Is ICX Capital safe?

Business

License

Is ICX Capital Safe or a Scam?

Introduction

ICX Capital is an online forex broker that has positioned itself in the competitive landscape of foreign exchange trading. With claims of offering a wide range of financial instruments and trading platforms, it aims to attract both novice and experienced traders. However, the forex market is rife with potential pitfalls, making it essential for traders to conduct thorough assessments of any broker before committing their funds. This article investigates ICX Capital's legitimacy, focusing on its regulatory status, company background, trading conditions, customer experiences, and overall safety. Our analysis draws from various online resources, user reviews, and regulatory databases to provide a comprehensive overview of whether ICX Capital is safe or a potential scam.

Regulatory Status and Legitimacy

The regulatory environment is a crucial factor in determining the safety of a forex broker. Regulation ensures that brokers adhere to strict standards, protecting traders' funds and providing a framework for accountability. Unfortunately, ICX Capital operates without any significant regulatory oversight. This lack of regulation is a major red flag for potential investors.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Unregulated |

The absence of a valid regulatory license means that ICX Capital does not fall under the jurisdiction of any financial authority that could provide oversight or recourse for traders. This raises serious concerns about the broker's operational practices and the safety of clients' funds. Historically, unregulated brokers have been linked to fraudulent activities, including the misappropriation of funds and refusal to honor withdrawal requests. Therefore, it is imperative for traders to be cautious when dealing with ICX Capital, as the lack of regulation significantly increases the risk of financial loss.

Company Background Investigation

ICX Capital's company history and ownership structure are essential in assessing its credibility. The broker claims to be based in Saint Vincent and the Grenadines, a common jurisdiction for many offshore brokers. However, the lack of detailed information regarding its establishment, ownership, and operational history further complicates the assessment.

The management team behind ICX Capital is not well-documented, which raises questions about their expertise and commitment to ethical trading practices. Transparency is crucial in the financial industry, and ICX Capital's failure to provide sufficient information about its team and operational history may indicate a lack of accountability. Without a clear understanding of the company's background, potential investors should exercise extreme caution when considering trading with ICX Capital.

Trading Conditions Analysis

The overall trading conditions offered by a broker play a significant role in determining its attractiveness to traders. ICX Capital claims to provide competitive spreads and various trading instruments. However, the absence of detailed information regarding its fee structure raises concerns.

| Fee Type | ICX Capital | Industry Average |

|---|---|---|

| Major Currency Pair Spread | N/A | 1.0 - 2.0 pips |

| Commission Model | N/A | Varies |

| Overnight Interest Range | N/A | 0.5% - 2.0% |

The lack of clarity regarding spreads, commissions, and overnight fees is troubling. Traders typically expect transparent fee structures, and ICX Capitals vague policies may lead to unexpected costs. Furthermore, the absence of information on any unusual fees or penalties can make it difficult for traders to accurately assess their potential trading costs. This lack of transparency could suggest that traders may face hidden fees, which is a common tactic employed by less reputable brokers.

Client Fund Safety

Client fund safety is paramount in forex trading. A reputable broker should have robust measures in place to protect clients' funds. Unfortunately, ICX Capital does not provide clear information on its fund safety protocols.

In regulated environments, brokers typically segregate client funds from their operational funds, ensuring that client money is protected in case of bankruptcy. However, ICX Capital's lack of regulation raises questions about whether it employs such practices. Without clear policies on fund segregation, investor protection, and negative balance protection, traders may find themselves at risk of losing their entire investment.

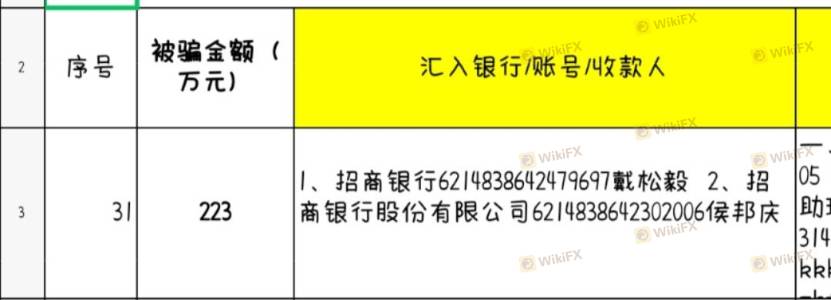

Furthermore, there have been reports of clients facing difficulties when attempting to withdraw their funds, a common issue with unregulated brokers. The absence of a reliable withdrawal process can lead to significant financial losses, making it crucial for traders to be wary of depositing funds with ICX Capital.

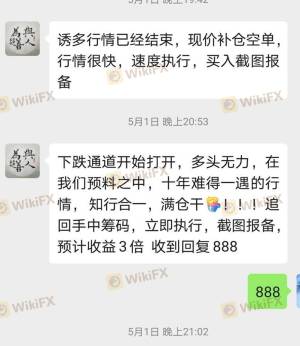

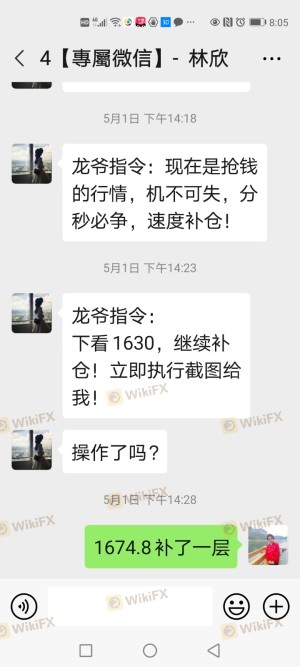

Customer Experience and Complaints

Customer feedback is an invaluable resource for evaluating a broker's reliability. Unfortunately, reviews of ICX Capital reveal a pattern of negative experiences among traders. Common complaints include difficulties in fund withdrawals, unresponsive customer support, and issues with account management.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Poor |

| Account Blocking | Medium | Poor |

| Customer Support Issues | High | Poor |

One notable case involved a trader who reported being unable to withdraw funds after multiple requests, ultimately leading to the conclusion that ICX Capital may not be a trustworthy broker. Such experiences highlight the importance of conducting thorough research before engaging with any trading platform. Given the significant number of complaints, potential investors should consider these factors when assessing whether ICX Capital is safe.

Platform and Execution

The trading platform's performance is critical for successful trading. ICX Capital claims to offer a user-friendly trading platform; however, user reviews suggest that the platform may experience issues related to stability and execution quality. Reports of slippage and order rejections have raised concerns about the broker's reliability.

In a competitive trading environment, execution speed and reliability are essential. If a broker's platform is prone to delays or technical issues, it can severely impact traders' ability to capitalize on market opportunities. Without reliable data on platform performance, traders may find themselves at a disadvantage, further underscoring the need for caution when dealing with ICX Capital.

Risk Assessment

The risks associated with trading through ICX Capital are significant, primarily due to its unregulated status and negative customer feedback.

| Risk Category | Risk Level | Brief Description |

|---|---|---|

| Regulatory Risk | High | No regulatory oversight |

| Fund Safety Risk | High | Lack of clear safety protocols |

| Withdrawal Risk | High | Reports of difficulties in fund retrieval |

Given these risks, potential traders should consider the implications of trading with an unregulated broker. It is advisable to approach ICX Capital with caution and consider alternative, regulated options that offer greater safety and transparency.

Conclusion and Recommendations

In conclusion, the evidence suggests that ICX Capital raises numerous red flags regarding its legitimacy and safety. The lack of regulation, negative customer feedback, and unclear trading conditions indicate that traders should exercise extreme caution. While some may still consider trading with ICX Capital, it is essential to be aware of the potential risks involved.

For traders seeking a safer trading environment, it is advisable to consider alternative brokers that are well-regulated and have a proven track record of reliability. Options such as IC Markets or OANDA, which are known for their robust regulatory frameworks and positive customer experiences, may provide a more secure trading environment. Ultimately, ensuring the safety of your investments should always be the top priority when choosing a forex broker.

Is ICX Capital a scam, or is it legit?

The latest exposure and evaluation content of ICX Capital brokers.

ICX Capital Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

ICX Capital latest industry rating score is 1.55, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.55 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.