Is Meiwork safe?

Business

License

Is Meiwork Safe or Scam?

Introduction

Meiwork, a relatively new player in the forex market, has attracted attention due to its aggressive marketing and promises of high returns. As traders navigate the complex and often risky landscape of forex trading, it becomes crucial to evaluate the legitimacy and safety of brokers like Meiwork. The forex market is rife with both opportunities and pitfalls, making it essential for traders to conduct thorough due diligence before committing their funds. This article aims to provide an objective analysis of Meiwork's safety and legitimacy, drawing on various sources to assess its regulatory status, company background, trading conditions, and customer experiences.

Regulatory and Legitimacy

Regulation is a cornerstone of trust in the financial services industry. A reputable forex broker should be regulated by a recognized financial authority, which ensures compliance with industry standards and offers some level of protection to traders. In the case of Meiwork, there are significant concerns regarding its regulatory status. According to multiple sources, Meiwork operates without any valid regulatory oversight, raising red flags for potential investors.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Not Regulated |

The absence of regulation means that there is no governing body overseeing Meiwork's operations, which can lead to potential issues such as fraudulent activities or mismanagement of client funds. Furthermore, the lack of regulatory history raises questions about the broker's commitment to compliance and ethical business practices. Without a regulatory framework, traders are left vulnerable, with limited recourse in the event of disputes or financial losses.

Company Background Investigation

Meiwork's company background is another critical aspect to consider when evaluating its safety. The firm appears to have a relatively short history, having been established only a few years ago. This limited track record can be concerning, especially in an industry where experience often correlates with reliability. The ownership structure of Meiwork is also opaque, with reports indicating that the identities of its owners are hidden through privacy services, further complicating transparency.

Additionally, the management teams qualifications and experience are crucial indicators of a broker's reliability. Unfortunately, there is little publicly available information regarding the expertise or professional backgrounds of Meiwork's management. This lack of transparency can be a warning sign for potential clients, as it raises questions about the broker's accountability and operational integrity.

Trading Conditions Analysis

When evaluating a forex broker, understanding the trading conditions offered is vital. Meiwork's fee structure and trading conditions are key components that traders should scrutinize. Reports indicate that Meiwork employs a commission structure that may not be competitive compared to industry averages, which could erode potential profits for traders.

| Fee Type | Meiwork | Industry Average |

|---|---|---|

| Spread on Major Pairs | High | Moderate |

| Commission Model | Unclear | Clear |

| Overnight Interest Range | Unfavorable | Favorable |

High spreads can significantly affect trading profitability, especially for frequent traders. Furthermore, if the commission structure is not transparent, it can lead to unexpected costs that may deter traders from utilizing the platform effectively. Understanding these conditions is paramount for anyone considering whether Meiwork is safe for trading.

Customer Funds Security

The security of customer funds is a fundamental concern for any forex trader. Meiwork's approach to safeguarding client funds has come under scrutiny. Reports suggest that the broker does not employ adequate measures for fund segregation or investor protection, which could expose traders to significant risks in the event of financial instability or operational failure.

Moreover, the absence of negative balance protection policies raises further concerns. Negative balance protection is a critical feature that prevents traders from losing more than their initial investment, providing a safety net during volatile market conditions. Without such protections, traders could face substantial financial losses, making it essential to question whether Meiwork is safe for managing your trading capital.

Customer Experience and Complaints

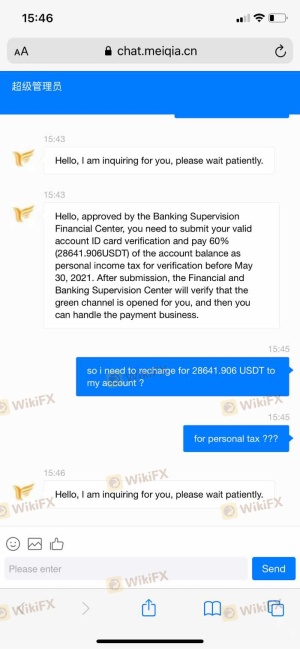

Analyzing customer feedback is crucial in assessing the overall reliability of a broker. For Meiwork, customer reviews present a mixed picture. While some users report satisfactory experiences, a significant number of complaints highlight issues related to withdrawal difficulties and poor customer service.

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow Response |

| Customer Service | Moderate | Inconsistent |

The prevalence of withdrawal complaints is particularly alarming, as it suggests potential liquidity issues or operational inefficiencies within the broker. Traders should be cautious when dealing with a broker that has a history of such complaints, as it may indicate deeper systemic problems.

Platform and Trade Execution

The performance of a trading platform is another critical factor in determining a broker's reliability. Meiwork's platform has received mixed reviews regarding its performance and stability. Users have reported instances of slippage and order rejections, which can severely impact trading outcomes.

In addition, the lack of transparency regarding execution quality raises concerns about potential manipulation or unfair practices. Traders should be wary of any broker that does not provide clear information about execution policies or shows signs of platform instability.

Risk Assessment

Using Meiwork as a trading platform presents several risks that traders should carefully consider. The absence of regulation, potential issues with fund security, and customer complaints create a concerning picture of the broker's overall safety.

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | No regulatory oversight. |

| Financial Risk | High | Lack of fund protection. |

| Operational Risk | Medium | Complaints regarding withdrawals. |

To mitigate these risks, traders are advised to conduct thorough research, consider starting with minimal investments, and explore alternative brokers with better regulatory oversight and customer feedback.

Conclusion and Recommendations

In conclusion, the evidence suggests that Meiwork may not be a safe choice for forex trading. The lack of regulation, transparency issues, and customer complaints raise significant concerns about the broker's legitimacy. Traders should proceed with caution and consider these factors before deciding to invest their hard-earned money with Meiwork.

For those seeking reliable alternatives, it is advisable to look for brokers that are regulated by reputable financial authorities, have transparent fee structures, and demonstrate a strong commitment to customer service. By prioritizing safety and reliability, traders can protect their investments and enhance their trading experience.

Is Meiwork a scam, or is it legit?

The latest exposure and evaluation content of Meiwork brokers.

Meiwork Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Meiwork latest industry rating score is 1.50, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.50 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.