Is Hui Deli safe?

Business

License

Is Hui Deli A Scam?

Introduction

Hui Deli, an online trading platform, has garnered attention in the Forex market for its aggressive marketing strategies and promises of high returns. As a relatively new player, it positions itself as a broker catering to both novice and experienced traders. However, the rise of online trading has also led to an increase in fraudulent activities, making it essential for traders to conduct thorough due diligence before engaging with any broker. This article aims to explore the legitimacy of Hui Deli and assess whether it is a safe trading option or a potential scam. Our investigation is based on a comprehensive review of available information, including regulatory status, client feedback, and overall trading conditions.

Regulation and Legitimacy

The regulatory status of a broker is a critical factor in determining its legitimacy. Hui Deli claims to operate under a regulatory framework, yet it lacks a clear licensing status. The absence of proper regulation raises red flags, as it indicates that the broker may not adhere to industry standards designed to protect traders. Below is a summary of the regulatory information available for Hui Deli:

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Unregulated |

The lack of regulation means that Hui Deli does not offer the same level of protection that regulated brokers provide. For instance, many jurisdictions require brokers to maintain segregated accounts to protect client funds, a practice that Hui Deli does not appear to follow. Furthermore, the absence of a transparent regulatory history raises concerns about the broker's compliance with financial regulations. In essence, without a regulatory license, there is little recourse for traders if something goes wrong, making it a significant risk factor when considering if Hui Deli is safe.

Company Background Investigation

Hui Deli Global Limited, the company behind Hui Deli, was incorporated in February 2021 in the United Kingdom. However, it has since been dissolved as of June 2023, raising questions about its operational stability and long-term viability. The company's ownership structure is unclear, with limited information available regarding its management team. This lack of transparency is concerning, as a reputable broker typically provides detailed information about its executives and their qualifications.

The absence of a physical address on the website further complicates matters, as it is a common practice for legitimate brokers to provide clear contact details. The lack of transparency makes it difficult for potential clients to assess the broker's credibility. Thus, the overall company background suggests that Hui Deli may not have the necessary operational integrity to be considered a safe trading platform.

Trading Conditions Analysis

When evaluating whether Hui Deli is safe for trading, it is crucial to analyze its trading conditions, including fees, spreads, and leverage. Hui Deli requires a minimum deposit of $1,000, which is significantly higher than the industry average, where many brokers offer accounts starting at $100 or less. This high entry barrier could deter novice traders and raises concerns about the broker's accessibility.

The following table summarizes the core trading costs associated with Hui Deli:

| Fee Type | Hui Deli | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 0.6 pips | 1.0 pips |

| Commission Structure | N/A | Varies |

| Overnight Interest Range | N/A | Varies |

While Hui Deli offers competitive spreads, the lack of transparency regarding commissions and overnight interest is troubling. Typically, brokers provide clear information about all fees, which is essential for traders to make informed decisions. The absence of such information could indicate hidden costs that may arise later, further questioning the safety of trading with Hui Deli.

Client Fund Security

The safety of client funds is paramount when assessing a broker's credibility. Hui Deli does not appear to implement any measures to protect client funds, such as segregated accounts or negative balance protection. These features are standard in regulated brokers, providing an additional layer of security for traders.

Historically, unregulated brokers often face issues related to fund mismanagement and withdrawal problems. Many traders have reported difficulties in accessing their funds, leading to significant financial losses. The lack of a compensation scheme also means that traders have no safety net in case of broker insolvency. Given these factors, it is evident that Hui Deli does not prioritize the security of client funds, raising serious concerns about whether it is safe to trade with them.

Customer Experience and Complaints

Customer feedback is an essential aspect of assessing a broker's reliability. Reviews of Hui Deli indicate a pattern of dissatisfaction among users. Common complaints include difficulties in withdrawing funds, lack of customer support, and issues related to account management.

The following table summarizes the primary complaint types associated with Hui Deli:

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Support | Medium | Poor |

| Account Management | High | Poor |

Several users have shared experiences of being unable to withdraw their funds, with some claiming that their accounts were frozen without explanation. Such complaints highlight significant operational deficiencies and raise questions about the broker's commitment to customer service. If a broker fails to address client concerns adequately, it casts doubt on its overall reliability and safety.

Platform and Trade Execution

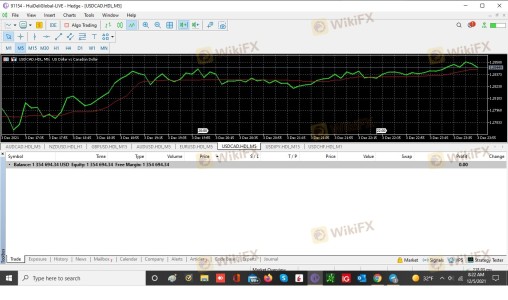

The trading platform offered by Hui Deli is the widely recognized MetaTrader 5 (MT5), known for its robust features and user-friendly interface. However, the performance and stability of the platform are critical factors in determining whether Hui Deli is safe. Reports from users indicate mixed experiences regarding order execution, with some mentioning issues related to slippage and order rejections.

The quality of trade execution is vital for traders, as delays or inaccuracies can lead to substantial financial losses. If Hui Deli's platform demonstrates signs of manipulation or inconsistency, it could further undermine its credibility. Therefore, while the platform itself may be reputable, the overall execution quality raises concerns about the broker's integrity.

Risk Assessment

Using Hui Deli for trading comes with inherent risks, primarily due to its unregulated status and lack of transparency. The following risk assessment summarizes the key risk areas associated with this broker:

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | Unregulated broker |

| Fund Security Risk | High | Lack of protection measures |

| Customer Service Risk | Medium | Poor response to complaints |

| Trading Execution Risk | High | Issues with slippage and order rejection |

Given these risks, traders should exercise extreme caution. It is advisable to consider alternative brokers that offer better regulatory oversight and customer protection.

Conclusion and Recommendations

In conclusion, the evidence suggests that Hui Deli is not a safe trading platform. The lack of regulation, poor customer feedback, and questionable trading conditions raise significant concerns about its legitimacy. Traders should be wary of engaging with this broker, as there are numerous red flags indicating potential scams.

For those considering trading in Forex, it is recommended to explore more reputable alternatives that have established regulatory frameworks, transparent fee structures, and positive customer reviews. Brokers such as IG, OANDA, or Forex.com are examples of platforms that prioritize client safety and regulatory compliance. Always conduct thorough research before committing funds to any trading platform to ensure a secure trading experience.

Is Hui Deli a scam, or is it legit?

The latest exposure and evaluation content of Hui Deli brokers.

Hui Deli Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Hui Deli latest industry rating score is 1.51, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.51 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.