Regarding the legitimacy of LONDON CAPITAL GROUP forex brokers, it provides FCA, CYSEC, SCB and WikiBit, (also has a graphic survey regarding security).

Is LONDON CAPITAL GROUP safe?

Pros

Cons

Is LONDON CAPITAL GROUP markets regulated?

The regulatory license is the strongest proof.

FCA Forex Execution License (STP)

Financial Conduct Authority

Financial Conduct Authority

Current Status:

RegulatedLicense Type:

Forex Execution License (STP)

Licensed Entity:

LONDON CAPITAL GROUP LIMITED

Effective Date:

2001-12-01Email Address of Licensed Institution:

compliance@lcg.comSharing Status:

No SharingWebsite of Licensed Institution:

www.lcg.comExpiration Time:

--Address of Licensed Institution:

2nd Floor 75 King William Street London City Of London EC4N 7BE UNITED KINGDOMPhone Number of Licensed Institution:

+4402074567020Licensed Institution Certified Documents:

CYSEC Forex Execution License (STP)

Cyprus Securities and Exchange Commission

Cyprus Securities and Exchange Commission

Current Status:

RevokedLicense Type:

Forex Execution License (STP)

Licensed Entity:

London Capital Group (Cyprus) Ltd

Effective Date:

2017-10-23Email Address of Licensed Institution:

compliancecy@lcg.comSharing Status:

No SharingWebsite of Licensed Institution:

www.lcg.com, https://cy-my.lcg.comExpiration Time:

--Address of Licensed Institution:

Arch. Makariou III, 205, VICTORY HOUSE, 5th floor, 3030, LimassolPhone Number of Licensed Institution:

35725266606Licensed Institution Certified Documents:

SCB Derivatives Trading License (MM)

The Securities Commission of The Bahamas

The Securities Commission of The Bahamas

Current Status:

RevokedLicense Type:

Derivatives Trading License (MM)

Licensed Entity:

LCG Capital Markets Limited

Effective Date: Change Record

--Email Address of Licensed Institution:

sean.munnings@lcg.com, Philip.Dorsett@lcg.comSharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

5 North Buckner Square Olde Towne, Sandyport West Bay StreetPhone Number of Licensed Institution:

--Licensed Institution Certified Documents:

Is LCG A Scam?

Introduction

London Capital Group (LCG) is a well-established brokerage firm in the forex market, founded in 1996 and headquartered in London, UK. With over two decades of experience, LCG has positioned itself as a reputable provider of online trading services, offering access to a wide array of financial instruments, including forex, CFDs, and spread betting. Given the increasing number of scams in the forex industry, it is essential for traders to exercise caution and thoroughly evaluate the credibility of brokers before committing their funds. This article aims to provide a comprehensive analysis of LCG's legitimacy by examining its regulatory status, company background, trading conditions, client fund security, customer experiences, and associated risks. Our evaluation methodology involved reviewing multiple sources, including regulatory information, user reviews, and expert analyses.

Regulation and Legitimacy

The regulatory environment is a crucial factor in determining a broker's legitimacy. LCG operates under the oversight of several regulatory bodies, which adds layers of protection for traders. The primary regulators include the Financial Conduct Authority (FCA) in the UK, the Cyprus Securities and Exchange Commission (CySEC), and the Securities Commission of the Bahamas (SCB). Each of these regulators has strict requirements that brokers must adhere to, including maintaining client funds in segregated accounts and ensuring transparency in operations.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| FCA | 182110 | United Kingdom | Verified |

| CySEC | 341/17 | Cyprus | Verified |

| SCB | SIA-F-194 | Bahamas | Verified |

The FCA is known for its stringent regulations, providing a higher level of oversight that protects retail clients. Traders are covered by the Financial Services Compensation Scheme (FSCS), which offers compensation up to £85,000 in the event of broker insolvency. CySEC provides similar protections, albeit with a lower compensation limit. LCG's compliance history shows that it has maintained its licenses without significant regulatory breaches, reinforcing its reputation as a legitimate broker.

Company Background Investigation

LCG has a rich history and has evolved significantly since its inception. The company began as a spread betting provider and has since expanded its offerings to include a broad range of financial instruments. LCG is publicly listed on the London Stock Exchange, which adds a layer of transparency to its operations. The ownership structure of LCG is composed of various stakeholders, ensuring that the company is accountable to its investors.

The management team at LCG consists of experienced professionals with backgrounds in finance and trading. Their expertise contributes to the firm's operational efficiency and strategic direction. Furthermore, LCG emphasizes transparency and information disclosure, regularly updating its clients about market conditions, trading strategies, and educational resources. This commitment to transparency is vital for building trust with clients and enhancing the overall trading experience.

Trading Conditions Analysis

The trading conditions at LCG are competitive, with a range of account types and fee structures designed to cater to different trader profiles. LCG offers both a classic account and an ECN account, each with distinct features and pricing models. The classic account has no minimum deposit requirement, while the ECN account requires a minimum balance of $10,000.

| Fee Type | LCG | Industry Average |

|---|---|---|

| Major Currency Pair Spread | From 1.45 pips | 1.0 - 1.5 pips |

| Commission Model | $10 per lot (MT4) | $5 - $10 per lot |

| Overnight Interest Range | 0.04% daily | 0.03% - 0.05% daily |

The spreads on the classic account are wider compared to the ECN account, which offers tighter spreads starting from 0 pips but incurs a commission. While these fees are generally competitive, some users have reported instances of widening spreads during high volatility periods, which could impact trading costs. It is essential for traders to understand these fee structures to make informed decisions.

Client Fund Security

Client fund security is paramount in the forex trading environment. LCG employs several measures to ensure the safety of client funds, including segregated accounts. This means that clients' funds are held separately from the company's operational funds, minimizing the risk of loss in the event of financial difficulties.

Additionally, LCG offers negative balance protection, ensuring that clients cannot lose more than their deposited amount. This feature is particularly important for traders using leverage, as it protects them from significant losses during volatile market conditions. LCG's commitment to fund security is further enhanced by its adherence to regulatory requirements, which mandate that client funds be kept in reputable financial institutions.

Customer Experience and Complaints

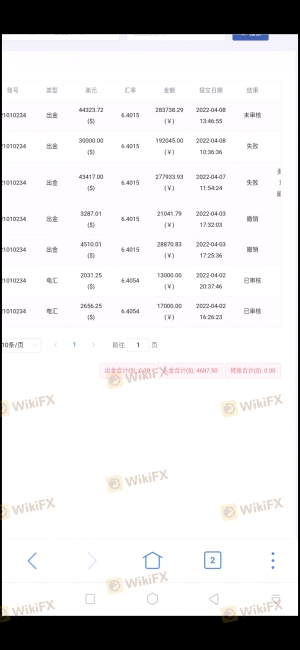

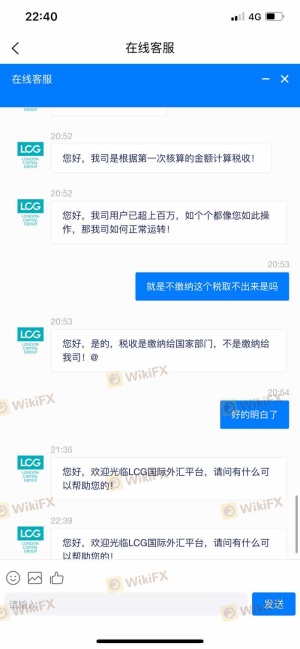

Customer feedback is a crucial aspect of evaluating a broker's reliability. While many users report positive experiences with LCG, there are also notable complaints. Common issues include withdrawal difficulties and delays in processing requests.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Slow response times |

| Account Verification Issues | Medium | Generally responsive |

| Customer Support Quality | Medium | Mixed reviews |

For instance, some clients have reported being unable to withdraw funds promptly, leading to frustration and dissatisfaction. However, LCG's customer support team has been noted for its responsiveness, often addressing inquiries within a reasonable timeframe.

Platform and Trade Execution

The trading platforms offered by LCG include the widely used MetaTrader 4 (MT4) and its proprietary platform, LCG Trader. Both platforms provide a range of features that cater to different trading styles.

The execution quality on these platforms is generally regarded as reliable, with low slippage and quick order execution. However, there have been reports of occasional delays during peak trading hours, which could affect trading performance. Overall, the platforms are user-friendly and equipped with essential tools for both novice and experienced traders.

Risk Assessment

Trading with LCG comes with inherent risks, as with any broker. However, the regulatory oversight and protective measures in place help mitigate these risks.

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | Low | Well-regulated by multiple authorities |

| Fund Security Risk | Low | Segregated accounts and negative balance protection |

| Customer Service Risk | Medium | Mixed reviews on support response times |

Traders are advised to conduct thorough research and remain aware of the potential risks associated with trading, including market volatility and the broker's operational practices.

Conclusion and Recommendations

In conclusion, LCG is not a scam. It is a legitimate broker with solid regulatory backing and a long-standing history in the forex market. While there are some concerns regarding withdrawal processes and customer complaints, the overall assessment indicates that LCG operates transparently and securely.

For traders considering LCG, it is advisable to start with a demo account to familiarize themselves with the platform and trading conditions. Additionally, those who may be hesitant about potential withdrawal issues should evaluate their trading strategies and ensure they are comfortable with the broker's terms.

For those seeking alternatives, brokers like IG or OANDA, which also have strong regulatory frameworks and positive reputations, may be worth considering.

Is LONDON CAPITAL GROUP a scam, or is it legit?

The latest exposure and evaluation content of LONDON CAPITAL GROUP brokers.

LONDON CAPITAL GROUP Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

LONDON CAPITAL GROUP latest industry rating score is 5.17, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 5.17 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.