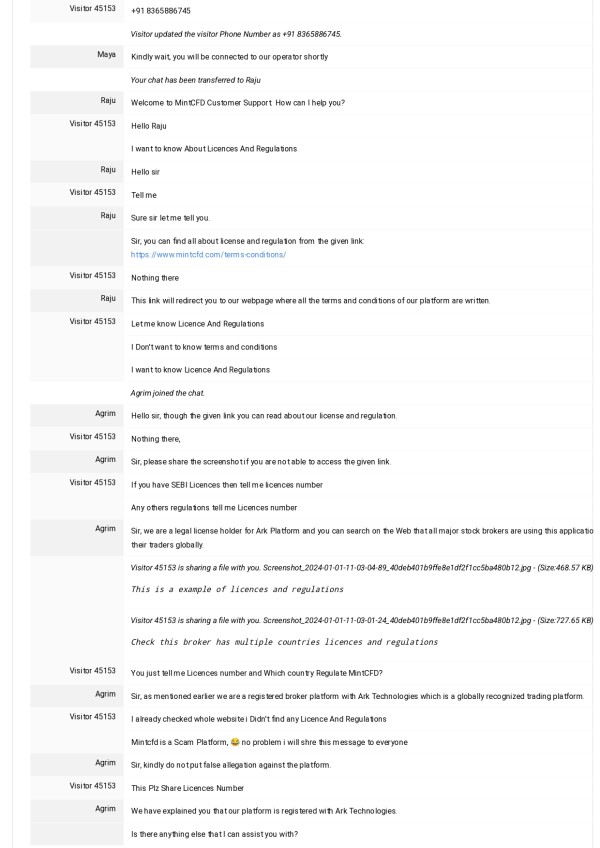

MintCFD 2025 Review: Everything You Need to Know

Executive Summary

This comprehensive mintcfd review looks at a new CFD trading platform that has appeared in the competitive forex and derivatives market. MintCFD calls itself an exclusive trading platform that focuses on Contracts for Difference (CFDs). This lets traders make money from price changes across different financial markets like stocks, indices, commodities, and cryptocurrencies.

User feedback and platform information show that MintCFD offers several good features including zero brokerage fees and leverage up to 100x. This makes it appealing to traders who want cost-effective trading solutions. The platform mainly serves beginners and intermediate traders who want to diversify their trading portfolios across multiple asset classes with low entry barriers.

However, users have mixed feelings about how reliable and trustworthy the platform is. User reviews and industry analysis show the platform gets moderate ratings. Users like the trading conditions but worry about various operational aspects. The platform entered the market recently, so long-term track record data is limited. This means potential users should be careful when evaluating the service.

MintCFD's trading setup includes both web-based and mobile trading applications. This gives flexibility to traders who prefer different trading environments. The platform focuses on the Indian market and offers competitive trading terms. This suggests an attempt to capture market share in the rapidly growing retail trading sector.

Important Disclaimers

This mintcfd review uses publicly available information, user feedback, and platform details collected from various sources as of early 2025. MintCFD's regulatory information has not been clearly specified in available materials. Potential users should independently verify the platform's compliance status in their jurisdictions before engaging in any trading activities.

The evaluation presented here does not constitute investment advice or a recommendation to use or avoid this trading platform. All trading involves substantial risk of loss. Past performance does not guarantee future results. Readers should conduct their own research and consider their financial situation and risk tolerance before making any trading decisions.

Cross-regional regulatory differences may apply, and services may vary depending on the user's location. This review reflects information available at the time of writing. It may not reflect subsequent changes to the platform's services, terms, or regulatory status.

Rating Framework

Broker Overview

MintCFD operates as a specialized CFD trading platform headquartered in India. It focuses on providing transparent trading environments for retail traders. The company emphasizes its commitment to offering trading services without hidden fees. This positions it as a cost-effective solution for traders seeking exposure to multiple financial markets through a single platform interface.

The platform's business model centers around providing Contract for Difference trading across various asset classes. This allows users to speculate on price movements without owning the underlying assets. This approach enables traders to potentially profit from both rising and falling markets while utilizing leverage to amplify their market exposure. The company's focus on the Indian market reflects the growing demand for accessible trading platforms in emerging markets.

MintCFD offers trading access through two primary platforms: a web-based trading interface called WebTrader and a dedicated mobile application named MintCFD trading app. These platforms provide access to multiple asset categories including foreign exchange currencies, individual stocks, various commodities, major market indices, and a selection of cryptocurrencies. The platform's emphasis on mobile accessibility aligns with the increasing trend toward mobile-first trading solutions.

The regulatory framework under which MintCFD operates has not been clearly detailed in available information. This represents a significant consideration for potential users evaluating the platform's legitimacy and oversight. This lack of transparent regulatory disclosure is particularly important for traders who prioritize regulatory protection and oversight in their broker selection process.

Regulatory Framework

Available information does not provide specific details regarding MintCFD's regulatory status or oversight by recognized financial authorities. This absence of clear regulatory disclosure represents a notable gap in transparency. Potential users should carefully consider this when evaluating the platform's suitability for their trading needs.

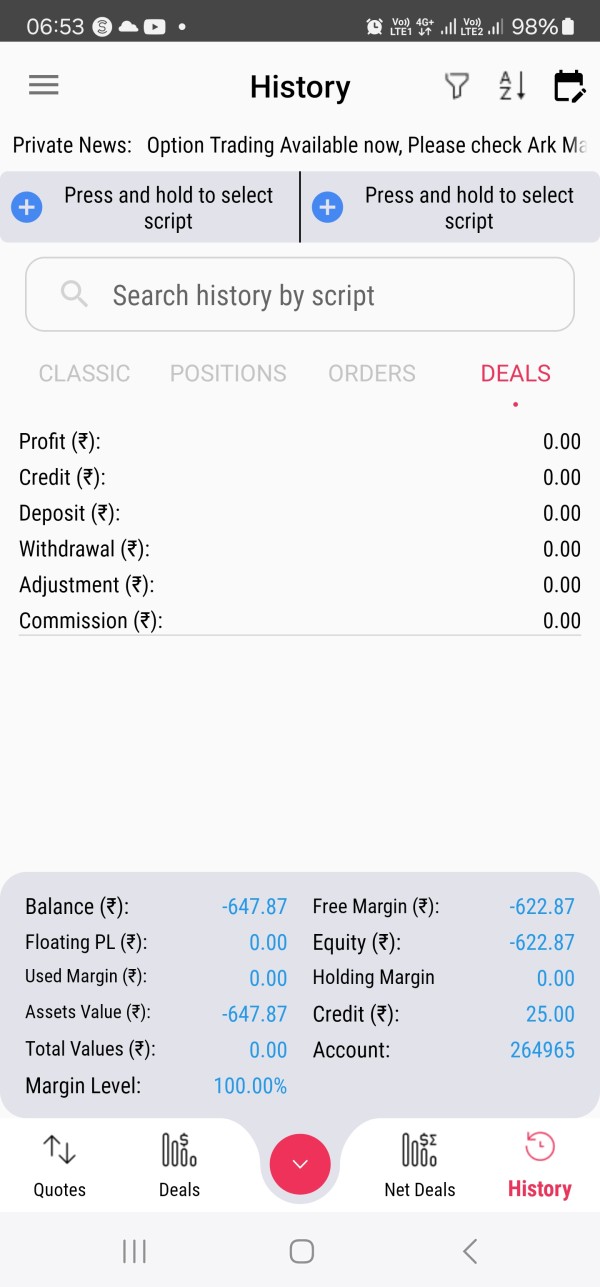

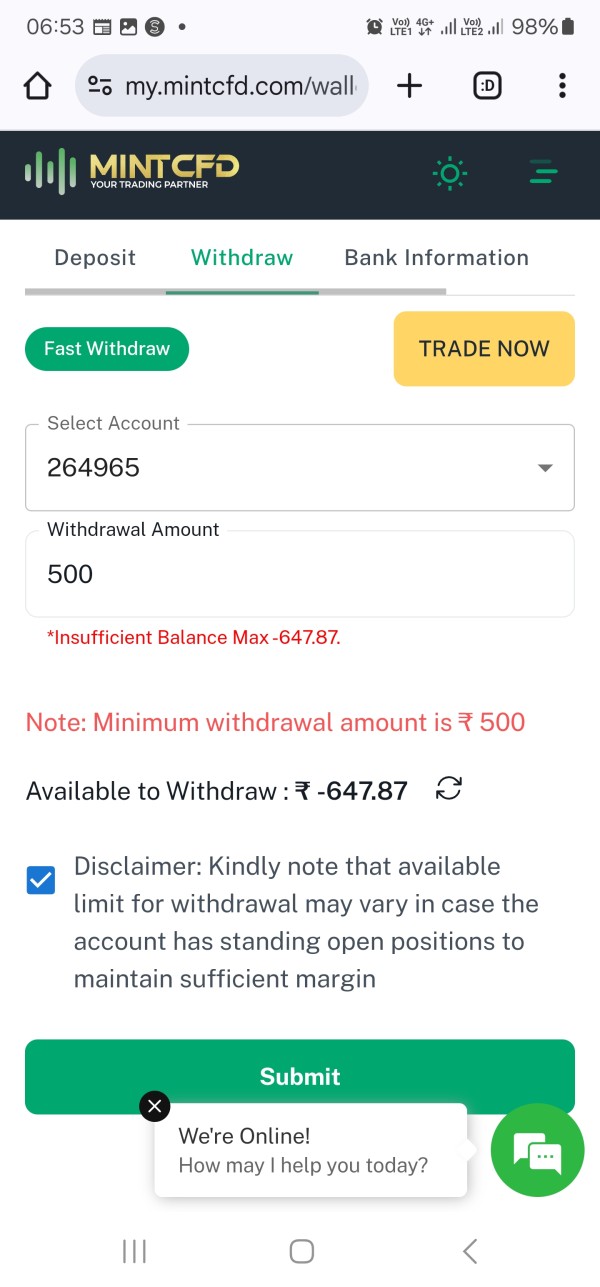

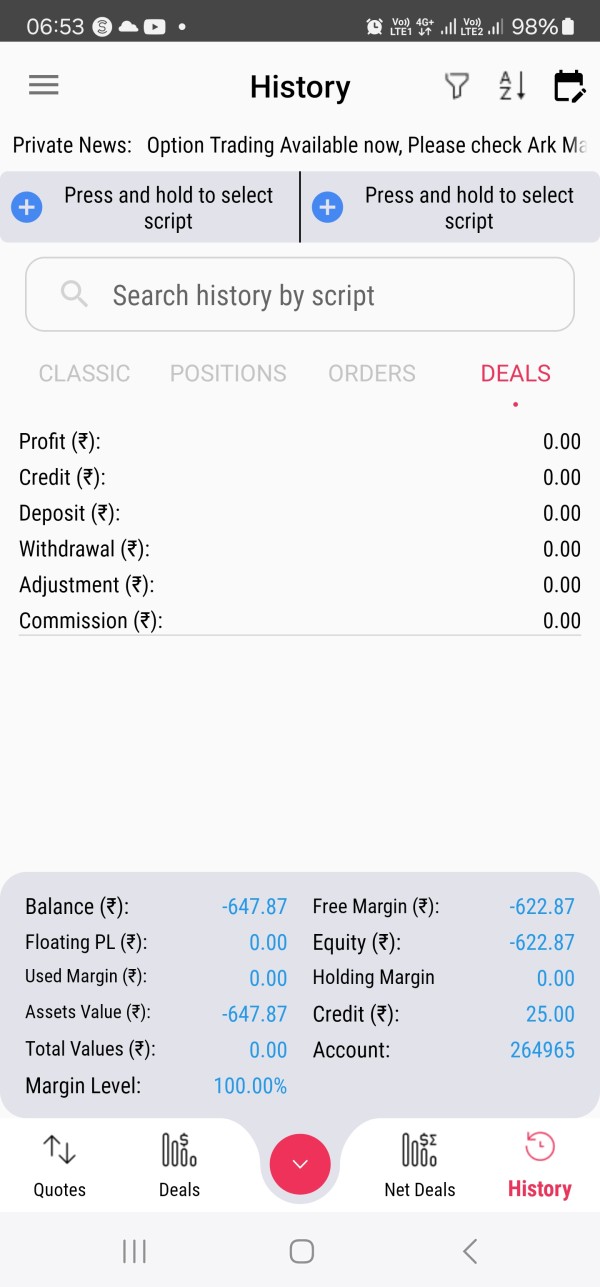

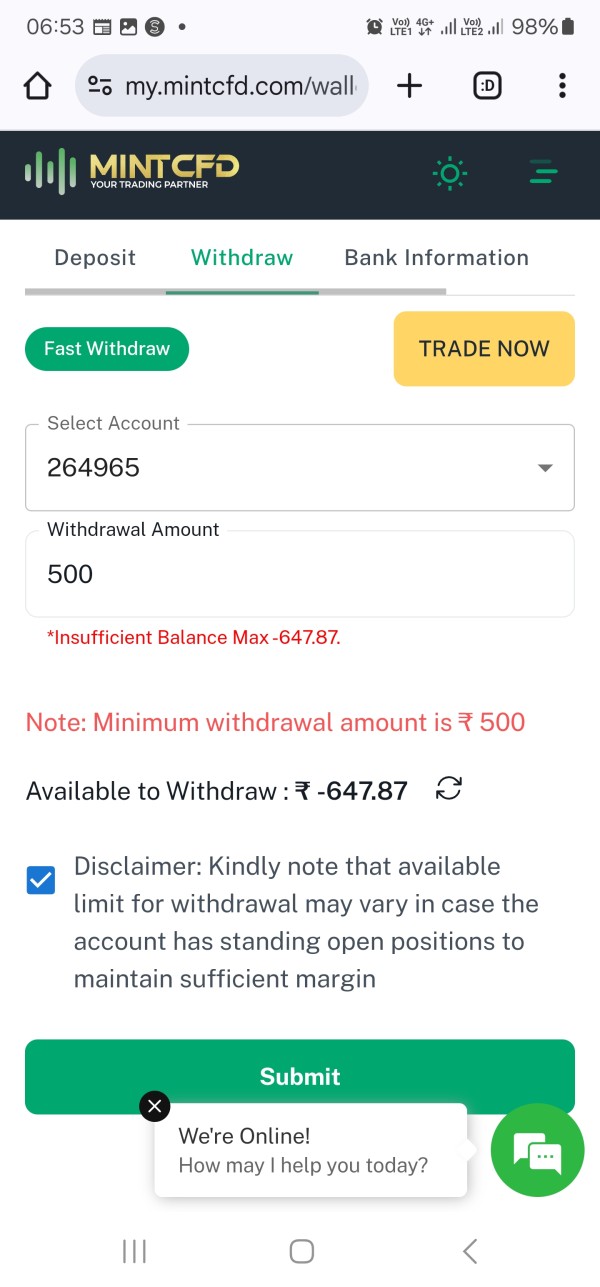

Funding Methods

Specific information regarding deposit and withdrawal methods has not been detailed in available platform documentation. Some sources mention the platform has a minimum deposit requirement as low as certain rupee amounts for Indian users. However, comprehensive funding options and processing procedures require further clarification directly from the platform.

Minimum Deposit Requirements

Some sources suggest relatively low minimum deposit requirements to accommodate beginning traders. However, specific deposit thresholds and currency options have not been comprehensively detailed in available materials.

Information regarding bonus structures, promotional campaigns, or new user incentives has not been specified in available platform documentation. This suggests either minimal promotional activity or limited disclosure of such programs.

Available Trading Instruments

MintCFD provides access to a diverse range of tradeable assets including major cryptocurrency pairs, individual equity securities, commodity futures, major global indices, and foreign exchange currency pairs. This broad asset coverage enables portfolio diversification and multiple trading strategies within a single platform environment.

Cost Structure and Fees

The platform emphasizes zero commission trading across its asset offerings. Revenue is presumably generated through spread differentials. The platform claims to offer tight spreads. However, specific spread ranges and potential additional fees have not been comprehensively disclosed in available materials.

Leverage Options

Maximum leverage ratios of up to 100:1 are advertised. This provides significant capital amplification opportunities for experienced traders. It requires careful risk management due to the associated increased loss potential.

Users can choose between the web-based WebTrader interface and the mobile MintCFD trading application. This provides flexibility for different trading preferences and situations.

Geographic Restrictions

Specific information regarding geographic limitations or restricted jurisdictions has not been detailed in available platform documentation.

Customer Support Languages

Available customer service language options have not been specifically outlined in accessible platform materials.

Detailed Rating Analysis

Account Conditions Analysis (Score: 7/10)

MintCFD's account structure appears designed to accommodate traders seeking cost-effective market access. The zero commission model represents a significant advantage for frequent traders. This mintcfd review finds that eliminating traditional commission fees can substantially reduce trading costs. This is particularly beneficial for high-volume traders who would otherwise face significant fee accumulation over time.

The platform's leverage offering of up to 100:1 provides substantial capital amplification opportunities. However, this also significantly increases risk exposure. Such high leverage ratios are particularly attractive to traders with limited capital who seek to maximize their market exposure. They require sophisticated risk management strategies to avoid substantial losses.

The lack of detailed information regarding specific account types, tier structures, or special account features represents a notable limitation. Many established brokers offer multiple account categories with varying features, minimum deposits, and service levels. The absence of clear account classification information makes it difficult for potential users to understand exactly what services and features they can expect.

User feedback regarding account conditions appears mixed. Some traders express satisfaction with the cost structure while others raise concerns about various operational aspects. The platform's relatively recent market entry means that comprehensive long-term user experience data remains limited. This requires potential users to exercise appropriate caution when evaluating account suitability.

The platform's comprehensive asset coverage represents one of its strongest features. It provides traders access to multiple market categories through a single interface. The ability to trade cryptocurrencies, stocks, commodities, indices, and forex pairs within one platform eliminates the need for multiple broker relationships. This can simplify portfolio management and monitoring.

MintCFD claims to provide advanced trading tools, though specific details regarding analytical capabilities, charting features, and technical indicators have not been comprehensively documented. Modern traders typically expect sophisticated charting packages, multiple timeframe analysis, and comprehensive technical indicator libraries as standard platform features.

The platform's focus on providing tools suitable for multiple asset classes suggests a comprehensive approach to trader needs. However, the actual quality and sophistication of these tools require direct evaluation. User feedback regarding tool effectiveness and reliability appears varied. Some users express satisfaction while others indicate room for improvement.

Educational resources and market analysis capabilities have not been detailed in available platform information. This represents a potential limitation for traders who rely on broker-provided research and educational content to support their trading decisions.

Customer Service and Support Analysis (Score: 6/10)

MintCFD advertises 24-hour customer support availability. This represents a positive feature for traders who may need assistance outside traditional business hours or across different time zones. User feedback suggests that actual service quality and response times may not consistently meet expectations.

User reports indicate that customer service response times can be slower than desired. The quality of problem resolution appears inconsistent. These service quality issues can be particularly problematic for active traders who require prompt assistance with account or trading issues that could impact their market positions.

The specific channels available for customer contact have not been comprehensively detailed in available materials. These include phone support, email, live chat, or support ticket systems. Modern traders typically expect multiple contact options and prefer real-time communication channels for urgent issues.

Multi-language support capabilities and the availability of local language assistance for different geographic markets have not been specified. This could limit accessibility for non-English speaking users or those who prefer support in their native language.

Trading Experience Analysis (Score: 7/10)

Platform stability and execution quality represent critical factors for trading success. User feedback regarding MintCFD's performance in these areas appears mixed. Some users report satisfactory trading experiences. Others indicate concerns about platform reliability and order execution consistency.

The availability of both web-based and mobile trading platforms provides flexibility for different trading styles and situations. However, the actual performance, feature completeness, and reliability of these platforms require direct evaluation. User experiences appear to vary significantly.

The platform claims to offer competitive spreads across various asset classes. However, specific spread ranges and their stability during different market conditions have not been comprehensively documented. Spread consistency during volatile market periods is particularly important for traders who rely on predictable trading costs.

Some user reports suggest potential issues with slippage and execution quality. This could impact trading profitability and overall user satisfaction. These execution-related concerns are particularly significant for active traders and scalping strategies where precise order execution is critical.

This mintcfd review notes that platform performance feedback varies considerably among users. This suggests that individual experiences may depend on factors such as trading style, market conditions, and specific platform usage patterns.

Trust and Reliability Analysis (Score: 5/10)

The absence of clear regulatory disclosure represents the most significant concern regarding MintCFD's trustworthiness and reliability. Regulatory oversight provides important protections for traders. These include segregated client funds, compensation schemes, and standardized operational requirements that help ensure fair treatment.

User sentiment regarding platform trustworthiness appears notably mixed. Some users express satisfaction while others raise concerns about potential risks. The platform's relatively recent market entry means that long-term track record data remains limited. This makes it difficult to assess historical reliability and stability.

Information regarding client fund protection measures has not been detailed in available materials. These measures include segregated accounts, insurance coverage, or compensation schemes. These protections are typically considered essential features for reputable trading platforms. Their absence raises important questions about client asset security.

The platform's transparency regarding company ownership, financial backing, and operational history appears limited based on available information. Established brokers typically provide comprehensive corporate information and financial disclosures to demonstrate their stability and legitimacy.

Third-party verification of platform claims and independent audits of operational procedures have not been documented. This limits the ability to independently verify platform representations and operational standards.

User Experience Analysis (Score: 6/10)

Overall user satisfaction levels appear moderate based on available feedback. Users express both positive and negative experiences across different aspects of the platform. The diversity of user opinions suggests that individual experiences may vary significantly based on specific usage patterns and expectations.

Platform interface design and usability have received mixed feedback. Some users find the platforms accessible while others suggest room for improvement. Modern trading platforms are expected to provide intuitive interfaces that accommodate both beginner and advanced users effectively.

The account registration and verification processes have not been comprehensively detailed in available information. Some sources suggest relatively straightforward onboarding procedures. Efficient account opening processes are important for user satisfaction. This is particularly true in competitive markets where users have multiple platform options.

Funding and withdrawal experiences represent critical aspects of user satisfaction. However, specific user feedback regarding these processes has not been extensively documented. Transaction processing times, fee structures, and procedural efficiency significantly impact overall user experience.

Common user concerns appear to center around platform reliability, customer service quality, and transparency issues. These concerns are consistent with the platform's relatively recent market entry and limited regulatory disclosure. This suggests that user confidence may improve with increased operational transparency and regulatory clarity.

Conclusion

This comprehensive mintcfd review reveals a trading platform that offers competitive trading conditions, including zero commission structures and high leverage ratios. However, it faces significant challenges regarding transparency and user confidence. MintCFD's cost-effective trading terms and diverse asset offerings present attractive features for cost-conscious traders. The platform's limited regulatory disclosure and mixed user feedback require careful consideration.

The platform appears most suitable for beginner to intermediate traders who prioritize low-cost trading access and are comfortable with moderate risk levels. However, traders who prioritize regulatory oversight, established track records, and comprehensive customer support may find the platform's current offering insufficient for their needs.

Key advantages include the zero commission structure, high leverage availability, and broad asset coverage. Primary concerns center on regulatory transparency, customer service consistency, and mixed user experiences. Potential users should conduct thorough due diligence and carefully consider their risk tolerance before engaging with the platform.