Is Monex TR safe?

Business

License

Is Monex TR Safe or a Scam?

Introduction

Monex TR is a relatively new player in the forex market, positioned as a broker offering a range of trading services. As the forex market continues to grow, the number of brokers has surged, making it essential for traders to carefully evaluate their options. The potential for scams and fraudulent activities is high, especially with unregulated brokers. This article aims to provide a comprehensive analysis of Monex TR, exploring its regulatory status, company background, trading conditions, client safety, customer experiences, and overall risks involved. The findings are based on a review of various sources, including user feedback and regulatory information.

Regulation and Legitimacy

Regulatory oversight is a crucial factor in determining the safety of any forex broker. Monex TR currently operates without regulation from any major financial authorities, which raises significant concerns regarding its legitimacy and trustworthiness. The absence of regulatory oversight means that there are no guarantees regarding the safety of traders' funds or the fairness of trading practices.

| Regulatory Body | License Number | Regulatory Area | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Not Verified |

The lack of regulation can expose traders to risks such as unfair trading conditions, potential fraud, and difficulty in resolving disputes. Furthermore, the company's history of compliance is unclear, as there are no records of regulatory oversight that would typically ensure adherence to industry standards. In summary, the question of "Is Monex TR safe?" remains unanswered due to its unregulated status, making it a risky choice for traders.

Company Background Investigation

Monex TR has a brief history, reportedly established within the last 2-5 years. However, detailed information about its ownership structure and management team is limited. This lack of transparency is concerning, as it raises questions about the accountability of the company's leadership.

The management team's background and professional experience are critical indicators of a company's reliability. Unfortunately, Monex TR does not provide sufficient information regarding its executives, which further diminishes its credibility. Transparency in operations and information disclosure is vital for building trust with clients. Given that Monex TR lacks a clear history or established reputation in the forex market, potential clients should exercise caution when considering this broker.

Trading Conditions Analysis

An essential aspect of evaluating a forex broker is understanding its trading conditions, including fees and spreads. Monex TR's overall fee structure is not clearly defined, which can be a red flag for traders. Unusual or hidden fees can significantly impact trading profitability.

| Fee Type | Monex TR | Industry Average |

|---|---|---|

| Major Currency Pair Spread | N/A | Varies (1-3 pips) |

| Commission Model | N/A | Varies (0-10 USD per lot) |

| Overnight Interest Range | N/A | Varies (0.5% - 2%) |

The lack of specified spreads and commissions raises questions about the broker's transparency and fairness. Traders are encouraged to inquire directly with Monex TR regarding any potential fees before engaging in trading activities. The absence of clear information on trading costs may indicate a lack of professionalism, making it difficult for traders to assess the true cost of trading with this broker.

Client Funds Safety

The safety of client funds is a paramount concern when choosing a forex broker. Monex TR has not disclosed sufficient information regarding its fund safety measures, which is a significant concern for potential clients.

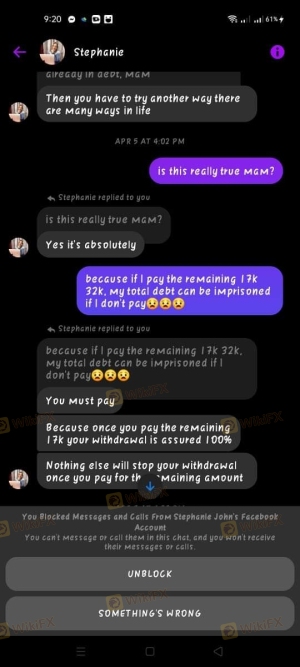

Key aspects of fund safety include the segregation of client funds, investor protection mechanisms, and policies regarding negative balance protection. Without clear policies in these areas, traders may find themselves at risk of losing their entire investment. Furthermore, there have been reports of clients experiencing difficulties with fund withdrawals, which raises additional alarms about the broker's reliability.

In conclusion, the question "Is Monex TR safe?" leans towards the negative due to the lack of transparency and security measures regarding client funds.

Customer Experience and Complaints

The user experience with Monex TR appears to be mixed, with some clients expressing satisfaction while others report significant issues. Customer feedback is a crucial indicator of a broker's reliability and service quality.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow Response |

| Lack of Transparency | Medium | Minimal Response |

| Poor Customer Support | High | Inconsistent |

Common complaints include difficulties in withdrawing funds, lack of transparency regarding fees, and inadequate customer support. One notable case involved a client who reported substantial delays in fund withdrawals, leading to frustration and distrust towards the broker. Such experiences highlight the need for potential clients to exercise caution and conduct thorough research before engaging with Monex TR.

Platform and Trade Execution

The performance and reliability of a trading platform are critical for successful trading. Monex TR's platform has not been extensively reviewed, leading to uncertainty regarding its stability and user experience.

Key factors to consider include order execution quality, slippage, and the frequency of rejected orders. Traders have reported varying experiences, with some noting satisfactory execution while others encountered issues. The absence of detailed performance metrics raises concerns about the platform's reliability and efficiency.

In summary, traders should be cautious when considering Monex TR as their trading platform, as the lack of information regarding execution quality and platform stability poses potential risks.

Risk Assessment

Engaging with Monex TR carries several risks that potential clients should be aware of.

| Risk Category | Risk Level | Brief Description |

|---|---|---|

| Regulatory Risk | High | Unregulated status raises concerns about legitimacy. |

| Fund Safety Risk | High | Lack of transparency regarding fund protection measures. |

| Customer Support Risk | Medium | Mixed feedback on service quality and responsiveness. |

Given these risks, traders should be prepared for the possibility of encountering challenges and should consider implementing risk mitigation strategies, such as starting with a minimal investment or using demo accounts to test the platform.

Conclusion and Recommendations

In conclusion, the evidence suggests that Monex TR may not be a safe choice for traders. The lack of regulation, transparency issues, and mixed customer feedback raise significant concerns about the broker's legitimacy and reliability.

For traders considering Monex TR, it is crucial to weigh the potential risks against the benefits carefully. If you are a beginner or risk-averse trader, it may be wise to explore alternative options with established, regulated brokers. Recommended alternatives include brokers with strong regulatory oversight, transparent fee structures, and positive customer feedback.

Ultimately, the question "Is Monex TR safe?" leans towards the negative, and potential clients should proceed with caution.

Is Monex TR a scam, or is it legit?

The latest exposure and evaluation content of Monex TR brokers.

Monex TR Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Monex TR latest industry rating score is 1.51, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.51 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.