Is MILIGO safe?

Pros

Cons

Is Miligo Safe or a Scam?

Introduction

Miligo, operating under the name Million Yango Index Limited, positions itself as a forex broker in the competitive trading landscape, offering a range of financial instruments including forex, commodities, indices, cryptocurrencies, and stocks. However, the legitimacy of Miligo has been a topic of contention among traders and financial analysts alike. In an industry rife with scams and unregulated entities, it is crucial for traders to exercise caution and conduct thorough evaluations before engaging with any forex broker. This article aims to assess whether Miligo is a safe trading platform or a potential scam by examining its regulatory status, company background, trading conditions, customer experiences, and overall risk profile.

Regulation and Legitimacy

The regulatory framework surrounding a forex broker is fundamental to its legitimacy and the safety of its clients' funds. Miligo operates without proper regulatory oversight, which raises significant concerns regarding its trustworthiness. Below is a summary of the regulatory information related to Miligo:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | Canada | Unverified |

The absence of a regulatory license means that Miligo is not subject to the stringent standards set by reputable financial authorities. Regulatory bodies, such as the Financial Conduct Authority (FCA) in the UK or the Australian Securities and Investments Commission (ASIC), enforce rules that protect investors, such as requiring brokers to maintain segregated accounts and providing negative balance protection. The lack of these safeguards at Miligo indicates a higher risk for traders, as they may not have recourse in the event of financial disputes or broker insolvency. Additionally, the accumulation of complaints against Miligo, particularly regarding withdrawal issues and alleged fraudulent practices, further underscores the need for caution.

Company Background Investigation

Miligo was founded approximately 2 to 5 years ago, with its operations based in Canada. The company is owned by Million Yango Index Limited, but specific details regarding its ownership structure and management team remain largely undisclosed. This lack of transparency is concerning, as it complicates the ability of potential clients to assess the qualifications and credibility of those managing their funds.

While the trading platform offers various account types aimed at different market segments, including personal and business accounts, the absence of detailed information about the management team raises red flags. A well-structured company typically provides insights into its leadership, showcasing their professional experience and expertise in the financial sector. The lack of such information at Miligo may indicate a deliberate effort to obscure the company's operations, further questioning its legitimacy.

Trading Conditions Analysis

Understanding the trading conditions offered by a broker is essential for evaluating its overall value proposition. Miligo claims to provide competitive trading conditions, including a maximum leverage of 1:100 and spreads starting around 0.1% for major currency pairs. However, the absence of a minimum deposit requirement and unclear information regarding commissions and overnight interest rates may lead to unexpected costs for traders. Below is a comparison of core trading costs at Miligo:

| Cost Type | Miligo | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 0.1% | 1.0% - 1.5% |

| Commission Structure | Unclear | Varies by broker |

| Overnight Interest Range | Unspecified | 2% - 5% |

The trading cost structure appears to be atypical, particularly with respect to the lack of clarity surrounding commissions and overnight fees. This could potentially lead to hidden costs that traders are unaware of until they engage with the platform. Moreover, the lack of detailed information on trading conditions raises concerns about transparency and fairness in trading practices.

Customer Funds Security

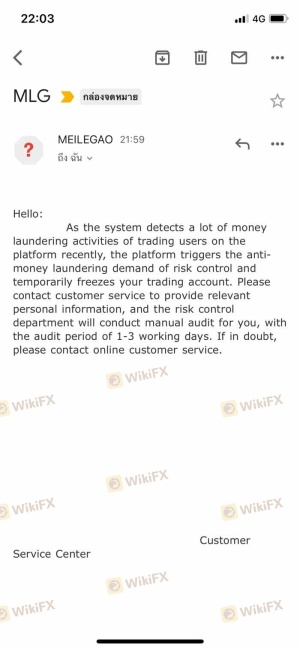

The security of customer funds is a paramount concern when choosing a forex broker. Miligo's lack of regulatory oversight means that there are no mandated protections in place for client funds. This raises significant concerns regarding the safety of deposits, as there are no guarantees that funds are held in segregated accounts or that investor protection mechanisms are in place.

Historically, many unregulated brokers have faced allegations regarding mishandling client funds, leading to significant financial losses for traders. Miligo's operational model, lacking transparency and regulatory backing, suggests that traders may be at risk of losing their investments without any legal recourse. The absence of negative balance protection further heightens this risk, as traders could potentially lose more than their initial deposits.

Customer Experience and Complaints

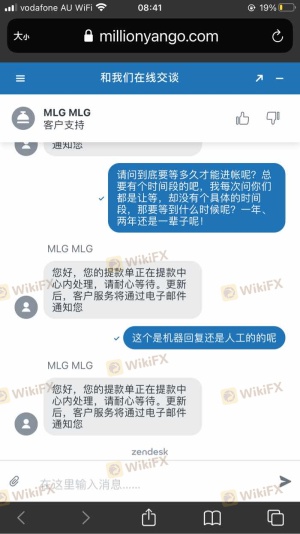

Customer feedback plays a crucial role in assessing the reliability of a broker. Reviews of Miligo on platforms like WikiFX reveal a concerning pattern of complaints, with numerous users reporting difficulties in withdrawing funds and unresponsive customer service. The following table summarizes the primary types of complaints received:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Service | Medium | Inadequate |

| Fraud Allegations | High | Unaddressed |

One notable case involved a trader who reported being unable to withdraw their profits after months of attempts, leading to frustration and accusations of fraudulent practices. Such experiences highlight the potential risks associated with trading through Miligo and suggest that many customers feel victimized by the broker's actions.

Platform and Trade Execution

The performance and reliability of a trading platform are essential for a seamless trading experience. Miligo utilizes the MetaTrader 4 platform, which is generally well-regarded in the trading community. However, reports indicate issues with order execution quality, including instances of slippage and rejected orders.

Traders have expressed concerns about the platform's stability, particularly during high-volatility market conditions. The potential for platform manipulation is also a topic of discussion, especially given the broker's lack of regulatory oversight and the numerous complaints regarding trade execution practices.

Risk Assessment

Engaging with Miligo presents a range of risks that potential traders should carefully consider. The following risk assessment summarizes key areas of concern:

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | No regulatory oversight, increasing the risk of fraud. |

| Financial Risk | High | Lack of fund protection and potential for loss of deposits. |

| Operational Risk | Medium | Issues with order execution and platform stability. |

To mitigate these risks, potential traders are advised to conduct thorough due diligence before opening an account. Engaging with regulated brokers that offer robust investor protections is a prudent strategy for safeguarding investments.

Conclusion and Recommendations

In conclusion, the evidence suggests that Miligo operates in a high-risk environment characterized by a lack of regulatory oversight and numerous complaints from dissatisfied customers. The absence of proper fund protection mechanisms and transparency raises significant concerns about the broker's legitimacy.

For traders considering engaging with Miligo, it is crucial to weigh the risks carefully and consider alternative options. Reliable brokers with established regulatory frameworks and positive customer feedback should be prioritized. Recommendations for trustworthy alternatives include brokers regulated by top-tier authorities such as the FCA or ASIC, which offer enhanced protections and a more secure trading environment.

In summary, is Miligo safe? The overwhelming evidence points to the conclusion that caution is warranted, and potential traders should be wary of the risks associated with this broker.

Is MILIGO a scam, or is it legit?

The latest exposure and evaluation content of MILIGO brokers.

MILIGO Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

MILIGO latest industry rating score is 1.53, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.53 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.