Is hongyuan safe?

Pros

Cons

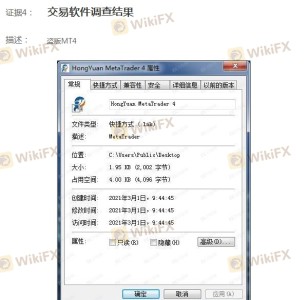

Is Hongyuan Safe or a Scam?

Introduction

Hongyuan Futures, a financial institution based in China, specializes in futures trading and offers a variety of financial instruments, including stock index futures, treasury futures, and options. Established in 2007, Hongyuan has positioned itself as a significant player in the Chinese financial market, particularly in futures trading. As the forex market continues to grow, traders must exercise caution when selecting a broker, as the landscape is rife with both reputable and questionable entities. Evaluating a broker‘s legitimacy is crucial to safeguarding one’s investments and ensuring a positive trading experience. This article aims to assess the safety of Hongyuan by examining its regulatory status, company background, trading conditions, customer experiences, and risk factors.

Regulation and Legitimacy

When assessing the safety of any financial broker, regulatory oversight is paramount. Hongyuan is regulated by the China Financial Futures Exchange (CFFEX), which is a significant regulatory body in the region. The regulatory framework is designed to ensure that brokers adhere to industry standards, thereby enhancing investor confidence. Below is a summary of Hongyuan's regulatory information:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| CFFEX | 0137 | China | Verified |

The regulation by CFFEX indicates a level of credibility, as it mandates compliance with strict operational guidelines. However, it is essential to note that regulatory oversight does not eliminate all risks associated with trading. Historical compliance issues, if any, can serve as red flags for potential investors. Thus, while Hongyuan appears to be a legitimate broker under the CFFEX, traders should remain vigilant and conduct thorough research before engaging.

Company Background Investigation

Hongyuan Futures has a relatively short but impactful history since its inception in 2007. It operates as a futures brokerage firm and has established itself as a full member of major exchanges like the Shanghai Futures Exchange and the Dalian Commodity Exchange. The ownership structure of Hongyuan is not publicly detailed, but it is essential to understand the management team's background. Key personnel typically possess extensive experience in finance and trading, which can significantly influence the firm's operational integrity.

Transparency is another critical aspect of evaluating a broker. Hongyuan provides contact information and maintains a presence across major Chinese cities, which can enhance trust among potential clients. However, the companys transparency regarding its financial performance and operational practices could be more pronounced. Investors should seek comprehensive information about the management team and their professional history to gauge their competence and reliability.

Trading Conditions Analysis

Hongyuan offers a variety of trading conditions, including competitive spreads and leverage options. However, understanding the full cost structure is crucial for traders. The following table outlines the core trading costs associated with Hongyuan:

| Fee Type | Hongyuan | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 1.5 pips | 1.2 pips |

| Commission Structure | Variable | Fixed/Variable |

| Overnight Interest Range | 3% - 5% | 2% - 4% |

The spread on major currency pairs is slightly higher than the industry average, which could affect profitability for day traders. Additionally, the commission structure is variable, meaning that traders should be cautious of hidden fees that may arise. While Hongyuan's trading conditions are generally favorable, potential clients should thoroughly read the fee schedule to avoid unexpected costs.

Client Fund Safety

The safety of client funds is a paramount concern for any broker. Hongyuan implements several measures to protect client investments, including segregated accounts that keep client funds separate from the companys operational funds. This practice is crucial in the event of bankruptcy or financial instability. Furthermore, Hongyuan adheres to anti-money laundering (AML) policies, ensuring that its operations comply with regulatory standards.

Despite these safety measures, traders should inquire about additional investor protection mechanisms, such as negative balance protection. Historically, any incidents related to fund security can impact a brokers reputation, so it is vital to research whether Hongyuan has faced any significant issues in this regard.

Customer Experience and Complaints

Customer feedback is invaluable when evaluating a broker's reliability. Overall, reviews of Hongyuan indicate a mixed bag of experiences. While some clients praise the broker for its robust trading platform and customer service, others have reported issues related to withdrawal processes and account management. Below is a summary of common complaint types:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Slow response |

| Account Management Issues | Medium | Generally responsive |

| Platform Stability | Low | Regular updates |

Typical case studies reveal that some clients experienced significant delays when attempting to withdraw funds, leading to frustration and dissatisfaction. While Hongyuan has generally responded to complaints, the delays in withdrawal processing can be a concern for potential investors.

Platform and Trade Execution

The performance of a trading platform is critical for successful trading. Hongyuan offers various trading platforms, with features designed to enhance user experience. However, the platform's stability and execution quality are vital factors to consider. Traders have reported occasional slippage during high-volatility periods, which can affect trade outcomes. Additionally, instances of order rejections have been noted, raising concerns about the platform's reliability.

Risk Assessment

Using Hongyuan involves several risks that traders must consider. The following risk assessment summarizes key risk areas associated with this broker:

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | Medium | Compliance with CFFEX is crucial. |

| Financial Risk | Medium | Variable fees can affect profitability. |

| Operational Risk | High | Complaints about withdrawal delays. |

To mitigate these risks, traders are advised to maintain a diversified portfolio, set strict risk management rules, and keep abreast of any regulatory changes that may affect their trading environment.

Conclusion and Recommendations

After thorough analysis, it can be concluded that Hongyuan is not a scam, but caution is warranted. While it operates under the oversight of CFFEX, the mixed customer feedback and issues related to fund withdrawals suggest that potential clients should conduct their due diligence. Traders should weigh the pros and cons before deciding to engage with Hongyuan. For those seeking alternatives, considering brokers with higher transparency and better customer service records may be prudent. Overall, while Hongyuan has established itself in the market, potential investors should remain vigilant and informed.

Is hongyuan a scam, or is it legit?

The latest exposure and evaluation content of hongyuan brokers.

hongyuan Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

hongyuan latest industry rating score is 1.54, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.54 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.