Is Asia Capitals safe?

Pros

Cons

Is Asia Capitals Safe or Scam?

Introduction

Asia Capitals is a forex broker that has emerged in the competitive landscape of online trading. Positioned as a platform for forex and CFD trading, it claims to offer a variety of trading instruments and account types to cater to diverse trader needs. However, the importance of conducting thorough due diligence before engaging with any forex broker cannot be overstated. Traders must be cautious, as the forex market is rife with both legitimate opportunities and potential scams. In this article, we will explore whether Asia Capitals is a safe trading option or if it raises red flags that warrant concern. Our investigation is based on a comprehensive analysis of regulatory status, company background, trading conditions, customer feedback, and overall risk assessment.

Regulation and Legitimacy

One of the primary factors determining the safety of a forex broker is its regulatory status. Regulation ensures that brokers adhere to strict standards that protect traders' interests and funds. In the case of Asia Capitals, our investigation reveals a concerning lack of legitimate regulatory oversight.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Not regulated |

The absence of a valid regulatory license raises significant concerns about the broker's legitimacy and the safety of traders' funds. Asia Capitals does not appear to be registered with any reputable financial authority, which typically provides a layer of protection for traders. The lack of oversight means that there are no guarantees regarding the broker's operations, fund safety, or adherence to ethical trading practices.

The importance of regulation cannot be overstated; it serves as a safeguard against fraud and malpractice. Brokers regulated by top-tier authorities are required to maintain transparency, segregate client funds, and provide a clear framework for dispute resolution. The unregulated status of Asia Capitals indicates a higher risk for traders, as there is no accountability or oversight to protect their investments.

Company Background Investigation

Asia Capitals, while relatively new in the forex trading landscape, has not provided sufficient information regarding its history, ownership structure, or management team. The lack of transparency about the company's origins and operational history raises further questions about its credibility.

The management teams background is critical in assessing a broker's reliability. However, details about the individuals behind Asia Capitals are sparse, leaving potential clients in the dark about their qualifications and experience in the industry. A reputable broker typically shares information about its team, including their professional backgrounds and expertise in financial markets.

Furthermore, the level of information disclosure by Asia Capitals is inadequate. Traders should expect clear and accessible information regarding account types, trading conditions, and company policies. The absence of such transparency can be a red flag, suggesting that the broker may not prioritize the interests of its clients.

Trading Conditions Analysis

When evaluating whether Asia Capitals is safe, it is essential to consider its trading conditions, including fees and spreads. A transparent fee structure is vital for traders to understand the costs associated with their trades.

Asia Capitals claims to offer competitive spreads and various account types, but specific details regarding its fee structure remain unclear.

| Fee Type | Asia Capitals | Industry Average |

|---|---|---|

| Major Currency Pair Spread | N/A | 1.0 - 2.0 pips |

| Commission Structure | N/A | Varies by broker |

| Overnight Interest Range | N/A | 2% - 5% |

The lack of clarity about spreads, commissions, and overnight interest can significantly impact trading profitability. Traders should be wary of brokers that do not provide clear information about their fee structures, as this could indicate hidden fees or unfavorable trading conditions.

Moreover, any unusual or problematic fee policies, such as excessive withdrawal fees or inactivity charges, can further complicate the trading experience. In the absence of transparent information, potential clients of Asia Capitals should proceed with caution.

Client Fund Safety

The safety of client funds is a paramount concern when assessing any forex broker. Traders need to know that their investments are protected and that the broker has implemented measures to ensure fund security.

Asia Capitals has not provided adequate information regarding its safety measures for client funds. There is no indication of whether the broker employs segregated accounts, which are essential for protecting client funds from being used for operational expenses. Additionally, the absence of investor protection schemes raises significant concerns about the security of traders' investments.

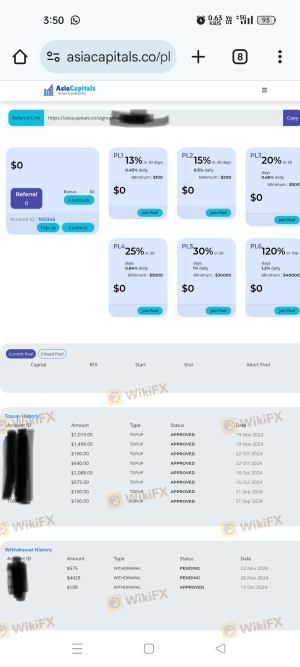

Historical issues related to fund safety, such as withdrawal problems or fund mismanagement, can be detrimental to a broker's reputation. Unfortunately, there are reports from users who have experienced difficulties in withdrawing their funds from Asia Capitals, which further underscores the need for caution when considering this broker.

Customer Experience and Complaints

The experiences of existing clients provide valuable insights into the reliability of a broker. In the case of Asia Capitals, customer feedback is mixed, with several users expressing dissatisfaction with their trading experience.

Common complaints include difficulties in fund withdrawals, lack of responsive customer support, and issues related to account management.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow response |

| Customer Support | Medium | Limited availability |

| Account Management | High | Poor communication |

Two notable cases involve clients who reported being unable to withdraw their funds despite multiple requests. In one instance, a trader claimed that their withdrawal request was pending for an extended period, while another user stated that additional deposits were requested before they could access their funds. These patterns of complaints are concerning and suggest that potential clients should approach Asia Capitals with caution.

Platform and Execution

The trading platform offered by a broker is crucial for ensuring a smooth trading experience. Asia Capitals utilizes the widely recognized MetaTrader 4 platform, known for its user-friendly interface and robust features. However, the performance and stability of the platform are critical factors that can impact trading effectiveness.

Reports of slippage, order rejections, and execution delays have been noted by some users. Such issues can hinder traders' ability to execute their strategies effectively and may indicate potential manipulation or technical shortcomings within the platform.

Risk Assessment

Using Asia Capitals presents several risks that traders should consider before engaging with the broker. The overall risk profile can be summarized as follows:

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | No regulation or oversight |

| Fund Safety Risk | High | Lack of transparency in fund management |

| Customer Support Risk | Medium | Mixed reviews on responsiveness |

| Trading Conditions Risk | High | Unclear fee structures |

To mitigate these risks, traders are advised to conduct thorough research before committing any funds. Seeking alternative brokers with robust regulatory oversight and transparent practices is a prudent strategy.

Conclusion and Recommendations

In conclusion, the evidence suggests that Asia Capitals raises significant concerns regarding its safety and legitimacy. The lack of regulation, transparency issues, and reports of withdrawal difficulties indicate that traders should exercise caution when considering this broker.

For traders looking for a safer trading environment, it is advisable to explore alternatives that are regulated by reputable authorities and offer clear, transparent trading conditions. Brokers such as IC Markets, Pepperstone, and OANDA are examples of platforms that provide robust regulatory oversight and a better overall trading experience.

Ultimately, the question "Is Asia Capitals safe?" leans towards a negative response, as the broker's lack of regulation and transparency poses considerable risks to potential clients.

Is Asia Capitals a scam, or is it legit?

The latest exposure and evaluation content of Asia Capitals brokers.

Asia Capitals Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Asia Capitals latest industry rating score is 1.29, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.29 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.