Regarding the legitimacy of PROBIS forex brokers, it provides ASIC and WikiBit, (also has a graphic survey regarding security).

Is PROBIS safe?

Pros

Cons

Is PROBIS markets regulated?

The regulatory license is the strongest proof.

ASIC Market Making License (MM)

Australia Securities & Investment Commission

Australia Securities & Investment Commission

Current Status:

UnverifiedLicense Type:

Market Making License (MM)

Licensed Entity:

Probis Securities Pty Limited

Effective Date:

2012-02-06Email Address of Licensed Institution:

james.yu@probisgroup.com.auSharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

2020-01-28Address of Licensed Institution:

--Phone Number of Licensed Institution:

0290477800Licensed Institution Certified Documents:

Is Probis Safe or a Scam?

Introduction

Probis is an Australian-based forex broker that has gained attention in the trading community since its inception in 2009. Positioned primarily as a platform for trading forex, commodities, and CFDs, Probis claims to offer a diverse range of financial instruments for both novice and experienced traders. However, with the proliferation of online trading platforms, it has become crucial for traders to thoroughly evaluate the legitimacy and safety of their chosen brokers. This article aims to provide an objective assessment of whether Probis is safe or a potential scam by analyzing its regulatory status, company background, trading conditions, customer experience, and overall risk profile.

The investigation is based on a comprehensive review of various sources, including regulatory disclosures, customer feedback, and expert analyses, to form a well-rounded understanding of Probis as a trading platform. The evaluation framework includes examining the broker's regulatory compliance, financial practices, customer security measures, and user experiences.

Regulation and Legitimacy

The regulatory status of a forex broker is often the first indicator of its legitimacy. For traders, a broker regulated by reputable authorities typically signifies a higher level of trust and safety. Probis was previously regulated by the Australian Securities and Investments Commission (ASIC) under license number 338241. However, it is important to note that this license has been revoked, raising significant concerns about the broker's operational legitimacy.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| ASIC | 338241 | Australia | Revoked |

The revocation of ASIC's license is a critical red flag. ASIC is known for its strict regulatory standards, and any broker losing its license often indicates serious compliance issues. Furthermore, the broker was placed into voluntary administration in July 2023, which suggests financial instability and raises questions about its ability to safeguard client funds. This situation necessitates caution for potential investors, as trading with an unregulated broker can expose traders to significant risks.

Company Background Investigation

Probis Financial Services Limited, established in 2009, has undergone various phases in its operational history. Initially, it was recognized as a legitimate trading platform, but its recent troubles have overshadowed its earlier reputation. The company is headquartered in Sydney, Australia, and offers a range of trading services. However, the lack of transparency regarding its ownership structure and management team raises concerns.

The management teams background is also crucial in assessing the broker's reliability. Unfortunately, specific details about the team's experience and qualifications are not readily available, further diminishing the trustworthiness of the broker. Transparency in company operations and management is vital for building trader confidence, and the absence of this information in Probis's case is alarming.

Trading Conditions Analysis

When evaluating a broker, understanding the trading conditions is essential. Probis offers various trading instruments, including forex pairs, commodity CFDs, and securities CFDs. However, the overall fee structure and trading costs can significantly impact a trader's profitability.

| Fee Type | Probis | Industry Average |

|---|---|---|

| Spread for Major Pairs | Starts at 3 pips | 1-2 pips |

| Commission Model | Not specified | Varies widely |

| Overnight Interest Range | Varies | Varies by broker |

The spreads offered by Probis are notably higher than the industry average, which can eat into potential profits. Additionally, the lack of transparency regarding commission structures raises further concerns. Traders should be aware of any hidden fees that may not be immediately apparent, as these can significantly affect overall trading costs.

Client Fund Safety

The safety of client funds is paramount when selecting a trading platform. Probis reportedly had measures in place for client fund protection, such as segregated accounts and investor protection schemes, but the revocation of its regulatory license casts doubt on the effectiveness of these measures.

The lack of a clear policy on negative balance protection also raises concerns. In the event of significant market volatility, traders could find themselves in a position where their losses exceed their deposits, leading to substantial financial implications. Historical issues related to fund security, including the recent voluntary administration, further heighten the risk for potential investors.

Customer Experience and Complaints

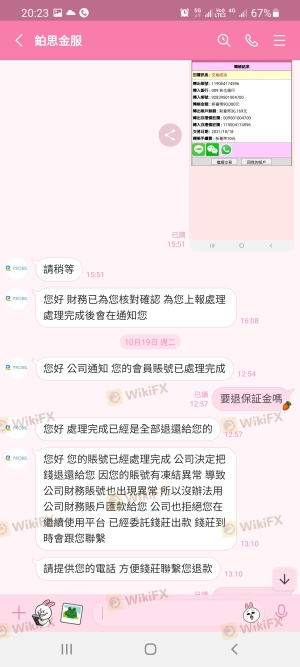

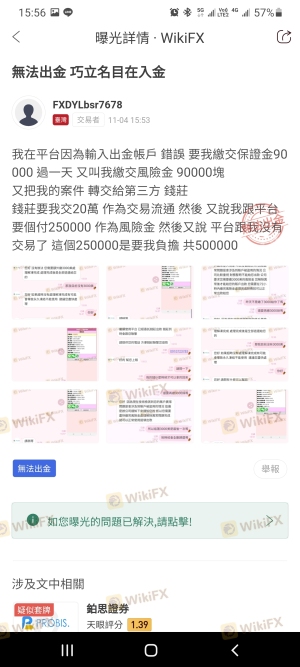

Customer feedback is a valuable resource for understanding a broker's reliability. Many reviews of Probis indicate dissatisfaction among users, particularly regarding withdrawal issues and customer support responsiveness.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Slow response |

| Poor Customer Support | Medium | Inconsistent |

Common complaints include delays in processing withdrawals and a lack of adequate customer service. In some cases, users have reported waiting weeks to access their funds, which is unacceptable for any trading platform. These issues can be indicative of deeper operational problems within the company, further suggesting that Probis may not be safe for trading.

Platform and Execution

The trading platform offered by Probis, known as Probis Auton, is designed for efficient trading. However, user experiences reveal concerns regarding platform stability and execution quality. Reports of slippage and order rejections have been noted, which can be detrimental to traders relying on timely execution for their strategies.

Traders should be wary of any signs of platform manipulation, as this could indicate unethical practices. A reliable trading environment is crucial for maintaining trader confidence, and any inconsistencies in execution can lead to significant losses.

Risk Assessment

Using Probis as a trading platform comes with inherent risks. The combination of regulatory issues, financial instability, and poor customer experiences contributes to a high-risk profile.

| Risk Category | Risk Level | Brief Description |

|---|---|---|

| Regulatory Compliance | High | License revoked by ASIC |

| Financial Stability | High | Entered voluntary administration |

| Customer Service | Medium | Frequent complaints regarding support and withdrawals |

To mitigate these risks, traders should consider diversifying their investments and not committing substantial capital to a broker with such a questionable background. Seeking alternative, well-regulated brokers may be a prudent decision.

Conclusion and Recommendations

In conclusion, the evidence strongly suggests that Probis is not safe for trading. The revocation of its ASIC license, coupled with reports of financial instability and poor customer experiences, raises significant red flags. Traders should exercise extreme caution when considering this broker, as the potential for loss is high.

For those still interested in trading, it is advisable to seek out well-regulated alternatives that offer transparent fee structures, reliable customer service, and robust fund protection measures. Brokers with positive user reviews and a solid regulatory framework will provide a safer trading environment.

Is PROBIS a scam, or is it legit?

The latest exposure and evaluation content of PROBIS brokers.

PROBIS Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

PROBIS latest industry rating score is 1.58, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.58 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.