Is SKYTOP safe?

Pros

Cons

Is Skytop Safe or Scam?

Introduction

Skytop is a forex trading platform that has emerged in the competitive landscape of online trading. As traders become increasingly interested in forex markets, the importance of selecting a reputable broker cannot be overstated. Is Skytop safe? This question poses significant implications for potential investors, as the wrong choice could lead to financial loss and frustration. Given the prevalence of scams in the financial sector, it is crucial for traders to conduct thorough evaluations of any broker before committing their funds.

This article employs a comprehensive investigative approach, analyzing Skytop's regulatory status, company background, trading conditions, customer safety measures, user experiences, and overall risk profile. By synthesizing data from multiple authoritative sources, we aim to provide a balanced view of whether Skytop represents a legitimate trading opportunity or a potential scam.

Regulation and Legitimacy

A broker's regulatory status is a cornerstone of its legitimacy. In the case of Skytop, it has come to light that the platform is not authorized or registered by any major regulatory authority, particularly the Financial Conduct Authority (FCA) in the UK. The FCA has issued warnings regarding Skytop, indicating that it may be providing financial services without the necessary permissions. This lack of regulation raises serious concerns about the safety of client funds and the overall integrity of the platform.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| FCA | N/A | UK | Not Authorized |

The absence of regulatory oversight means that traders using Skytop will not have access to the Financial Ombudsman Service in case of disputes, nor will they benefit from the Financial Services Compensation Scheme (FSCS) if things go awry. This lack of protection is a significant red flag for anyone considering trading with Skytop. In conclusion, the regulatory landscape surrounding Skytop strongly suggests that it is not a safe option for traders looking for a secure trading environment.

Company Background Investigation

Understanding a broker's history and ownership structure can provide insights into its reliability. Unfortunately, information about Skytop's background is sparse. The company claims to operate under the UK Companies House, yet no matching results were found during our investigation. Furthermore, Skytop has stated that it is regulated by the Australian Securities and Investments Commission (ASIC), but again, no evidence corroborates this claim.

The management team behind Skytop is also shrouded in mystery, raising questions about their professionalism and experience in the financial sector. A lack of transparency regarding the company's leadership and operational practices is concerning and adds to the uncertainty surrounding the broker. Given these factors, it is difficult to ascertain whether Skytop operates with the integrity that traders expect. Therefore, the absence of credible information regarding its background further complicates the question: Is Skytop safe?

Trading Conditions Analysis

When evaluating a broker, understanding its fee structure and trading conditions is essential. Skytop's trading conditions have been criticized for being opaque, with reports of high fees and commissions that can significantly erode traders' profits. Such practices are common among unregulated platforms, which often exploit inexperienced traders through hidden costs.

| Fee Type | Skytop | Industry Average |

|---|---|---|

| Major Currency Pair Spread | High | Moderate |

| Commission Model | High | Low |

| Overnight Interest Range | Unclear | Clear |

The lack of clarity regarding fees is particularly troubling. Traders have reported unexpected charges that were not clearly outlined in their agreements, leading to frustration and financial loss. This opacity raises serious questions about the fairness of Skytop's trading conditions. Therefore, it is reasonable to conclude that potential clients should approach Skytop with caution regarding its trading conditions, as they may not be as favorable as advertised.

Customer Fund Safety

The safety of customer funds is paramount when considering a trading platform. In the case of Skytop, the lack of regulatory oversight means that there are no mandatory measures in place to protect client funds. This includes the absence of segregation of client accounts and no investor protection schemes.

Historical complaints about Skytop include reports of clients being unable to withdraw their funds, which is a significant warning sign. Such issues indicate that Skytop may not have adequate financial safeguards in place. Without robust measures to protect customer funds, the question remains: Is Skytop safe? The overwhelming evidence suggests that it is not.

Customer Experience and Complaints

User experiences can provide valuable insights into a broker's reliability. Unfortunately, Skytop has garnered numerous negative reviews, with many users reporting issues related to customer service and fund withdrawals. Common complaints include:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Service | Medium | Poor |

| Transparency | High | Poor |

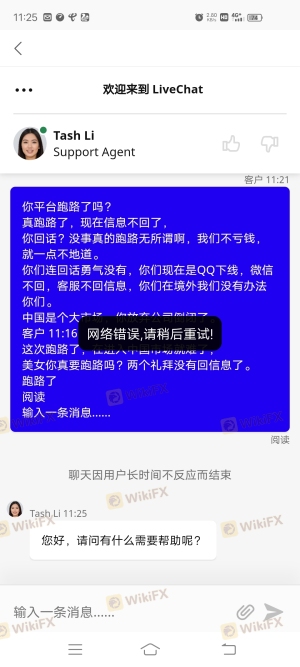

For instance, one user reported being unable to withdraw funds for over a month, while another mentioned unresponsive customer service. Such patterns of complaints are concerning and indicate that Skytop may not prioritize customer satisfaction. The overall sentiment from users suggests that many have had negative experiences, raising further doubts about the platform's credibility and safety.

Platform and Trade Execution

A broker's trading platform and execution quality are critical for a positive trading experience. Skytop's platform has been described as unstable, with reports of frequent outages and poor execution quality. Traders have experienced slippage and rejected orders, which can significantly impact trading performance. Such issues raise concerns about the integrity of Skytop's trading environment.

If a broker's platform is unreliable, it can lead to significant financial consequences for traders. Therefore, the performance and reliability of Skytop's platform are crucial factors to consider when evaluating whether it is a safe trading option.

Risk Assessment

Engaging with an unregulated broker like Skytop carries inherent risks. The overall risk profile for Skytop can be summarized as follows:

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | No regulatory oversight |

| Financial Risk | High | Lack of fund protection |

| Operational Risk | Medium | Platform instability |

Given these risk factors, it is advisable for traders to exercise extreme caution when considering Skytop as a trading option. Potential users should be aware of the high level of risk associated with unregulated brokers and consider alternative platforms with robust regulatory oversight and better customer protection.

Conclusion and Recommendations

In summary, the investigation into Skytop reveals several alarming indicators that suggest it is not a safe trading platform. The lack of regulation, opaque fee structures, poor customer service, and negative user experiences all point toward a conclusion that potential traders should be wary.

For those seeking a reliable trading environment, it is advisable to consider alternatives that are regulated by reputable authorities. Brokers that offer transparency, robust customer support, and a clear fee structure are essential for a positive trading experience. Is Skytop safe? The overwhelming evidence suggests that it is not, and traders should proceed with caution or avoid it altogether.

Is SKYTOP a scam, or is it legit?

The latest exposure and evaluation content of SKYTOP brokers.

SKYTOP Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

SKYTOP latest industry rating score is 1.47, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.47 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.