Is CGL safe?

Pros

Cons

Is CGL a Scam?

Introduction

CGL is a forex broker that claims to provide a wide range of trading services to both novice and experienced traders in the foreign exchange market. With the rapid growth of online trading platforms, it has become increasingly important for traders to carefully assess the legitimacy and reliability of their chosen brokers. The forex market is notorious for its volatility and high-risk nature, making it essential for traders to ensure they are working with credible and regulated firms. This article aims to provide a comprehensive evaluation of CGL, focusing on its regulatory status, company background, trading conditions, customer experience, and overall risk assessment. The information presented is based on a thorough review of various online sources, including user feedback, regulatory data, and expert analyses.

Regulatory Status and Legitimacy

Regulation plays a critical role in determining the safety and legitimacy of a forex broker. A regulated broker is typically subject to strict oversight by financial authorities, which helps protect traders from fraud and financial mismanagement. CGL's regulatory situation is concerning; it claims to be licensed by the Securities and Futures Commission (SFC) of Hong Kong. However, investigations have raised suspicions about the legitimacy of this claim, suggesting that the broker may be operating without proper authorization.

| Regulatory Body | License Number | Regulatory Area | Verification Status |

|---|---|---|---|

| SFC | BCZ 158 | Hong Kong | Suspicious Clone |

The SFC's role is to ensure that financial services firms adhere to high standards of integrity and transparency. The fact that CGL's license is labeled as a "suspicious clone" indicates that it may not be a legitimate entity. This lack of proper regulation raises red flags for potential investors, as trading with an unregulated broker can expose them to significant risks, including the potential loss of funds without any recourse.

Company Background Investigation

CGL's company history and ownership structure are crucial aspects to consider when evaluating its credibility. Unfortunately, there is limited publicly available information regarding the broker's founding, ownership, and management team. The absence of transparency in these areas is often a red flag for potential investors. A reputable broker typically provides clear information about its history and key personnel, including their qualifications and experience in the financial industry.

The lack of details regarding CGL's management team further complicates the assessment of its legitimacy. Without knowing the backgrounds of the individuals running the firm, it becomes challenging to gauge the company's commitment to ethical practices and customer service. Transparency is a fundamental characteristic of trustworthy brokers, and CGL's failure to provide this information raises concerns about its reliability.

Trading Conditions Analysis

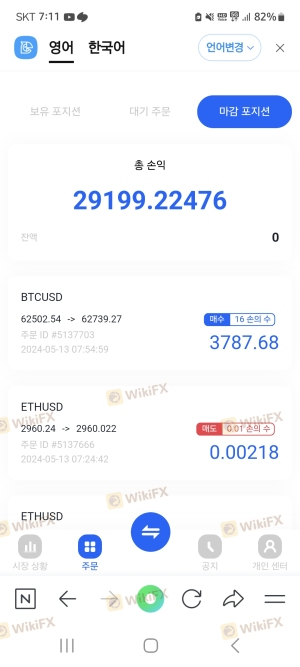

Understanding the trading conditions offered by a broker is essential for evaluating its overall value proposition. CGL claims to provide competitive trading conditions, including low spreads and various account types. However, user reviews suggest that there may be hidden fees and unfavorable trading terms that could significantly impact traders' profitability.

| Fee Type | CGL | Industry Average |

|---|---|---|

| Major Currency Pair Spread | Variable | 0.5 - 1.5 pips |

| Commission Model | Yes | Varies |

| Overnight Interest Range | High | Moderate |

The spread on major currency pairs is reported to be variable, which can lead to unexpected costs for traders. Additionally, some users have reported issues with withdrawal fees and conditions that are not clearly stated upfront. Such practices are often indicative of brokers that prioritize their profits over the interests of their clients, making it essential for potential investors to approach CGL with caution.

Client Fund Security

The security of client funds is a paramount concern for any trader. CGL claims to implement various measures to protect client deposits, including segregated accounts and negative balance protection. However, the effectiveness of these measures is questionable given the broker's dubious regulatory status.

Traders should be aware that if a broker operates without proper regulation, the protections it claims to offer may not be enforceable. The potential for fund mismanagement or loss increases significantly in such scenarios. There have been reports from users who experienced difficulties withdrawing their funds, raising further concerns about CGL's commitment to safeguarding client assets.

Customer Experience and Complaints

Customer feedback is a valuable resource for assessing a broker's reliability. Many users have reported negative experiences with CGL, particularly concerning withdrawal issues and poor customer support. Common complaints include difficulties in accessing funds, unresponsive customer service, and unclear communication regarding fees.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Support | Medium | Poor |

| Fee Transparency | High | Poor |

Several users have shared their frustrations regarding the withdrawal process, with some claiming they were asked to pay additional fees before being allowed to access their funds. Such practices are often seen in scam operations and indicate a lack of transparency and integrity within the brokerage.

Platform and Trade Execution

The performance of a trading platform is another critical aspect of a broker's reliability. CGL offers a trading platform that is reported to have stability issues, with users experiencing frequent outages and slow execution times. These issues can significantly affect traders' ability to capitalize on market opportunities and may lead to financial losses.

Furthermore, reports of slippage and order rejections have raised concerns about the broker's execution quality. In a competitive trading environment, reliable execution is essential for traders to succeed, and CGL's apparent shortcomings in this area warrant caution.

Risk Assessment

Based on the information gathered, the overall risk associated with trading through CGL appears to be high. The combination of regulatory concerns, negative customer feedback, and questionable trading conditions creates an environment that may not be conducive to successful trading.

| Risk Category | Risk Level | Brief Description |

|---|---|---|

| Regulatory Compliance | High | Operating without proper regulation. |

| Fund Security | High | Potential for fund mismanagement. |

| Customer Support | Medium | Poor response to complaints and issues. |

| Trading Conditions | High | Hidden fees and unfavorable terms. |

To mitigate these risks, traders are advised to conduct thorough research and consider alternative brokers with a proven track record of reliability and transparency.

Conclusion and Recommendations

In conclusion, the evidence suggests that CGL may not be a trustworthy forex broker. The combination of regulatory concerns, negative user experiences, and questionable trading practices indicates a higher likelihood of potential issues for traders. As such, it is essential for individuals considering trading with CGL to exercise caution and conduct further due diligence.

For traders seeking reliable alternatives, it is advisable to consider brokers that are well-regulated, transparent, and have a positive reputation in the industry. Reputable options include brokers regulated by recognized authorities such as the FCA, ASIC, or NFA, which provide greater assurance of fund protection and ethical practices. By choosing a credible broker, traders can enhance their chances of a successful and secure trading experience.

Is CGL a scam, or is it legit?

The latest exposure and evaluation content of CGL brokers.

CGL Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

CGL latest industry rating score is 1.33, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.33 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.