Is iPrime safe?

Pros

Cons

Is Iprime Safe or a Scam?

Introduction

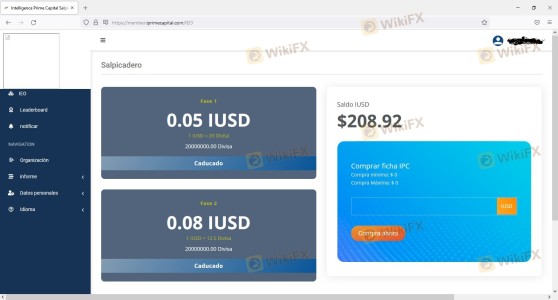

Iprime, also known as Intelligence Prime Capital, positions itself within the forex market as a trading platform that offers various financial instruments, including forex, commodities, and cryptocurrencies. As the online trading landscape continues to grow, it's essential for traders to exercise caution and thoroughly assess any broker before engaging in trading activities. With the prevalence of scams and unregulated entities in the market, understanding the legitimacy of a broker like Iprime is crucial for safeguarding investments.

This article employs a comprehensive investigative approach, utilizing information from regulatory bodies, user reviews, and expert analyses to evaluate Iprime's credibility. By examining the broker's regulatory status, company background, trading conditions, customer experiences, and risk factors, this article aims to provide a balanced view of whether Iprime is safe for traders or if it raises red flags.

Regulation and Legitimacy

The regulatory status of a broker is a fundamental aspect that determines its legitimacy and reliability. Regulation ensures that brokers adhere to specific standards, providing a level of protection for traders. In the case of Iprime, the findings indicate that the broker lacks proper regulation.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Not Verified |

Iprime claims to be regulated by various authorities, including the Australian Securities and Investments Commission (ASIC) and the Financial Transactions and Reports Analysis Centre of Canada (FINTRAC). However, investigations reveal that these claims are unfounded, as no credible evidence supports Iprime's regulatory status. This lack of proper oversight raises significant concerns regarding the broker's operational practices and investor protection measures.

The absence of regulation means that traders using Iprime may not have access to the same level of recourse and protection that regulated brokers provide. This situation is particularly alarming, as unregulated brokers often operate with minimal accountability, which can lead to fraudulent activities. Traders should be aware that engaging with an unregulated broker like Iprime poses substantial risks.

Company Background Investigation

Understanding the company behind a trading platform is essential for assessing its trustworthiness. Iprime is operated by Intelligence Prime Capital Ltd, which claims to be based in Canada. However, the company's history is relatively obscure, with limited information available regarding its establishment and ownership structure.

The management teams background is another critical factor in evaluating the broker's credibility. Unfortunately, there is insufficient public information about the qualifications and professional experiences of Iprime's management. This lack of transparency can be a red flag, as reputable brokers typically provide detailed information about their leadership team and their industry experience.

Moreover, Iprime's website lacks clarity regarding its operations, and essential details such as physical addresses and contact information are either missing or difficult to find. This opacity raises concerns about the broker's commitment to transparency and accountability, which are vital for fostering trust among clients.

Trading Conditions Analysis

Iprime's trading conditions are a key aspect that traders need to consider before investing. The broker claims to offer competitive spreads and leverage; however, the specifics of these conditions are often vague and not clearly outlined.

| Fee Type | Iprime | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 2 pips | 1 pip |

| Commission Model | N/A | Varies |

| Overnight Interest Range | N/A | Varies |

The spread on major currency pairs is reported to be higher than the industry average, which could significantly affect trading profitability. Additionally, the absence of a clear commission structure raises concerns about hidden fees that may not be disclosed upfront. Traders should be cautious of any broker that does not provide transparent information regarding its fee structure, as this can lead to unexpected costs.

Unusual or excessive fees can erode trading profits and may indicate a lack of integrity in the broker's business practices. Therefore, prospective clients should approach Iprime with caution and consider these factors before committing funds.

Customer Fund Security

The security of customer funds is paramount when choosing a broker. A reliable broker should implement robust measures to protect client investments. Unfortunately, the information available regarding Iprime's security policies is insufficient.

Iprime does not provide clear details about its fund segregation practices or investor protection measures. Without proper fund segregation, client funds may be at risk if the broker faces financial difficulties. Furthermore, the absence of a negative balance protection policy could leave traders liable for losses exceeding their account balance, which is particularly concerning in volatile markets.

Historically, there have been reports of clients experiencing difficulties in withdrawing their funds from Iprime. Such issues can indicate potential financial instability or unethical practices within the broker's operations. Traders should be wary of any broker that has a history of fund withdrawal problems, as this can be a significant warning sign.

Customer Experience and Complaints

Analyzing customer feedback is crucial for understanding a broker's reputation and reliability. Reviews of Iprime reveal a mixed bag of experiences, with many users citing issues related to withdrawal difficulties and poor customer service.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Lack of Customer Support | Medium | Inadequate |

| Misleading Information | High | No Response |

Common complaints include delayed withdrawals, unresponsive customer support, and misleading information regarding trading conditions. These issues can significantly impact the trading experience and raise concerns about the broker's integrity.

For instance, one user reported being unable to withdraw their funds for several months, while another noted that their inquiries were met with silence from the support team. Such experiences suggest a lack of accountability and responsiveness, which are critical for building trust between traders and their brokers.

Platform and Trade Execution

The trading platform's performance is another vital factor in assessing a broker's reliability. Iprime claims to offer access to popular trading platforms, including MetaTrader 4 (MT4). However, user reviews indicate that the platform may not be as stable or reliable as advertised.

Issues such as slippage, order rejections, and slow execution times have been reported by users. These problems can severely affect trading outcomes and suggest potential manipulation or inefficiencies within the platform. Traders should be cautious of brokers that exhibit signs of poor execution quality, as this can lead to significant financial losses.

Risk Assessment

Engaging with Iprime carries inherent risks that traders should carefully consider. The following risk assessment summarizes key risk areas associated with this broker:

| Risk Category | Risk Level | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | Unregulated status raises concerns. |

| Financial Risk | High | Potential withdrawal issues and lack of transparency. |

| Operational Risk | Medium | Reports of execution problems and poor support. |

To mitigate these risks, traders should conduct thorough due diligence before investing. It is advisable to start with a small investment, if at all, and to remain vigilant regarding any unusual activity on the trading account.

Conclusion and Recommendations

In summary, the evidence suggests that Iprime raises several red flags that potential traders should carefully consider. The lack of regulation, transparency issues, and numerous complaints regarding customer service and fund withdrawals are significant indicators of a potentially unsafe trading environment.

For traders seeking reliable and secure trading options, it may be prudent to avoid Iprime and consider alternative brokers that are properly regulated and have a proven track record of customer satisfaction. Trusted alternatives include brokers regulated by top-tier authorities such as the FCA or ASIC, which offer more robust investor protections.

In conclusion, is Iprime safe? The consensus points towards caution, as the broker exhibits several characteristics typical of potentially fraudulent operations. Therefore, traders should prioritize their safety and consider other options before committing their funds to Iprime.

Is iPrime a scam, or is it legit?

The latest exposure and evaluation content of iPrime brokers.

iPrime Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

iPrime latest industry rating score is 1.57, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.57 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.