Regarding the legitimacy of Marketbrokers forex brokers, it provides CYSEC and WikiBit, (also has a graphic survey regarding security).

Is Marketbrokers safe?

Business

License

Is Marketbrokers markets regulated?

The regulatory license is the strongest proof.

CYSEC Derivatives Trading License (MM)

Cyprus Securities and Exchange Commission

Cyprus Securities and Exchange Commission

Current Status:

Clone FirmLicense Type:

Derivatives Trading License (MM)

Licensed Entity:

IC Markets (EU) Ltd

Effective Date:

2018-06-25Email Address of Licensed Institution:

compliance@icmarkets.euSharing Status:

No SharingWebsite of Licensed Institution:

www.icmarkets.euExpiration Time:

--Address of Licensed Institution:

86 Franklinou Roosvelt, 4th floor, Office 401, 3011 Omonoia, Limassol, CyprusPhone Number of Licensed Institution:

+357 25 761 455Licensed Institution Certified Documents:

Is Marketbrokers Safe or Scam?

Introduction

Marketbrokers positions itself as a player in the forex trading landscape, catering to a variety of traders with different experience levels. Established in 2019, it claims to offer a range of trading services, including access to multiple account types and the popular MetaTrader 4 platform. However, the forex market is notorious for its potential risks, and traders must exercise caution when evaluating brokers. The legitimacy and safety of a broker can significantly impact a trader's experience and financial security. This article aims to objectively assess whether Marketbrokers is a safe option for trading or if it raises red flags that warrant concern. Our investigation will rely on various sources, including regulatory information, company background, trading conditions, customer feedback, and overall risk assessment.

Regulation and Legitimacy

The regulatory status of a broker is a critical factor in determining its safety. Marketbrokers operates under the jurisdiction of the Cyprus Securities and Exchange Commission (CySEC). This regulatory body is known for enforcing compliance with financial standards, which can provide a layer of protection for traders. However, it is essential to note that not all regulations are created equal.

Here is a summary of the regulatory information for Marketbrokers:

| Regulatory Body | License Number | Regulatory Area | Verification Status |

|---|---|---|---|

| CySEC | 362/18 | Cyprus | Verified |

While Marketbrokers is licensed by CySEC, it is crucial to delve deeper into the quality of this regulation. CySEC is considered a mid-tier regulator, which means it may not offer the same level of investor protection as top-tier regulators like the FCA in the UK or ASIC in Australia. Additionally, the broker has received a low score of 1.48 on WikiFX, indicating that it has multiple exposures and complaints against it. This raises questions about its compliance history and overall trustworthiness.

Company Background Investigation

Marketbrokers was founded in 2019, a relatively short history in the forex industry. The ownership structure and management team are vital for assessing the broker's credibility. Unfortunately, there is limited information available regarding the backgrounds of the company's executives, which raises transparency concerns. A lack of information about the management team can lead to skepticism regarding their expertise and commitment to regulatory compliance.

Furthermore, the company's transparency level is questionable, as it does not provide comprehensive details about its operations, financial health, or ownership structure on its website. In an industry where trust is paramount, such opacity can deter potential clients from engaging with the broker. Overall, the limited historical performance and lack of transparency are factors that traders should consider when evaluating the safety of Marketbrokers.

Trading Conditions Analysis

Marketbrokers claims to offer competitive trading conditions, but a closer examination reveals some concerning aspects. The broker has a high minimum deposit requirement, with the lowest account type starting at $250. This could be a barrier for novice traders who wish to start with smaller investments. Additionally, the broker does not provide information on its spreads and commissions, which can be critical in understanding the overall cost of trading.

Here is a comparison of core trading costs:

| Cost Type | Marketbrokers | Industry Average |

|---|---|---|

| Major Currency Pair Spread | Not disclosed | 1.0 - 2.0 pips |

| Commission Structure | Not disclosed | $0 - $7 per lot |

| Overnight Interest Range | Not disclosed | Varies widely |

The lack of transparency regarding these costs raises concerns about potential hidden fees that could affect traders' profitability. Furthermore, the absence of clearly defined commission structures and spreads may indicate that the broker is not entirely upfront about its pricing, which is a significant red flag. As traders assess whether Marketbrokers is safe, these factors warrant careful consideration.

Client Fund Safety

The safety of client funds is a paramount concern when choosing a forex broker. Marketbrokers claims to implement various measures to protect client funds, including segregated accounts and investor protection policies. However, the effectiveness of these measures remains uncertain without transparent disclosures.

To evaluate the broker's fund safety measures, it is crucial to investigate the following aspects:

- Segregated Accounts: Are client funds held in segregated accounts to prevent misuse?

- Investor Protection: What mechanisms are in place to protect investors in case of insolvency?

- Negative Balance Protection: Does the broker offer policies to ensure that clients do not lose more than their initial investment?

- Execution Quality: Are orders executed promptly and at the desired price?

- Slippage: How often do traders experience slippage, and is it in their favor?

- Order Rejections: What percentage of orders are rejected, and what reasons are provided?

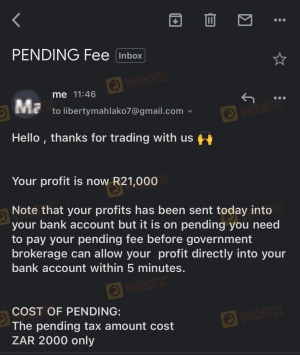

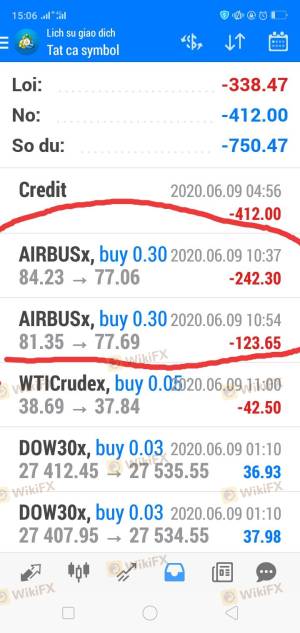

Historically, Marketbrokers has faced allegations related to fund security, with complaints about frozen accounts and unexplained fund deductions. Such issues raise significant concerns regarding the safety of client funds and the broker's overall reliability. Traders should be cautious and consider these factors when determining if Marketbrokers is safe.

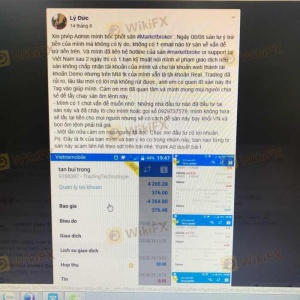

Customer Experience and Complaints

Customer feedback is an essential component of evaluating a broker's performance. Marketbrokers has garnered a mix of reviews, with many clients expressing dissatisfaction regarding withdrawal processes and customer service responsiveness. Common complaints include delayed withdrawals, unresponsive support, and issues with account security.

Here is a summary of the primary complaint types and their severity:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow response |

| Account Security | Medium | Unresolved |

| Customer Support | High | Unresponsive |

For instance, one user reported that their account was frozen without explanation, and attempts to contact customer support were met with silence. Such experiences suggest a lack of effective communication and support from Marketbrokers, which can be detrimental to traders seeking assistance. As traders ponder whether Marketbrokers is safe, these complaints highlight the need for caution.

Platform and Execution

The trading platform provided by Marketbrokers is based on MetaTrader 4, which is widely recognized for its robustness and user-friendly interface. However, the platform's performance and execution quality are critical for traders. Feedback from users indicates that while the platform is functional, issues such as slippage and order rejections have been reported.

Traders have raised concerns about the following:

While the platform itself may be reliable, any signs of manipulation, such as excessive slippage or high rejection rates, can be alarming. Traders should be vigilant and assess these factors when determining if Marketbrokers is a trustworthy option.

Risk Assessment

Using Marketbrokers entails several risks that traders must consider. The combination of regulatory concerns, customer complaints, and issues related to fund safety contribute to an overall risk profile that may not be favorable.

Here is a summary of key risk areas:

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Compliance | High | Uncertain oversight by CySEC |

| Fund Security | High | Historical issues with fund management |

| Customer Support | Medium | Frequent complaints about responsiveness |

To mitigate these risks, potential clients should consider starting with a small investment, thoroughly reading the terms and conditions, and maintaining regular communication with the broker. Additionally, traders should remain vigilant about any unusual activities within their accounts.

Conclusion and Recommendations

In conclusion, the evidence suggests that while Marketbrokers may offer certain trading opportunities, it raises several red flags that warrant caution. The regulatory oversight from CySEC, while present, is not robust enough to guarantee complete safety for traders. Additionally, the lack of transparency regarding trading costs, combined with numerous customer complaints, indicates that potential clients should proceed with caution.

For traders looking for a safer alternative, it is advisable to consider brokers with top-tier regulation, transparent fee structures, and proven track records of customer satisfaction. Brokers such as FCA-licensed firms or those regulated by ASIC in Australia may provide a more secure trading environment.

Ultimately, assessing whether Marketbrokers is safe requires careful consideration of the factors outlined in this article. Traders should prioritize their financial security and choose brokers that align with their risk tolerance and trading goals.

Is Marketbrokers a scam, or is it legit?

The latest exposure and evaluation content of Marketbrokers brokers.

Marketbrokers Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Marketbrokers latest industry rating score is 1.56, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.56 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.