Is MINTCFD safe?

Pros

Cons

Is MintCFD A Scam?

Introduction

MintCFD is an online trading platform that has positioned itself in the forex and CFD (Contracts for Difference) markets, claiming to offer a user-friendly experience for both novice and experienced traders. The platform promotes itself as a provider of a wide variety of trading instruments, including forex, commodities, stocks, and cryptocurrencies, with features like zero commission trading and high leverage options. However, the rise of online trading platforms has also led to an increase in fraudulent activities, making it vital for traders to carefully evaluate the legitimacy of brokers before investing their hard-earned money. This article aims to provide a comprehensive analysis of MintCFD, focusing on its regulatory status, company background, trading conditions, customer safety, user experiences, and overall risk assessment. The evaluation is based on a review of multiple sources, including user feedback, regulatory information, and industry reports.

Regulation and Legitimacy

The regulatory framework under which a trading platform operates is a critical factor in determining its legitimacy. Regulated brokers are subject to strict oversight, which helps protect investors from fraud. Unfortunately, MintCFD lacks any valid regulatory licenses from recognized authorities. This absence of regulation raises significant red flags for potential investors.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Not Verified |

The lack of oversight means that MintCFD operates in a high-risk environment where it can easily alter its terms and conditions without accountability. Regulated brokers typically provide investor protection measures, such as segregated accounts and compensation schemes. In contrast, MintCFD's unregulated status leaves clients vulnerable to potential losses, as there are no legal recourses available should the platform engage in fraudulent activities. Furthermore, historical compliance issues have been reported, with many users expressing concerns about the platform's transparency and operational integrity.

Company Background Investigation

MintCFD's company background is shrouded in ambiguity. The platform's ownership and management details are not readily available, which is a common trait among many fraudulent brokers. A thorough investigation reveals that MintCFD appears to be operated by an anonymous group, further complicating efforts to assess its legitimacy. The absence of clear information about the management team and their qualifications raises questions about the platform's operational transparency.

Moreover, potential investors should be wary of platforms that do not disclose their physical office locations. This lack of transparency can be indicative of a broker that is attempting to evade regulatory scrutiny and accountability. In the financial services industry, transparency is crucial for building trust, and the failure of MintCFD to provide this information is a significant concern for potential investors.

Trading Conditions Analysis

MintCFD claims to offer competitive trading conditions, including zero commission trading and high leverage options. However, an in-depth analysis of the fee structure reveals potential discrepancies that could be problematic for traders.

| Fee Type | MintCFD | Industry Average |

|---|---|---|

| Spread on Major Currency Pairs | Variable | 1.0 - 2.0 pips |

| Commission Structure | None | Varies (0-10 USD) |

| Overnight Interest Range | High | 2.0 - 5.0% |

While the allure of zero commissions may attract traders, it is essential to consider the spread and other hidden fees that may apply. Many traders have reported experiencing high spreads, especially during volatile market conditions, which can significantly impact profitability. Additionally, the platform's overnight interest rates have been flagged as unusually high, which could lead to substantial costs for traders holding positions overnight. This combination of hidden fees and potentially unfavorable trading conditions raises concerns about the overall cost-effectiveness of using MintCFD.

Customer Funds Safety

The safety of client funds is paramount when choosing a trading platform. MintCFD has been criticized for its lack of effective security measures to protect client funds. The platform does not appear to utilize segregated accounts, which means that client funds may not be kept separate from the company's operational funds. This lack of segregation poses a significant risk, as clients could lose their funds in the event of the company's insolvency.

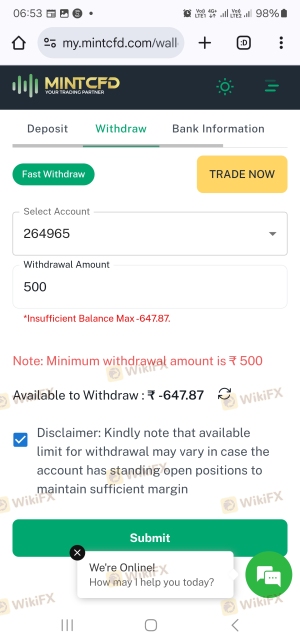

Furthermore, MintCFD does not provide any investor protection schemes, which are typically offered by regulated brokers. This absence of protection leaves clients vulnerable to potential losses without any recourse. Historical issues regarding fund withdrawals have also been reported, with many users expressing frustration over their inability to access their funds. These concerns highlight the importance of conducting thorough research into a broker's safety measures before committing any capital.

Customer Experience and Complaints

Customer feedback is a crucial aspect of assessing a trading platform's reliability. MintCFD has received a considerable amount of negative reviews, with many users reporting unsatisfactory experiences. Common complaints include difficulties in withdrawing funds, aggressive sales tactics from customer service representatives, and poor overall communication from the company.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Inconsistent |

| High-pressure Sales Tactics | Medium | Poor |

| Customer Support Quality | High | Lacking |

Users have reported that once they deposit funds, the customer support team becomes unresponsive, making it challenging to resolve issues. In one notable case, a user reported being pressured to invest more money despite their initial concerns about the platform's legitimacy. This pattern of behavior is consistent with tactics employed by fraudulent brokers, which further underscores the need for caution when dealing with MintCFD.

Platform and Execution

The performance of a trading platform is critical for a smooth trading experience. MintCFD's platform has been described as unstable, with frequent outages and slow loading times. Users have reported issues with order execution, including slippage and rejections, which can be detrimental during high-volatility trading periods.

Moreover, there are concerns about potential platform manipulation, as some users have claimed that their trades were not executed at the prices they expected. This lack of reliability raises questions about the overall integrity of the trading environment provided by MintCFD.

Risk Assessment

Using MintCFD presents several risks that potential traders should be aware of.

| Risk Category | Risk Level | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | Unregulated status poses significant risks. |

| Fund Safety Risk | High | Lack of fund segregation and investor protection. |

| Execution Risk | Medium | Issues with order execution and platform stability. |

| Customer Service Risk | High | Poor response to customer complaints. |

To mitigate these risks, it is crucial for traders to conduct thorough due diligence before engaging with MintCFD. Potential investors should consider using regulated brokers that offer adequate protection and transparency.

Conclusion and Recommendations

In conclusion, the evidence suggests that MintCFD raises significant concerns regarding its legitimacy and operational integrity. The lack of regulation, transparency issues, and numerous negative user experiences indicate that traders should approach this platform with caution. While MintCFD may offer attractive features such as zero commissions and high leverage, the associated risks far outweigh the potential benefits.

For traders seeking a reliable and secure trading experience, it is advisable to consider regulated alternatives that provide robust investor protection and transparent operations. Platforms such as IG, OANDA, or Forex.com have established reputations in the industry and are subject to regulatory oversight, making them safer choices for trading activities. Ultimately, the safety of your funds and the quality of your trading experience should be the top priorities when selecting a broker.

Is MINTCFD a scam, or is it legit?

The latest exposure and evaluation content of MINTCFD brokers.

MINTCFD Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

MINTCFD latest industry rating score is 1.37, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.37 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.