Is NeithFX safe?

Business

License

Is NeithFX Safe or a Scam?

Introduction

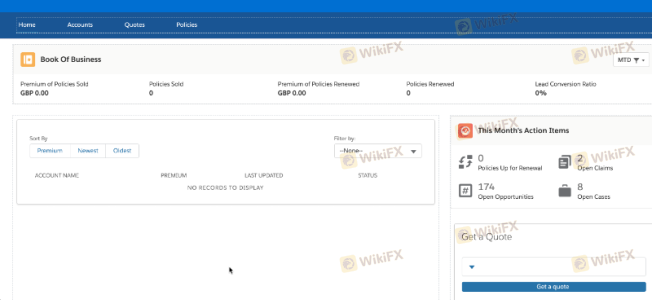

NeithFX is an online trading platform that positions itself as a sophisticated brokerage catering to both novice and experienced traders in the forex market. With promises of a diverse range of financial assets, including forex, commodities, and cryptocurrencies, it aims to attract a wide spectrum of investors. However, in an environment rife with fraudulent schemes, it is crucial for traders to assess the legitimacy and safety of any broker before committing their funds. This article employs a comprehensive investigation framework, analyzing NeithFX's regulatory status, company background, trading conditions, and customer experiences to determine whether it is a safe investment or a potential scam.

Regulation and Legitimacy

Understanding the regulatory landscape is essential for evaluating any trading platform. Regulation serves as a safeguard for investors, ensuring that brokers adhere to strict operational standards and providing a framework for accountability. In the case of NeithFX, it operates as an unregulated entity, lacking oversight from recognized financial authorities such as the Financial Conduct Authority (FCA) or the Australian Securities and Investments Commission (ASIC). This absence of regulation raises significant concerns about the platform's credibility and operational practices.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Unregulated |

The lack of a valid regulatory license means that NeithFX is not subject to the same scrutiny as regulated brokers, which can lead to unethical practices and potential financial mismanagement. Investors are advised to approach unregulated platforms with extreme caution, as they often lack the necessary protections that come with regulatory oversight.

Company Background Investigation

NeithFX is operated by Neith Capital Limited, which claims to provide a wide array of trading services. However, details about the company's history, ownership structure, and management team are scant. The absence of transparent information regarding the company's establishment and operational history raises red flags. A credible broker typically offers clear insights into its background, including the qualifications and experiences of its management team.

Furthermore, the overall transparency of NeithFX is questionable. A reliable brokerage should provide comprehensive information about its operations, fee structures, and risk disclosures. In this case, potential investors may find themselves entering into a financial relationship without a complete understanding of who they are dealing with, which can lead to significant risks.

Trading Conditions Analysis

When evaluating a broker, it is crucial to examine their trading conditions, including fees and costs associated with trading. NeithFX offers a variety of financial products, but its fee structure has raised concerns among users. Reports indicate that traders may face unexpected fees and unfavorable trading conditions, which are common indicators of a less-than-reputable broker.

| Fee Type | NeithFX | Industry Average |

|---|---|---|

| Major Currency Pair Spread | High | Low |

| Commission Structure | Unclear | Standard |

| Overnight Interest Range | Unfavorable | Competitive |

The high spreads and unclear commission policies may significantly impact a trader's profitability, making it essential for potential clients to fully understand these costs before investing. Moreover, the lack of clarity in the fee structure can be a tactic used by fraudulent firms to obscure their true costs, further emphasizing the need for caution when considering NeithFX.

Client Fund Security

The safety of client funds is a paramount concern for any investor. NeithFX's lack of regulation means that there are no guarantees regarding the protection of client deposits. Regulated brokers are typically required to segregate client funds, ensuring that they are kept separate from the broker's operational funds, and often participate in compensation schemes that protect investors in the event of insolvency.

Unfortunately, NeithFX does not appear to offer such protections, which raises significant concerns about the safety of funds deposited with the broker. Additionally, the absence of negative balance protection means that traders could potentially lose more than their initial investment, exposing them to further financial risk.

Customer Experience and Complaints

Analyzing customer feedback is critical for assessing the reliability of a broker. A review of user experiences with NeithFX reveals a pattern of complaints, particularly regarding withdrawal issues and unresponsive customer support. Many users report difficulties in withdrawing their funds, which is a common red flag for potential scams.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Poor |

| Unresponsive Support | High | Poor |

| Misleading Marketing | Medium | Poor |

Typical complaints include unexplained delays in processing withdrawals and demands for additional fees before funds can be released. These issues indicate a lack of transparency and accountability, which are essential qualities for any trustworthy broker. Potential investors should be wary of these patterns and consider the implications of choosing a broker with such a problematic track record.

Platform and Trade Execution

The performance of a trading platform is another crucial factor in assessing a broker's reliability. NeithFX claims to provide a user-friendly trading platform; however, reports from users suggest issues with execution quality, including slippage and order rejections. Such problems can significantly affect trading outcomes, particularly for those employing high-frequency trading strategies.

Furthermore, any signs of platform manipulation, such as consistently unfavorable execution prices, should raise concerns about the broker's integrity. Traders should ensure that they have access to a stable and reliable platform that allows for fair trading conditions.

Risk Assessment

Using NeithFX involves inherent risks that potential investors should carefully consider. The following risk assessment summarizes key areas of concern:

| Risk Category | Risk Level | Brief Description |

|---|---|---|

| Regulatory Risk | High | Unregulated status exposes investors to potential fraud. |

| Financial Risk | High | Lack of fund protection increases the risk of total loss. |

| Operational Risk | Medium | Complaints about withdrawal issues and platform reliability. |

To mitigate these risks, investors should conduct thorough due diligence, seek alternatives with robust regulatory oversight, and consider starting with a small investment until they are confident in the broker's reliability.

Conclusion and Recommendations

In conclusion, the evidence suggests that NeithFX is not a safe option for trading. The lack of regulatory oversight, combined with a history of customer complaints and questionable trading conditions, raises significant concerns about its legitimacy. Potential investors should be extremely cautious and consider seeking alternatives that are regulated and have a proven track record of reliability.

For traders seeking safer options, it is advisable to explore well-regulated brokers with transparent practices, strong customer support, and a solid reputation in the industry. By prioritizing safety and due diligence, traders can protect their investments and minimize risks associated with online trading.

Is NeithFX a scam, or is it legit?

The latest exposure and evaluation content of NeithFX brokers.

NeithFX Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

NeithFX latest industry rating score is 1.34, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.34 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.