Miligo 2025 Review: Everything You Need to Know

Summary: Miligo, a broker operating under Million Yango Index Limited, has garnered significant attention due to its lack of regulatory oversight and numerous complaints from users. While it offers a variety of trading instruments and account types, its reputation is marred by allegations of fraudulent practices and inadequate customer support.

Note: It is essential to recognize that Miligo operates in various jurisdictions, and the absence of proper regulation raises significant concerns about its legitimacy. This review aims to provide a balanced view of Miligo, taking into account various sources to ensure fairness and accuracy.

Rating Overview

We rate brokers based on user feedback, expert opinions, and factual data.

Broker Overview

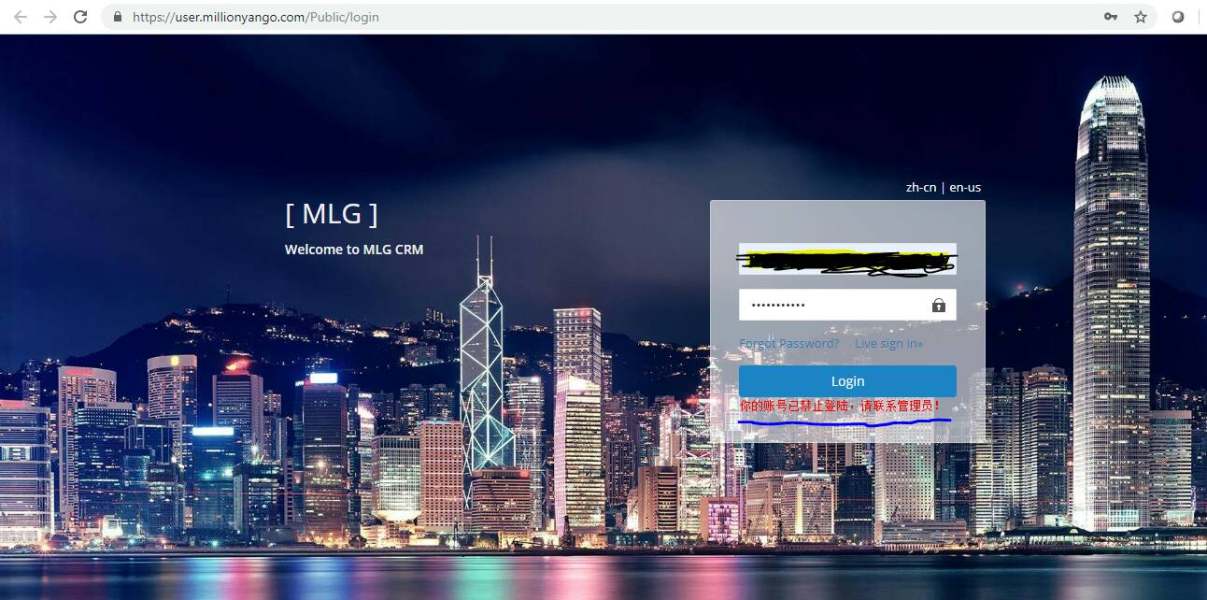

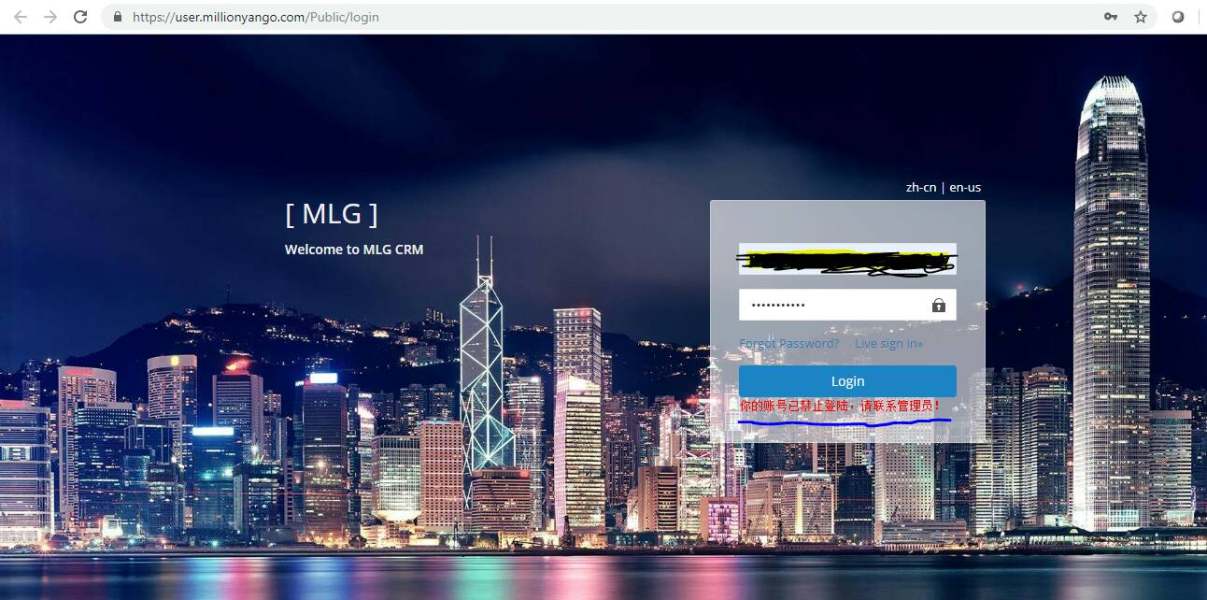

Founded approximately 2 to 5 years ago, Miligo operates under the name Million Yango Index Limited and is registered in Canada. The broker primarily offers the MetaTrader 4 (MT4) platform, which is widely recognized for its user-friendly interface and robust trading capabilities. Miligo provides access to a diverse array of trading instruments, including forex, commodities, indices, cryptocurrencies, and stocks. However, it is crucial to note that Miligo lacks proper regulatory oversight, which raises concerns about its credibility and the safety of client funds.

Detailed Breakdown

Regulatory Environment

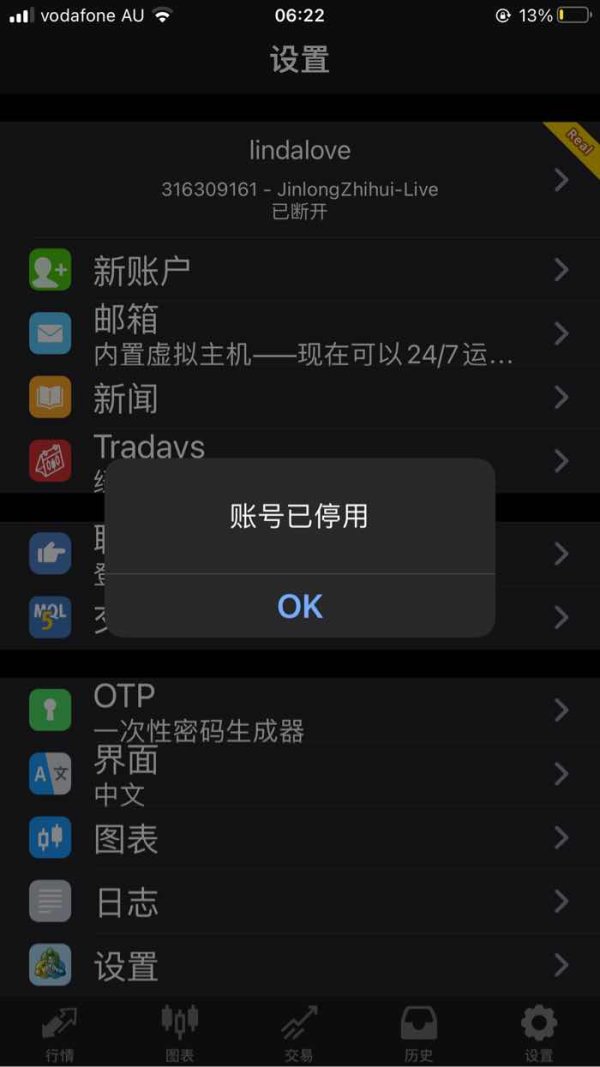

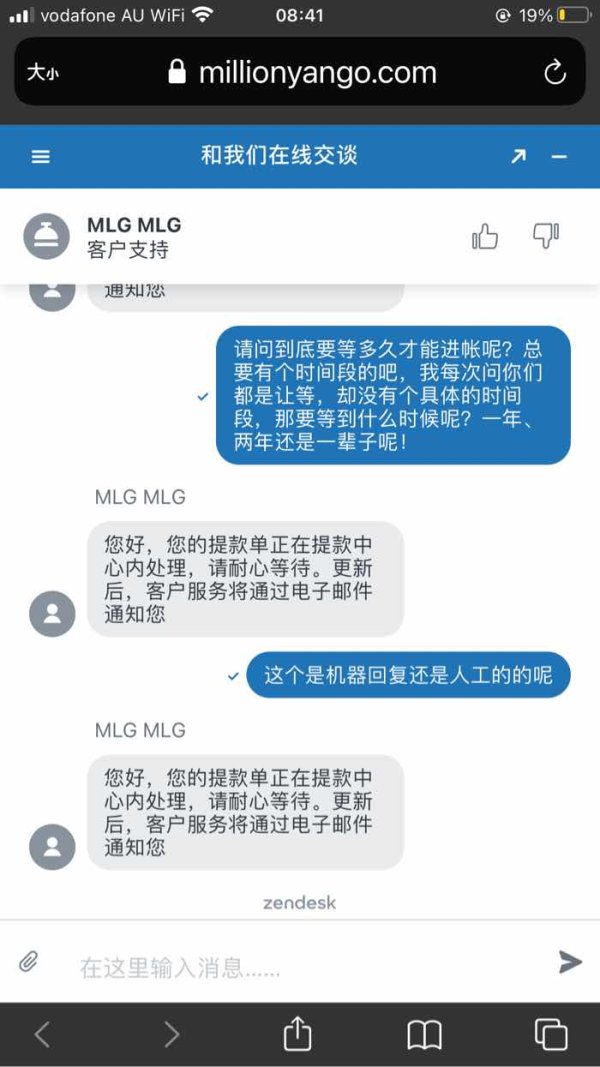

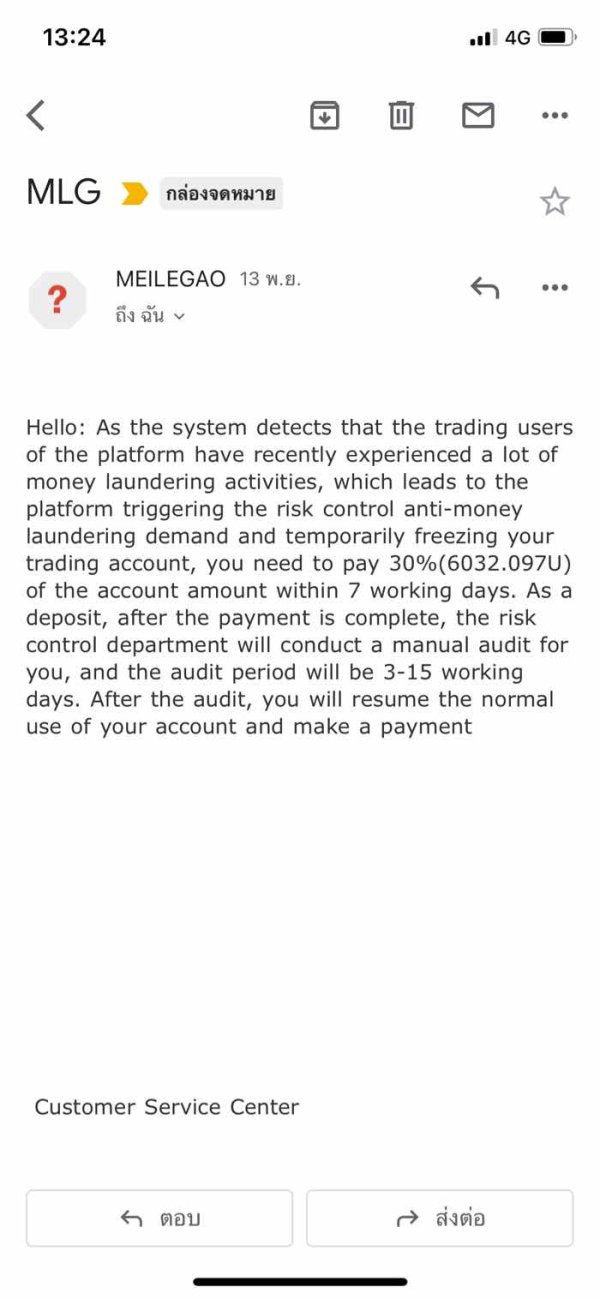

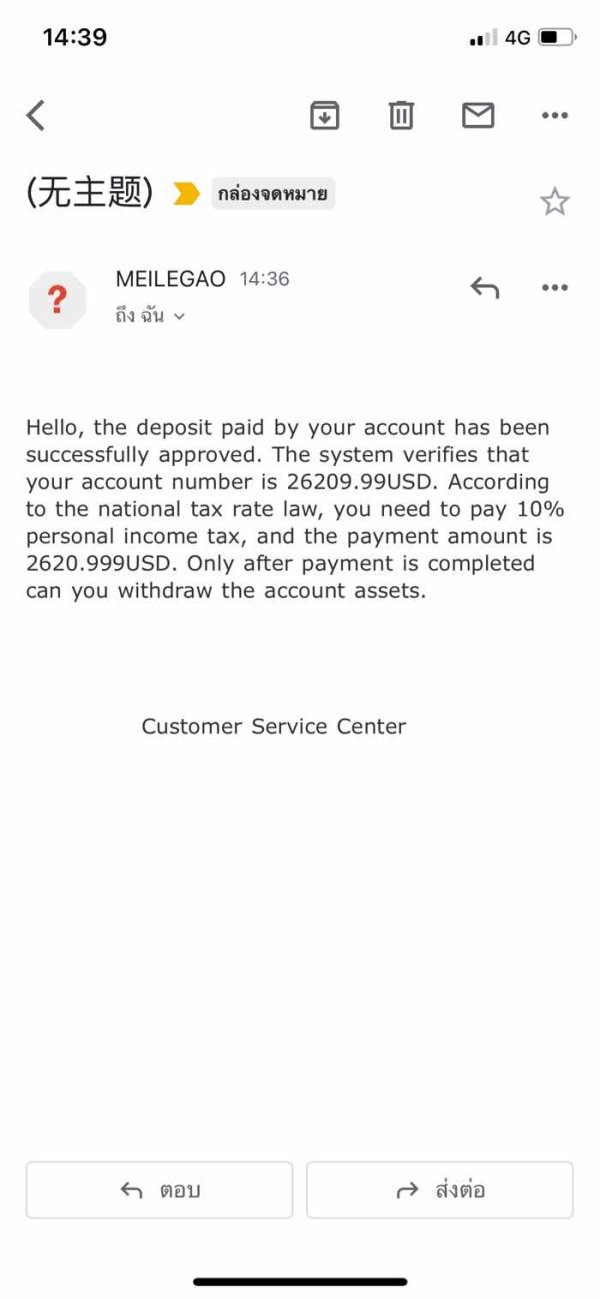

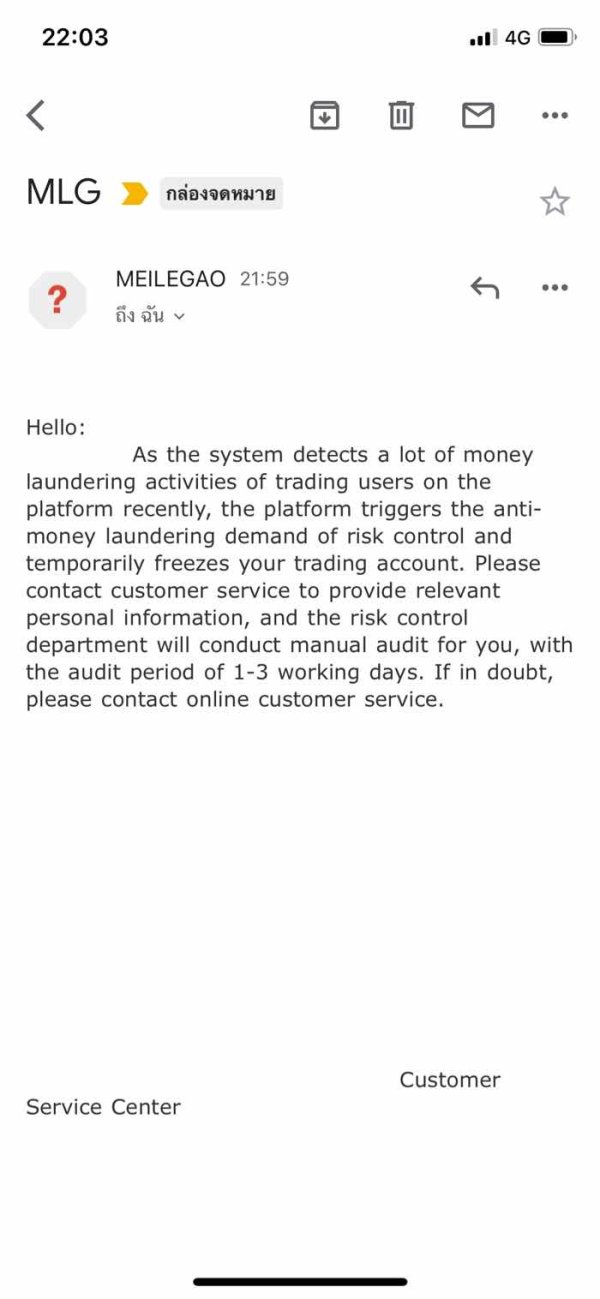

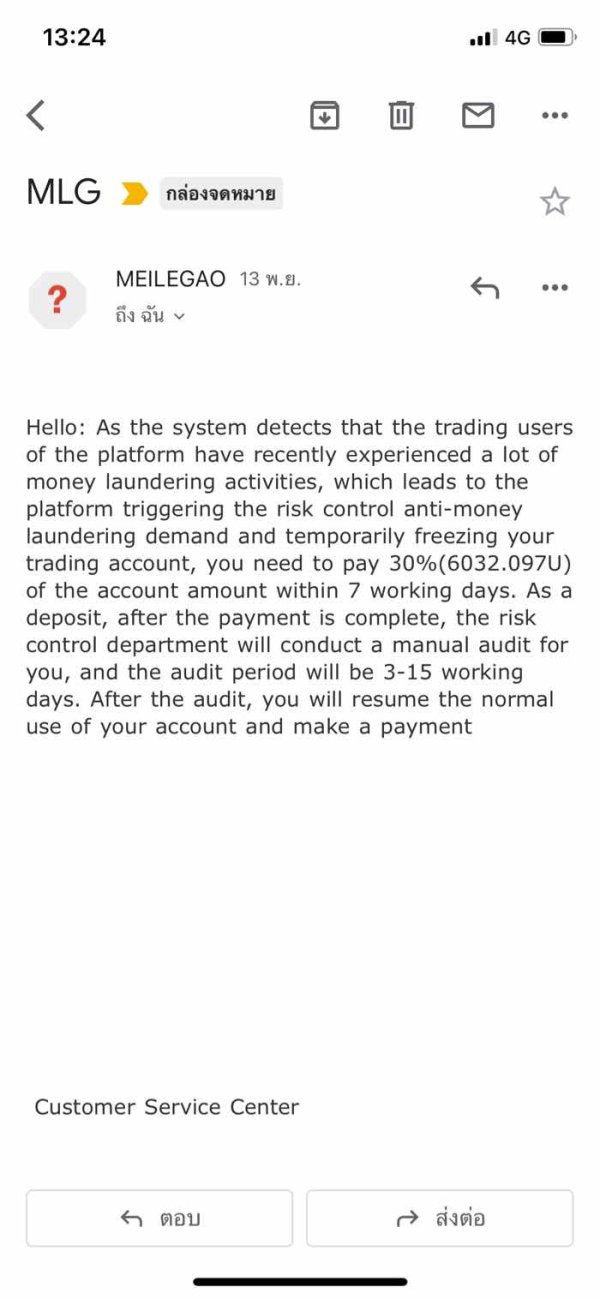

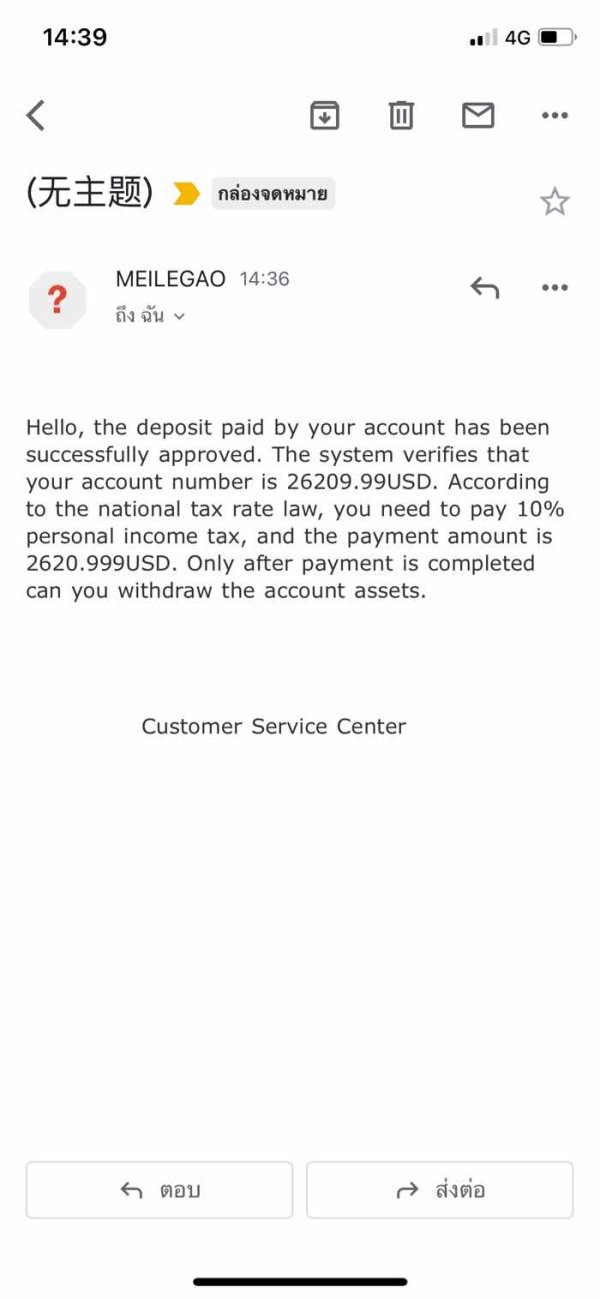

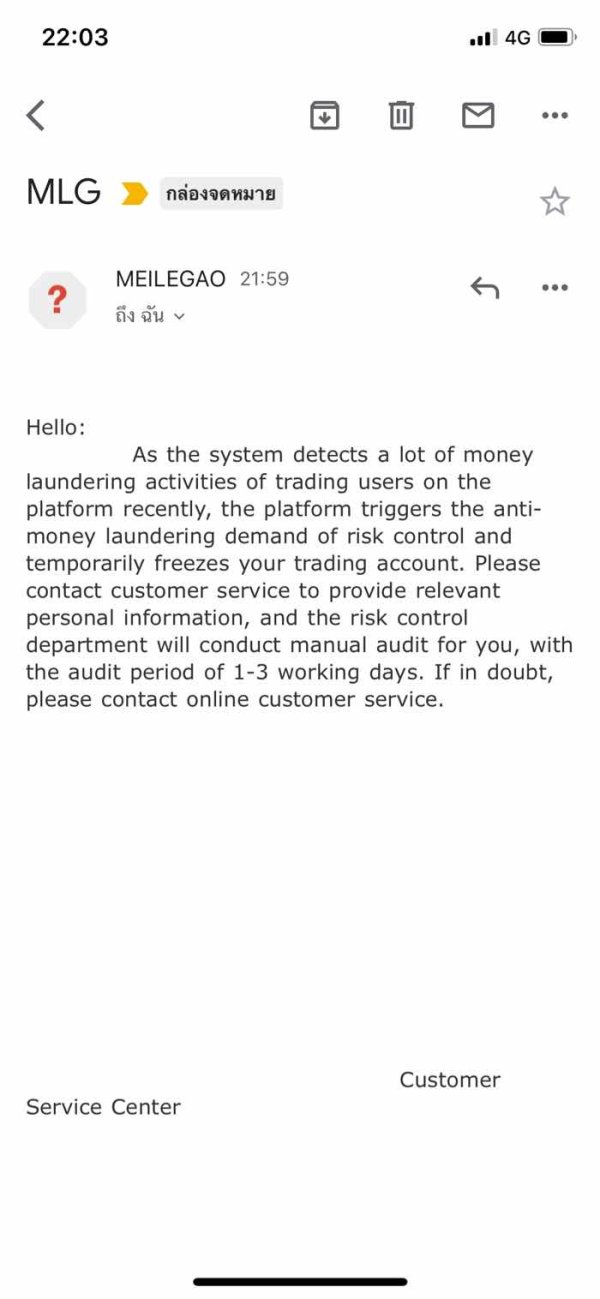

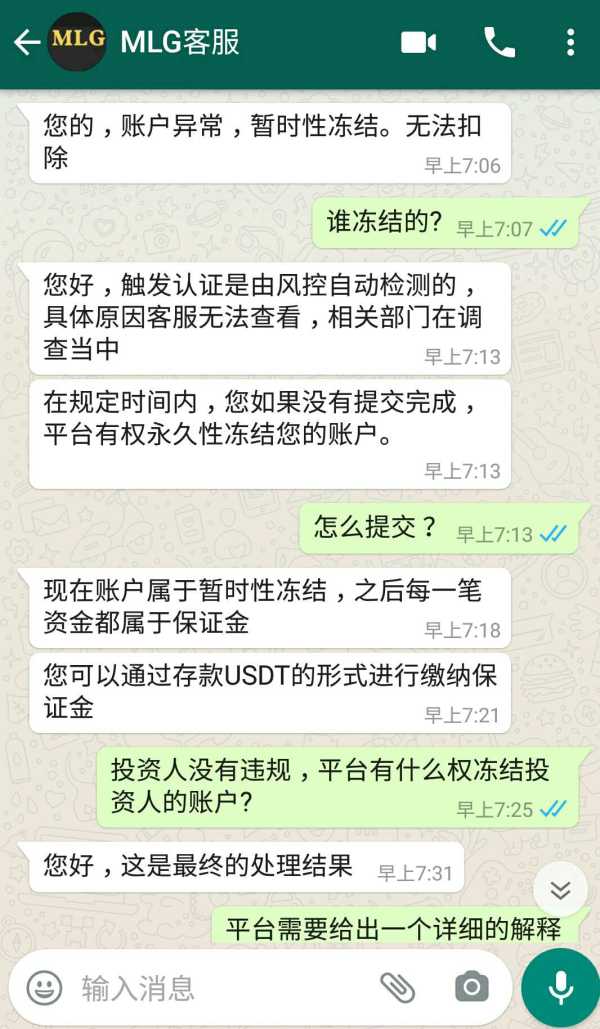

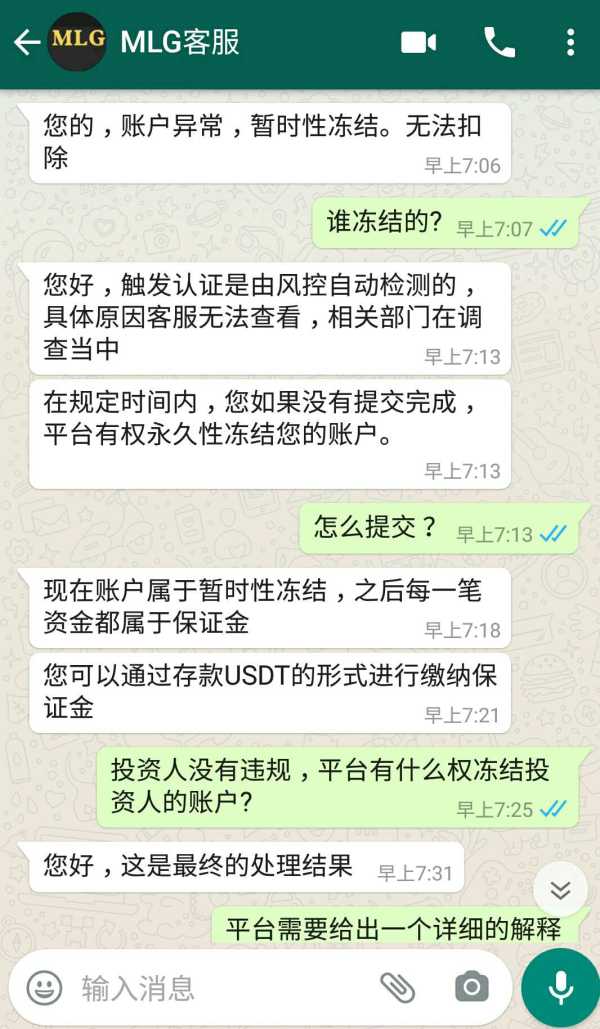

Miligo operates without any valid regulatory licenses, which is a significant red flag for potential investors. According to sources, the broker has accumulated numerous complaints regarding fraudulent practices and unresponsive customer service. The absence of regulatory oversight means that clients have little to no recourse in case of disputes or issues with withdrawals.

Deposit/Withdrawal Methods

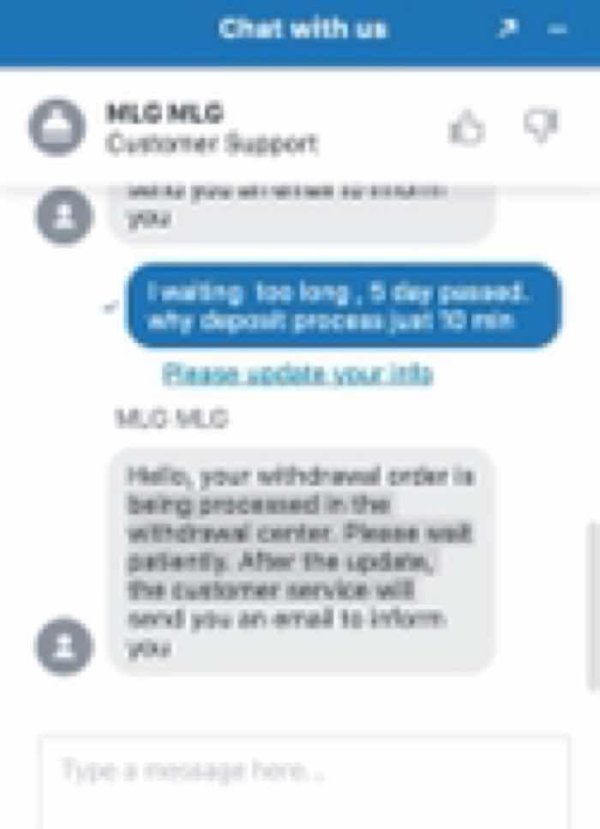

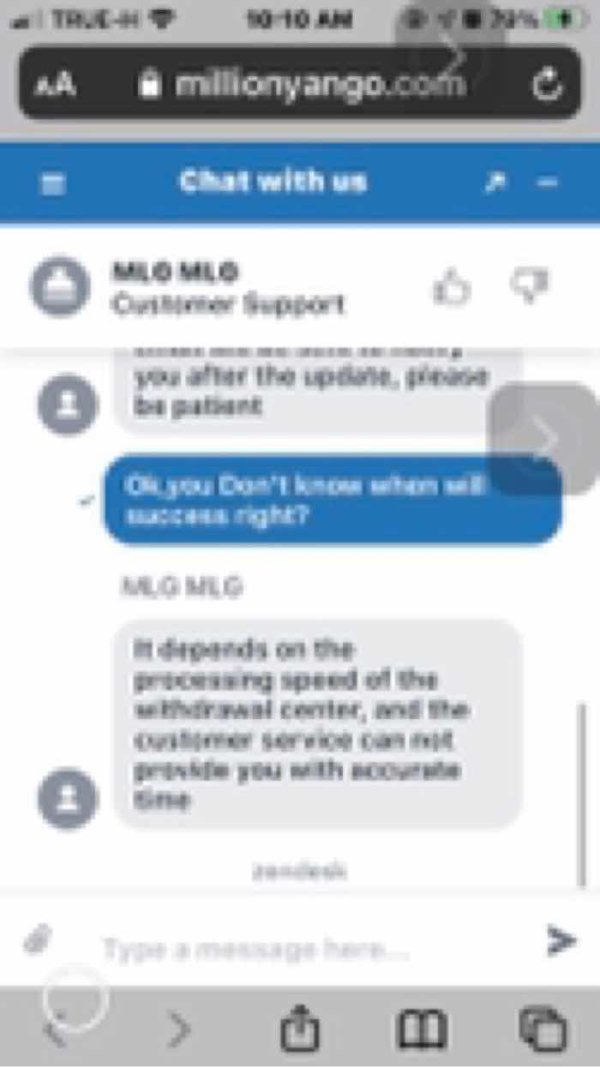

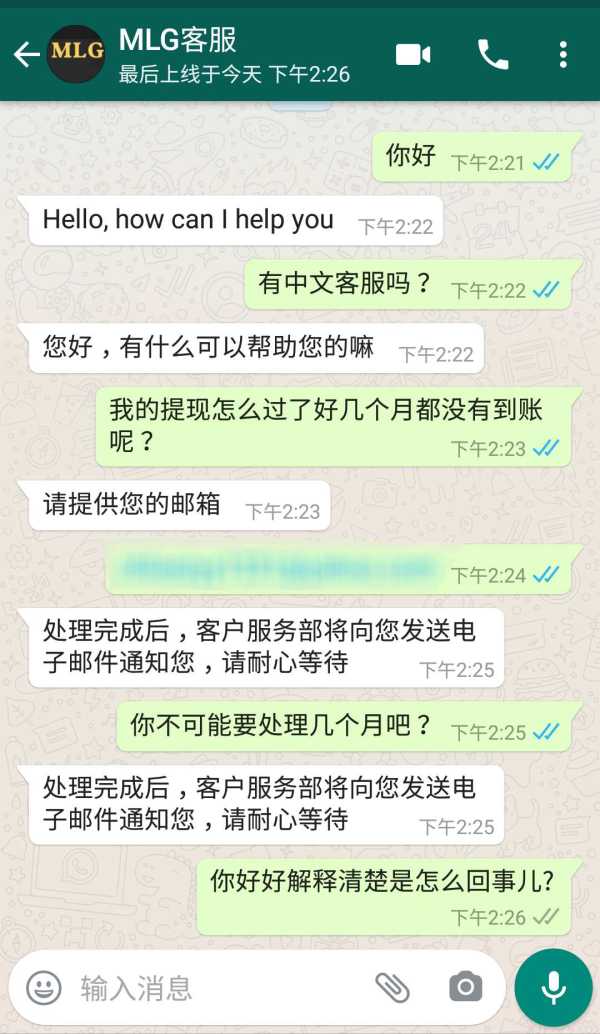

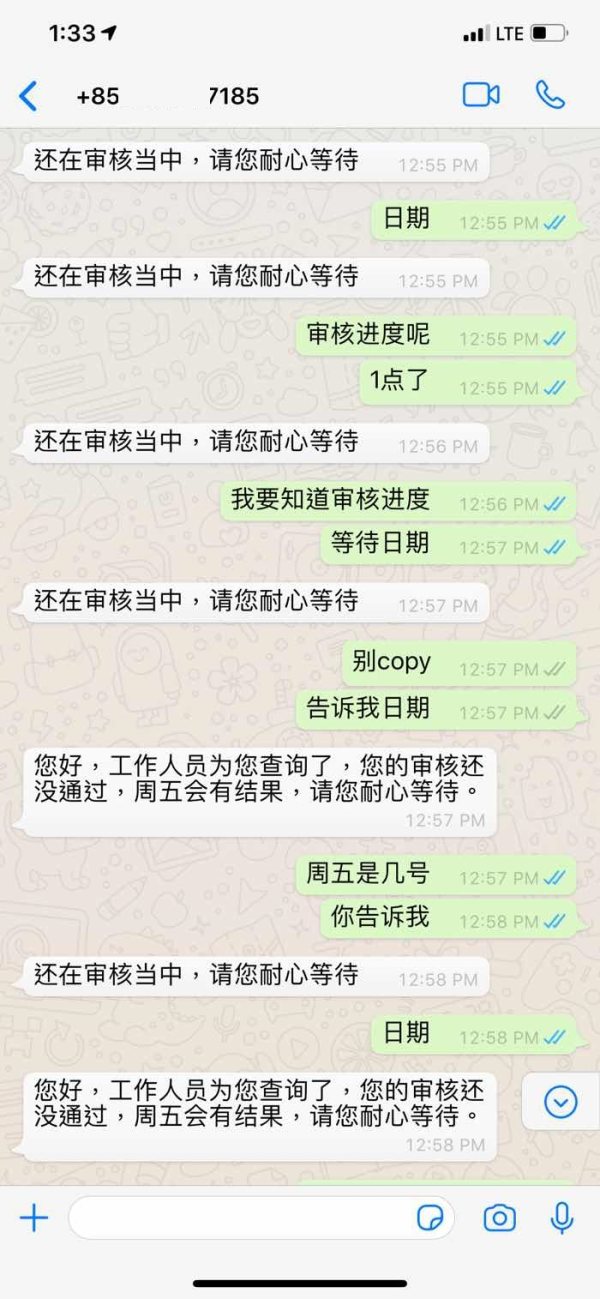

Miligo supports various deposit and withdrawal methods, including bank transfers, credit/debit cards, e-wallets, and cryptocurrencies. Notably, there are no deposit fees for bank transfers and cryptocurrency transactions, which can be an advantage. However, withdrawal fees can vary depending on the chosen payment method, and a minimum withdrawal amount of $100 is imposed. Users have reported difficulties in processing withdrawals, often citing delays and unresponsive customer service.

Minimum Deposit

There is no specified minimum deposit requirement to open an account with Miligo. This feature could attract novice traders; however, it also raises concerns regarding the broker's intentions and the safety of funds deposited.

Currently, there is no information available regarding bonuses or promotions offered by Miligo. This lack of clarity could indicate a more significant issue with transparency, as many reputable brokers provide clear details about their promotional offers.

Tradable Asset Classes

Miligo offers a wide range of tradable assets, including:

- Forex: Major currency pairs such as EUR/USD, USD/JPY, and GBP/JPY.

- Commodities: Trading options include gold, silver, and crude oil.

- Indices: Access to global indices, including the S&P 500 and FTSE 100.

- Cryptocurrencies: Popular cryptocurrencies like Bitcoin (BTC) and Ethereum (ETH).

- Stocks: Opportunities to trade shares of major companies like Apple and Amazon.

Costs (Spreads, Fees, Commissions)

The spreads offered by Miligo are reportedly around 0.1% for major currency pairs, with commissions typically around $1. However, the lack of transparency regarding overall trading costs, including margin requirements and contract specifications, is a concern for potential traders.

Leverage

Miligo offers a maximum leverage of 1:100 across all trading accounts. While leverage can amplify potential returns, it also increases the risk of significant losses, especially for inexperienced traders.

The only trading platform provided by Miligo is the MetaTrader 4 (MT4) for Windows. While MT4 is a popular choice among traders, the lack of additional platforms or mobile trading options may limit flexibility for users.

Restricted Regions

Miligo has not specified any restricted regions on its website; however, the lack of regulation suggests that it may not be suitable for traders from jurisdictions with stringent regulatory requirements.

Available Customer Service Languages

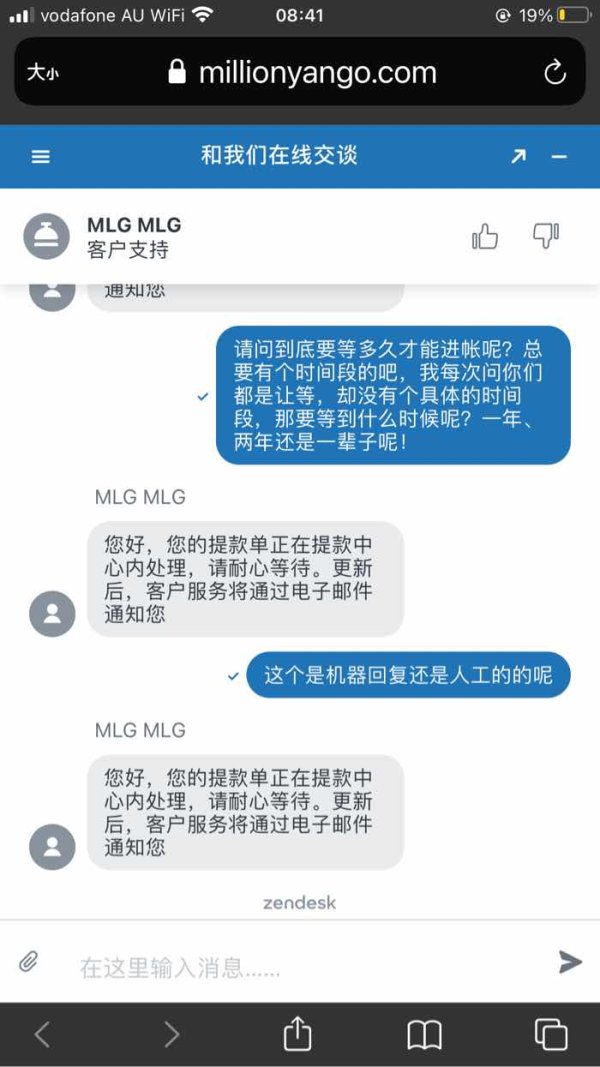

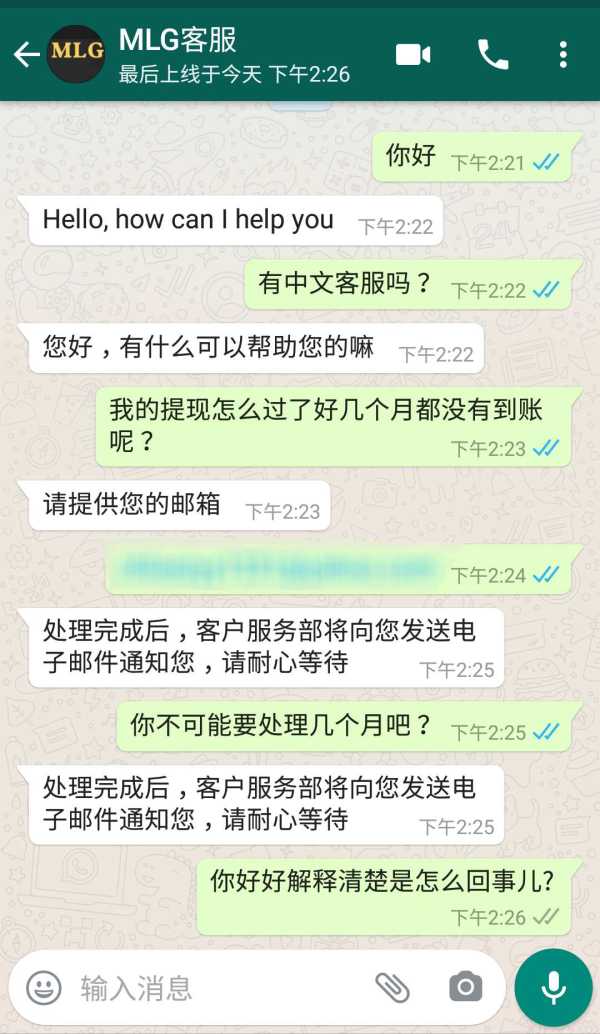

Reports indicate that customer support at Miligo is insufficient, with limited channels available for assistance. Users have expressed frustration over the unresponsiveness of customer service, which is a significant drawback for potential investors.

Final Rating Overview

Detailed Assessment

Account Conditions

Miligo offers various account types, including business, personal, and premium accounts. However, the lack of detailed information on account features and fee structures raises concerns about transparency.

The educational resources provided by Miligo are reportedly limited, which may hinder less experienced traders in developing their skills.

Customer Service and Support

Customer service has received significant criticism, with many users reporting difficulties in reaching support and resolving issues. This aspect is crucial for any trader, especially beginners who may require assistance.

Trading Experience

While the trading experience on the MT4 platform is generally positive, the lack of transparency regarding trading conditions and execution quality is a concern.

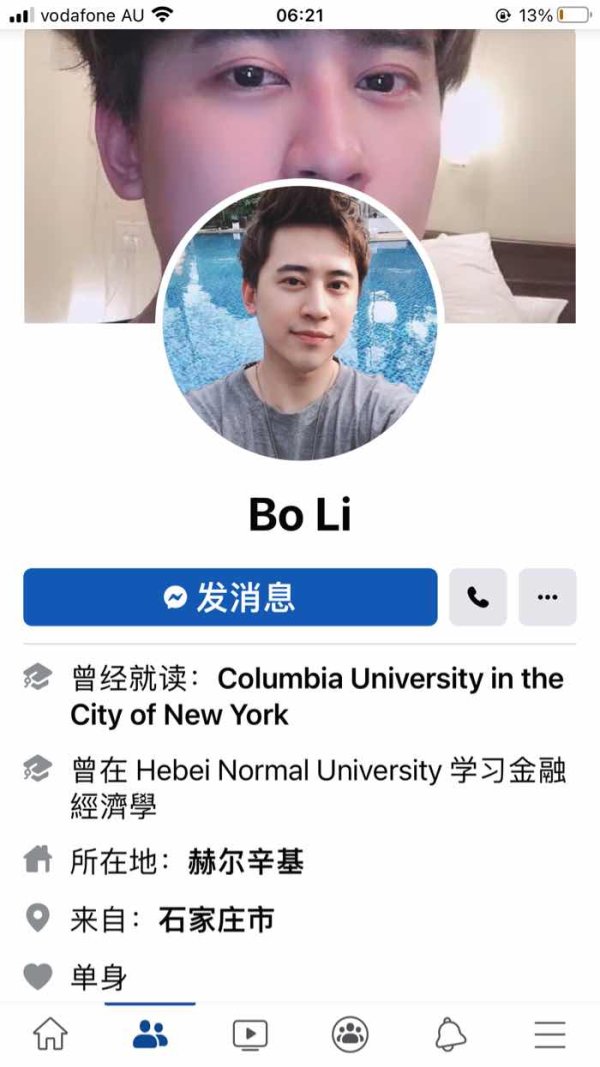

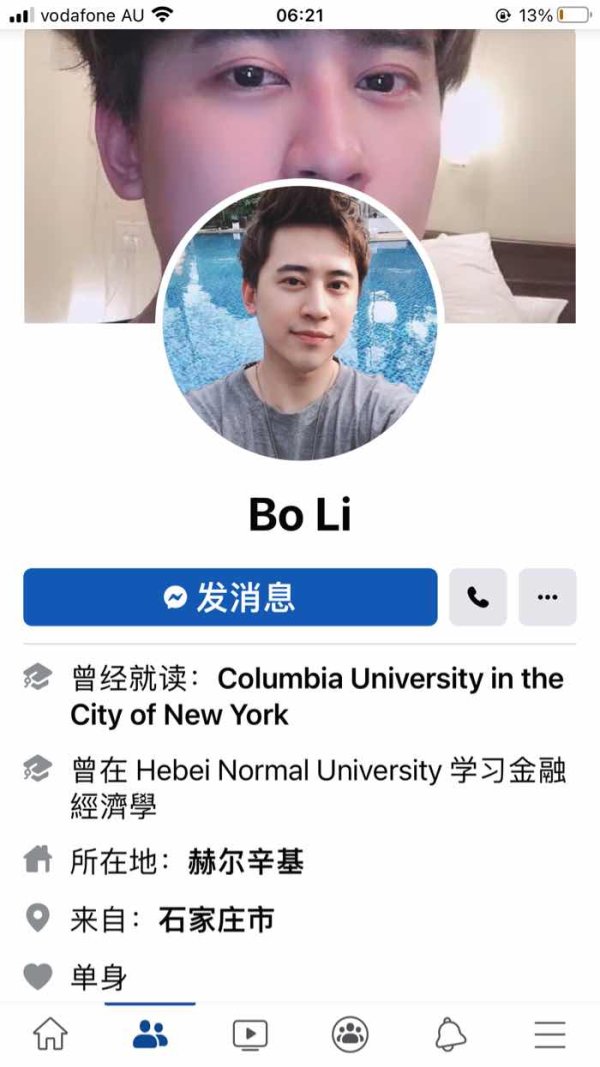

Trustworthiness

Miligo's lack of regulation and the accumulation of negative reviews significantly impact its trustworthiness. Potential investors should exercise caution when considering this broker.

User Experience

User experiences with Miligo have been largely negative, with many reporting issues related to fund withdrawals and unresponsive customer service.

In conclusion, while Miligo offers a variety of trading options and account types, its lack of proper regulation and concerning user feedback warrant caution for potential investors. It is advisable to conduct thorough research and consider alternative brokers with a stronger reputation and regulatory oversight.