Regarding the legitimacy of Globex360 forex brokers, it provides FSCA and WikiBit, (also has a graphic survey regarding security).

Is Globex360 safe?

Pros

Cons

Is Globex360 markets regulated?

The regulatory license is the strongest proof.

FSCA Derivatives Trading License (EP)

Financial Sector Conduct Authority

Financial Sector Conduct Authority

Current Status:

UnverifiedLicense Type:

Derivatives Trading License (EP)

Licensed Entity:

IQUOTO AFRICA (PTY) LTD

Effective Date: Change Record

2019-07-10Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

67 MOUNTAIN ROADSOMERSET WESTWESTERN CAPE7130Phone Number of Licensed Institution:

074 422 3573Licensed Institution Certified Documents:

Is Globex360 A Scam?

Introduction

Globex360, established in 2017, is a South African brokerage firm that primarily focuses on providing trading services to clients in Africa and beyond. As a relatively new player in the forex market, it offers a range of trading instruments including forex, commodities, indices, and cryptocurrencies. However, the rapid growth of online trading has also led to an influx of unregulated and potentially fraudulent brokers. Therefore, it is crucial for traders to carefully evaluate the legitimacy and reliability of any forex broker before committing their funds. This article aims to investigate whether Globex360 is a scam or a legitimate trading platform by examining its regulatory status, company background, trading conditions, customer fund security, customer experiences, platform performance, and associated risks.

Regulation and Legitimacy

Regulation is a critical factor in determining the legitimacy of a forex broker. Globex360 is regulated by the Financial Sector Conduct Authority (FSCA) in South Africa, which is responsible for overseeing financial markets and protecting investors. Regulatory bodies like the FSCA enforce strict compliance measures to ensure that brokers operate fairly and transparently. Below is a summary of Globex360's regulatory information:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| FSCA | FSP 50130 | South Africa | Verified |

The FSCA's regulatory framework aims to ensure that brokers maintain a high standard of integrity, transparency, and security. However, it is important to note that the FSCA does not require brokers to offer negative balance protection or participate in compensation schemes, which could pose risks to traders. Furthermore, there have been instances where Globex360 faced regulatory scrutiny, raising questions about its compliance history. Despite being regulated, the lack of additional tier-one regulations may leave traders feeling vulnerable.

Company Background Investigation

Globex360 was founded with the intention of providing a reliable trading platform for clients in Africa. The company has its headquarters in Johannesburg, South Africa, and operates under the legal name "Globex 360 (Pty) Ltd." The management team comprises experienced professionals from the financial services industry, though specific details about their backgrounds are limited. The company's transparency regarding its ownership structure and operational practices is crucial for building trust with clients.

As part of its commitment to transparency, Globex360 maintains segregated accounts for client funds, ensuring that these funds are kept separate from the company's operational capital. This practice is essential for safeguarding client investments and providing a level of assurance regarding fund security. However, the companys communication regarding its financial practices and regulatory compliance could be more robust, as some users have reported difficulties in accessing clear information.

Trading Conditions Analysis

When assessing whether Globex360 is a scam, it is essential to analyze its trading conditions, including fees and spreads. The overall fee structure can significantly impact a trader's profitability. Globex360 offers various account types, each with different fee structures. Below is a comparison of key trading costs:

| Fee Type | Globex360 | Industry Average |

|---|---|---|

| Spread on Major Currency Pairs | From 1.6 pips | 0.5 - 1.0 pips |

| Commission Model | $8 per lot (for ECN accounts) | $5 per lot |

| Overnight Interest Range | Variable | Variable |

Globex360's spreads are generally higher than the industry average, which may deter some traders. Additionally, the commission structure, particularly on ECN accounts, is relatively high compared to other brokers. The lack of transparency regarding additional fees, such as deposit and withdrawal fees, further complicates the fee assessment. Traders should be cautious and fully understand the fee structure before opening an account.

Customer Fund Security

The safety of customer funds is paramount when evaluating a broker's credibility. Globex360 implements several measures to secure client funds, including the use of segregated accounts. This means that client funds are held in separate accounts from the companys operational funds, reducing the risk of misappropriation. However, it is important to note that while the FSCA regulates Globex360, it does not mandate negative balance protection, which means traders could potentially lose more than their initial deposit.

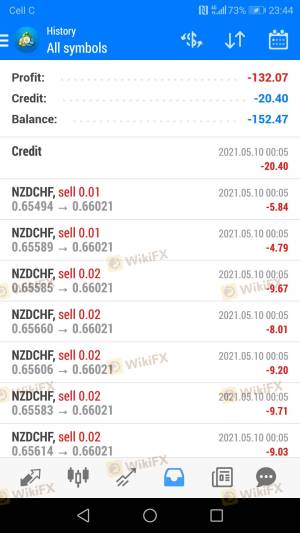

Additionally, there have been reports of withdrawal issues from some clients, raising concerns about the broker's reliability in processing transactions. The absence of a compensation scheme means that traders may not be reimbursed in the event of the company's insolvency. Therefore, while Globex360 has implemented some safety measures, the lack of comprehensive protections may leave traders vulnerable.

Customer Experience and Complaints

Customer feedback is a vital indicator of a broker's reliability. Reviews of Globex360 reveal a mixed bag of experiences. While some traders commend the platform for its user-friendly interface and range of trading instruments, others express frustration over slow withdrawal times and unresponsive customer service. Below is a summary of common complaint types and their severity:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Inconsistent |

| Poor Customer Service | Medium | Slow response |

| High Spreads | Medium | Acknowledged |

Typical cases include traders experiencing significant delays in receiving their funds after withdrawal requests, leading to frustration and distrust. Additionally, some users have reported difficulties in reaching customer support, particularly during off-hours. These complaints indicate potential weaknesses in Globex360's customer service and operational efficiency.

Platform and Trade Execution

The performance of a trading platform is crucial for a seamless trading experience. Globex360 primarily utilizes the MetaTrader 4 (MT4) platform, which is known for its stability and advanced features. However, the platform's performance can vary based on market conditions. Traders have reported instances of slippage and order execution delays, which can significantly impact trading outcomes.

Users have expressed concerns regarding the execution quality, particularly during high-volatility periods. The potential for price manipulation is also a concern, especially if the broker has the ability to influence order execution. Therefore, while the MT4 platform is generally reliable, the execution quality at Globex360 may not meet the standards expected by professional traders.

Risk Assessment

Utilizing Globex360 comes with its own set of risks. Below is a concise risk scorecard summarizing key risk areas:

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | Medium | Limited regulatory protections. |

| Fund Security Risk | High | No negative balance protection. |

| Customer Service Risk | Medium | Reports of poor support and withdrawal delays. |

| Trading Cost Risk | Medium | Higher spreads and commissions compared to industry standards. |

Traders are advised to exercise caution and consider these risks before engaging with Globex360. It is recommended to start with a demo account to familiarize oneself with the platform and its features before committing real funds.

Conclusion and Recommendations

In conclusion, while Globex360 is regulated by the FSCA, there are several areas of concern that potential traders should consider. The lack of negative balance protection, reports of withdrawal issues, and higher-than-average trading costs raise red flags. Therefore, it is essential for traders to approach this broker with caution.

For those seeking a reliable trading experience, it may be prudent to explore alternative brokers that offer more robust regulatory protections and better customer service. Brokers such as IG, Pepperstone, or Avatrade may provide safer and more competitive trading environments. Ultimately, it is crucial for traders to conduct thorough research and carefully assess their options before committing to any broker in the forex market.

Is Globex360 a scam, or is it legit?

The latest exposure and evaluation content of Globex360 brokers.

Globex360 Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Globex360 latest industry rating score is 1.56, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.56 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.