GMI 2025 Review: Everything You Need to Know

Executive Summary

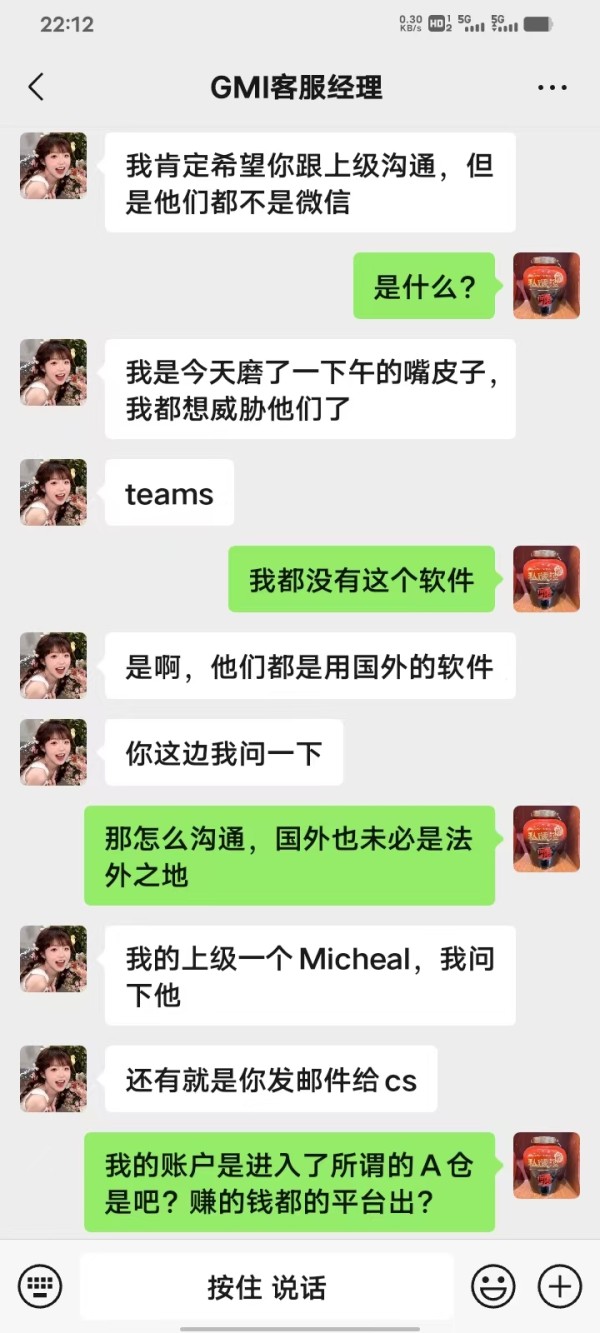

GMI is a forex and CFD broker that started in 2009. This GMI review shows that the company has an overall neutral rating, with employee satisfaction scores averaging 3.3 out of 5 across various review platforms. The broker's customer feedback shows 67% positive reviews and 33% negative reviews, which means there is room for improvement in service delivery and client satisfaction.

The broker offers access to over 40 forex currency pairs and multiple asset classes for both retail and institutional traders. GMI's trading setup uses two main platforms: the popular MetaTrader 4 and their own GMI Edge platform, which works well with existing MT4 users. The company serves different types of clients, from individual traders to larger institutional entities that need complete trading solutions.

However, our analysis shows several areas where the company could be more transparent, especially about regulatory details, fee structures, and account conditions that modern traders expect from established brokers.

Important Disclaimers

GMI operates in multiple locations including Saint Vincent and the Grenadines, Mauritius, and Vanuatu. This means clients may have different levels of protection depending on where they live and which company entity they trade with. These different regulatory environments can significantly impact how disputes are resolved, what compensation is available, and overall client protection standards.

This review uses comprehensive analysis of user feedback, company background information, and publicly available market data. However, potential clients should note that specific regulatory details and licensing information were not clearly detailed in available sources, so you should verify this information yourself before opening an account.

Rating Framework

Broker Overview

GMI entered the competitive forex and CFD brokerage market in 2009. The company has built its business model around providing access to diverse financial markets, including foreign exchange, contracts for difference, precious metals, and major global indices. Over its operational history, GMI has developed a client-focused approach that accommodates various trading styles and investment strategies across different market segments.

The broker's operational framework emphasizes technology integration through its dual-platform approach. This GMI review identifies the company's strategic focus on platform compatibility and user accessibility as key differentiators in their service proposition. GMI's asset portfolio includes more than 40 forex currency pairs alongside energy commodities, precious metals including gold and silver, and major international indices, giving traders diversified market exposure opportunities.

Regulatory Jurisdictions: GMI maintains registrations across multiple offshore jurisdictions including Saint Vincent and the Grenadines, Mauritius, and Vanuatu. However, specific regulatory authority details and license numbers remain unspecified in available documentation.

Payment Processing: Available information does not detail specific deposit and withdrawal methods, processing times, or fees that clients might encounter during funding operations.

Minimum Capital Requirements: The broker has not disclosed minimum deposit amounts for different account types. This leaves potential clients without clear entry-level investment guidance.

Promotional Offerings: Current marketing materials do not highlight specific bonus programs, welcome incentives, or ongoing promotional campaigns for new or existing clients.

Trading Instruments: GMI provides access to over 40 foreign exchange currency pairs, major global indices, energy commodities, and precious metals including gold and silver trading opportunities.

Cost Structure: Detailed information about commission schedules, spread configurations, overnight financing charges, and other trading-related fees remains unavailable in public documentation.

Leverage Ratios: Specific maximum leverage ratios offered across different asset classes and account types are not clearly specified in available materials.

Platform Technology: Clients can access markets through MetaTrader 4 or the proprietary GMI Edge platform. The GMI Edge platform offers MT4 compatibility and integrated account funding capabilities.

Geographic Restrictions: Available documentation does not specify countries or regions where GMI services may be restricted or unavailable.

Customer Support Languages: Multi-language support capabilities are not detailed in current informational materials.

Comprehensive Rating Analysis

Account Conditions Analysis

GMI's account structure lacks the transparency that modern traders expect from established brokers in 2025. The absence of clearly defined account tiers, minimum deposit requirements, and specific feature differences makes it challenging for potential clients to make informed decisions about their trading setup. This GMI review notes that without detailed account specifications, traders cannot properly assess whether the broker's offerings align with their capital allocation strategies or trading objectives.

The account opening process details remain unspecified, leaving questions about documentation requirements, verification timeframes, and approval procedures. Additionally, the availability of specialized account types such as Islamic accounts for religious compliance, demo accounts for strategy testing, or institutional-grade accounts for larger clients is not clearly communicated. This information gap significantly impacts the broker's accessibility assessment for diverse trader demographics and religious considerations.

Account management features are not adequately detailed in available materials, including the ability to modify leverage settings, access multiple trading platforms from a single account, or integrate with third-party analytical tools. These limitations in account condition transparency contribute to the moderate rating assigned to this evaluation category.

The trading tools and resources at GMI appear limited based on available information. The GMI Edge platform's integration with MetaTrader 4 represents the broker's main technological offering, though specific features, customization options, or advanced trading tools within this environment remain undetailed.

Educational resources, which have become essential for modern forex brokers, are not prominently featured in GMI's service description. The absence of trading guides, market analysis reports, economic calendars, or educational webinars suggests a potential gap in supporting trader development and market understanding. This limitation particularly impacts newer traders who rely on broker-provided education to develop their skills and market knowledge.

Research and analysis capabilities are not clearly outlined in available documentation, including proprietary market insights, technical analysis tools, or third-party research partnerships. The lack of automated trading support details, expert advisor compatibility, or algorithmic trading features further limits the broker's appeal to technologically sophisticated traders seeking advanced execution capabilities.

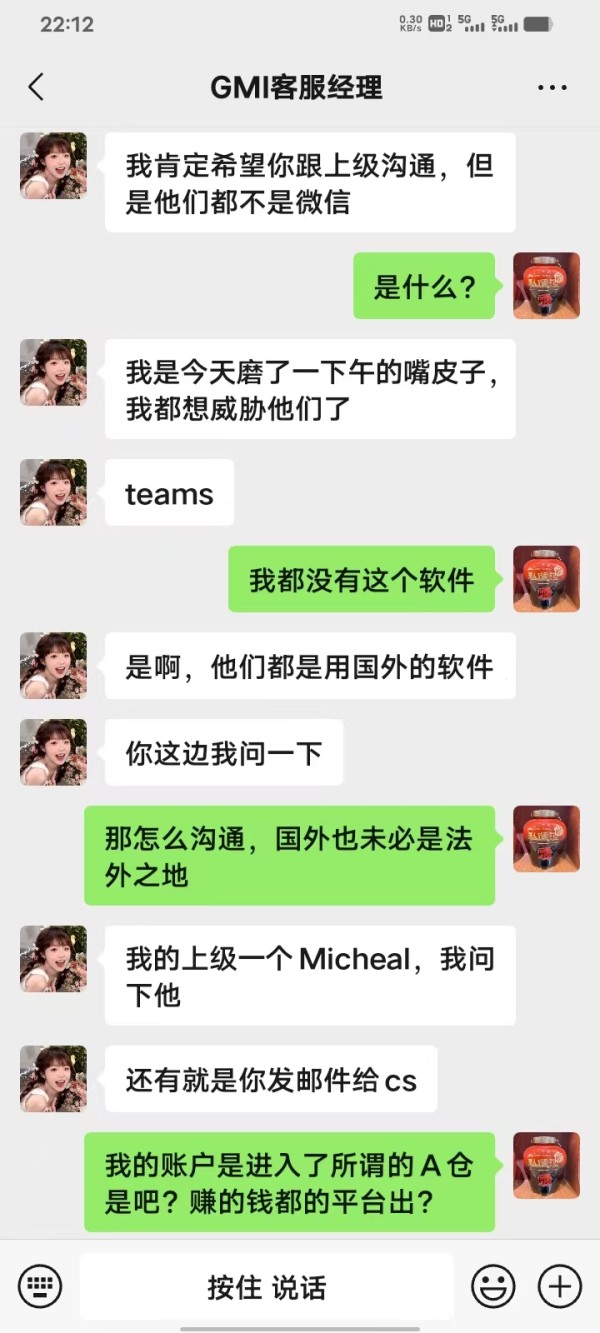

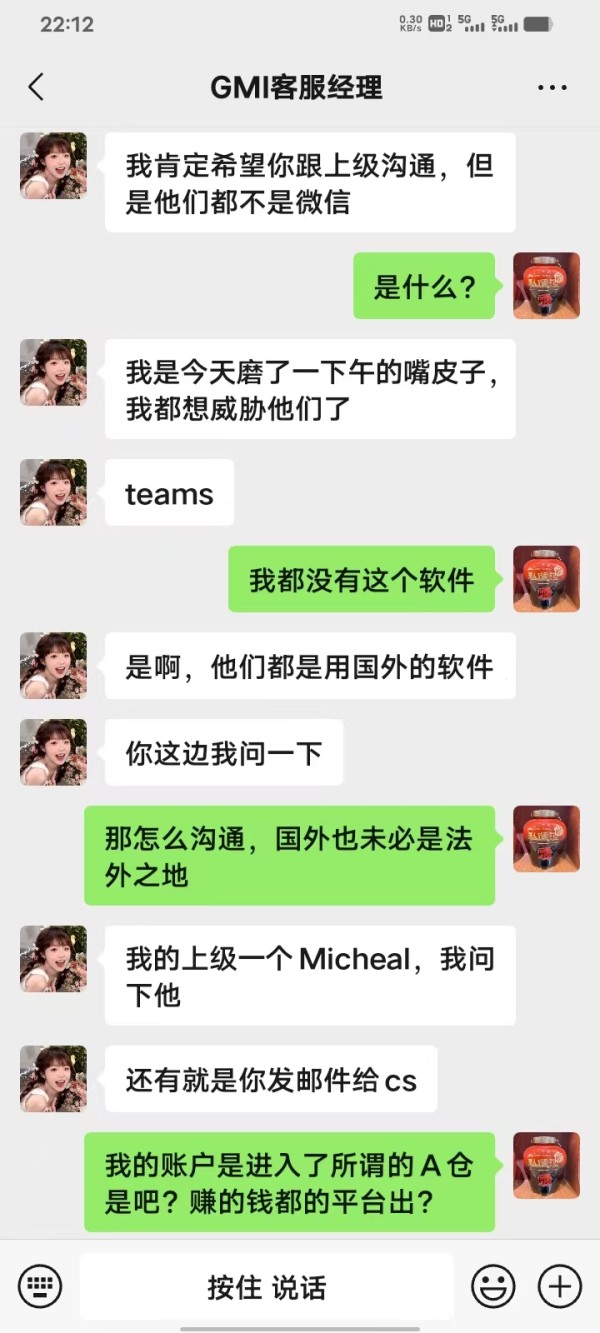

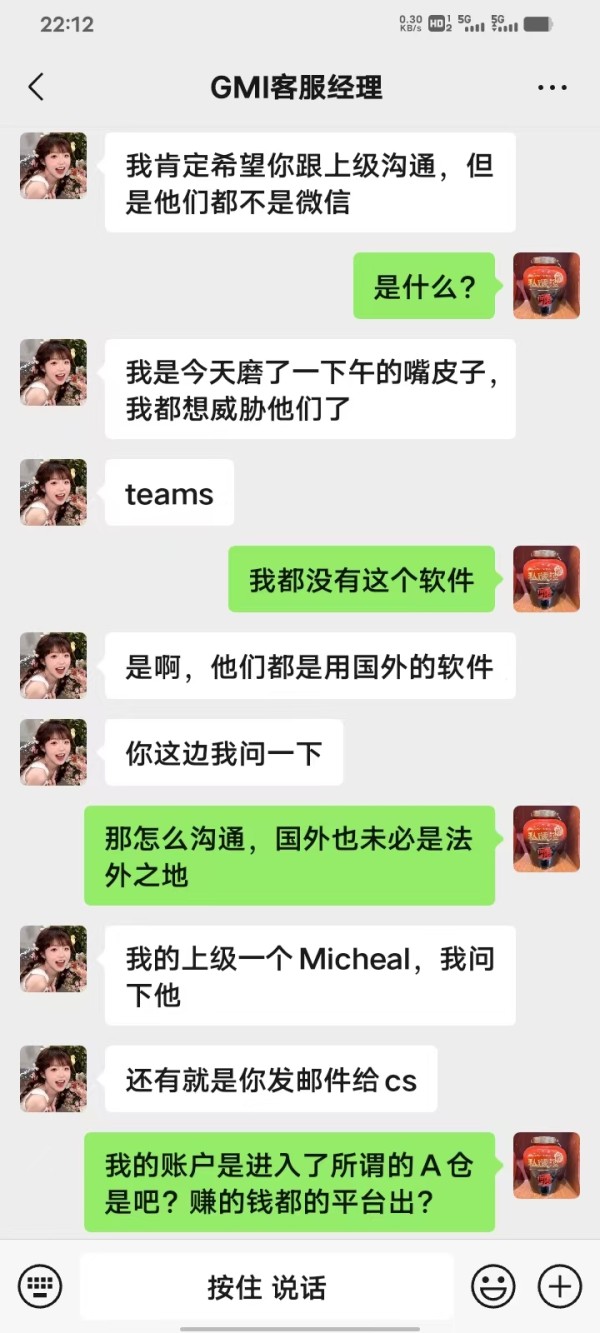

Customer Service and Support Analysis

Customer service quality at GMI presents a mixed picture based on available feedback. Employee satisfaction ratings of 3.3 out of 5 indicate inconsistent service delivery standards. The distribution of customer feedback showing 67% positive alongside 33% negative reviews suggests that while many clients receive satisfactory support, a significant minority experience service-related challenges that require attention.

Available information does not specify customer support channels, whether clients can access assistance through live chat, telephone, email, or social media platforms. Response time commitments, support availability hours, and escalation procedures for complex issues remain undetailed, making it difficult to assess the broker's commitment to client assistance accessibility.

Multi-language support capabilities, which are crucial for international brokers serving diverse client bases, are not clearly specified in current documentation. The absence of detailed support structure information, including specialized assistance for different account types or dedicated relationship management for institutional clients, contributes to uncertainty about service quality consistency across GMI's client base.

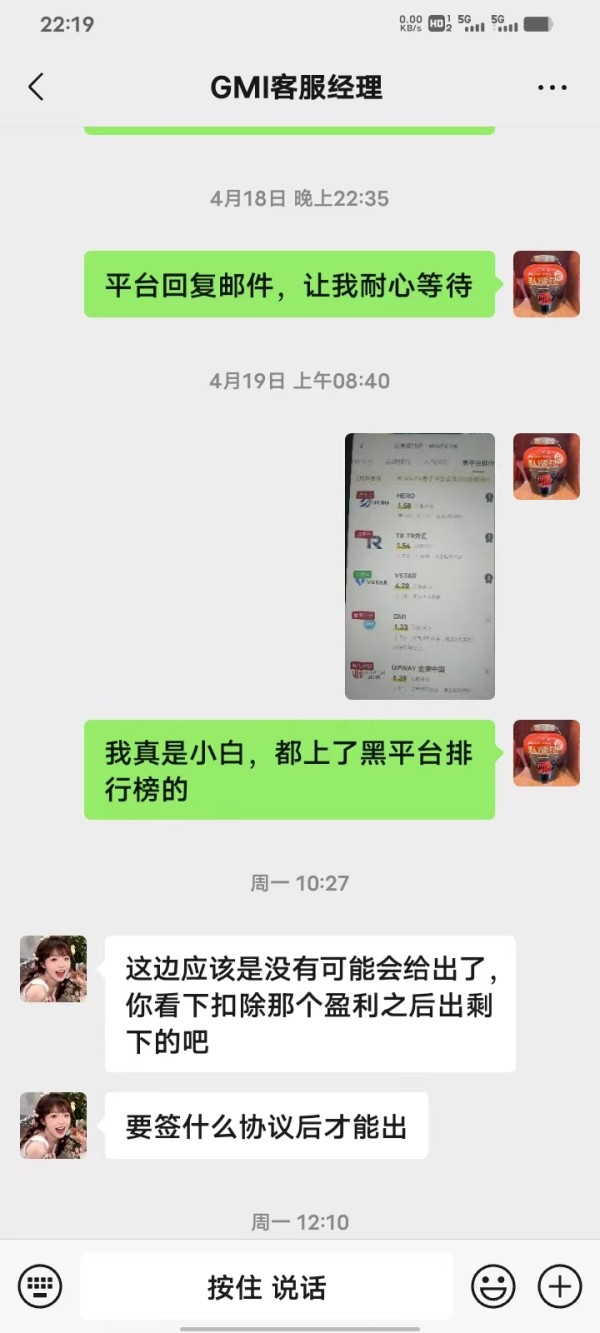

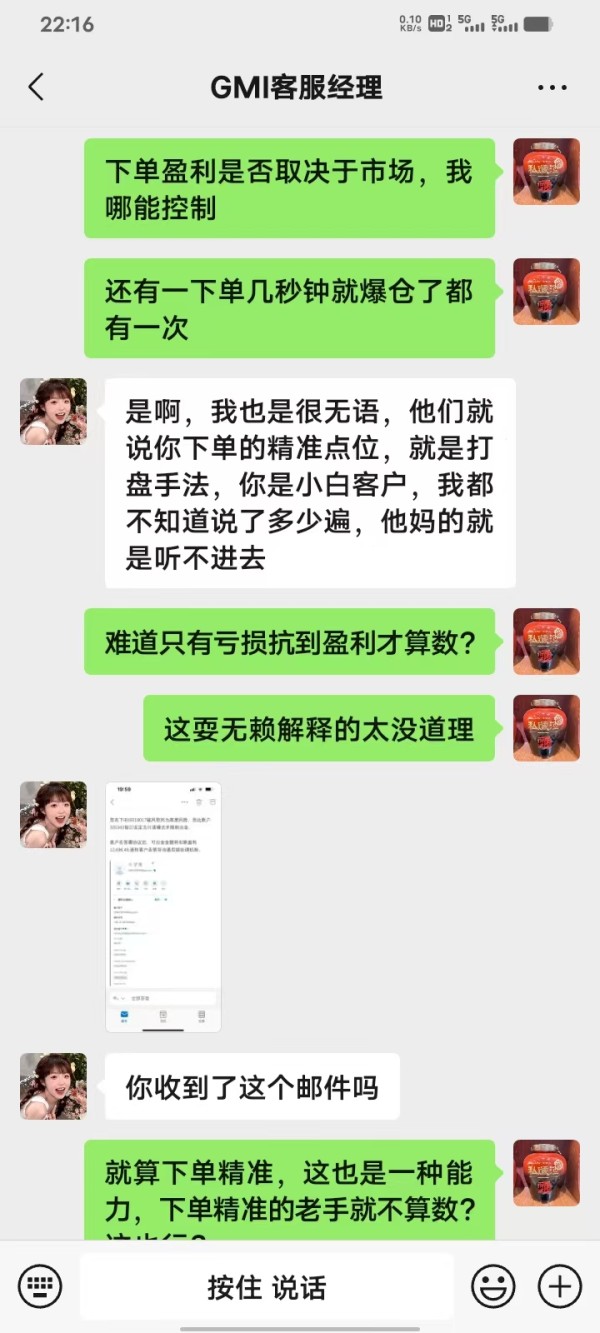

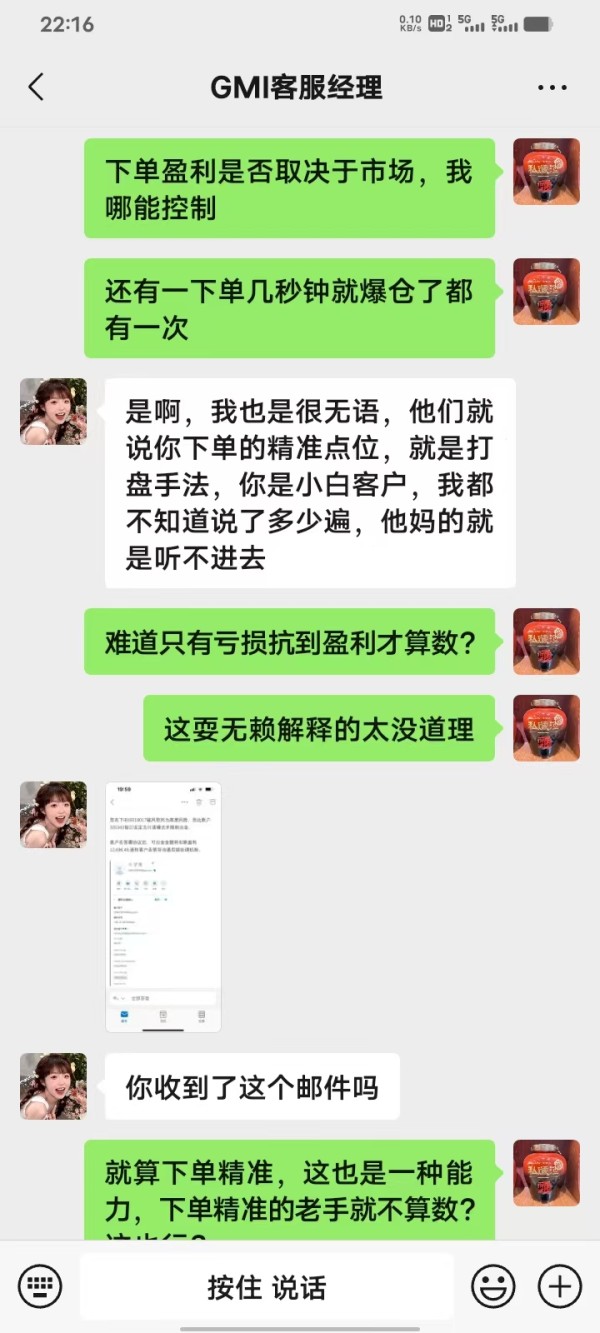

Trading Experience Analysis

The trading experience at GMI centers around two platform options: MetaTrader 4 and the proprietary GMI Edge system. However, detailed performance metrics, execution speeds, or reliability statistics are not provided in available materials. This GMI review notes that while MT4 remains an industry standard, the lack of additional platform diversity may limit appeal to traders seeking cutting-edge trading technology or specialized execution features.

Order execution quality information is not detailed in current documentation, including slippage rates, requote frequencies, or execution speed benchmarks. These technical performance indicators are crucial for active traders, particularly those using scalping strategies or high-frequency trading approaches where execution quality directly impacts profitability.

Mobile trading capabilities, cross-device synchronization, and offline trading features are not comprehensively described, leaving questions about the broker's commitment to modern trading accessibility requirements. The absence of advanced order types, automated trading capabilities, or integration with third-party trading tools further limits the platform's appeal to sophisticated trading strategies.

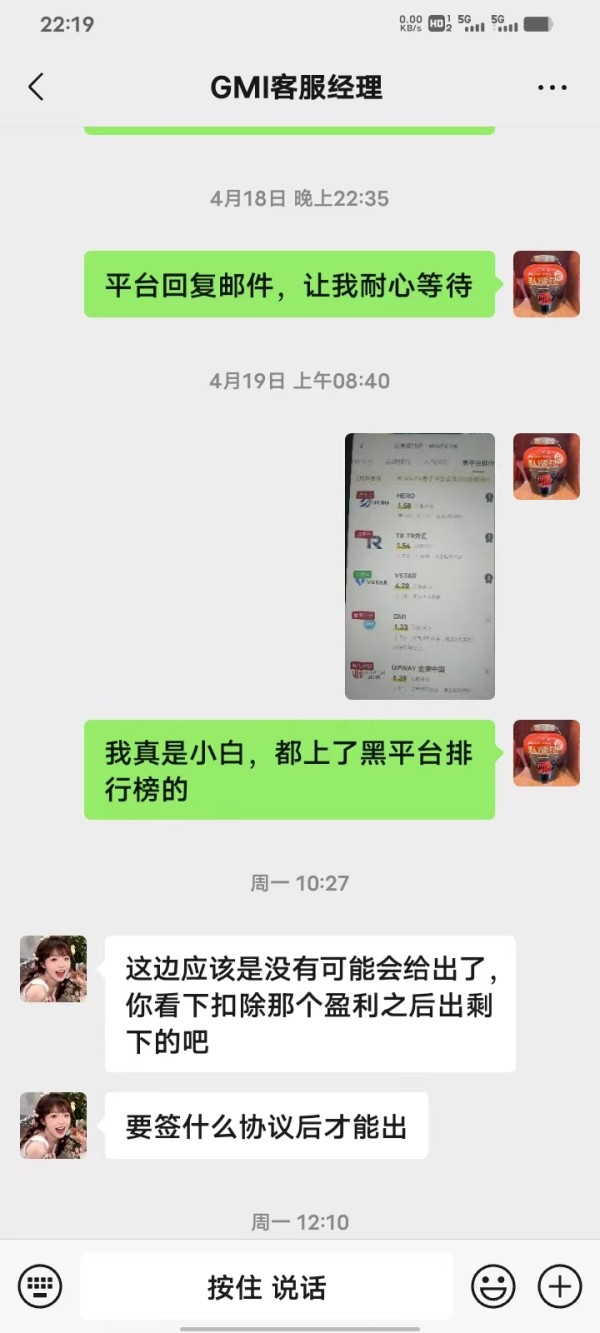

Trust and Security Analysis

GMI's trust profile presents mixed signals, with the absence of specific regulatory authority details and license numbers raising questions about transparency standards. However, the company's A+ rating from the Better Business Bureau provides some credibility validation, though this primarily reflects business practice standards rather than financial services regulatory compliance.

The broker's multi-jurisdictional registration approach across Saint Vincent and the Grenadines, Mauritius, and Vanuatu may provide operational flexibility but potentially complicates client protection standards. Without clear regulatory authority specifications, clients cannot fully assess their protection levels under relevant investor compensation schemes or dispute resolution mechanisms.

Fund security measures are not clearly outlined in available documentation, including client money segregation policies, insurance coverage, or banking partner details. The absence of third-party auditing information, financial transparency reports, or regulatory compliance updates further limits the ability to assess the broker's commitment to maintaining industry-standard security practices.

User Experience Analysis

Overall user satisfaction at GMI reflects moderate performance levels. Employee feedback and client reviews indicate average service delivery that requires improvement across multiple operational areas. The 3.3 out of 5 employee satisfaction score suggests internal operational challenges that may impact client service quality and consistency.

Platform interface design, navigation efficiency, and user-friendly features are not specifically detailed in available materials, making it difficult to assess the broker's commitment to modern user experience standards. Account registration and verification processes remain unspecified in current information sources, including required documentation, approval timeframes, and onboarding support.

The 33% negative feedback rate indicates recurring client concerns that management needs to address systematically. Common user complaints, resolution procedures, and improvement initiatives are not detailed in available documentation, suggesting potential gaps in client feedback integration and service enhancement processes.

Conclusion

This GMI review reveals a broker with moderate performance across key evaluation criteria. The company requires significant improvements in transparency, service delivery, and client communication standards. While GMI offers access to diverse trading instruments through established platforms, the lack of detailed information about regulatory compliance, fee structures, and account conditions creates uncertainty for potential clients.

The broker appears most suitable for retail and institutional clients seeking basic forex and CFD trading access without requiring advanced analytical tools or comprehensive educational resources. However, traders who prioritize regulatory transparency, detailed cost structures, and premium customer service may find GMI's current offerings insufficient for their requirements.

GMI's primary advantages include diversified asset access and platform compatibility, while significant disadvantages include unclear regulatory positioning and limited transparency regarding essential trading conditions. Potential clients should conduct thorough research and request detailed information directly from the broker before making account opening decisions.