Is ORIENT SECURITIES safe?

Pros

Cons

Is Orient Securities Safe or a Scam?

Introduction

Orient Securities, also known as 东方证券, is a prominent player in the Chinese financial market, primarily engaged in investment banking, brokerage services, and asset management. Founded in 1998 and headquartered in Shanghai, the firm has established itself as a significant entity in the realm of securities trading. However, the increasing number of unregulated brokers in the forex market has made it essential for traders to exercise caution in their evaluations. Ensuring the legitimacy and safety of a broker can prevent potential financial losses and safeguard investments. This article aims to provide a comprehensive analysis of Orient Securities, focusing on its regulatory standing, company background, trading conditions, customer experiences, and overall safety. The investigation is rooted in data gathered from reputable financial sources, user reviews, and regulatory disclosures.

Regulation and Legitimacy

The regulatory framework surrounding a brokerage is crucial in determining its credibility and operational integrity. Orient Securities operates under the supervision of Chinese regulatory authorities, specifically the China Financial Futures Exchange (CFFEX), which oversees futures trading in the country. Below is a summary of the regulatory information pertinent to Orient Securities:

| Regulatory Authority | License Number | Regulated Area | Verification Status |

|---|---|---|---|

| CFFEX | 0156 | China | Verified |

The significance of regulation cannot be understated; it provides a layer of protection for traders by enforcing compliance with industry standards. In the case of Orient Securities, the firm is indeed regulated, which indicates a commitment to maintaining integrity in its operations. However, there have been concerns regarding the quality of regulation and historical compliance issues. While the firm has held its license for several years, some user reviews have highlighted difficulties in fund withdrawals, raising questions about operational transparency and reliability.

Company Background Investigation

Orient Securities has a rich history that dates back to its founding in 1998. Over the years, it has expanded its services to include a wide array of financial products, including equities, futures, and asset management. The company's ownership structure is relatively straightforward, with significant stakes held by state-owned enterprises and private investors. The management team comprises seasoned professionals with extensive backgrounds in finance and investment, which adds to the firm's credibility.

Transparency is a critical factor in assessing a brokerage's reliability. While Orient Securities provides basic information about its services and operations, there is limited disclosure regarding its financial health and strategic direction. This lack of detailed information could be a red flag for potential investors, as it may indicate a reluctance to fully disclose operational challenges or financial issues.

Trading Conditions Analysis

Understanding the trading conditions offered by Orient Securities is essential for potential traders. The firm employs a diverse fee structure that varies based on the type of investment. However, concerns have been raised about the clarity of these fees, particularly regarding withdrawal processes and potential hidden costs. Below is a comparison of key trading costs associated with Orient Securities:

| Fee Type | Orient Securities | Industry Average |

|---|---|---|

| Major Currency Pair Spread | Varies | 1.2 pips |

| Commission Structure | 0.2-3‰ | 0.1-1% |

| Overnight Interest Range | Varies | 0.5-2% |

The potential for high commissions and unclear fee structures could deter traders, especially those who engage in frequent trading. Moreover, the absence of popular trading platforms may limit the trading experience for users accustomed to more established interfaces.

Customer Funds Security

The safety of customer funds is paramount when evaluating a brokerage. Orient Securities claims to implement rigorous security measures, including segregated accounts for client funds. This practice ensures that client assets are kept separate from the company's operational funds, providing a layer of protection in the event of financial difficulties.

Additionally, the firm adheres to local regulations regarding investor protection. However, the lack of negative balance protection has raised concerns among users, particularly those engaged in leveraged trading. Historical complaints regarding withdrawal difficulties further compound these concerns, suggesting that while the firm may have safety measures in place, the execution of these policies could be lacking.

Customer Experience and Complaints

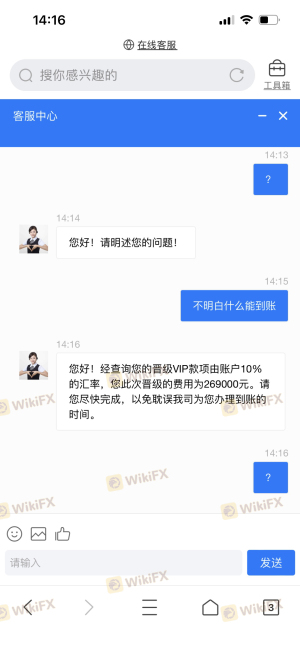

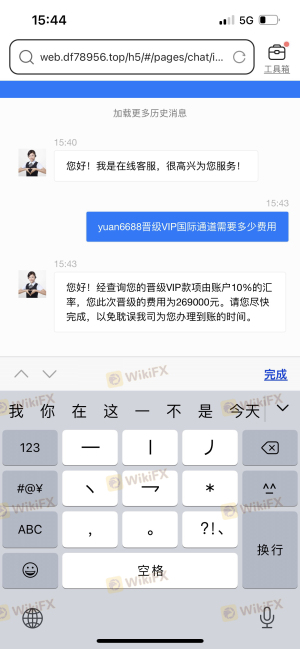

Customer feedback is invaluable in assessing the reliability of a brokerage. Reviews of Orient Securities reveal a mixed bag of experiences. While some users praise the firm's trading options and customer service, others have reported significant issues, particularly with fund withdrawals. Common complaints include:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Difficulties | High | Slow/Unresponsive |

| High Commission Rates | Medium | Acknowledged |

| Limited Payment Methods | Low | Addressed |

Two notable cases highlight the withdrawal issues faced by clients. In both instances, users reported being unable to access their funds despite meeting all necessary requirements. These complaints suggest a pattern that could indicate deeper operational issues within the firm.

Platform and Execution

Evaluating the trading platform and execution quality is crucial for traders. Orient Securities offers proprietary trading platforms, but user reviews indicate that these platforms may not be as stable or user-friendly as those offered by more established brokers. Concerns about order execution quality, slippage, and rejection rates have been noted, which could hinder trading performance.

The lack of well-known trading platforms such as MetaTrader 4 or 5 may also deter potential clients who prefer these widely recognized interfaces. The absence of transparent information regarding execution quality further complicates the evaluation of the trading experience with Orient Securities.

Risk Assessment

Engaging with Orient Securities carries inherent risks, as with any brokerage. The following risk assessment summarizes key risk areas associated with the firm:

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Compliance | Medium | Concerns over historical compliance issues. |

| Withdrawal Issues | High | Frequent complaints about fund access. |

| Fee Transparency | Medium | Unclear fee structures may impact profitability. |

To mitigate these risks, potential traders are advised to conduct thorough research, utilize demo accounts, and only invest funds they can afford to lose.

Conclusion and Recommendations

In conclusion, while Orient Securities is regulated and has a significant presence in the Chinese financial market, there are notable concerns regarding its operational practices, particularly related to fund withdrawals and fee transparency. The mixed customer feedback and historical compliance issues suggest that traders should approach this broker with caution.

For traders seeking reliable alternatives, it may be wise to consider brokers with a proven track record, transparent fee structures, and strong regulatory oversight. Ultimately, the decision to engage with Orient Securities should be based on individual risk tolerance and investment goals.

Is ORIENT SECURITIES a scam, or is it legit?

The latest exposure and evaluation content of ORIENT SECURITIES brokers.

ORIENT SECURITIES Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

ORIENT SECURITIES latest industry rating score is 1.51, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.51 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.