Skytop 2025 Review: Everything You Need to Know

Executive Summary

This skytop review reveals concerning findings about a broker that has attracted significant scrutiny from financial authorities worldwide. Skytop operates as a forex-focused trading platform. Its legitimacy remains highly questionable due to the absence of proper regulatory oversight. The broker has been specifically identified by multiple financial regulatory bodies, including the UK's Financial Conduct Authority as operating without authorization.

The platform primarily targets forex trading enthusiasts. Yet critical information about trading conditions such as spreads, commissions, and leverage remains conspicuously absent from available resources. This lack of transparency, combined with regulatory warnings, raises serious red flags for potential investors. The broker's business model appears centered on forex trading. Without concrete details about account types, minimum deposits, or trading platforms, prospective clients face significant uncertainty.

Given the regulatory concerns and limited operational transparency, this review strongly advises extreme caution when considering Skytop as a trading partner. The combination of regulatory warnings and insufficient disclosure of trading terms creates an environment of heightened risk for potential investors seeking legitimate forex trading opportunities.

Important Disclaimer

Regulatory Status Concerns: Skytop operates in a complex regulatory environment where different jurisdictions maintain varying legal and compliance requirements. Investors must pay particular attention to the broker's regulatory status. It has been flagged by multiple financial authorities as operating without proper authorization.

This evaluation is based exclusively on publicly available information and user feedback, without direct trading experience verification. The regulatory warnings from established financial authorities form a crucial component of this assessment. These include the Financial Conduct Authority's identification of Skytop as an unauthorized entity. Potential investors should conduct independent due diligence and consult with financial advisors before making any investment decisions.

Rating Framework

Broker Overview

Skytop positions itself as a forex trading specialist. Fundamental details about its establishment date and headquarters location remain undisclosed in available documentation. The broker's business model centers on foreign exchange trading. Yet the absence of comprehensive company background information raises immediate transparency concerns. Without clear information about founding dates, corporate structure, or leadership team, potential clients face significant uncertainty about the organization's stability and credibility.

The platform's operational focus appears limited to forex markets. Specific asset class offerings beyond currency pairs remain unclear. This narrow specialization might appeal to dedicated forex traders. But the lack of diversification options could limit its attractiveness to broader investment audiences. The broker's regulatory status presents the most significant concern. Multiple financial authorities have issued warnings about its unauthorized operations.

According to regulatory findings, Skytop has been specifically identified by the Financial Conduct Authority and other supervisory bodies as operating without proper licensing. This skytop review emphasizes that such regulatory warnings represent serious red flags that potential investors cannot ignore. The absence of legitimate regulatory oversight eliminates crucial investor protections typically associated with authorized financial service providers.

Regulatory Jurisdiction: Multiple financial regulatory authorities, particularly the Financial Conduct Authority, have identified Skytop as operating without authorization. This creates significant legal and financial risks for potential clients.

Deposit and Withdrawal Methods: Available documentation lacks specific information about supported payment methods, processing times, or associated fees for funding accounts or withdrawing profits.

Minimum Deposit Requirements: No concrete minimum deposit thresholds are specified in accessible materials. This leaves potential investors without clear entry-level expectations.

Promotional Offers: Bonus structures, promotional campaigns, or incentive programs remain unspecified in available broker information. This suggests limited marketing transparency.

Available Trading Assets: While forex trading appears to be the primary focus, comprehensive asset listings including specific currency pairs, exotic options, or additional financial instruments lack detailed specification.

Cost Structure Analysis: Critical pricing information including typical spreads, commission rates, overnight financing charges, and hidden fees remains undisclosed. This prevents accurate cost assessment.

Leverage Options: Maximum leverage ratios, margin requirements, and risk management parameters are not clearly outlined in accessible broker documentation.

Platform Selection: Specific trading platform offerings, including popular options like MetaTrader 4 or MetaTrader 5, remain unspecified in this skytop review analysis.

Geographic Restrictions: Regional availability and jurisdictional limitations for account opening and trading services lack clear documentation.

Customer Support Languages: Multilingual support capabilities and communication options are not detailed in available broker materials.

Comprehensive Rating Analysis

Account Conditions Analysis

The evaluation of Skytop's account conditions reveals significant information gaps that severely impact potential client decision-making. Available documentation fails to specify account type varieties. Each typically has distinct features and benefits that help traders select appropriate service levels. Without clear account tier structures, investors cannot assess which options might align with their trading capital and experience levels.

Minimum deposit requirements remain completely unspecified. This creates uncertainty about entry barriers for new clients. Legitimate brokers typically offer transparent deposit thresholds ranging from micro-accounts with minimal requirements to premium accounts demanding substantial initial funding. The absence of such specifications raises questions about operational transparency and client communication standards.

Account opening procedures and verification requirements lack detailed explanation. This leaves potential clients uncertain about documentation needs, processing timeframes, and approval criteria. Additionally, specialized account features such as Islamic accounts for Sharia-compliant trading, professional trader classifications, or institutional service options receive no mention in available materials.

User feedback regarding account conditions remains absent from accessible sources. This prevents objective assessment of client satisfaction with account management, funding processes, or service delivery. This skytop review emphasizes that without comparative analysis against industry standards, potential investors lack crucial context for evaluating account quality and competitiveness.

Skytop's trading tools and resources portfolio suffers from significant transparency deficiencies that impact trader capability assessment. Available information fails to specify trading tool varieties and quality levels that modern forex traders typically expect from professional platforms. Without detailed tool specifications, potential clients cannot evaluate whether the broker provides adequate technical analysis capabilities, charting functions, or automated trading support.

Research and analysis resources remain unspecified in accessible documentation. These include market commentary, economic calendars, trading signals, or expert analysis. These resources typically form crucial components of comprehensive trading platforms. They help clients make informed decisions based on market insights and professional guidance. The absence of such information suggests either limited resource availability or poor communication transparency.

Educational resources for trader development lack detailed description. These include webinars, tutorials, trading guides, or mentoring programs. Quality brokers typically invest significantly in client education to improve trading success rates and long-term relationships. Without educational program specifications, new traders cannot assess learning support availability.

Automated trading support receives no mention in available materials. This includes expert advisor compatibility, algorithmic trading platforms, or copy trading services. Modern traders increasingly rely on automation for strategy implementation and risk management. This makes the information gap particularly concerning for technically sophisticated clients seeking advanced trading capabilities.

Customer Service and Support Analysis

Customer service evaluation reveals substantial information deficiencies that prevent accurate assessment of support quality and availability. Available documentation lacks specification of customer service channels. These include telephone support, live chat capabilities, email response systems, or help desk ticketing platforms. Without clear communication channel information, potential clients cannot assess support accessibility or convenience.

Response time commitments and service level agreements remain unspecified. This creates uncertainty about support efficiency and reliability. Professional brokers typically maintain specific response time standards for different communication channels and issue severity levels. The absence of such commitments suggests either inadequate service standards or poor transparency in client communication.

Service quality metrics lack documentation in accessible materials. These include customer satisfaction ratings, issue resolution success rates, or support team expertise levels. These metrics typically help potential clients assess whether support teams can effectively address technical issues, account problems, or trading difficulties.

Multilingual support capabilities remain unclear. This potentially limits accessibility for international clients who require assistance in their native languages. Additionally, customer service availability hours lack specification. These include weekend support or extended trading session coverage. Without comprehensive support information, potential clients face uncertainty about assistance availability during critical trading periods or emergency situations.

Trading Experience Analysis

Platform stability and execution speed metrics remain absent from available documentation. This prevents objective assessment of technical performance quality. Modern traders require reliable platform operation with minimal downtime, fast order processing, and stable connectivity during volatile market conditions. Without performance specifications or user testimonials, potential clients cannot evaluate technical reliability.

Order execution quality lacks detailed documentation. This includes slippage rates, requote frequencies, and fill accuracy. These factors significantly impact trading profitability and user satisfaction, particularly for scalping strategies or high-frequency trading approaches. Professional brokers typically provide execution statistics or third-party verification of order processing quality.

Platform functionality completeness remains unspecified. This includes advanced order types, risk management tools, market depth information, or customization options. Comprehensive trading platforms typically offer sophisticated features that enhance trading efficiency and strategy implementation capabilities.

Mobile trading experience receives no detailed coverage. This includes dedicated applications, mobile platform features, or cross-device synchronization capabilities. Modern traders increasingly rely on mobile access for position monitoring and trade management. This makes mobile platform quality crucial for overall user satisfaction.

This skytop review emphasizes that without concrete trading experience data, potential clients cannot make informed decisions about platform suitability for their specific trading requirements and technical expectations.

Trust and Reliability Analysis

Regulatory compliance represents the most critical concern in Skytop's trustworthiness assessment. Multiple financial regulatory authorities, including the prominent Financial Conduct Authority, have specifically identified Skytop as operating without proper authorization. This regulatory status eliminates fundamental investor protections typically associated with licensed financial service providers. These include compensation schemes, complaint resolution procedures, and operational oversight.

Fund security measures remain unspecified in available documentation. These include client money segregation, deposit protection insurance, or third-party custodial arrangements. Legitimate brokers typically maintain strict client fund separation protocols and provide detailed explanations of money protection procedures. The absence of such information raises serious concerns about client asset safety and recovery procedures.

Corporate transparency lacks comprehensive disclosure. This includes company registration details, ownership structure, financial statements, or audit reports. Professional financial service providers typically maintain high transparency standards to build client confidence and demonstrate operational legitimacy. Without such transparency, potential clients cannot verify company stability or operational integrity.

Industry reputation assessment proves challenging due to limited third-party evaluations, professional reviews, or industry recognition. Established brokers typically accumulate positive industry recognition, awards, or professional endorsements that validate their service quality and market standing.

The handling of negative events demonstrates concerning patterns. This particularly applies to regulatory warnings and unauthorized operation allegations. Rather than addressing regulatory concerns transparently, the continued operation despite official warnings suggests disregard for compliance requirements and client protection standards.

User Experience Analysis

Overall user satisfaction assessment faces significant challenges due to absent user evaluation data in accessible sources. Legitimate brokers typically accumulate substantial user feedback through review platforms, social media, or direct testimonials. These provide insights into client satisfaction levels and service quality perceptions.

Interface design and usability factors remain unspecified. This prevents evaluation of platform navigation ease, visual design quality, or user-friendly features. Modern trading platforms require intuitive interfaces that accommodate both novice and experienced traders while providing efficient access to essential functions.

Registration and verification procedures lack detailed explanation. This creates uncertainty about account opening complexity, documentation requirements, or approval timeframes. Streamlined onboarding processes typically enhance user experience while maintaining necessary compliance standards.

Fund management experience receives no detailed coverage in available materials. This includes deposit processing efficiency, withdrawal procedures, or payment method convenience. Smooth financial operations significantly impact overall user satisfaction and platform usability for active traders.

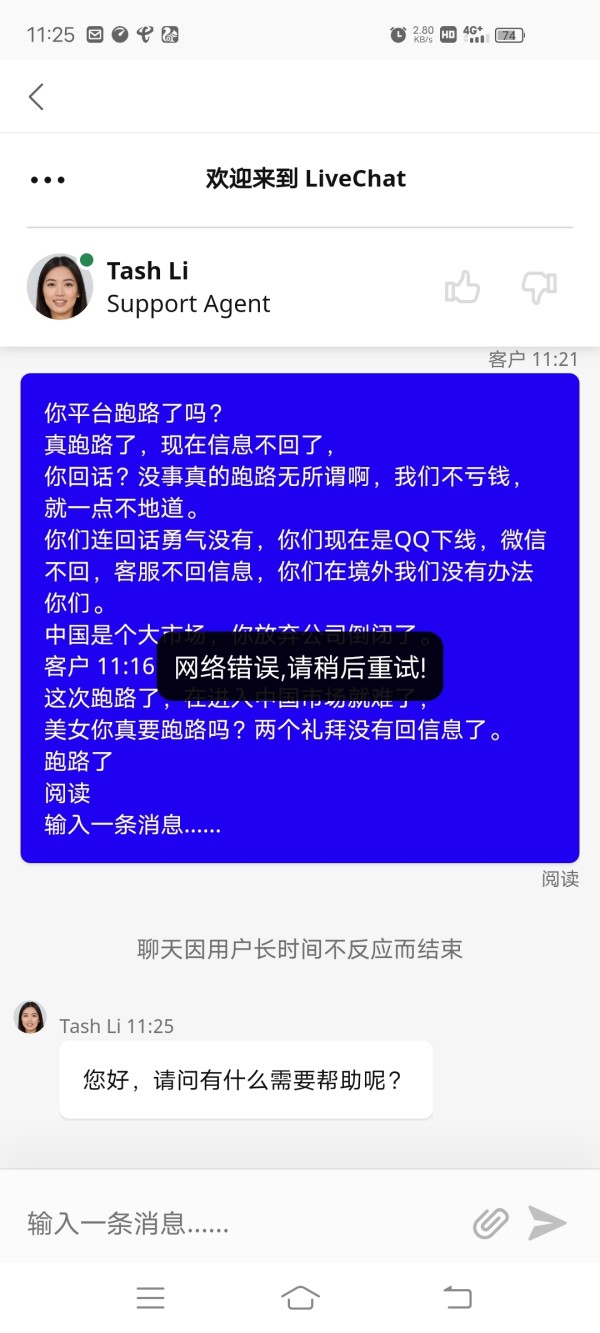

Common user complaints or satisfaction patterns remain undocumented. This prevents identification of recurring issues or service strengths. Professional brokers typically monitor user feedback systematically to identify improvement opportunities and address client concerns proactively. The absence of such feedback suggests either limited client base or inadequate feedback collection mechanisms.

Conclusion

This comprehensive skytop review reveals significant concerns that strongly advise against choosing this broker for forex trading activities. The combination of regulatory warnings from established financial authorities creates unacceptable risks for potential investors seeking legitimate trading opportunities. This particularly applies to the Financial Conduct Authority's identification of unauthorized operations.

The absence of fundamental information about trading conditions, platform specifications, and client protection measures demonstrates transparency deficiencies that legitimate financial service providers typically avoid. Without proper regulatory oversight, clients lack essential protections. These include complaint resolution procedures, compensation schemes, and operational supervision.

Potential investors interested in forex trading should prioritize authorized brokers with clear regulatory compliance, transparent operational practices, and comprehensive client protection measures. The risks associated with unauthorized operations far outweigh any potential benefits. This is particularly true given the availability of numerous legitimate alternatives in the competitive forex brokerage market.