Is HUGE safe?

Pros

Cons

Is Huge Safe or a Scam?

Introduction

Huge is a forex broker that has garnered attention in the trading community, but its reputation has come under scrutiny. As the forex market continues to expand, traders must exercise caution when selecting a broker, as the risk of encountering scams is ever-present. This article aims to provide a comprehensive evaluation of Huge, exploring its legitimacy, regulatory status, trading conditions, and customer experiences. Our investigation is based on a thorough analysis of various sources, including user reviews, regulatory databases, and financial reports, to determine if Huge is indeed safe for traders.

Regulation and Legitimacy

When assessing any forex broker, the regulatory environment in which it operates is crucial. Regulation serves as a safeguard for traders, ensuring that brokers adhere to certain standards of conduct. In the case of Huge, the regulatory status appears to be concerning.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| FCA | N/A | UK | Revoked |

| ASIC | N/A | Australia | Unlicensed |

| NFA | N/A | USA | Unauthorized |

As shown in the table, Huge does not hold valid licenses from reputable regulatory bodies such as the FCA, ASIC, or NFA. The FCA has revoked any licenses associated with Huge, indicating a potential lack of compliance with regulatory standards. This raises significant red flags regarding the broker's legitimacy and operational practices. Moreover, the absence of a regulatory license not only puts traders at risk but also suggests that Huge may not be subject to the same stringent oversight as regulated brokers.

The quality of regulation is paramount; traders should be wary of brokers operating without oversight, as this can lead to issues such as fund mismanagement and lack of recourse in the event of disputes. Therefore, the lack of credible regulatory backing raises serious questions about whether Huge is safe for trading activities.

Company Background Investigation

Understanding the history and ownership structure of a broker can provide valuable insights into its reliability. Huge, operating under the name Huge Inspiration Limited, has a sketchy background. The company claims to be based in the UK, but investigations reveal inconsistencies in its operational address and contact information. The lack of transparency regarding its ownership and management team further complicates the evaluation of its credibility.

The management team‘s background is also critical. A solid team with extensive experience in finance and trading can inspire confidence in a broker. However, information about Huge’s management is limited and lacks transparency. Without clear details about the team‘s qualifications and industry experience, it becomes challenging to assess the broker’s commitment to ethical trading practices.

Furthermore, the companys transparency regarding its operations and financial disclosures is inadequate. Legitimate brokers typically provide comprehensive information about their services, fees, and operational practices. In contrast, Huge seems to lack this level of transparency, which can be a significant warning sign for potential traders.

Trading Conditions Analysis

A broker's trading conditions, including fees, spreads, and commissions, are vital for traders to understand their potential costs. Huge advertises competitive spreads and commissions, but a deeper analysis reveals some concerning practices.

| Fee Type | Huge | Industry Average |

|---|---|---|

| Major Currency Pairs Spread | 2.0 pips | 1.0-1.5 pips |

| Commission Model | Variable | Fixed/Variable |

| Overnight Interest Range | 2.5%-5% | 1%-3% |

As depicted in the table, Huge's spreads are significantly wider than the industry average, which can eat into traders' profits. Additionally, the commission structure is vague, raising concerns about hidden fees that could be charged. The overnight interest rates are also higher than what is typically seen in the industry, which can adversely affect long-term traders.

These unfavorable trading conditions suggest that traders may face higher costs than anticipated, which could impact their profitability. Therefore, it is essential for potential clients to consider whether these trading conditions align with their trading strategies and risk tolerance.

Client Funds Security

The safety of client funds is a paramount concern for any trader. Legitimate brokers implement robust security measures to protect their clients' investments. In the case of Huge, the information regarding its fund security measures is limited and raises concerns.

Huge claims to have segregated accounts for client funds, but without regulatory oversight, there is no guarantee that this practice is being followed. Additionally, the absence of investor protection schemes, such as those provided by regulated brokers, further exacerbates the risk associated with trading with Huge. Traders should be aware that without proper fund protection, they may stand to lose their investments in the event of a broker's insolvency.

Historically, there have been reports of issues regarding fund withdrawals and mismanagement, which can be indicative of deeper problems within the broker's operations. Therefore, the lack of transparency and assurance regarding fund security is a significant concern for those considering trading with Huge.

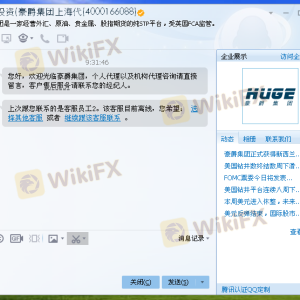

Customer Experience and Complaints

Customer feedback is a crucial aspect of evaluating a broker's reliability. A review of user experiences with Huge reveals a pattern of complaints that cannot be ignored.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Misleading Information | Medium | Inconsistent |

| Customer Service | High | Unresponsive |

Many users have reported difficulties in withdrawing their funds, with some claiming that the broker imposes unnecessary hurdles. Additionally, complaints regarding misleading information about trading conditions and fees have surfaced, indicating a lack of transparency. The company's response to these complaints has been largely inadequate, with many users expressing frustration over unresponsive customer service.

Two notable cases involve clients who reported being unable to withdraw their funds despite repeated attempts to contact customer support. These experiences highlight potential systemic issues within Huge that could pose significant risks to traders.

Platform and Trade Execution

The trading platform is another critical component of the trading experience. A reliable and efficient platform can significantly enhance a trader's ability to execute trades effectively. However, user reviews of Huge's platform indicate that it may not meet these expectations.

Users have reported issues with platform stability, including frequent outages and slow order execution. Additionally, there have been allegations of slippage and rejected orders, which can severely impact a trader's performance, particularly in volatile market conditions. Such issues raise concerns about whether Huge is safe for traders who rely on timely execution and platform reliability.

Risk Assessment

Trading with any broker involves inherent risks, and Huge is no exception. The following risk assessment summarizes the key areas of concern when considering this broker.

| Risk Category | Risk Level | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | Unregulated status raises concerns about legitimacy. |

| Financial Risk | High | Lack of transparency regarding fund security and withdrawal issues. |

| Operational Risk | Medium | Platform stability issues and complaints about execution. |

Given the high levels of regulatory and financial risk associated with Huge, traders must be cautious. It is advisable for potential clients to thoroughly evaluate their risk tolerance before engaging with this broker. Additionally, seeking alternative, more reputable brokers may mitigate these risks.

Conclusion and Recommendations

In conclusion, the evidence suggests that Huge raises several red flags that may indicate it is not a safe option for traders. The absence of credible regulation, concerning trading conditions, and a pattern of customer complaints all point to potential issues that could jeopardize traders' investments.

For traders seeking a reliable and trustworthy broker, it is advisable to consider alternatives that are well-regulated and have a proven track record of customer satisfaction. Brokers such as IC Markets or OANDA, which are known for their transparency and robust regulatory frameworks, may provide safer trading environments.

In summary, caution is warranted when considering whether Huge is safe for trading. The potential risks associated with this broker should not be overlooked, and traders are encouraged to conduct thorough research before making any commitments.

Is HUGE a scam, or is it legit?

The latest exposure and evaluation content of HUGE brokers.

HUGE Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

HUGE latest industry rating score is 1.61, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.61 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.