Regarding the legitimacy of Profitlevel forex brokers, it provides CYSEC and WikiBit, (also has a graphic survey regarding security).

Is Profitlevel safe?

Pros

Cons

Is Profitlevel markets regulated?

The regulatory license is the strongest proof.

CYSEC Forex Execution License (STP) 19

Cyprus Securities and Exchange Commission

Cyprus Securities and Exchange Commission

Current Status:

RegulatedLicense Type:

Forex Execution License (STP)

Licensed Entity:

BCM Begin Capital Markets CY Ltd

Effective Date:

2015-04-23Email Address of Licensed Institution:

info@begicapitalmarkets.comSharing Status:

Website of Licensed Institution:

www.profitlevel.com, www.capitalpanda.com, www.begincapitalmarkets.comExpiration Time:

--Address of Licensed Institution:

2, Filiou Zannetou, Ground Floor, Office 1, 3021 Limassol, CyprusPhone Number of Licensed Institution:

+357 25 030 565Licensed Institution Certified Documents:

Is Profitlevel A Scam?

Introduction

Profitlevel is a forex broker that positions itself as a provider of trading services for both novice and experienced traders. Operating primarily in the competitive landscape of forex and CFD trading, it claims to offer a wide array of trading instruments, including currency pairs, commodities, and indices. However, as with any financial service provider, potential traders must exercise caution and conduct thorough evaluations before committing their funds. The forex market is fraught with risks, and choosing the right broker is crucial for safeguarding investments and ensuring a positive trading experience. This article aims to provide a comprehensive analysis of Profitlevel, examining its regulatory status, company background, trading conditions, customer experience, and overall safety. The assessment is based on a review of multiple sources, including user feedback, regulatory reports, and industry analyses.

Regulation and Legitimacy

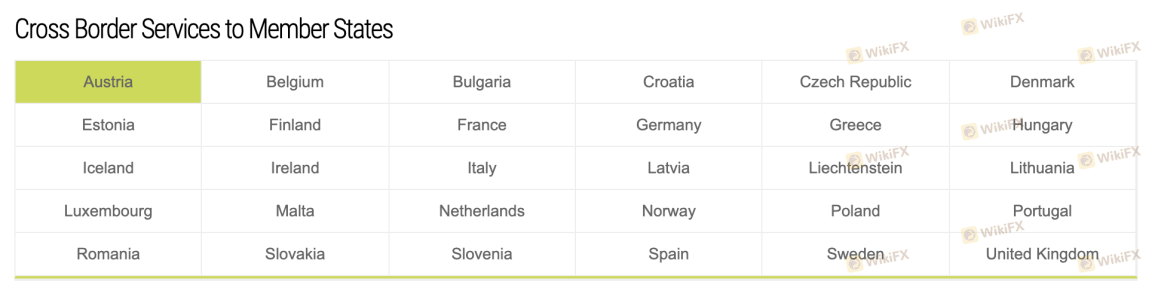

Understanding the regulatory framework surrounding a broker is vital for assessing its legitimacy. Profitlevel claims to be regulated by the Cyprus Securities and Exchange Commission (CySEC), which is a well-known regulatory body in the European Union. However, the effectiveness and reliability of this regulation are often debated, particularly given the prevalence of unregulated brokers operating in the same region.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| CySEC | 274/15 | Cyprus | Verified |

While CySEC is recognized as a reputable regulator, it is often classified as a Tier 2 regulator, which means that it may not enforce regulations as stringently as Tier 1 regulators. This raises concerns regarding the overall safety of funds held with Profitlevel. Additionally, there have been reports of the parent company, BCM Begin Capital Markets Ltd, being linked to other brokers with questionable reputations. Given these factors, it is essential to scrutinize the regulatory claims made by Profitlevel and consider the implications of trading with a broker that operates under such circumstances.

Company Background Investigation

Profitlevel is operated by BCM Begin Capital Markets Ltd, a company founded in 2015 and headquartered in Limassol, Cyprus. The company has undergone several name changes, which can be a red flag for potential investors. The management team behind Profitlevel has not been extensively detailed in available resources, leading to concerns about transparency and accountability. A lack of information regarding the team can hinder trust, as traders may feel uncertain about the expertise and experience of those managing their funds.

The company's history is relatively short, and its rapid growth raises questions about its stability and long-term viability. The opacity in ownership and management details further complicates the evaluation of Profitlevel's reliability. In an industry where trust is paramount, the absence of clear information about the management team can deter potential clients from engaging with the broker.

Trading Conditions Analysis

When assessing whether Profitlevel is safe, it is crucial to examine its trading conditions, including fees and commissions. The broker offers various account types, each with different minimum deposit requirements and associated costs. However, many reviews highlight that the overall fee structure is relatively high compared to industry standards.

| Fee Type | Profitlevel | Industry Average |

|---|---|---|

| Spread on Major Currency Pairs | 3.0 pips | 1.0 - 1.5 pips |

| Commission Model | None | Varies |

| Overnight Interest Range | High | Moderate |

The spreads offered by Profitlevel are significantly higher than the industry average, which could negatively impact trading profitability. Additionally, the lack of a transparent commission structure raises concerns about hidden fees that could be levied on trades. These factors contribute to the overall perception of Profitlevel as a potentially costly trading option, prompting traders to weigh their choices carefully.

Customer Funds Safety

The safety of customer funds is a critical aspect when evaluating any broker. Profitlevel claims to implement several measures to ensure the security of client deposits, including segregated accounts for holding customer funds. This practice is essential as it protects traders' money in case of the broker's insolvency. Furthermore, Profitlevel asserts that it complies with anti-money laundering (AML) regulations, which is crucial for maintaining a secure trading environment.

However, there have been concerns regarding the effectiveness of these measures. Reports of clients experiencing difficulties in withdrawing funds have surfaced, raising questions about the broker's operational integrity. The absence of a robust investor protection scheme, such as that provided by the Financial Services Compensation Scheme (FSCS) in the UK, may leave clients vulnerable in case of financial disputes.

Customer Experience and Complaints

Analyzing customer feedback is vital for understanding the overall reputation of Profitlevel. While some users report satisfactory experiences, a significant number of complaints have emerged, particularly regarding withdrawal issues and the quality of customer support. Common complaints include delays in processing withdrawals, lack of transparency, and unresponsive customer service.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Slow response |

| Lack of Transparency | Medium | Inadequate |

| Customer Support Issues | High | Unresponsive |

One notable case involved a trader who reported being unable to withdraw their funds for several months, leading to frustration and distrust in the broker. Such experiences can severely impact the broker's credibility and raise alarms about whether Profitlevel is safe for potential investors.

Platform and Trade Execution

The trading platform offered by Profitlevel is MetaTrader 5 (MT5), a widely recognized and respected trading platform known for its advanced features and user-friendly interface. However, the performance of the platform, including order execution quality and slippage rates, has been a point of contention among users. Some traders have reported issues with order execution, including delays and rejections, which can significantly impact trading outcomes.

While the platform itself is robust, the overall user experience may be hindered by these execution issues. Traders need to be cautious and consider these factors when deciding if Profitlevel is a safe trading partner.

Risk Assessment

Using Profitlevel comes with inherent risks that potential traders must acknowledge. The combination of high spreads, withdrawal issues, and a lack of transparency raises concerns about the broker's overall reliability.

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Compliance | Medium | CySEC regulation, but questionable practices |

| Fund Safety | High | Reports of withdrawal issues |

| Customer Support | High | Frequent complaints about responsiveness |

To mitigate these risks, traders should conduct thorough research, consider starting with a demo account, and only invest amounts they can afford to lose.

Conclusion and Recommendations

In conclusion, the evidence suggests that potential traders should approach Profitlevel with caution. While it is regulated by CySEC, the broker's history, customer feedback, and trading conditions raise significant concerns about its trustworthiness. Is Profitlevel safe? The answer is not straightforward, as the broker exhibits several red flags that warrant careful consideration.

For traders seeking a reliable forex broker, it may be prudent to explore alternatives that offer better regulatory oversight, transparent fee structures, and a proven track record of positive customer experiences. Brokers such as IG, OANDA, or Forex.com may provide safer trading environments with more robust customer support and lower trading costs. Ultimately, making an informed decision is crucial for safeguarding investments in the volatile forex market.

Is Profitlevel a scam, or is it legit?

The latest exposure and evaluation content of Profitlevel brokers.

Profitlevel Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Profitlevel latest industry rating score is 1.64, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.64 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.