Orient Securities 2025 In-Depth Review: Opportunity or Trap?

Executive Summary

Orient Securities, a regulated brokerage, offers a variety of financial products and services, making it an attractive option for experienced traders in Asia. However, potential investors face significant challenges in the form of user complaints regarding fund withdrawals and customer support deficiencies. Given these concerns, it is crucial for individuals considering Orient Securities to carefully weigh the risks against the potential benefits.

The ideal clientele includes seasoned traders who prioritize regulatory oversight and need access to diverse financial instruments, including equities, futures, and options. Conversely, newcomers should avoid the broker due to its complexities and reported service issues. In light of various risk signals, including withdrawal difficulties and customer service complaints, prospective investors would be wise to proceed with caution.

⚠️ Important Risk Advisory & Verification Steps

When considering opening an account with Orient Securities, potential users should be aware of the following risks:

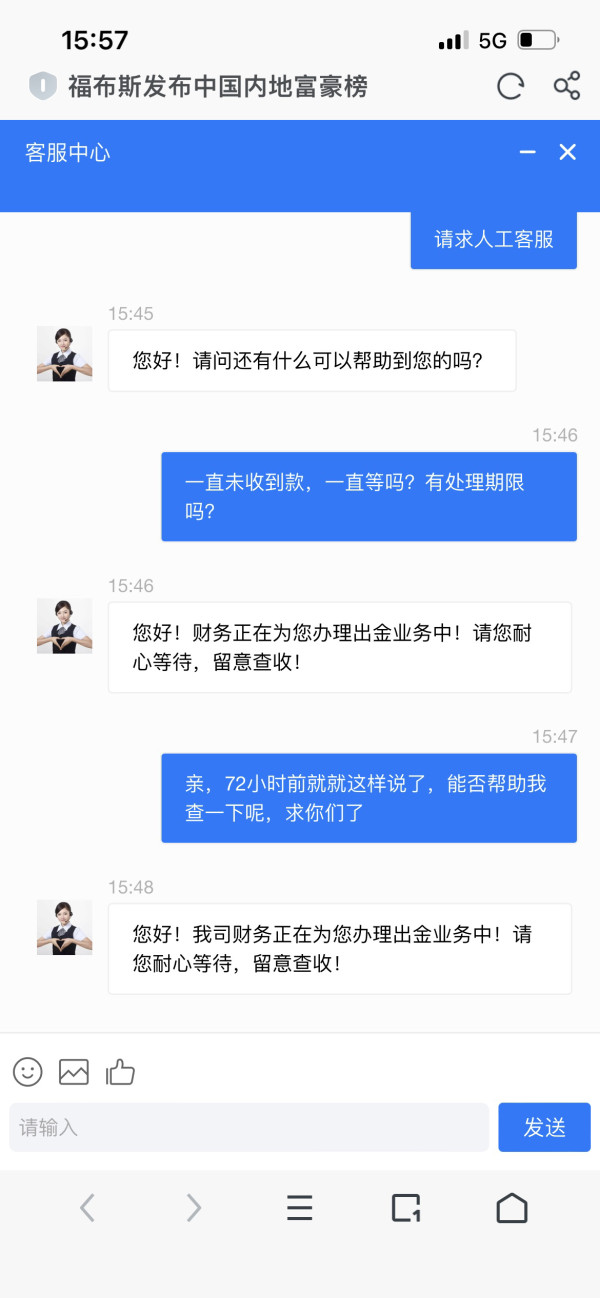

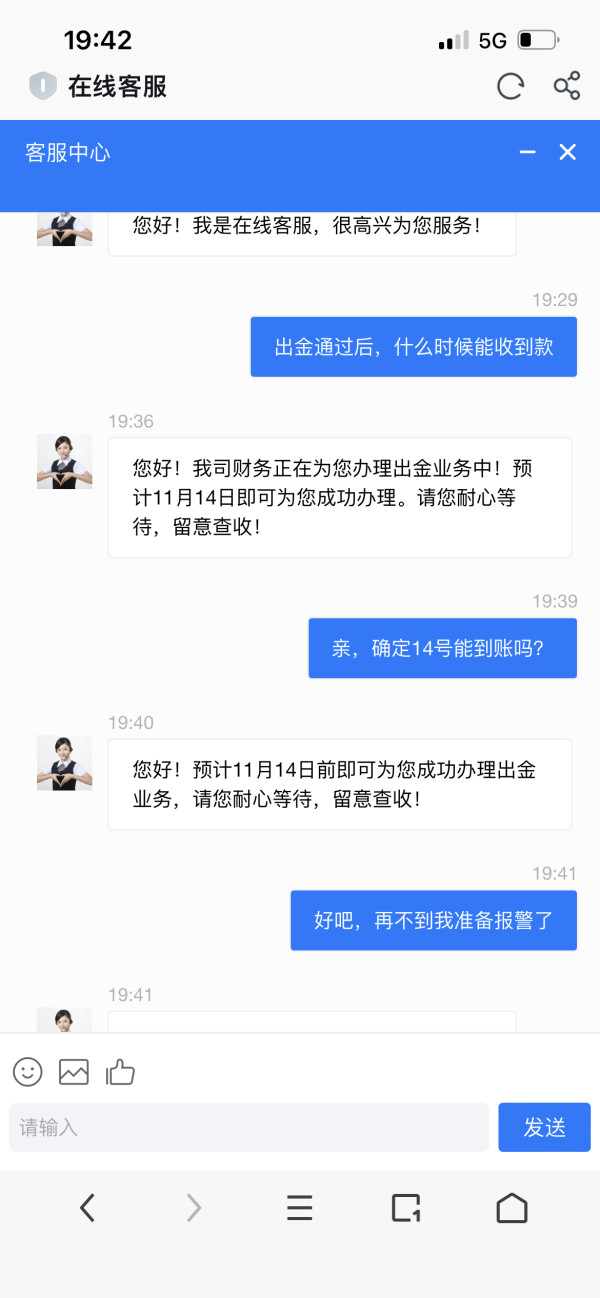

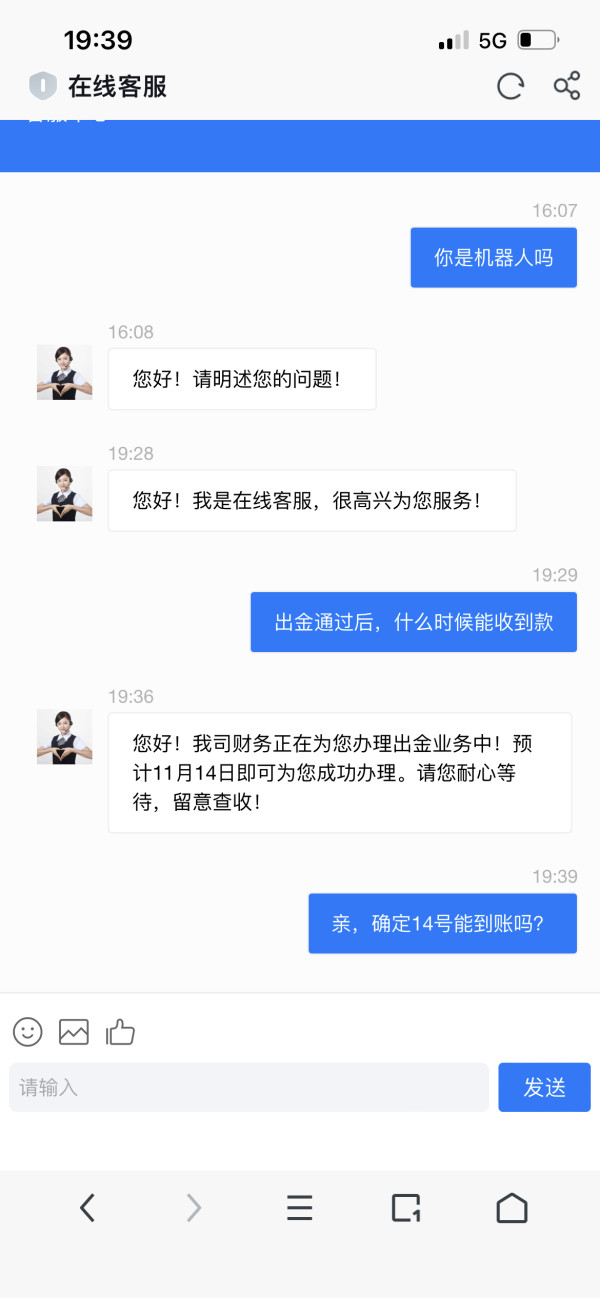

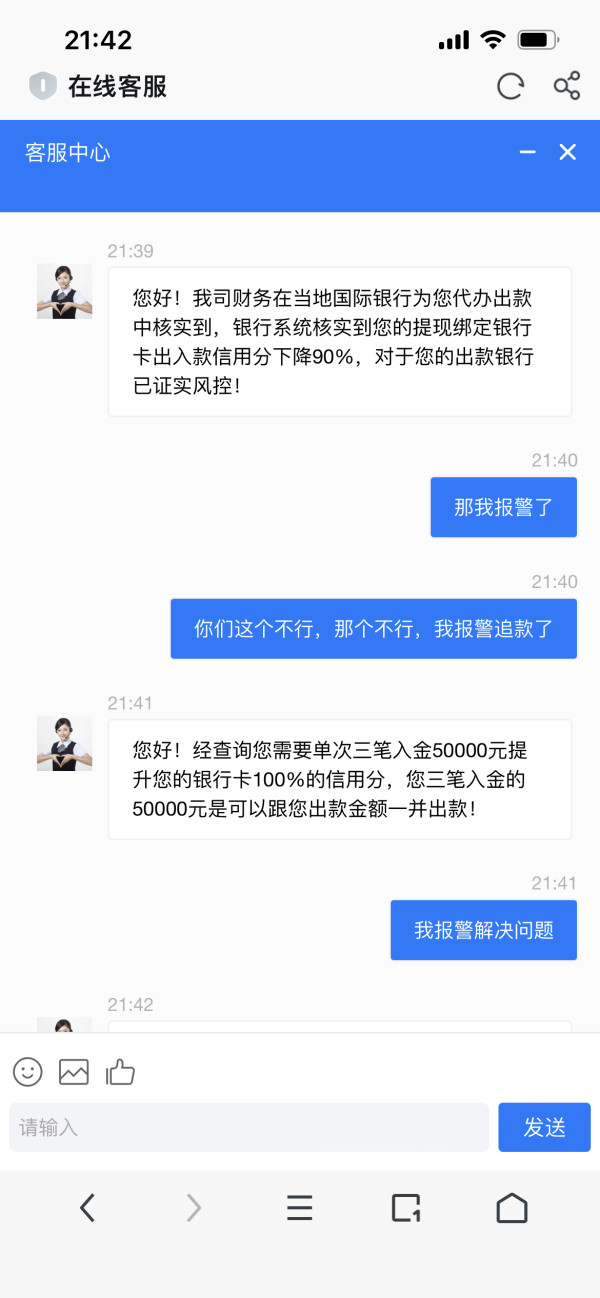

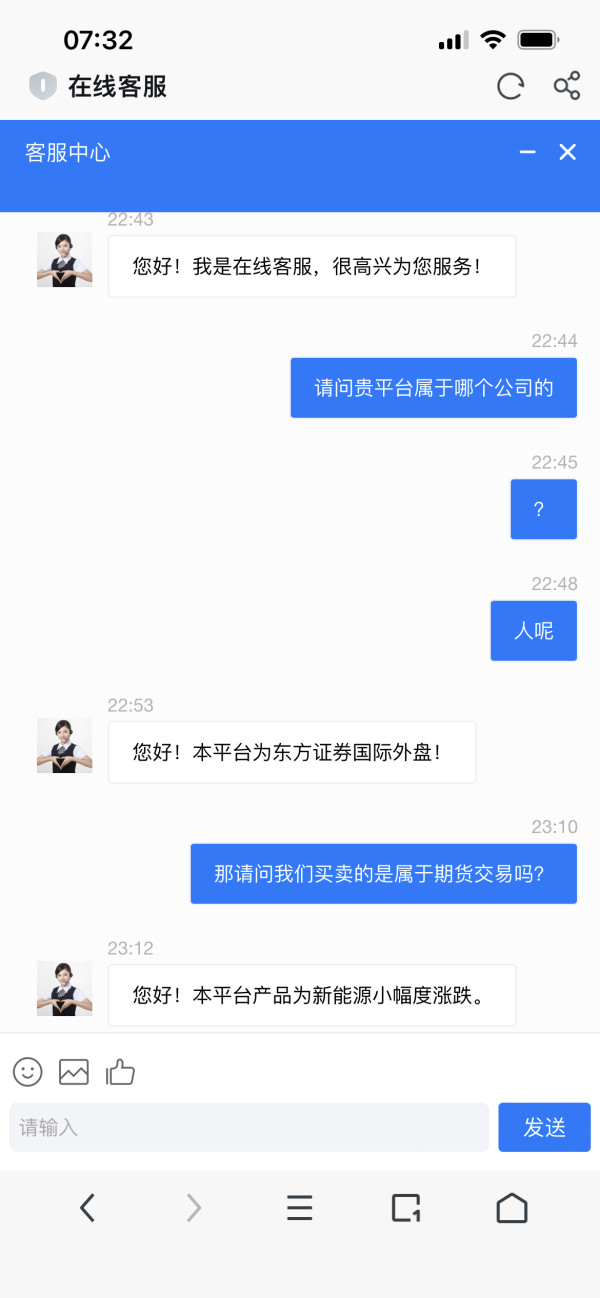

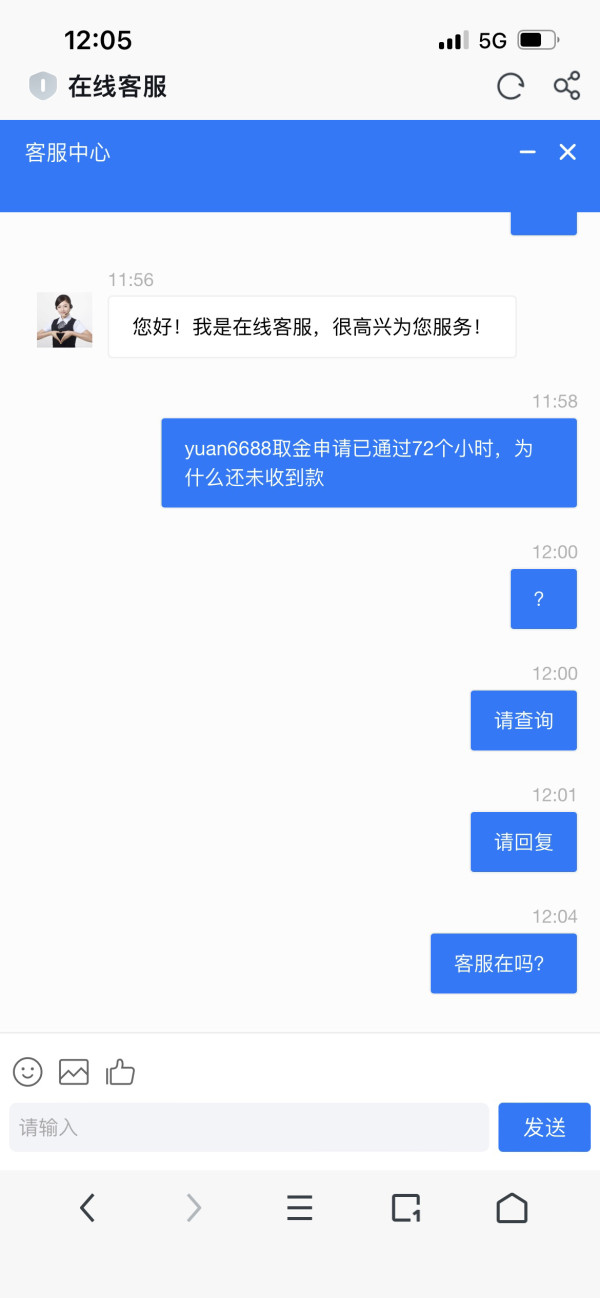

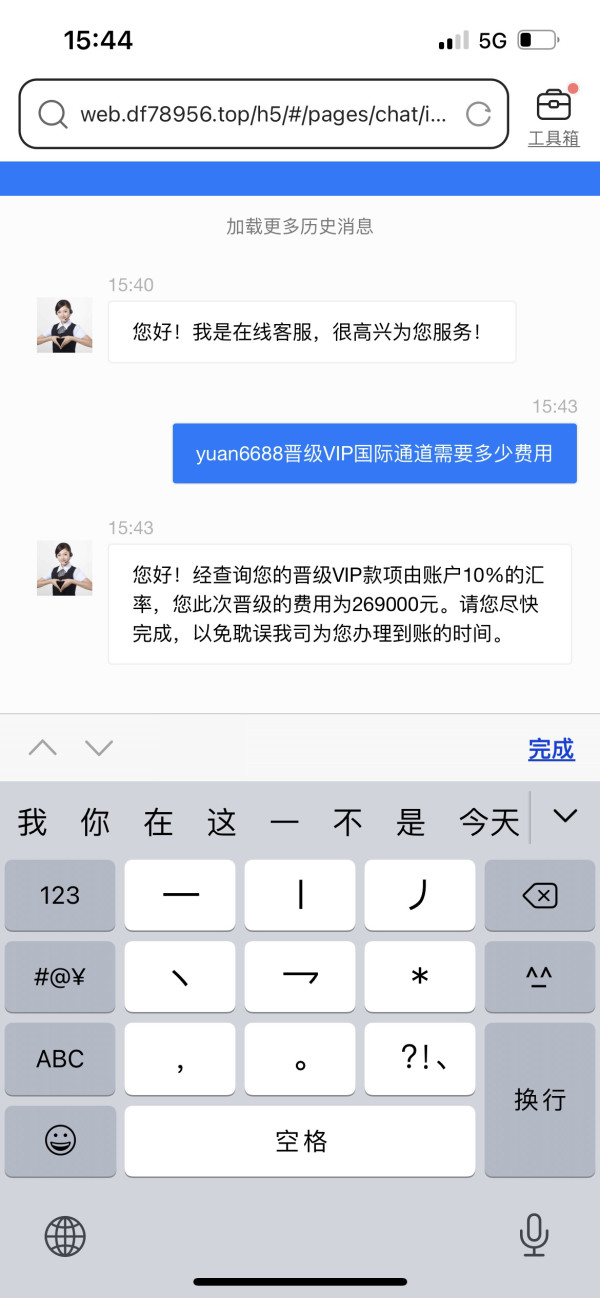

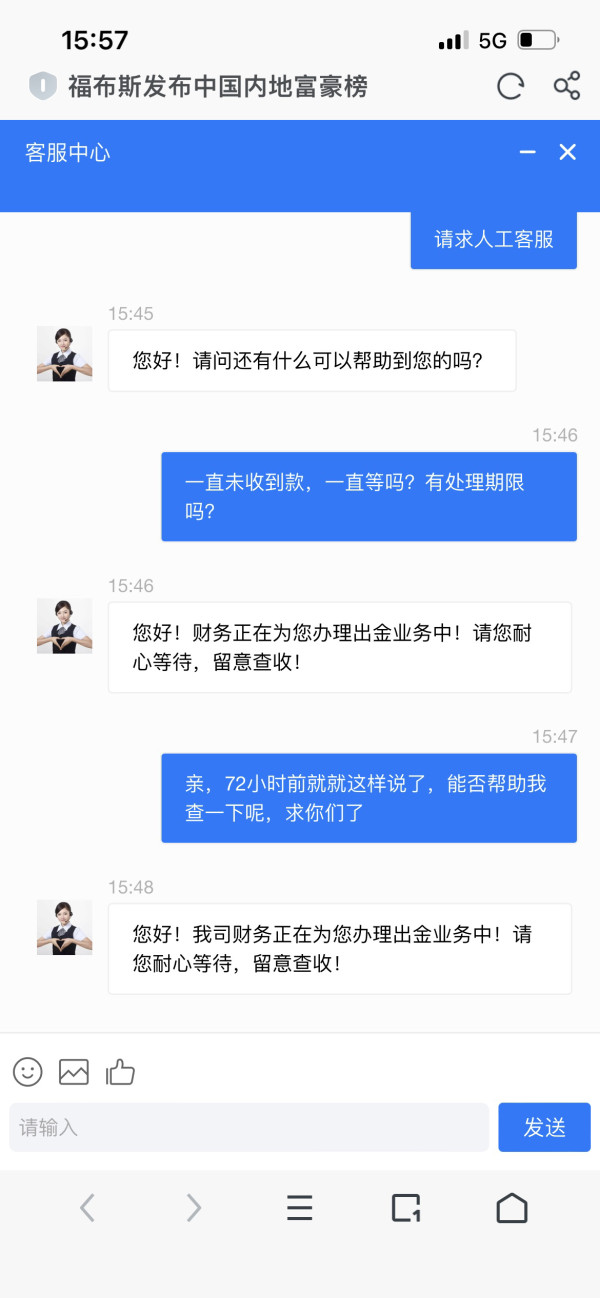

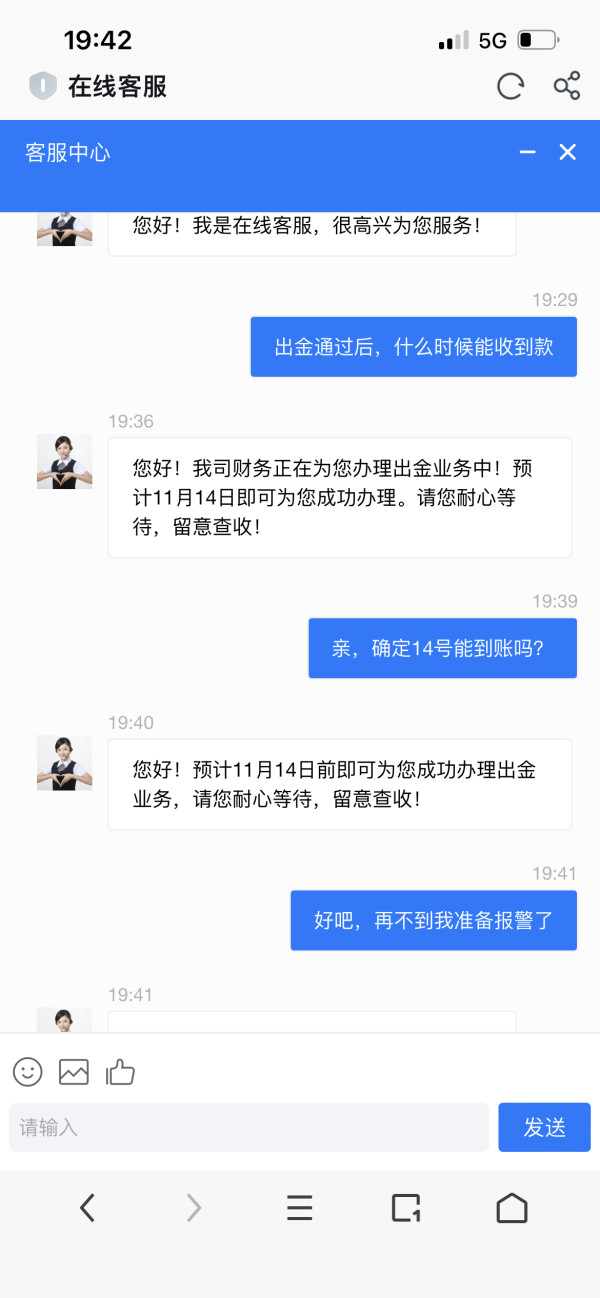

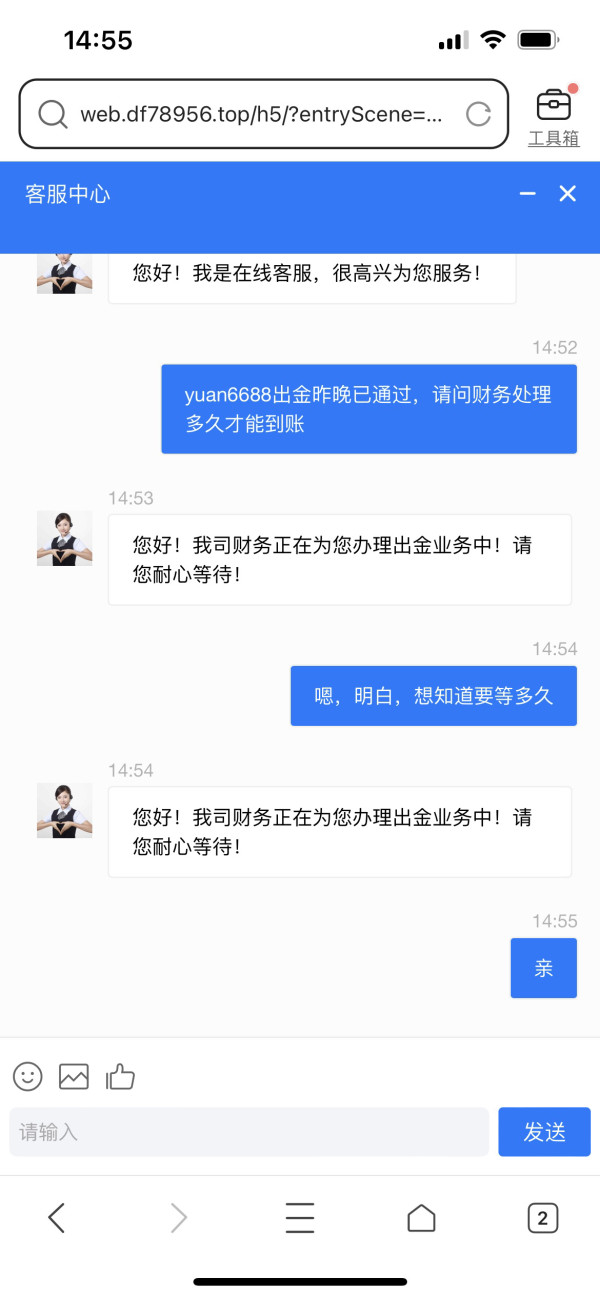

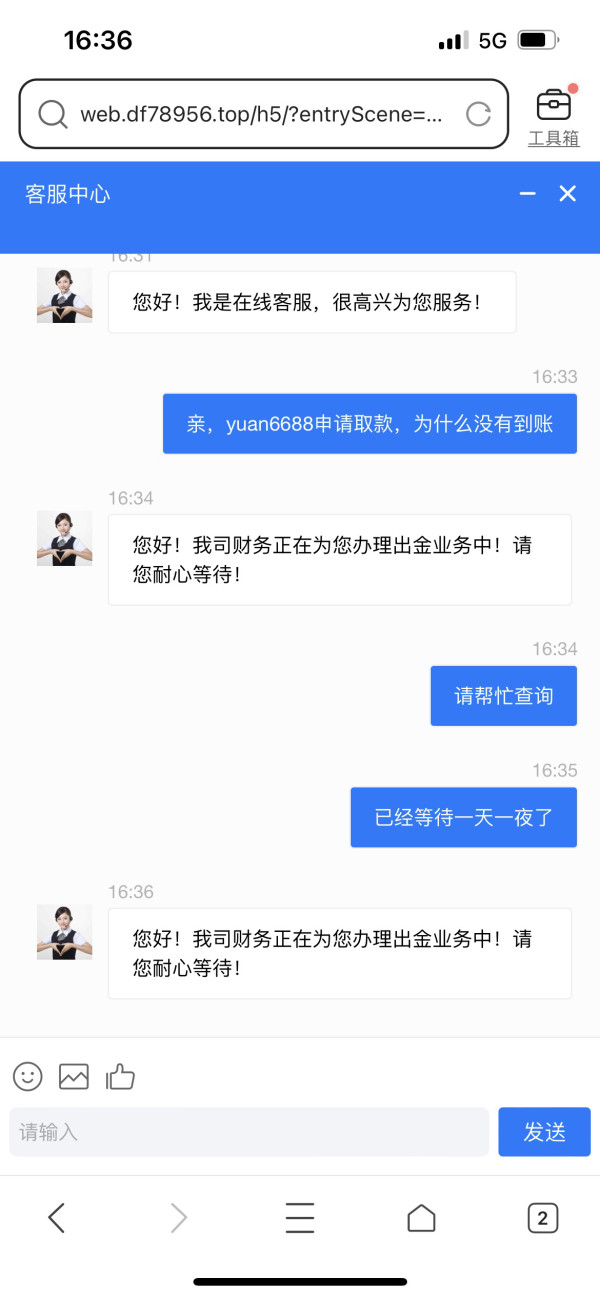

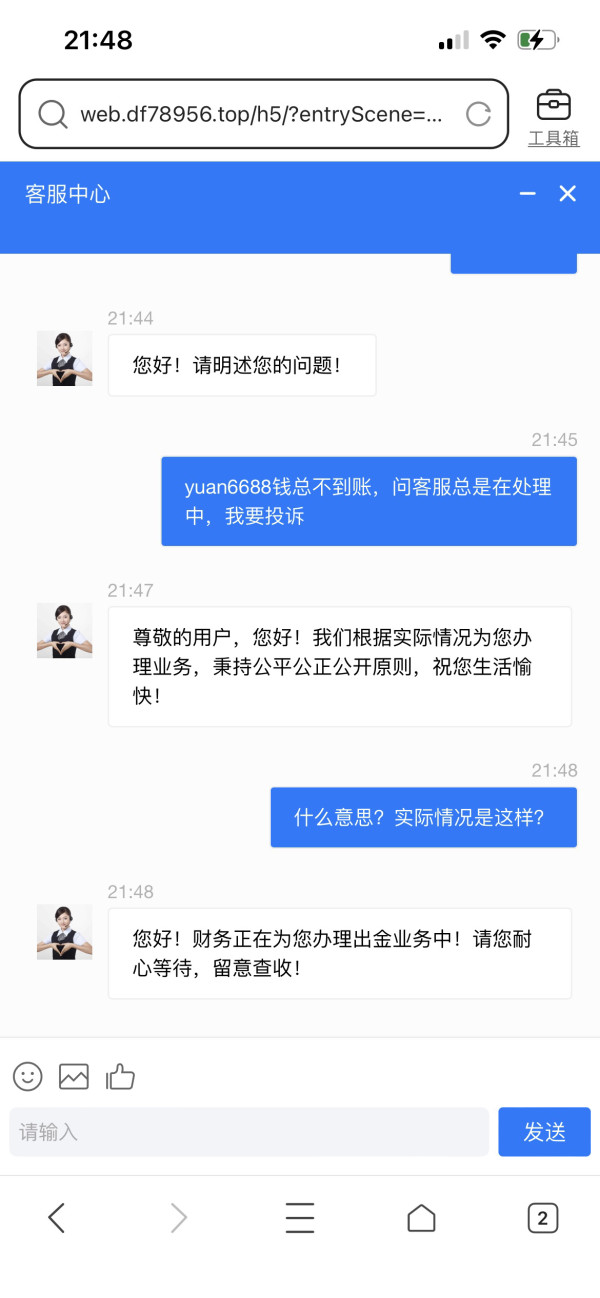

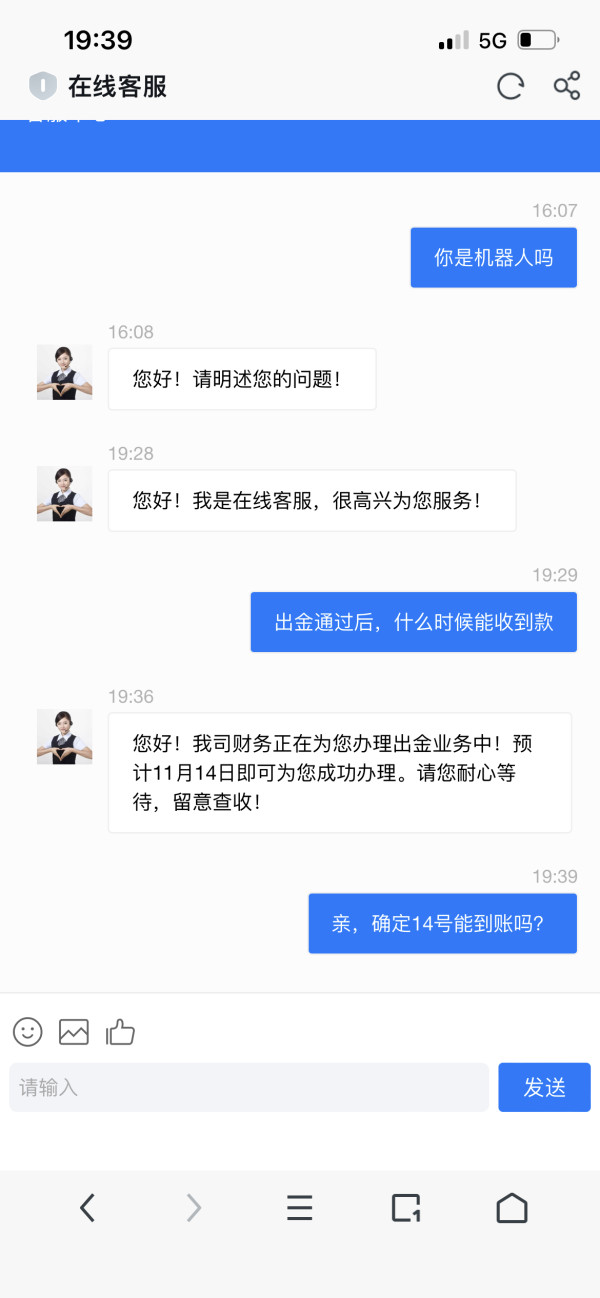

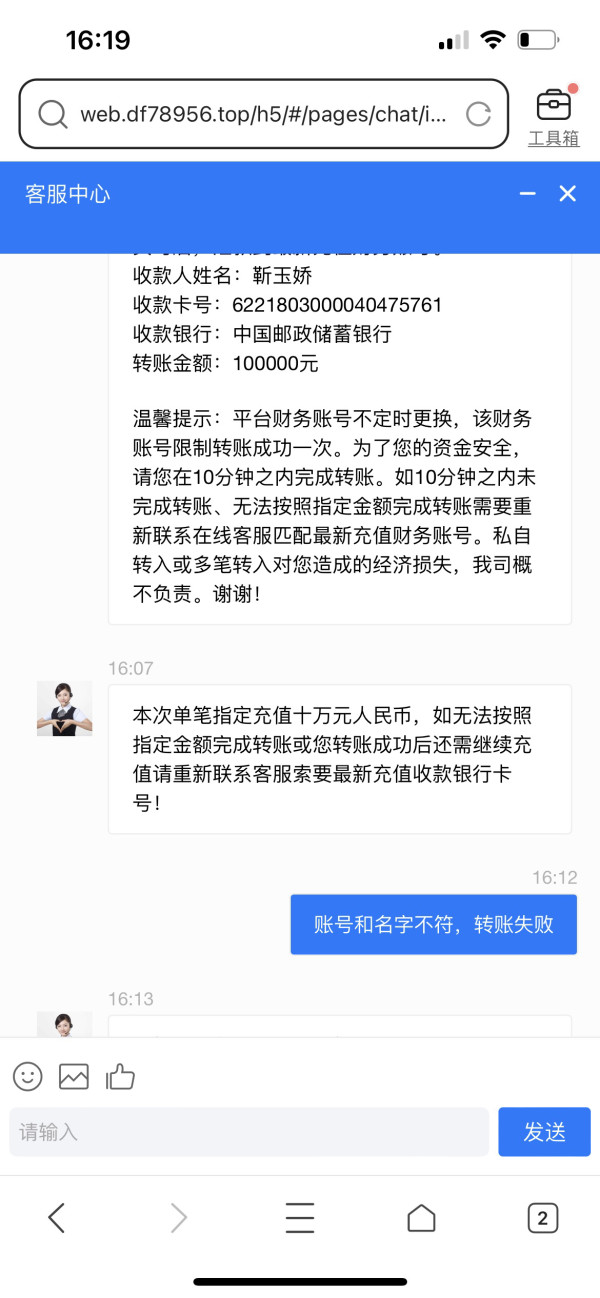

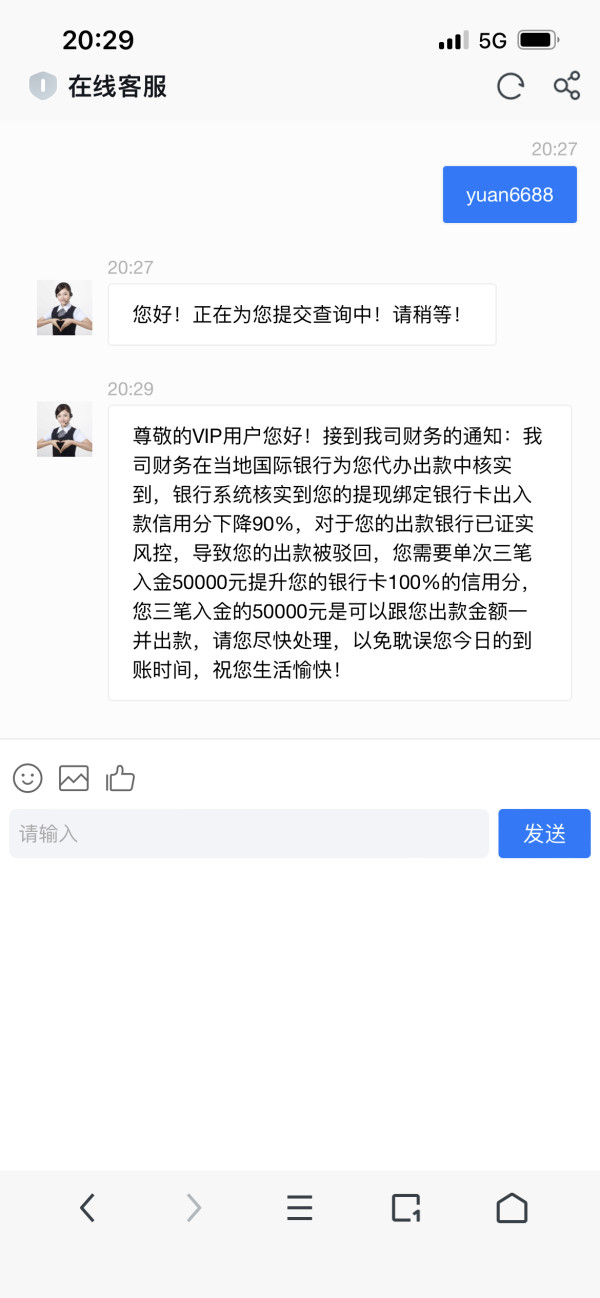

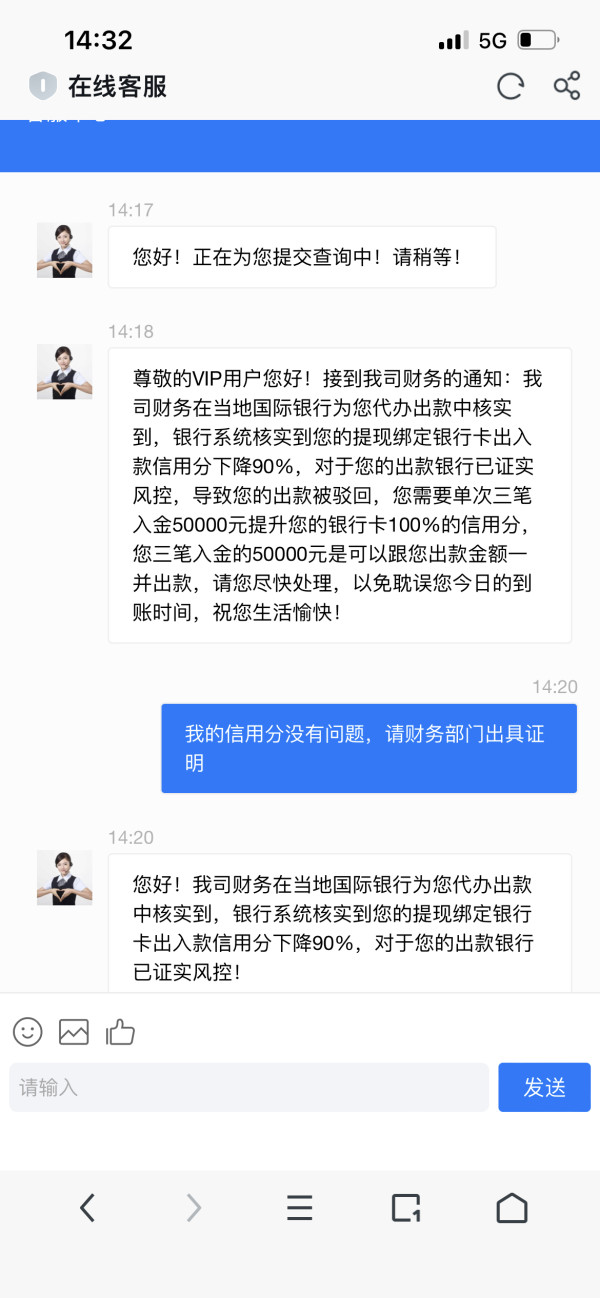

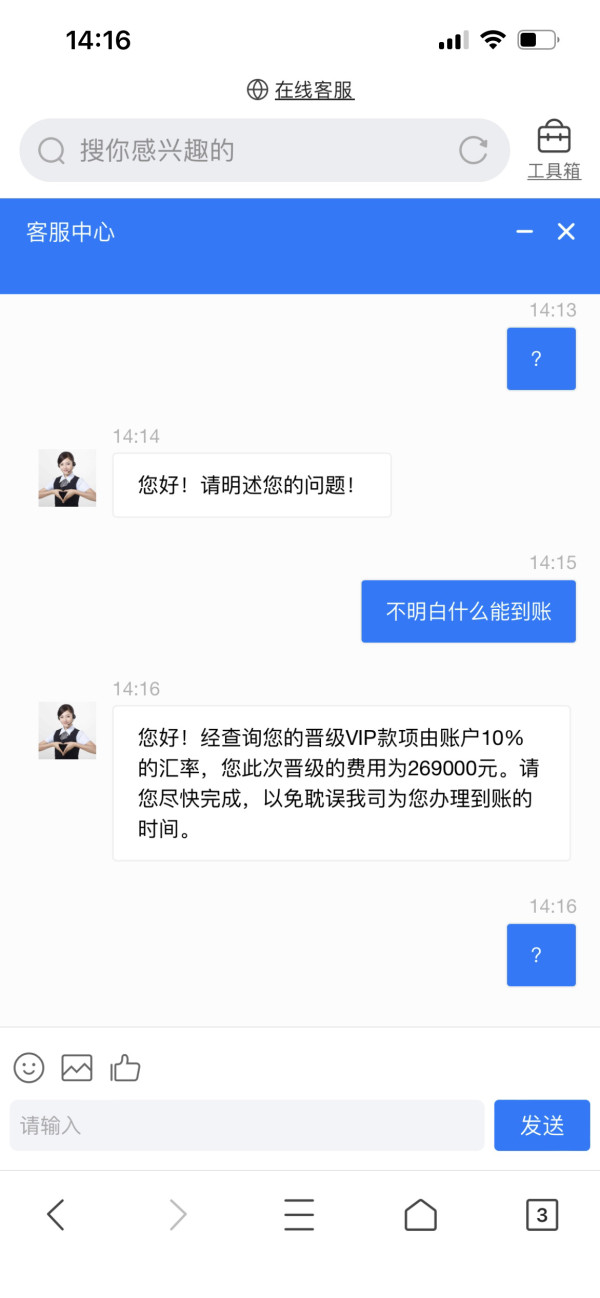

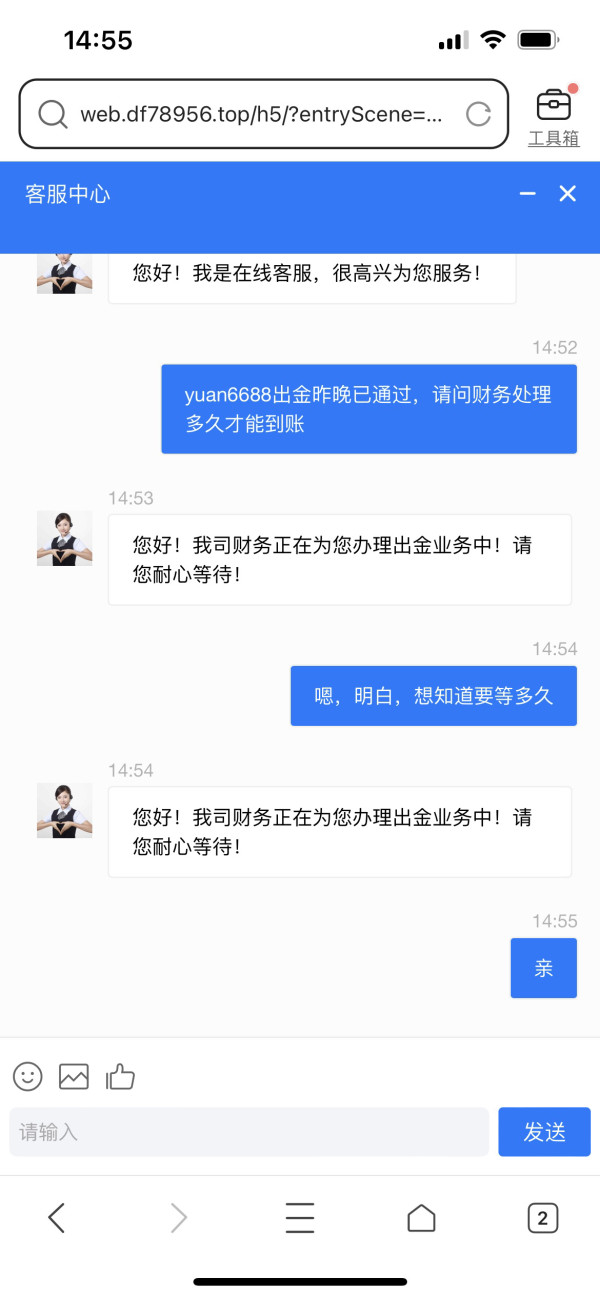

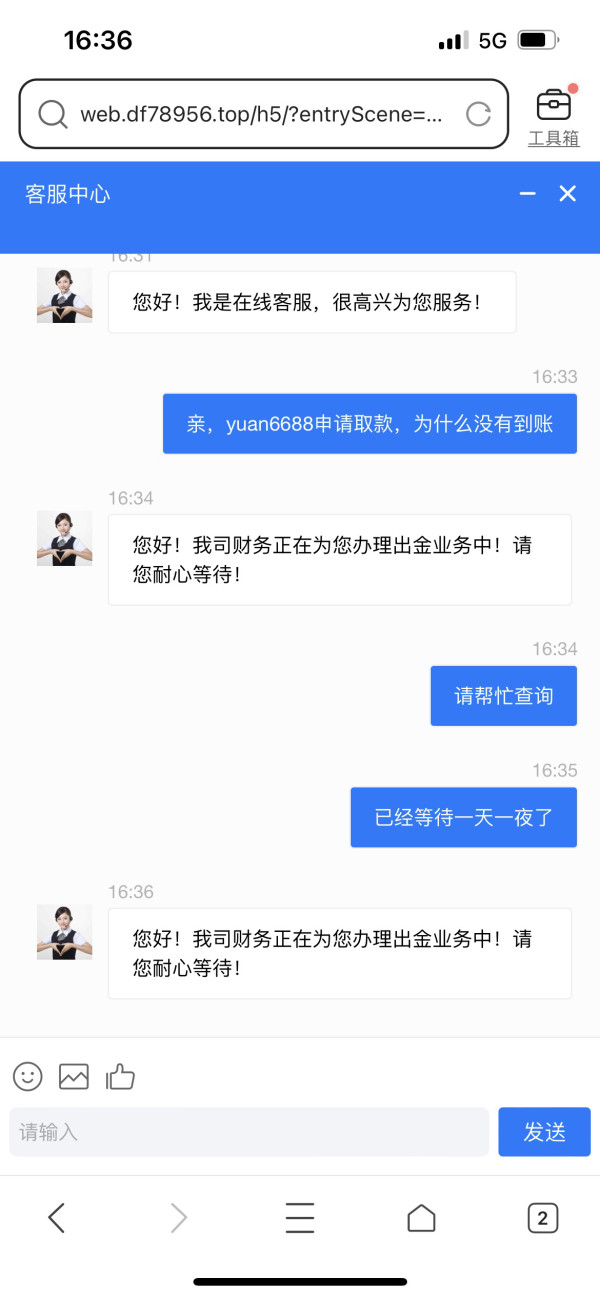

Withdrawal Difficulties: Numerous reports indicate that users have faced issues withdrawing funds. Common complaints include:

Excuses for denied requests.

Lack of clear communication regarding withdrawal processes.

Customer Service Concerns: Users have voiced dissatisfaction with the responsiveness of the customer support team.

Regulatory Scrutiny: While Orient Securities is overseen by the Hong Kong Securities and Futures Commission (SFC), confusion regarding regulatory information in other jurisdictions raises further concerns.

How to Self-Verify

To ensure the legitimacy of Orient Securities:

- Check Regulatory Status: Visit the SFC website and confirm the brokerage's licensing.

- Read User Reviews: Search for reliable reviews on independent platforms to gauge user experiences.

- Contact Customer Support: Engage with the support team before opening an account to assess their responsiveness and helpfulness.

- Monitor Regulatory Updates: Stay informed about any regulatory actions against the brokerage.

Rating Framework

Broker Overview

Company Background and Positioning

Founded in the early 2010s and with its headquarters located in Shanghai, Orient Securities is a licensed entity under the supervision of the China Financial Futures Exchange. The brokerages aim is to provide a comprehensive range of financial tools, catering primarily to seasoned trading professionals in the Asian markets. Despite its regulated status, the broker faces scrutiny due to complaints regarding inadequate customer support and complications surrounding fund withdrawals.

Core Business Overview

Orient Securities presents a broad array of services encompassing multiple asset classes, such as equities, debt instruments, derivatives, and structured products. Its offerings include:

- Equity Market Instruments: A-shares, B-shares, H-shares, and N-shares provide traders with diversified options.

- Debt Instruments: Options include various types of bonds and notes, catering to varied investment needs.

- Derivatives: Futures and options contracts allow traders to hedge risks and speculate.

- Structured Products: This includes collateralized debt obligations (CDOs) and credit default swaps (CDSs).

The brokerage claims oversight by significant regulatory bodies, including the SFC, enhancing its appeal among cautious investors.

Quick-Look Details Table

In-Depth Analysis of Each Dimension

Trustworthiness Analysis

Despite being regulated by credible authorities such as the Hong Kong Securities and Futures Commission (SFC), conflicting reports about its operational practices raise red flags. Users have voiced ongoing concerns about the withdrawals and overall fund security, contrasting against the regulatory assurances provided.

2. User Self-Verification Guide

To assess the credibility of Orient Securities, clients should:

- Verify its regulatory status through the SFCs official website.

- Consult industry reviews on platforms like WikiFX to gauge user feedback.

- Reach out to customer support for direct inquiries regarding fund security and terms.

3. Industry Reputation and Summary

Orient Securities has garnered mixed reviews among users, particularly due to:

- Withdrawal issues experienced by multiple clients, as highlighted below:

"I was unable to withdraw my funds and encountered several excuses for this. It's pretty frustrating!" - User Review, WikiBit.

This further emphasizes the need for prospective clients to conduct their due diligence.

Trading Costs Analysis

1. Advantages in Commissions

Orient Securities promotes competitive commission rates, which can appeal to cost-conscious traders. Commission rates on various asset classes start as low as 0.2‰ for certain bonds and go up to 3‰ for A and B shares.

2. The "Traps" of Non-Trading Fees

However, clients have reported unexpected fees that can eat into profits. Some common complaints include high withdrawal fees. For example:

"I faced a $30 fee when trying to withdraw, which I didn't anticipate." - User Feedback.

3. Cost Structure Summary

Overall, while trading costs may seem attractive, the hidden fees can pose significant threats to the profitability of trades, especially for high-frequency traders.

Orient Securities offers several platforms:

- Orient Winner (东方赢家): A mobile trading application that provides real-time market data and AI customer support.

- Tong Da Xin Terminal (东方证券通达信金融终端): Focused on market data and trading capabilities.

Despite the options available, critics note that performance issues and glitches may hinder user experience.

Tools available for trading include charting capabilities and various analytical tools. However, users have expressed concerns about the usability and intuitiveness of these tools.

Feedback on the user interface indicates that while some features are advanced and useful, there are reports of occasional glitches that disrupt trading.

"The platform has great potential, but it often fails when I need it the most." - User Review.

User Experience Analysis

1. Navigational Structure

The website and trading platform could be better organized. Users report confusion when trying to navigate through the various options.

Users have noted that system slowdowns can affect trading ability during peak hours, leading to dissatisfaction and frustration.

A mixed bag of online reviews indicates a struggling user experience overall, creating doubt about the broker's operational infrastructure.

Customer Support Analysis

1. Service Responsiveness

User complaints are rampant concerning customer support, which many consider inadequate. Average response times vary significantly, with some waiting days for replies.

"I had to wait over a week for an email response, which is unacceptable." - User Feedback.

2. Available Support Channels

While Orient Securities offers email, phone support, and live chat, clients frequently report inadequate support, particularly with urgent inquiries like fund withdrawals.

Account Conditions Analysis

1. Account Availability

Orient Securities offers a range of accounts suited for different trading strategies. However, the minimum deposit requirement of $2,700 might deter some potential clients.

2. Account Type Transparency

There is a visible lack of clear information on the benefits and fees associated with various account types.

Conclusion

In conclusion, while Orient Securities presents itself as a legitimate and regulated brokerage, the numerous complaints regarding fund withdrawals and customer support issues raise substantial concerns. The brokerage offers a diverse portfolio and a variety of trading tools, but potential users must be aware of the risks associated with its services. Careful consideration and due diligence are paramount for anyone contemplating opening an account with Orient Securities.

Potential users are strongly advised to proceed with caution, given the FAQ below:

Q: Is Orient Securities a legitimate company?A: Yes, it is regulated under the Hong Kong Securities and Futures Commission, but complaints regarding withdrawals persist.

Q: What types of market instruments does it offer?A: Orient Securities provides access to equities, derivatives, and structured products.

Q: What should I be cautious about when trading?A: Be aware of potential withdrawal difficulties and customer support challenges that previous users have highlighted.

By thoroughly researching and understanding the landscape, traders can make informed decisions about whether Orient Securities aligns with their trading needs and risk tolerance.