost Type | Shine | Industry Average |

|---|---|---|

| Spread on Major Currency Pairs | From 2.5 pips | 1.0 - 1.5 pips |

| Commission Structure | N/A | Varies |

| Overnight Interest Range | N/A | Varies |

The spreads offered by Shine are notably higher than the industry average, which could significantly impact profitability for traders. Additionally, the lack of clarity regarding commission structures and overnight interest rates raises further concerns about hidden costs that may not be immediately apparent to traders. Such factors highlight the necessity for potential clients to thoroughly evaluate the overall cost of trading with Shine.

Client Fund Safety

The safety of client funds is a paramount concern for any trader. Shine's lack of regulatory oversight means it is not required to maintain segregated accounts for client funds, which is a standard practice among regulated brokers. This absence of segregation poses a significant risk, as client funds could potentially be used for the broker's operational expenses, thereby exposing traders to the risk of losing their investments in the event of financial instability.

Moreover, Shine does not provide any investor protection schemes, which are typically offered by regulated brokers to safeguard client funds in case of financial failure. The absence of such measures further exacerbates the risks associated with trading on this platform. Historical incidents of fund mismanagement or disputes involving Shine have not been widely reported, but the lack of transparency and regulatory oversight leaves traders vulnerable.

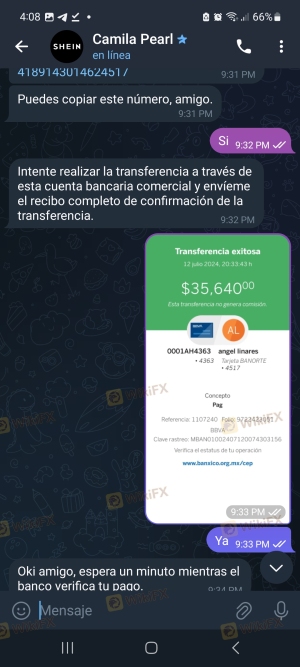

Customer Experience and Complaints

Analyzing customer feedback is vital to understanding the overall user experience with a broker. Reviews of Shine reveal a mixed bag of experiences, with several users expressing dissatisfaction with the platform. Common complaints include difficulties in withdrawing funds, slow customer service responses, and issues with account verification processes.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow/Unresponsive |

| Customer Service Delays | Medium | Inconsistent |

| Account Verification Problems | Low | Vague Responses |

For instance, one user reported being unable to withdraw their funds despite multiple requests, highlighting a significant issue with the broker's operational transparency. Another common theme in user feedback is the slow response time from customer service, which can be frustrating for traders seeking immediate assistance. These complaints indicate potential operational inefficiencies that could affect traders' overall experiences.

Platform and Execution

The trading platform's performance is a critical aspect of a trader's experience. Shine offers the widely-used MetaTrader 4 (MT4) platform, known for its user-friendly interface and advanced trading tools. However, reports suggest that users have experienced issues with platform stability and execution quality, including slippage and order rejections.

A reliable trading platform should provide seamless execution without significant delays or errors. Any indications of platform manipulation or technical issues could severely impact a trader's ability to execute trades effectively and manage risk. Therefore, potential clients should remain vigilant when assessing the platform's performance and reliability.

Risk Assessment

Engaging with Shine carries inherent risks that potential traders should carefully consider. The lack of regulation, high trading costs, and customer complaints contribute to a riskier trading environment.

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | No regulatory oversight |

| Financial Risk | Medium | High spreads and potential hidden fees |

| Operational Risk | High | Customer service issues and fund access |

To mitigate these risks, traders should conduct thorough research, consider starting with a small investment, and be cautious about leveraging their trades. Additionally, exploring alternative brokers with better regulatory standing and customer feedback may provide a safer trading environment.

Conclusion and Recommendations

In conclusion, the evidence suggests that Shine exhibits several characteristics that warrant caution among potential traders. The lack of regulatory oversight, high trading costs, and mixed customer feedback raise significant concerns about the broker's legitimacy and the safety of client funds. While it may offer appealing features such as low minimum deposits, the associated risks may outweigh the benefits for many traders.

For those considering trading with Shine, it is crucial to approach with caution and conduct thorough due diligence. Traders might also explore alternative brokers with strong regulatory backing, transparent fee structures, and positive customer reviews. Recommendations include brokers like XM, Pepperstone, and IG, which are known for their regulatory compliance and favorable trading conditions. Ultimately, ensuring a safe trading environment should be a top priority for any trader.

In summary, while the question of "Is Shine Safe?" remains open, the current landscape suggests a need for potential traders to proceed with caution and consider their options carefully.

Is SHINE a scam, or is it legit?

The latest exposure and evaluation content of SHINE brokers.

SHINE Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

SHINE latest industry rating score is 1.53, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.53 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.